4 Ways Marketing Can Enhance the Value of Your Private Equity Portfolio

Private equity (PE) firms are increasingly using a secret weapon to enhance the value of their portfolio companies and generate growth: marketing. PE firms excel at deal flow and restructuring, yet once they’ve acquired a company their toolkit should include strategies that improve brand identity and communications. Operational improvement, of which marketing plays an integral role, is a growing share of the value add provided by PE investors. Strong marketing strategies are proven to create value and attract higher exit premiums.

1. Increase market relevance.

Revisiting a company’s story and key messaging framework can help identify valuable attributes a portfolio company might have that align with current market demands. Identifying emerging or unmet needs in the industry and curating brand messaging that highlights these relevant attributes can be a game-changer in attracting investors, increasing value and capturing market share.

For example, a company may have inherent Environmental, Social and Governance (ESG) characteristics to bring to the forefront of their story in a way that bolsters that company’s overall value.

2. Improve competitive position in the current market.

Ensuring your portfolio companies’ brands and marketing strategies are as strong as possible will position them more favourably to investors. Uncertain markets are an essential time for stronger brands to vault over their more anemic competitors. Strong branding builds a sustainable competitive advantage that can withstand market fluctuations and make a company more resilient to external pressures.

3. Elevate digital presence.

Firms should not underestimate the power of a digital presence. With increased competition for consumer attention online, a harmonious brand presence across all relevant platforms is imperative. A well-designed website, up-to-date social media profiles and strategic content marketing all work to validate a company’s business model, enhance credibility and lead to a better consumer experience.

4. Improve internal and external communications.

Ensuring communications are aligned, both internally and externally, is vital to the strength of a brand. Internally, this can take the form of roadmaps, toolkits and dealer materials. Externally, this can involve communication with key stakeholders and customers, including whitepapers, thought leadership, educational materials and videos. Improved communication channels add value to your portfolio companies by streamlining operational practices and promoting transparency.

A marketing agency can give your portfolio companies the brand refresh they need to generate future value. A strong brand paired with a compelling digital presence, streamlined communications and other marketing materials will help position your companies advantageously, which can bode well for valuations and help promote successful exits.

Ext. Marketing recently won silver at the FCS Portfolio Awards 2023 for our Aqua Finance, Inc. rebrand campaign, and has worked with many other portfolio companies to successfully improve brand structuring and communications.

Discover how Ext. Marketing can add value to your firm. Book a call with us today at info@ext-marketing.com.

How wealth advisors can become thought leaders and generate leads online

A wealth advisor’s website is an important tool, but one that’s often overlooked. A website isn’t just a place where clients and prospects can learn more about you and your team. It is also a powerful tool advisors can use to establish their thought leadership brand and attract prospective clients.

By posting the right content, your website can appear higher in Google searches, making it easier for potential clients to find you. This increased visibility can translate into new client acquisitions.

Advisors can better attract inbound leads by following these four steps to posting search engine optimized (SEO) website content:

1. Identify your audience.

Create a target audience profile using your specific industry niche as a guide. Identify target client characteristics, including demographics, age, gender, income, etc. Read more about developing marketing personas here.

2. Determine where your audience is – both digitally and geographically.

Join digital forums where you can engage with potential clients through online groups in which they participate. Consider exploring LinkedIn and Facebook groups.

Update and maintain your offsite SEO. This will increase your credibility and legitimacy. Keep your Google My Business, Google Analytics, Google Search Console, etc. accounts updated with the latest information about your business, including address, target area and contact information. This will also make you visible to potential clients on Google Maps and Google Reviews.

Utilize geotargeting. You can reach relevant customers by including location information on your website and social profiles. Update your About Us, History and Contact information. Include location-specific keywords in your articles and posts.

3. Identify the content your audience wants.

Capture the attention of potential clients by identifying the keywords they tend to search for. Identifying keywords can take time. Prepare to test your choices to determine which ones best suit your target audience.

Take advantage of negative keywords. By adding negative keywords, you can filter out unwanted traffic to your website and increase your return on investment.

4. Develop relevant and engaging content.

Integrate your keywords. Relevant and timely content will grab the attention of both target clients and search engines. Develop content based on insights from your keyword testing insights. Match your content to what your audience is searching for.

Use a strong and specific call to action, urging readers to follow through a particular path – whether it’s signing up for a newsletter or scheduling a call.

Digital engagement is a long process. It may take months to see any results, but is crucial for wealth advisors when maximizing the benefits of their website and boosting their brand presence to generate prospects. Partnering with a digital marketing agency like Ext. Marketing will ensure your brand regularly distributes relevant content that harnesses SEO and drives conversions so that you can spend time growing your clients’ wealth. Contact us today at info@ext-marketing.com to get started.

Four ways financial marketing will evolve over the next 10 years

The investment industry isn’t always easy to predict, but one thing is certain: the financial services marketing and communications landscape will constantly evolve. This was evident in our recent exploration of digital marketing trends. And there’s so much more to come! We foresee unprecedented evolution fueled by emerging technologies and shifting investor behaviours in the next five to 10 years. The future of digital content marketing presents exciting opportunities for the financial services industry.

