Monday afternoon briefing: Small caps vs. large caps

A look at the top performing hedge fund strategies. The holdings of different generations. Europe is seeing a large increase in wearable payments. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held interest rates steady at 1.75%: Bank of Canada holds rates steady, citing ‘intact’ global recovery

Canada’s unemployment rate rose: Canada posts largest job loss since 2009 on full-time drop

U.S. labour markets were strong in November: Jobs growth surges in November, beating Wall Street expectations

Institutional investors’ looking to protect their portfolios: Global institutional investors sober as markets rally: survey

The challenges 2020 may bring: What headwinds do stocks face going into 2020?

Understanding the screening process of responsible investments: Lifting the veil on RI screening

Chart of the week

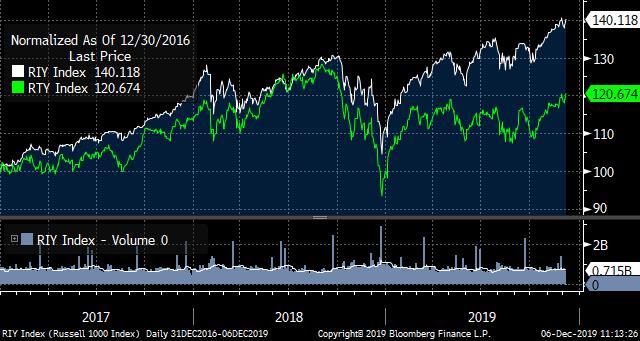

Since the end of 2016, small-caps have underperformed large-caps, as measured by the Russell 2000 Index and Russell 1000 Index, respectively. It’s not surprising given global trade tensions and their influence on equity market volatility. Investors have largely turned to larger-cap securities given their relative safety. If the U.S. and China reach a phase-one trade pact, will small-caps stocks take the lead? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Helping first-time managers raise money: These firms are helping managers beat their private capital fundraising goals

A look at the top performing hedge fund strategies: Equity long bias strategy tops hedge fund performance in 2019

Co-CEO of Bridgewater to leave firm: Murray to leave Bridgewater Associates

J.P. Morgan launches new ETF: J.P. Morgan Asset Management expands BetaBuilders suite

News and notes (Canada)

Horizons completes its corporate class reorganization: Horizons reorganizes 44 ETFs as corporate-class funds

Novacap launches Novacap Financial Services I: Private equity firm Novacap launches financial services fund

PE activity in Canada has slowed in 2019: Canadian PE industry on pace for investment slump

Onto the next step for a bitcoin fund: 3iQ files preliminary prospectus for Bitcoin fund

On the pulse – New frontiers in fintech

How changing technology will impact banking in 2020: The biggest technology trends that will disrupt banking in 2020

How tech and analytics are helping PE companies: Progressive VCs and private equity are using tech and analytics to revolutionize investing

Why regulators need to accept fintech in the banking industry: BankThink Charter or not, fintechs are already ‘banking’

Broadridge launches new AI tool: Broadridge launches new AI and machine learning platform for reconciliation, matching and exception management operations

A spotlight on emerging cities and fintech: Global fintech ranking shows importance of emerging cities

Europe is seeing a large increase in wearable payments: Wearable payments show sharp rise in uptake

High-net-worth topics

European private equity firms eyeing technology investments: Why Europe’s wealthy are betting on tech like never before

Younger U.S. high-net-worth investors showing interest in ESG: Wealthy, young investors driving shift to ESG, Cerulli reports

How the 2020 tax changes may impact the wealthy in the U.S.: What wealthy clients need to know about 2020 tax changes

Polls & surveys – What financials are saying

A look at the holdings of different generations (Charles Schwab): Self-directed millennials invested more in cash, ETFs than older investors

Business leaders uncertain about the outlook for the Canadian economy (CPA): Survey uncovers growing pessimism about Canada’s economy

A look at the struggles facing those who entered the labour market during the financial crisis (RBC): The struggle really is real for young investors

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: 25 years of value vs. growth

Value versus growth over the past 25 years. Private debt fundraising down in 2019. Working on an approach to DSC. And much more in this week’s briefing.

Economic/industry news

Canadian GDP grew 1.3% in third quarter: Canada’s economy slows in third quarter even as demand jumps

Europe continues to favour active management: McKinsey: Where active management survives

There’s still a place for value investing: Has value investing stopped working?

Why small-cap stocks may be set to soar: Small may turn mighty as strategists see Russell strength ahead

M&A deals in financial services was US$57 billion in the third quarter: Financial sector M&A jumps in Q3, GlobalData

Why private equity can help a portfolio during a market downturn: Worried about a downturn? Consider private equity

Investors concerned about interest rates: Global investors cite interest rates as key portfolio risk: survey

Current market conditions may require a unique approach to active management: Revisiting active management and asset allocation

Chart of the week

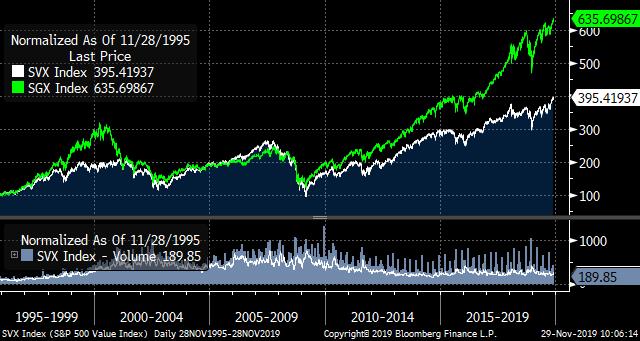

Let’s look at value versus growth stocks on the S&P 500 Index since 1995. Toward the end of the 1990s and early 2000s, growth stocks surged higher in response to the dot-com bubble. After moving in lockstep until the 2008 financial crisis, growth stocks began outpacing value stocks. Is value investing in trouble or is it primed for a comeback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The Volcker Rule’s impact on hedge funds: The great hedge fund retreat

Private debt fundraising down in 2019: Against expectations, private debt fundraising saw a decline in 2019

The risks of unitranches: A booming corner of private credit has some investors on edge

Why it’s important to invest across vintages: In private equity, vintage diversification matters

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 26 edition

New rules proposed to make it easier for leveraged funds to come to market: SEC proposes new rule to ease the market entry of leveraged funds

Charles Schwab to purchase TD Ameritrade: Schwab to acquire TD Ameritrade in US$26-billion deal

Looking to allow private companies to raise money through a direct listing: NYSE proposes big change to direct listings

News and notes (Canada)

TD launches 10 new ETFs: TD Asset Management introduces new ETFs

CI takes stake in U.S. RIA firm: CI Financial buys US advisory firm

Canadian ETF assets rose to $192.3 billion in October: ETF sales rebound, mutual fund sales hold steady in October

Working on an approach to DSC: OSC decision on DSCs to come – eventually

Here are the winners from the Women in Wealth Management awards: Women in Wealth Management award winners revealed

IIROC provides updated guidance on AML requirements: IIROC steps up AML guidance

On the pulse – New frontiers in fintech

The importance of customer engagement: Reinventing retail banking customer experience in a digital world

How the entry of Big Techs into banking may impact fintech companies: Should ‘fintech’ fear big tech’s push into banking?

Customers are demanding a better digital experience: Banks losing customers who want seamless digital experiences

Why data science skills will be crucial for businesses to thrive: Analytics skills essential for business survival in ‘data decade’

The importance of IT infrastructure in developing AI capabilities: Big data LDN: Why you need to modernize your IT infrastructure for AI

Data analysis will be the focus in 2020: Why data will change the game again in 2020

Ant Financial looking to invest in the payments space: Ant Financial preps $1bn investment fund

New platform for independent advisors: Pascal Financial launches wealth management platform for advisors

High-net-worth topics

The wealthy want quality information from their advisor: What ultra high net worth clients want from wealth managers

The money habits of the rich: 5 things rich people do with their money

Polls & surveys – What financials are saying

During a recession, people want help from advisors (MDRT): Clients want you to help them through a recession: MDRT survey

Where are the female portfolio managers? (Goldman Sachs): Investment management is still a boys’ club: Goldman

Canadians are looking to eliminate debt (Manulife): Canadians agree they have too much debt

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 18, 2019

Private equity looking at the financial advisory industry. Government and companies must work together to combat cyber risks. Asset allocation among alternative investments is changing. And much more in this week’s briefing.

Economic/industry news

U.S. inflation rate rose in October: U.S. consumer prices rise most in 7 months on higher gas prices

Economic growth in Japan stalled: Japan’s economic growth slumps to 1-year low in third quarter as trade war bites

The U.K. unemployment rate declined in September: U.K. unemployment falls while wages slow in September

VC funding had another strong quarter: Global VC funding remains strong in Q3

A look at the top research firms: The top research firm in the world is…

How to navigate through a market of lower expected returns: Navigating a slow growth market environment

Understanding the new economy: Understanding the 21st century economy

News and notes (U.S.)

A look at the hedge fund industry in October: State of the industry: October 2019

According to SS&C, hedge funds returned 1.15% in October: SS&C GlobeOp Hedge Fund Performance Index up 1.15 per cent in October

Private equity looking at the financial advisory industry: Private equity investors are zeroing in on financial advice business

JPMorgan invests in Limeglass: JPMorgan invests in financial research startup Limeglass

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 12 edition

News and notes (Canada)

iA Clarington goes fossil-fuel free in Inhance SRI funds: iA Clarington ensures certain funds are fossil-fuel free

A look at liquidity levels across Canadian funds: Currency & sector liquidity analysis report: Q3 2019

Lower mortgage rates helping housing affordability: Housing affordability improves thanks to lower rates, higher incomes

Looking for safety: The safest bet in Canada is also one of the hottest ETF trades

Taking a flexible approach to title reform: What’s next for title reform in Ontario

On the pulse – New frontiers in fintech

Security a concern for digital-only banking: More consumers will leave banks if digital offerings don’t improve

Why banks and big tech partnerships may work: Big banks and big tech (not versus)

A chequing account from Google: Google to offer checking accounts in partnership with banks starting next year

Customer experience should be at the forefront to combat disruptors: How to thrive in financial services in the age of digital disruption

How to better help small businesses: Big changes ahead for small business banking

A look at possible trends in the financial services industry over the next 10 years: Financial services in the 2020s: From open banking to open finance

Government and companies must work together to combat cyber risks: Bank of Canada urges public-private co-operation on cybersecurity

The data curation challenge: The challenge of data curation

Bringing cryptocurrency payment services to Swiss businesses: Bitcoin Suisse and Worldline to offer crypto payments acceptance in Switzerland

The CME will offer bitcoin options in the new year: Bitcoin options coming to the CME

High-net-worth topics

The wealthy are moving to cash: Geopolitics clouding the outlook for wealthy investors, UBS finds

Wealthy investors making direct investments in private firms: Wealthy families using 600-year-old plan to disrupt PE

How advisors can build trust with the high-net-worth: How to get wealthy people to trust you

Polls & surveys – What financials are saying

Institutional investors have an eye on China (Invesco): 80% of institutional investors planning to raise allocations to China: survey

Asset allocation among alternative investments is changing (EY): Investors are taking money out of hedge funds and putting in private equity

Canadians need help managing investments in retirement (Mackenzie): Value of advice more important as Canadians near retirement: study

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 28, 2019

Will active managers become more activist? A look at volatility in the private markets. Interest in impact investing continues to rise. And much more in this week’s briefing.

Economic/industry news

The ECB held its central interest rate steady: ECB holds rates at historic lows as Mario Draghi waves farewell to Frankfurt

Canadian retail sales dropped in August: Retail sales fell slightly in August, Statistics Canada reports

Why growth has outperformed value: The real reason value has been lagging growth

A look at what will impact markets over the next few decades: Aging population top global investment trend, institutional investors say

Interest in factor investing on the rise: Factor investing strategies becoming more popular for fixed income: survey

Will active managers become more activist?: A Wall Street revolution: Why active fund managers have ‘stopped yawning and started flexing their muscles’

Gold’s comeback: The story behind gold’s resurgence

News and notes (U.S.)

A look at the hedge fund industry in September: State of the industry: September 2019

Hedge funds have experienced net redemptions in 2019: Hedge fund industry sees 6th consecutive quarter of outflows

Charles Schwab launches the Schwab Alternative Investment Marketplace: Schwab launches alts marketplace for advisors

Jeffrey Vinik closes hedge fund: Billionaire investor Jeffrey Vinik closes hedge fund less than a year after its relaunch

A look at volatility in the private markets: KKR: Private markets are much more volatile than they appear

U.S. executives believe M&A activity will be better next year: US M&A remains resilient despite market fears

A look at ETF flows in 2019: Where the ETF money flowed in 2019

News and notes (Canada)

Picton Mahoney to acquire funds from Vertex One: Picton Mahoney gains five funds from Vertex One

New ETF from Mackenzie: Mackenzie launches emerging markets bond ETF

Mutual funds were in favour in September: Mutual fund sales soared in September

A look at the possible financial impact from a Liberal minority government: How a Liberal minority government could help, or hit, Canadians’ wallets

Learn about the head of the Canada Infrastructure Bank: A profile of Janice Fukakusa, chair of the Canada Infrastructure Bank

On the pulse – New frontiers in fintech

How finance can benefit from AI: What can AI and big data do for finance?

Four principles to launch unique products: 4 crucial steps to transform banking products for a fintech world

Partnership formed to launch fintech research unit: Fintech research unit founded by AMF, Finance Montreal

Why improving the onboarding process is crucial: Research shows banks could lose $22.75bn to slow onboarding

Alberta Investment Management Corp. using AI to predict stock price movements: Institutional investors turning to AI, data science to improve processes, yield alpha

Using API to better your business: How can organizations take advantage of the API economy?

Cyberattack discovered, focused on institutional investors: Cyber attack hits prominent hedge fund, endowment, and foundation

Wealthscope launched to help investors look at total portfolio diversification: New tool to help those accumulating and decumulating retirement assets

WealthBar acquires Snap Projections: WealthBar deepens financial-planning commitment with acquisition

Is there a place for blockchain in fintech?: Blockchain: Is it the future of fintech?

High-net-worth topics

The high-net-worth in the U.K. are concerned about the political landscape: Politics is more worrying than Brexit for Britain’s wealthy

Wealthy executives have specific needs from a financial advisor: What high-earning executives need, and aren’t getting, from advisors

A look at the world’s ultrawealthy: Who are the ultrawealthy? These charts will give you an idea

Polls & surveys – What financials are saying

Interest in impact investing continues to rise (American Century): US, UK millennials embrace impact, ESG investing: Survey

Lacking knowledge of fixed income securities (BNY Mellon): Survey reveals severe lack of awareness on fixed income

Canada falling behind in dealing with climate risk (FTSE Russell): Canada’s climate readiness gets a thumb-down

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 21, 2019

Digital-only banks succeeding through a robust customer experience. ESG adoption by institutional investors may be slowing. Venture capital mega-deals continue to grow. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate was 1.9% in September: Canadian inflation holds steady at 1.9%, core measures inch up

China’s economic growth slowed in the third quarter: China says its economy grew 6% in the third quarter, slower than expected

Retail sales in the U.S. declined: U.S. retail sales dip 0.3% in September

The end of the 60/40 portfolio?: Bank of America says 60-40 portfolios are dead. They’re right

Show a bit of pessimism towards a trade deal: Morgan Stanley tells stock bulls not to kid themselves on trade

The IMF predicts weaker economic growth in 2019: Global conflicts could lead to weakest growth since 2008: IMF

News and notes (U.S.)

The Eurekahedge Hedge Fund Index declined 0.30% in September: Hedge funds down 0.30 per cent in September

A look at hedge funds’ favourite research firms: The research hedge funds want to pay for

Why private markets will continue to flourish: The company of the future is private

How debt financing companies are attracting businesses: How debt financing is adapting to compete with equity financing

VC mega-deals continue to grow: 2019 on pace for another $100B invested as VC exit value tops $200B for the first time [datagraphic]

A look at how much the U.S. green economy is worth: America’s ‘green economy’ is now worth $1.3 trillion

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 15 edition

News and notes (Canada)

Waypoint launches liquid alternatives fund: Liquid alternatives: The Waypoint All Weather Liquid Alternative Mutual Fund

Desjardins launches ETF portfolios: Desjardins adds ETF portfolios to its roster

National Bank launches the NBI Unconstrained Fixed Income ETF: National Bank launches fixed-income ETF

Canaccord Genuity expands into Australia: Canaccord Genuity to acquire Australian firm for $23.3 million

Canadian M&A activity down in the third quarter: Mergers and acquisitions slow in third quarter: report

Michael Lee-Chin discusses the challenges impacting advisors: Adapt or become irrelevant, Lee-Chin warns advisors

On the pulse – New frontiers in fintech

Using technology to focus on consumer engagement: Digitizing banking is all about engagement and CX, not ‘tech’

Digital-only banks succeeding through a robust customer experience: Look to your customers for the key to banking success

Searching for innovative new technology: Where do incumbents look for game-changing innovation?

Canadians’ use of fintech on the rise: More Canadians using fintech, in spite of privacy concerns

The majority of U.K. financial institutions are using machine learning technology: Machine learning advancing in financial sector – Bank of England

Emerging challenger banks can be found all around the globe: Some challengers really are challenging … but not where you’re looking

Appealing to wealthier millennials: How upscale millennials’ money views impact their banking habits

How to keep up with regulatory change: How to approach modern regulatory change management in financial services

NatWest piloting a fingerprint credit card: Technology-based banking products launched

A look at what technologies are impacting advisors most: 10 female leaders share top tech trends that’ll change your practice

High-net-worth topics

Millennials’ wealth is expected to grow: There are more than 600,000 millennial millionaires in the US, according to report

What a wealth tax could mean for the high-net-worth: Explaining a wealth tax to clients

Polls & surveys – What financials are saying

Preparing portfolios for an economic slowdown (Aviva): Proceed with caution on asset allocation: report

ESG adoption by institutional investors may be slowing (RBC): Survey finds ESG adoption tapering off among institutional investors

There may not be a global recession until 2021 (HSBC): Global recession unlikely until 2021: HSBC

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 7, 2019

A look at hedge funds’ approaches to Brexit. The benefits and challenges of moving to the cloud. How AI will change the job market. And much more in this week’s briefing.

Economic/industry news

The U.S. unemployment rate hit a 50-year low: September unemployment rate falls to 3.5%, a 50-year low, as payrolls rise by 136,000

The Canadian economy was flat in July: StatsCan says economy flat in July as oil and gas sector down

More tariffs placed on Europe: U.S. to slap tariffs on European planes, whiskey after WTO ruling

How markets could be affected by an impeachment: What impeachment could mean for U.S. markets

Why now could be the time for alternatives: Is the tide turning for alternatives?

The benefits of investing in farmland: A look at the diversification benefits of farmland investing for pension funds

News and notes (U.S.)

Hedge fund launches rose in the second quarter: Number of new hedge fund launches up for second consecutive quarter

A look at hedge funds’ approaches to Brexit: How the hedge funds are really playing Brexit

Interest in private assets is high and will continue to grow: The unstoppable allure of private assets

A look at the PE middle market during the second quarter: 7 charts illustrating the US PE middle market in 2Q

Vanguard looking to enter the currency trading market: Vanguard to challenge banks’ grip on $6 trillion currency market

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 1 edition

The SEC is looking to modernize ETF regulations: The SEC says it’s making ETFs more accessible – here’s what that could mean for investors

More firms move to commission-free trading: TD Ameritrade announces zero commissions in tit-for-tat move

News and notes (Canada)

Purpose to incorporate ESG across all strategies: Purpose announces full ESG integration

National Bank launches green bond: National Bank issues sustainability bond

Canadian pension solvency fell to 98.6% in the third quarter: Canadian DB pension solvency declined in third quarter: surveys

CSA looking to improve its client-focused reforms: CSA introduces revised version of client-focused reforms

Responsible investing important to Canadian institutional investors: Canadian institutional investment pros say RI is important

On the pulse – New frontiers in fintech

A look at some fintech trends you may not already know about: Three overlooked trends in fintech

How to build a personalized experience: Secrets to building one-to-one digital experiences

How AI will change the job market: Artificial intelligence driving the next generation of jobs in the UK

Helping companies trade globally: Banks join forces on digital platform to help firms trade globally

Improving the branch experience: Interactive tech drives bank’s new experiential branch

The benefits and challenges of moving to the cloud: Interview with Bloomberg’s CIO: What’s driving financial services to the cloud?

A look at some examples of industry convergence: Industry convergence: Going beyond business boundaries

Robinhood adding well-known content to its app: Stock trading app Robinhood revamps its newsfeed with the Wall Street Journal and ad-free videos

The cost of fighting climate change: Americans fear climate change and the cost of fighting it

High-net-worth topics

Initiating the wealth transfer discussion between the high-net-worth and their children: How a UBS exec gets families to open up about wealth transfer

Goldman looking to attract the high-net-worth in Europe: Goldman is taking another stab at serving Europe’s rich

High-net-worth millennials believe they may need to work past retirement age: Survey: Many affluent millennials don’t think they can retire by 65

Polls & surveys – What financials are saying

Only 4% of CEO positions are held by women (CSA): Women gain share of board seats but not executive roles

Many Americans are concerned about their finances (NAPFA): Americans in need of some good financial advice: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 23, 2019

A bitcoin yield fund for the high-net-worth. Private equity and venture capital outperforming public equities. Why international co-operation is needed to combat cybercrime. And much more in this week’s briefing.

Economic/industry news

The Fed reduced its central interest rate: Fed lowers interest rate by a quarter-point, and is open to the idea of more easing

Canadian inflation rate was 1.9% in August: Canadian inflation slows to 1.9% on lower gas, vegetable prices

The BoE held its Bank Rate steady at 0.75%: Bank of England holds rates, warns another Brexit delay could hurt economic growth

The BoJ kept its key interest rate at -0.10%: BOJ keeps policy steady, signals chance of easing in October

A look at how liquidity affects an ETF’s trading costs: Why liquidity matters in ETF cost minimization

Does the value of benchmark data justify the cost?: Fund managers seek more insight from benchmark data

News and notes (U.S.)

Hedge fund net exposure at highest level since 2018: Goldman: Hedge fund exposure to stock market at 15-month high

A conversation with Josh Harris on private markets: Apollo’s Josh Harris talks private markets at delivering alpha

PE and VC outperforming public equities: Private equity outperforms and captures institutional flows

Private equity net cash flow was over US$150 billion in 2018: Eight years in the black for private equity cash flows

Vanguard to launch Digital Advisor: Vanguard preparing to offer digital-only robo-advisor

Rockefeller Capital eyes Silicon Valley: Rockefeller Capital buys wealth firm for Silicon Valley rich

The Fed took action in money markets for first time in a decade: Fed intervenes in money markets for first time in 10 years

Looking for more customized target-date funds: Interest rising in active/passive hybrid strategies for TDFs

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: September 17 edition

News and notes (Canada)

Horizons launches the Horizons Growth TRI ETF Portfolio: Horizons ETFs expands lineup of portfolio ETFs

CI Investments launches ESG funds: CI introduces debut ESG funds

Combining mutual funds and ETFs could be beneficial: Mutual funds and ETFs in harmony

Canada ranks “below average” in fund costs, according to Morningstar: Canada rates poorly in Morningstar survey of mutual fund costs

Foreign investors moving out of Canadian securities: Foreign investors continue to divest Canadian securities

On the pulse – New frontiers in fintech

Five fintech trends to watch in 2020: Five trends shaping fintech into 2020

How to navigate through customers’ fear of open banking: Open banking scares customers, but they want what APIs can deliver

A look at Canadians’ comfort with AI: How Canadians feel about AI in financial services

We’re in the early innings of AI’s impact on the financial services industry: The beginning of the road for AI in finance, the best is yet to come

Building a branch as an advice centre: Transforming branches into advice centers: The long road ahead

How technology is impacting capital markets: Buyers’ brief: Fintech drives capital markets

Why international co-operation is needed to combat cybercrime: Cyber-crime best tackled by international co-operation

Arab Bank launches custody and brokerage services for digital assets: Leading Swiss private bank launches full suite of digital asset services

High-net-worth topics

Family offices incorporating ESG principles: Wealthy families pour fortunes into $31 trillion ESG opportunity

A bitcoin yield fund for the high-net-worth: Wealth manager launches world-first bitcoin yield fund

Polls & surveys – What financials are saying

38% of fund managers expect a recession over the next year (Bank of America Merrill Lynch): Recession fears among fund managers rise to highest level in a decade

Immigration wage gap impacting Canada’s economy (RBC): Immigrant wage gap costing Canada $50 billion a year in GDP: RBC study

Millennials are starting to save early (E*Trade): Young investors are doin’ it for the ‘Gram

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

What Grissom and Caine can teach us about investment writing

Constant innovation has enabled the investment management industry to offer new and novel solutions designed to better serve the investing public. As more sophisticated solutions are introduced in the alternatives space, as well as in other product categories, the challenge of writing to these increasingly complex investment products becomes more pronounced.

While we should always strive to simplify our business communications, just opting to “dumb down” content may do investors a disservice. Is there a middle ground between simplicity and substance? The answer might lie with an old but influential television show.

CSI: Communicating Substance to Investors

It’s been just over three years since the last new episode of the hit CSI television franchise aired, but the footprint of this 16-year-long cultural touchstone is still present. Not only are the various CSI shows still being aired in syndication, they have continued to shape the public’s perception of law enforcement.

While the franchise has been criticized for taking artistic liberties with the real nature of police work and forensic investigation, CSI was never shy about using technical, highly scientific insider jargon.

That’s significant when you consider the CSI shows have been watched by millions, and that forensic science is no less an esoteric subject than yield curves or hedge funds.

Yet these shows, despite their complexities, spawned a generation of laypeople who could proudly discuss contusions, exit wounds and DNA sampling.

So, what can we learn from the exploits of Gil Grissom and Horatio Caine? From an investment communications perspective, we might take away the following:

1. Complexity doesn’t have to be scary; in fact, by its very nature can be compelling for readers.

2. Don’t be afraid of using complex terms, but also add in enough additional information so the reader can follow along, while also feeling educated and empowered by new knowledge.

3. Keep a “CSI toolkit” handy, meaning a spreadsheet of commonly used insider terms relevant to your investment mandate(s), plus their working definitions, for the benefit of investors. This toolkit can be used by you and your team in a variety of investment communications

The best practices for investment commentaries are always evolving. See what ext. can do to help you slay all your investment communications.

For more information on how ext. can help you improve your investment content, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – August 26, 2019

What’s impacting value investing? Why is 5G important to businesses? Why are CRM2 disclosures still confusing investors? Which cities have the most ultra-high-net-worth individuals? These and many more questions are answered in this week’s briefing.

Economic/industry news

Canadian inflation rate at 2.0% in July: Inflation holds steady at 2%, tempering case for rate cut

U.S. manufacturing contracts in August: Manufacturing sector contracts for the first time in nearly a decade

The Fed wasn’t unanimous in its decision to cut rates: Fed officials divided over July rate cut, minutes reveal

A look at what may be impacting value investing: Grantham Mayo: What’s gone wrong with value investing?

Interest in asset management jobs high: More people than ever want to be in asset management, CFA data shows

It’s not only about the shareholders: Top U.S. CEOs rethink the meaning of shareholder value

News and notes (U.S.)

Hedge fund assets growing, despite redemptions: Hedge funds still seeing outflows, but performance boosts AUM

Hedge funds don’t believe that the U.S. economy is headed for a recession: Hedge funds aren’t betting on a recession, Goldman data show

The stronger the conviction, the stronger the return: For short bets, higher conviction = higher returns

Using social media to research alternative firms: PE and hedge funds are targets of social media sleuthing, suggest survey

The orthopedic space garnering a lot of attention from PE: This joint is jumping: PE firms knee-deep in orthopedic space

Unicorn exits in the U.S. may set a record in 2019: Unicorn exits are booming in 2019. Will it last?

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: August 20 edition

News and notes (Canada)

Investors still don’t fully understand what they are paying for: Report finds investors still confused by CRM2 disclosures

Goldman Sachs invests in Canadian alternatives firm: Goldman Sachs unit invests in Toronto-based Slate Asset Management

The Ontario Teachers’ Pension Plan surpassed $200 billion in assets: Ontario Teachers’ Pension Plan returns 6.3% in H1

IIROC plain language rulebook to be instituted next year: New IIROC rulebook approved for June 2020

On the pulse – New frontiers in fintech

A look at how banks can benefit from adopting AI: AI advantages in banking grow, adding pressure for broad adoption

A culture change is needed to fully leverage new technology: AI is not a technology change but a cultural one

How retailers are benefitting from fintech: 5 ways retailers are adapting to fintech revolution

Helping baby boomers retire: Fintechs need to help baby boomers boom

How fintechs can stay relevant: The longevity of challenger banks

How banks may evolve to help clients in their daily lives: The bank of the future will have data vaults and money vaults

A look at why 5G will be so important: What 5G really means for your business

Visa launches new security services to protect banks and merchants: Visa launches security suite

Revolut to focus on the business banking sector with expense management tool: Revolut targets business banking market

JPMorgan Chase to discontinue Chase Pay: Chase Pay app shut down

High-net-worth topics

The next generation may move their assets to other firms: Trillions in HNW assets up for grabs in years ahead

These are the cities with the most ultra-high-net-worth individuals: Where the ultra-wealthy live in the United States

The high-net-worth are using 529 plans to reduce income and estate taxes: How high earners are maximizing this unique tax loophole for education funding

401(k) millionaires rose in the second quarter: The number of 401(k) millionaires hits an all-time high

Polls & surveys – What financials are saying

Canadians need assistance on how to use the TFSA (RBC): Many Canadians unsure how to use TFSAs to build wealth: RBC poll

Majority of U.S. economists expect a recession (National Association for Business Economics): Almost three-quarters of American economists expect a recession by end of 2021

Advisors benefit from outsourcing investment management (AssetMark): How outsourcing investment management can benefit advisors: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – August 19, 2019

First vegan ETF set for launch. U.S. household debt hits its highest level ever. Teens prefer fintech to manage their money. Plus much more news in this week’s briefing.

Economic/industry news

The U.S. inflation rate rose to 1.8% in July: Higher gasoline prices, rent boost cost of living in July, CPI shows, but inflation still mild

The U.K. economy contracted in the second quarter: UK economy shrinks for first time since 2012. Brexit could tip into recession

The U.K. unemployment rate rose to 3.9% in June: UK unemployment rate on the rise as fears grow ‘glory years over’

Understanding the 2020 version of GIPS: GIPS 2020: Everything you need to know

Why faith-based investors can benefit from impact investing: GIIN: Why impact investing is a natural fit for faith-based investors

Reconsidering the target-date glide path: Building better target-date fund glide paths

Bond markets still show signs of risk in the global economy: Equities on ‘borrowed time’ as recession signal nears inversion

News and notes (U.S.)

A look at the hedge fund industry in July: State of the industry – July, 2019

The Eurekahedge Hedge Fund Index returned 0.69% in July: Hedge fund managers recorded another positive month in July following strong H1 performance

SEC looking to make changes to alternatives regulation: Opportunities ahead as SEC pushes to modernize alternatives regulation

BlackRock finds first investment for long-term PE strategy: BlackRock begins PE foray with $875M bet on Sports Illustrated backer

A look at the most consistent top performers in the PE space: These private equity managers are the most consistent top performers

CBS and Viacom have agreed to merge: CBS, Viacom enter streaming wars with $30B combination

The first-ever vegan ETF to be launched: World’s first vegan ETF launches next month

U.S. household debt is at its highest level ever: Household debt sets new record: New York Fed

News and notes (Canada)

RBC launches three new ETF portfolios: RBC iShares expands lineup of portfolio ETFs

Invesco introduces investment portfolios: Invesco launches new suite of investment portfolios

CI launches asset allocation ETF: CI launches global asset allocation fund

Will the yield curve inversion force the BoC to lower its central interest rate?: Can BoC ignore blaring yield-curve inversion alarm?

OSC branch sees rise in enforcement referrals: Sales practices, suitability remain concerns for OSC

Canadian ETF assets rose to $183.7 billion in July: Canadian ETF assets continue to advance

On the pulse – New frontiers in fintech

Fintech is moving across many sectors of the economy: How fintech is eating the world

The importance of getting digital banking right: Make digital banking both seamless and secure or consumers will walk

Teens using technology to manage money: Fintech gains favor among teens

Successful automation will require quality data: Reliable data identified as key to successful automation

Securities lending through the use of machine learning: Northern Trust applies machine learning to securities lending

A look at the best fintech startups in Europe: The best fintech startups in Europe

A look at some business uses for blockchain technology: Five blockchain use cases: from property to sustainability

How the insurance industry can adapt to the future: How can the insurance industry face its challenges?

Another delay to the decision on a Bitcoin ETF: Bitcoin ETF decision delayed by SEC again

High-net-worth topics

Wealthsimple partners with Grayhawk to access the high-net-worth market: Wealthsimple announces partnership, looks to attract high-net-worth investors

How to transfer wealth: The art of transitioning wealth

Polls & surveys – What financials are saying

Asset managers believe a recession is on the horizon (Bank of America): Recession fears spike to 2011 high as risk of bubbles spreads

Generation Z may need some guidance on managing money (Northwestern Mutual): Gen Zers lack clarity on how to handle money, study says

Caring for elders is putting financial strain on Canadians (Angus Reid): Canadian caregivers worry about financial burden

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Upcoming macroeconomic events – August/September

Do you write or edit portfolio manager commentaries? Do you want to stay on top of the macroeconomic events that shape your day-to-day life as a financial services marketer?

If so, here are the big macro events that the ext. team is keeping an eye on over the coming weeks.

- Canada will announce its inflation rate for July on August 21. In June, Canada’s inflation rate fell to 2%, partly as a result of a decline in gasoline prices and a slowdown in shelter as well as clothing and footwear. Despite the slowdown in June, the inflation rate has crept higher in 2019, largely in response to higher food prices

- Canada’s gross domestic product (“GDP”) growth rate for the second quarter will be announced on August 30. In the first quarter, Canadian GDP grew 0.4% annualized, a slight improvement from 0.3% in the last quarter of 2018. GDP growth was led by consumer spending in the first quarter. However, real estate investment fell for a fifth consecutive quarter. Markets are hopeful that the Canadian consumer remained strong in the second quarter, while recent positive real estate news contributes, rather than impedes, economic growth

- The Bank of Canada (“BoC”) will announce its interest rate decision on September 4. The BoC’s benchmark overnight interest rate currently stands at 1.75%. At its most recent meeting in July, the BoC stated that the current level of its central interest rate is “appropriate.” However, the BoC does see some weakness in the Canadian and global economies as a result of continued trade tensions. The BoC will closely monitor how trade disputes are impacting the Canadian economy before any future interest rate decisions

- Also on September 4, the U.S. balance of trade for July will be announced. The U.S. trade deficit narrowed slightly from US$55.5 billion to US$55.2 billion in June, partly as a result of a reduction in imports. The trade deficit with China also narrowed. Given persistent trade tensions with China, markets will carefully monitor the results from this announcement

- On September 12, the European Central Bank (“ECB”) will announce its interest rate decision. At is last meeting on July 25, the ECB held its central interest rate steady at 0.00%. The ECB gave a more cautious tone, citing concerns about the slowing global economy. Furthermore, the ECB expects its rates to remain steady or even lower until at least the first half of 2020, hoping to push inflation up towards its target. The ECB is prepared to take measures to provide the European economy with more monetary stimulus, if needed

For investment commentary support (including monthly and quarterly commentaries, as well as MRFPs), contact us today at 1.844.243.1830 or info@ext-marketing.com.

Going deeper with your content

If you’ve been blogging and sharing content for a few years, you’ve probably reached the point at one time or another where you’ve run out of ideas or lost interest in your topic.

It happens.

Don’t fret. A little analytics and creativity will not only get you flush with ideas once again, but these ideas will be exactly what your readers want.

Identify your top posts

Google Analytics is your friend. While you can request anecdotal evidence from the field, it’s best not to rely solely on hearsay. Data is what you want, so seek it out.

Log on to your Analytics account. Your goal today is to find your 30 most-viewed posts since you first started blogging. Found them? Good.

These are the posts – better to think of them as themes – that you’ll focus your content efforts on for the next year. Feels good to have some direction, doesn’t it?

Go deep, creatively

Now that you know your top 30 posts, it’s time to sharpen your focus on the top 10.

How can you add depth to these topics? Write down everything you can think of, from the ideas that need a little more explaining to anything on the periphery of this theme that could add value.

While refreshing content is a good start (even your tried-and-true content may not be as evergreen as you think), we’re talking about supporting content, educational content, engaging content, inspiring content, content that looks good, content that gets people thinking, content that builds your authority, and the list goes on.

“We’re talking about supporting content, educational content, engaging content, inspiring content, content that looks good, content that gets people thinking, content that builds your authority, and the list goes on.”

Think infographics, surveys, whitepapers, more blog posts, newsletter articles, brochures, microsites and social campaigns. These are the tactics you’ll use to go deeper on your chosen themes.

Once you’ve worked through your top 10, start on your remaining 20.

Three quick examples

Let’s say your top three posts are “Saving for a comfortable retirement,” “What do I do with an inheritance?” and “Rethinking investing for Millennials.”

“Saving for a comfortable retirement” could benefit from a calculator that helps explain the power of compounding over the long term.

“What do I do with an inheritance?” might reach a bigger audience if it was backed up with stat … or, better yet, a handful of stats found in a great looking infographic.

“Rethinking investing for Millennials” may need an infographic too, but it would also benefit from a series of supporting blog posts that tackle (and provide solutions to) the financial challenges that younger people face every day.

Repeat the process

Let’s look a year into the future. You’ve added depth to your top 30 posts. Now identify your top posts once again but, this time, focus on your top 20. Explore ways that you can go even deeper on these themes.

Why are you doing this? You’re expanding your content and you’re refining your content. As time goes on, you’ll see that your focus is narrowing – and this is a good thing. This razor sharp focus is on themes that your readers want.

“You’re expanding your content and you’re refining your content. As time goes on, you’ll see that your focus is narrowing – and this is a good thing.”

Stop casting a wide net. Instead, go deeper on your top posts (and themes!) with creative solutions. Your readers will appreciate the knowledge you’re sharing.

Never run out of ideas again. Contact us today at 1.844.243.1830 or info@ext-marketing.com and we’ll help you explore your content options.

Tuesday morning briefing – August 6, 2019

Activist investors from the U.S. having an impact in Europe. IT attracting one-fifth of all U.S. private equity investment. Some thoughts on keeping data clean. And much more in this week’s briefing.

Economic/industry news

The Fed reduced its central interest rate: Fed cuts key rate, pledges to sustain expansion

Economic growth in Europe slowed in the second quarter: Euro zone second-quarter growth halves, inflation slows despite jobless at 11-year low

The Bank of Japan held its central rate steady at -0.10%: Bank of Japan commits to easing further if inflation sputters, keeps policy steady

BoE held its central bank rate steady at 0.75%: Bank of England cuts UK growth forecast

Taking a proactive approach with company management to follow ESG values: Turning a light on company behavior

Some asset classes that may help your portfolio: Assets to consider when traditional diversification fails

Fixed income ETFs should continue to see robust growth: ETF product trends to watch

Sustainable funds having a strong 2019 so far: Sustainable funds are winning at halftime, says Morningstar

News and notes (U.S.)

Hedge funds recorded a positive month in June: Hedge funds up 1.75 per cent in June

Element Capital increases performance fee: Top hedge fund sets 40% performance fee as assets hit $18bn

Activist investors from the U.S. having an impact in Europe: US activist investors’ aggressive strategies are starting to force change in Europe

Helping small businesses land even bigger government contracts: With PE backing, government contractors strive for bigger awards

IT attracting one-fifth of all U.S. PE investment: For the fifth straight year, PE’s appetite for IT continues to grow

A look at the top-performing PE fund of funds: These are the best performing funds of funds in private equity

Goldman Sachs to expand its business in South Africa: Goldman Sachs bets on South Africa’s strong economic growth

News and notes (Canada)

Emerge launches actively managed thematic ETFs: Emerge launches five ETFs

New CI fund to invest in high-interest savings accounts: CI launches high interest savings fund

Number of deals and funding of VCs fell in the first half of 2019: Canadian VC funding down in H1: Report

Canadian DB plans experience a positive return in the second quarter: Canadian DB plans post median 2.5% return for Q2

Canadian small business confidence declined in July: Small biz optimism drops in July

On the pulse – New frontiers in fintech

Digital transformation can ward off potential threats: The case for transforming banking (even when profits are strong)

A look at how financial advisors are benefiting from fintech: How advances in fintech are helping financial advisors

Why banks should be adopting AI now: Building an AI-powered financial institution

Keeping your data clean: How clean is your data?

Sorting through randomness: Facebook AI research is a game-changer

Helping small businesses with electronic payments: Mastercard and SumUp team to bolster SME offering

A look at a few fintech firms and how they are succeeding: Three global fintech innovations that created real value

Why the Fed should be looking at faster payments: Go slow on Libra. Speed up on faster payments.

Investing in drone technology: Retail investors interested in drone technology can now invest in it

High-net-worth topics

How the high-net-worth can discuss their estate planning: Heirs of HNW families in the dark on family wealth decisions

When is the best time for the high-net-worth to transfer their wealth: Dead or alive: When is the right time to transfer wealth?

The wealthy value their privacy: 10 ways the wealthy buy privacy

Polls & surveys – What financials are saying

Are those with a lower level of assets receiving financial planning information? (OSC): Many investors receive little advice for fees, survey finds

Eight out of 10 financial advisors are bullish on U.S. equities (NDR): Financial advisors remain upbeat about economy, markets

Financial advisors are getting younger (TD Ameritrade): ‘Graying trend’ in advisory industry is reversing: FA insight

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Top 10 marketing musts for hedge funds

You’re busy. But that doesn’t mean you can skip marketing – it’s just too important if you’re serious about raising assets.

Emerging and established managers tend to ask us the same questions. What are the right marketing steps I have to take? How can my brand truly represent who I am and what I do? Do I really need a website? When you work with ext., we can help you find the answers you need.

Here are 10 important things that you can do to ensure your fund is launched and/or operating on a solid marketing foundation:

- Design a pitchbook that works for your style of presenting – can you wing it or will you read from a page?

- Be yourself, not what you think allocators want you to be

- Learn how to tell your story

- Know your unique value proposition – be able to say it out loud

- Your pitchbook is essential – make sure it looks incredible and says the right things

- Know your audience – allocators, family offices, HNW investors, etc. all want to hear different things

- Always follow up and stay positive – not every meeting will go well and that’s okay

- It’s your business and your story – but it makes sense to bring in external marketing expertise to ensure your vision and your message are aligned

- Get out and market when things are going well – don’t wait until you’re facing adversity

- Understand that marketing is a profit center (not just an expense) – invest in marketing and it will drive sales

We know you’re busy and that’s why we kept this post short. If you’re too busy to implement these marketing best practices and truly set yourself apart, call us. We can help.

Contact us today at 1.844.243.1830 or info@ext-marketing.com to implement a solid marketing strategy and set your fund apart.

Monday morning briefing – July 29, 2019

Why financial institutions should focus on educating clients about digital banking. Preparing institutional portfolios for a market downturn. How mutual fund companies can adapt to the challenges they face. And much more in this week’s briefing.

Economic/industry news

U.S. GDP growth was 2.1% in the second quarter: GDP slows to 2.1% in second-quarter but beats expectations thanks to strong consumer

The ECB holds its central interest rate steady: ECB signals rate cut, QE ahead as global stimulus push picks up

What Prime Minister Johnson’s win could mean for Brexit: Johnson’s win elevates ‘no deal’ Brexit risks to U.K. economy

Facebook is not a favourite of ESG funds: Facebook getting booted from ESG index funds

Is there still more runway for global equities?: How long can the equity rally last?

Value stocks are falling behind their growth counterparts: Value stocks haven’t traded this low in nearly half a century

Preparing institutional portfolios for a market downturn: Are institutional portfolios prepared for the next market tumble?

The importance of manager research: Manager research matters even more than you think

News and notes (U.S.)

The forward redemption indicator for hedge funds declined in July: SS&C GlobeOp Forward Redemption Indicator at 2.69 per cent for July

Hedge fund assets that are invested based on ESG criteria are expected to grow: Hedge funds expect large jump in ESG assets

A look at the U.S. PE industry during the second quarter: Here are 9 charts that capture the US private equity industry in 2Q

Private markets may continue to grow: The expansion of private markets is irreversible

A look at some trends in the VC market: 21 charts showing current trends in US venture capital

Every company in the S&P 500 Index now has a female board member: The last all-male board in the S&P 500 finally added a woman

Home price inflation outpacing wages: American dream of owning a home out of reach for many, report says

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: July 23 edition

News and notes (Canada)

Evolve to offer 5G technology category to one of its existing ETFs: Evolve adds a new category to innovation ETF offering

Responsible Investment Association launches marketplace website: RIA launches RI Marketplace

Mackenzie launches emerging markets bond ETF: Mackenzie taps into EM bond market growth

Net inflows of Canadian-listed ETFs increased in the second quarter: Net inflows drive Q2 rebound for Canadian-listed ETFs

The BoC decreased the qualifying mortgage rate: BoC lowers qualifying rate used in mortgage stress tests

Does the new North American trade agreement hurt Canada?: America comes first in revamped NAFTA, report says

On the pulse – New frontiers in fintech

Why financial institutions should focus on educating clients about digital banking: No guarantees digital banking will continue to grow

New types of jobs in financial services will emerge from new technologies: The brightest fintech minds could be right in your office

The who’s who of the fintech industry: Influential business leaders in the fintech industry

Helping small businesses at the point of sale: ING tests software that turns mobile phones into POS terminals

Insurers to increase RPA spend: Insurers to spend $634m on Robotic Process Automation by 2024, as efficiency gains are sought

Using AI to attract deposit growth: AI savings tools help financial brands boost organic deposit growth

Tracking financial markets while driving: TD Ameritrade rolls out car-based tools for investors

Digital advisor to offer chequing and savings accounts: Betterment moves into banking

Technology can help reduce costs for meeting AML requirements: Tech reduces anti-money laundering compliance costs: report

High-net-worth topics

The high-net-worth should consider a family budget: Why wealthy people need to follow a budget, too

The importance of helping clients with their wealth transfer: The key to managing client wealth transfers

Helping clients with their wealth and health: Giving clients health to enjoy their wealth

Polls & surveys – What financials are saying

The IMF expects weaker economic growth in 2019 (IMF): IMF sees a weaker global economy but upgrades U.S. forecast

How mutual fund companies can adapt to a variety of challenges (PwC): Mutual fund industry at a crossroads: PwC report

Women and men differ on their views of financial markets (Nationwide): Women less optimistic than men about the market: Nationwide

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Upcoming macroeconomic events – July/August 2019

Do you write or edit portfolio manager commentaries? Do you want to stay on top of the macroeconomic events that shape your day-to-day life as a financial services marketer?

If so, here are the big macro events that the ext. team is keeping an eye on over the coming weeks.

- The European Central Bank (“ECB”) will announce its interest rate decision on July 25. The ECB held its benchmark refinancing rate at 0.00% at its most recent meeting in June, citing concerns about weak inflation and slower global economic growth. At that meeting, the ECB indicated it would not be raising its central interest rate until the second half of 2020 at the earliest. Since then, trade uncertainty, Brexit risks and weakness in the European economy has the ECB considering further stimulus to the European economy, if warranted

- On July 26, the U.S. will announce its advanced estimate of second quarter gross domestic product (“GDP”) growth. In the second quarter, GDP growth was 3.1%, an improvement over the 2.2% in the fourth quarter of 2018. U.S. GDP may remain relatively strong as personal spending and exports appear robust, which may offset some weakness in business investment

- The U.S. Federal Reserve Board (“Fed”) will announce its interest rate decision on July 31. On June 19, the Fed kept the target range for its federal funds rate steady at 2.25% to 2.50%. The Fed took a more cautious tone and hinted at a possible rate cut as a result of trade tensions with China and a slowdown in global economic growth. Investors are expecting an interest rate reduction at this meeting

- Canada’s balance of trade for June will be announced on August 2. Surprisingly, Canada’s trade balance turned positive in May, seeing a surplus of $760 million. This came despite slowing global economic growth and continued trade uncertainty. How trade restrictions from China and slowing demand for some commodities affected Canada’s trade balance will be closely watched by investors

- On August 9, Canada’s unemployment rate for June will be announced. The unemployment rate rose to 5.5% in June, slightly above the 40-year low of 5.4% reached in May. The unemployment rate rose as employment decreased by 2,000. The Canadian economy has seen a large increase in jobs being added throughout 2019, and is looking for a rebound from the decline in June

For investment commentary support (including monthly and quarterly commentaries, as well as MRFPs), contact us today at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – July 15, 2019

Hedge funds are changing their fee structures. A new climate change index from FTSE Russell. Turning the branch into an advice center. And much more in this week’s briefing.

Economic/industry news

The BoC held its rate steady at 1.75%: Poloz flags growing trade risks but keeps rates firmly on hold

The U.S. inflation rate fell to 1.6% in June: Consumer prices edge up in June, CPI shows, but inflation is still quite tame

Canadian housing starts rose to 246,000 in June: Canadian housing starts rise in June: CMHC

The debt ceiling may need to be raised by September: U.S. debt ceiling fears surface in “kink” in Treasury bill yield curve as drop-dead date approaches

A new climate change index from FTSE Russell: FTSE Russell launching climate change index for sovereign bonds

MSCI to provide ESG ratings on funds and ETFs: MSCI adds ESG ratings to 32,000 funds and ETFs

New guidelines on performance reporting from the CFA Institute: CFA Institute unveils new global investment standards

A look at the benefits of using multifactor ETFs: Why use multifactor ETFs?

News and notes (U.S.)

A look at the hedge fund industry in June: State of the industry – June, 2019

Hedge funds soared higher in the first half of 2019: Hedge funds post best first half in decade

Will there be a rebound in PE-backed exits?: Will US PE exits make up for lost time in the second half of 2019?

PE funds selling at a premium: The private equity funds selling for more than they’re worth

Charles Schwab adds more funds to its commission-free ETF platform: Schwab adds 25 ETFs to commission-free platform

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: July 9 edition

News and notes (Canada)

CIBC purchases U.S. investment banking firm: CIBC signs deal to buy Milwaukee-based boutique investment bank Cleary Gull

RBC purchases WayPay: RBC buys accounts payable specialist WayPay

Mercer and Wealthsimple partner to create a savings and advice solution: Mercer partners with Wealthsimple for digital investing solution

Canadians finding it difficult to move into higher income brackets: Canadian families are increasingly stuck in their income niche, StatsCan finds

Canadian ETFs experienced outflows in June: ETF flows flat in June as investors get defensive

On the pulse – New frontiers in fintech

A look at five fintech trends: Here is a look at where fintech is leading us and why

Understanding the bank-fintech partnership: Banks and fintech partnerships: A clash of extremes

Banking customers still demand human contact: Financial services customers set to embrace AI but human contact still vital

Turning the branch into an advice center: Branches should be advice centers, but are banks ready?

Creating highly personalized products and services: The market of one

Keeping AI ethical in corporate finance: Preventing unethical use of AI in corporate finance transactions

Advisors should be adopting new technologies: Why more advisors are embracing financial planning technology

JPMorgan enters robo-advice arena: JPMorgan rolls out robo-advisor

High-net-worth topics

The way the wealthy spend their money may be surprising: How do the wealthy spend their money?

The net worth of high-net-worth individuals fell: Wealth declines among the global rich after seven years of growth

A look at some traits of billionaires: The secrets of self-made billionaires

Polls & surveys – What financials are saying

Hedge funds are changing their fee structures (AIMA): Hedge funds replacing ‘2 and 20’ with more flexible fees: study

U.S., Canadian and Japanese investors typically hold their investments for over four years (Schroders): U.S. investors most patient, and demanding, in world, study says

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – July 8, 2019

Bitcoin’s volatile June may impede the possibility of an ETF. Funds-of-hedge funds are making a comeback. Ontario to get 50 more cannabis retail stores. 5G technology will enhance digital banking capabilities. And much more in this week’s briefing.

Economic/industry news

The Canadian unemployment rate rose to 5.5% in June: Canada’s jobs market pauses in June after monster start to year

The unemployment rate in the U.S. rose to 3.7% in June: Hiring rebounds as U.S. economy adds 224,000 jobs in June, unemployment rate inched up to 3.7 percent

Global equity issuance slow in the first half of 2019: Global equity issuance dives in the first half, Refinitiv reports

State Street launches ESG money market fund: State Street Global Advisors launches its first ESG money market fund

Christine Lagarde will become president of the ECB: Christine Lagarde: Key issues she must address at the ECB

Will more tariffs come to the EU?: U.S. proposes more tariffs on EU goods in Airbus-Boeing dispute

MSCI plans to add Kuwait to its emerging markets index: MSCI set to classify Kuwait as emerging market, subject to certain conditions

News and notes (U.S.)

Funds-of-hedge funds are making a comeback: They’re baaaaack: The investment that’s making an unlikely comeback

Europe’s interest in alternative investments growing: Interest in alternative investments on the rise in Europe

PE firms looking to raise US$1 trillion in fundraising efforts: Private equity seeks almost $1 trillion globally

Venture capitalists keeping a keen eye on companies that move people and things: Wheeling & dealing: In 2019, VCs can’t stop funding mobility startups

Fixed income ETFs see record inflows in June: Fixed income ETF inflows surpassed $25B during June

Understanding the rules of Reg BI: SEC’s Reg BI adds unexpected fiduciary hurdle for retirement advisors

News and notes (Canada)

Canadian banks meeting global regulatory standards on net stable fund ratio: Reports find Canadian banks meet global standards

Ontario to get 50 more cannabis retail stores: Ontario to issue 50 new cannabis store licences, eight to go to First Nations

Value of Canadian defined benefit pension plans stable in the second quarter: Strong equity market performance helped DB plans in Q2

Project Reconciliation preparing bid for the Trans Mountain pipeline: Indigenous group says Trans Mountain bid could be ready next week

On the pulse – New frontiers in fintech

Using data to drive the personalized customer experience: Digital changes customer engagement playbook for financial institutions

New associations will be important to drive fintech forward: We’re all in this together – The Value of associations in fintech

5G technology will enhance digital banking capabilities: Banking in 5G: Why financial marketers should care (now)

A look at the challenges and opportunities of AI in banking: AI in banking: The pitfalls and opportunities (research paper)

Understanding Intelligent Spend Management: Intelligent Spend Management and the evolution of procurement

Here are 10 payment start-up companies that you need to know about: 10 payments start-ups to watch

NatWest experiments with live chats on mobile, tablet and PC: NatWest trials video banking service for business customers

Online payment startups are focusing on these sectors: What sectors do online payment startups try to target?

Giving businesses unlimited access to their PayPal account: PayPal launches its first UK debit card with unlimited cash back for businesses

Bitcoin’s volatile June may impede the possibility of an ETF: Bitcoin’s wild June is ‘slam dunk’ against crypto ETF approval

High-net-worth topics

Ways business owners can save for retirement: Eight things business owners can do to build up funds for after retirement

Financial planning for families with assets in multiple countries: Cultivating foreign clients

How insurance can mitigate some of the risk for high-net-worth investors: The secret key to protecting your client’s wealth

Polls & surveys – What financials are saying

Professional accountants are bullish on the Canadian economy (CPA): Business leaders feel better about the economy: survey

Canada’s economic growth is dependent on global economic conditions (Russell Investments): Canadian economy not immune to outside forces: report

Why India might be a good source of investment returns (Manulife): Investors chasing higher returns can’t skip India, Manulife says

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Tuesday morning briefing – July 2, 2019

Spotting a financial bubble. The rising stars of the hedge fund industry. The benefits of advisors adopting technology. The affluent market is expected to grow. And much more in this week’s post.

Economic/industry news

U.S. GDP growth confirmed at 3.1% in the first quarter: US economy grew at a solid 3.1% rate in the first quarter

Optimism regarding small– and medium–sized businesses in the U.S. waning: Optimism hits nine-year low at U.S. small, midsize companies

Spotting a financial bubble: Can you spot a bubble before it bursts?

What’s hurting value investing: Two suspects behind value’s apparent death

New climate change indices announced: MSCI launches climate change indexes: Portfolio products

The number of global IPOs declined in the first half of the year: A weak first half for global IPOs, EY reports

News and notes (U.S.)

Forward Redemption Indicator was 3.81% in June 2019, lower than June 2018: SS&C GlobeOp Forward Redemption Indicator at 3.81 per cent for June

Equity leverage rising fast for hedge funds: Hedge funds boost equity leverage at fastest rate in three years

Alternative investment managers expect moderate economic growth for 2019: Alternative investment professionals bullish on prospects for remainder of 2019

A look at the most powerful hedge fund managers: The 10 most powerful hedge fund managers this year

The rising stars of the hedge fund industry: Hedge funds might be under scrutiny – but these rising stars are their future

Will Vanguard enter private equity space?: Vanguard mulling move into private equity: report

Another strong year for PE cashflows: Global PE cashflows eye eighth consecutive year in the black

U.S. tech firms reduced hiring in China amid trade dispute: Silicon Valley cools Chinese growth plans during trade war

Average wage earners having difficulty purchasing a home in many U.S. markets: Homebuying difficult for Americans in three-fourths of markets

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: June 25 edition

News and notes (Canada)

Mutual funds experienced $719 million of net sales in May: Mutual fund sales rebound, despite retreat in AUM, IFIC reports

Steve Hawkins takes over as board chair for the Canadian ETF Association: CETFA welcomes new board chair

Advisor title reform to be reviewed by new provincial regulator: FSRA to lead advisor title reform, while OSC works on other reforms

Tax proposal could hurt Canadian ETFs: Tax proposals get pushback from ETF industry

On the pulse – New frontiers in fintech

Wall Street is learning from Silicon Valley: Wall Street is taking cues from Silicon Valley to innovate fintech

The top trends in retail banking: The Top 5 retail banking technology trends of 2019 (so far)

Why it’s imperative that traditional banks adopt AI usage: Banking brands can’t keep pace with digital giants without AI

What is Facebook’s future in fintech?: Facebook’s Libra cryptocurrency is the future of fintech

Consumer use of fintech growing: More than half of global consumers use fintech

The benefits of advisors adopting technology: Five ways advisors can leverage technology

Welcome to the new Chase retail branch: Chase makes bold statement with stunning new flagship branch

Helping VCs make investment decisions: VCs double down on data-driven investment models

A look at how the investment banking industry can benefit from AI: How AI could shape the future of investment banking

High-net-worth topics

The affluent market is expected to grow: The growing promise from affluent individuals

How to respond to the traits of wealthy investors: 12 surprising traits of the wealthy

Sotheby’s to merge with BidFair USA: Sotheby’s goes private: What it means for the art market

Polls & surveys – What financials are saying

U.S. investor confidence falling (Wells Fargo/Gallup): Investors are battening down the hatches for a recession: Wells Fargo

Geopolitical and market risks affecting the outlook for institutional investors (Manulife): Uncertainty clouding institutional investor outlook: report

Canadians trust financial advisors for their retirement planning (Fidelity): Advisors top list of retirement planning resources: survey

A look at the contributors to growth in robo-advice (BMO): ETFs played a role in robo growth, fee-based shift: report

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – June 24, 2019

Can the Fed Chairman be replaced? How geopolitical risks impact emerging markets. Facebook is planning a new cryptocurrency. Advisors are preparing for a possible recession. Plus much more news in this week’s briefing.

Economic/industry news

The Fed holds steady, raises expectations of rate cut: Fed holds rates steady, but opens the door for a rate cut in the future

The Bank of England kept its Bank Rate steady at 0.75%: BOE warns on global economic outlook as it holds rates steady

The inflation rate in Canada rises to 2.4% in May: Canadian ‘inflation is back’ as rate rises most since October

Can Fed Chairman Powell be replaced?: Trump believes he has the authority to replace Powell at Fed

The impact of geopolitical risk on emerging markets investments: Geopolitical tensions high on investors’ list when examining emerging markets

News and notes (U.S.)

Hedge funds fell 0.71% in May: Eurekahedge Hedge Fund Index down 0.71 per cent in May

Hedge fund redemptions were US$9.4 billion in April: Hedge fund redemptions slow in April

Paulson & Co. to exit London: John Paulson’s hedge fund scales back operations

Goldman Sachs increasing its PE presence: Goldman Sachs looks to become the next private equity giant

The use of subscription credit facilities rising: Private capital funds increasingly turning to subscription credit facilities

How IPOs backed by PE and VC have fared in 2019: Here’s how much VC- and PE-backed IPOs have raised in 2019

Will the SEC open up hedge funds and PE funds to retail investors?: Hedge funds for all: SEC ponders letting in the not-so-rich

U.S. retirement assets rebounded in the first quarter: Retirement assets recover from fourth-quarter swoon

News and notes (Canada)

First Asset launches the CI First Asset High Interest Savings ETF: First Asset launches high-interest savings ETF

SSQ launches Smart Beta Plus Portfolios: SSQ delivers Canadian first with turnkey portfolio products

Sun Life launches SLC Management: Here comes a new $160 billion asset manager

Manulife partners with Mahindra and Mahindra of India: Manulife enters joint venture in market of more than 1 billion people

Stifel Financial purchases GMP Capital’s capital markets business: Deal throws shackles off ambitious Richardson GMP

The Trans Mountain pipeline expansion gets approved, again: Trans Mountain expansion gets second green light from Ottawa

On the pulse – New frontiers in fintech

A look at AI in the financial services industry: What the age of AI means for Wall Street

Four trends that will lead to more innovation in fintech: 4 trends that will rewire the inner workings of the fintech industry

A look at the growth of point-of-sale financing: POS finance growth is threat and opportunity for banking providers