What can we expect from financial marketing over the next five years?

1. Increased Personalization

Content will become even more personalized and tailored to individual customer needs and preferences. Advanced data analytics and AI technologies will enable financial marketers to deliver highly targeted content, personalized recommendations and customized experiences.

2. Gamification

Financial education and engagement may incorporate gamification elements to make learning and managing finances more interactive and enjoyable. Gamified experiences can help users understand complex financial concepts, track progress, and incentivize positive financial behaviours.

3. Voice-Activated Content

Voice-search optimization and voice-activated financial advice services will become increasingly prevalent components of marketing strategies.

4. Emphasis on Visual and Video Content

Visual and video content will continue to gain prominence in financial services marketing. Infographics, short videos and visual storytelling will be used to simplify complex financial information and captivate audiences with visually appealing content. Read more about ramping up your video marketing efforts here.

What about over the next 10 years?

1. Seamless Integration of Content and Transactions

Content marketing will become seamlessly integrated with transactional experiences. Financial brands may provide educational content and personalized offers at various touchpoints throughout the customer journey, ensuring a cohesive and value-driven experience.

2. Blockchain and Cryptocurrency Content

There is likely to be an increased focus on content aimed at educating audiences on the potential benefits, risks and investment opportunities in the blockchain and cryptocurrency spaces – including an emphasis on decentralized finance (DeFi) and digital assets.

3. Hyper-Personalization through Data Insights

By leveraging growth in data collection and analysis technologies, companies will gain access to improved insights into customer behaviours, preferences and needs. Content will be delivered in real time, enabling financial brands to provide timely and relevant information to their audiences.

4. Enhanced User Experience

The focus on the user experience will intensify, with financial brands aiming to provide seamless, intuitive and user-friendly experiences across multiple devices and platforms. User-centric design, intuitive interfaces, micro-interactions and enhanced accessibility will be key considerations in content marketing strategies.

Anticipating and adapting to industry changes will allow for strategic future planning. From increased demand for personalized content to a stronger focus on user-centric experiences, including immersive and interactive experiences, as well as digital advancements, will continue to redefine financial services marketing and communications.

If you’re interested in exploring these marketing trends further, or if you want to better align your messaging with these trends in mind, contact us today at info@ext-matketing.com.

How to engage hard-to-reach investor audiences

Investor audiences can be relatively difficult to reach for those raising capital or looking for new clients. By understanding the factors that make these audiences hard to reach, however, you can develop specialized marketing strategies to overcome the challenge of reaching investors and better engage this audience. Here are the main reasons investors can be tough to reach, along with some important strategic marketing solutions to attract investors.

Eight reasons why financial audiences can be particularly hard to reach:

1. Fragmented audience: Financial audiences can be diverse and comprise individuals with varying financial goals, knowledge levels and interests. This fragmentation makes it challenging to reach the entire target audience with a single approach or platform.

2. Information overload: The financial services industry is inundated with information from various sources, making it difficult to cut through the noise and capture investor attention. Strategic distribution and compelling content is required to stand out and engage the audience effectively.

3. Trust and credibility concerns: Financial decisions often involve a significant investment amount and a number of risks. As a result, investors tend to be cautious, and also tend to value trust and credibility. Companies looking to attract investors must establish themselves as reliable and trustworthy sources of information to gain investor attention and engagement.

4. Compliance and regulatory considerations: Financial content is subject to strict compliance and regulatory requirements. These regulations can impact the distribution channels and strategies available to companies looking to attract investors, while also requiring careful navigation to ensure compliance.

5. Financial jargon and complexity: The financial industry is notorious for its complex concepts and jargon. Communicating financial information in a clear and understandable manner is crucial to engaging your target audience.

6. Security and privacy concerns: Investor audiences are understandably concerned about their personal financial data and privacy. These concerns must be addressed to provide secure channels for content distribution.

7. Niche targeting: Investor audiences, including individual investors, retirees, small business owners or high-net-worth individuals, often have specific niches or segments. Effective distribution requires identifying and targeting these specific segments with tailored content that meets these audiences’ unique needs and preferences.

8. Relationship building and trust: Financial decisions are often based on trust and long-term relationships. Investing in building and nurturing relationships with your target investor audience requires consistent and targeted distribution strategies.

There are many opportunities to reach your target audience effectively. With the right marketing strategy and a focus on building trust, delivering valuable content and utilizing digital channels, you can easily overcome barriers to successfully engage investors.

Five ways to engage hard-to-reach investor audiences:

1. Leveraging digital channels and platforms: Utilize websites, blogs, social media, email marketing and industry-specific platforms to reach investors where they spend time.

2. Thought leadership and expertise: Establishing your thought leadership and expertise through content can help build trust and credibility, which, in turn, can make it easier to reach and engage investors.

3. Personalization and targeting: Leverage data and technology to personalize content and target specific audience segments to, deliver more relevant and tailored messages.

4. Strategic partnerships and collaborations: Partner with influencers, industry experts or complementary brands to expand your reach and credibility.

5. Educational and informative content: Provide valuable educational resources and informative content that positions you as a trusted source of information.

Reaching investor audiences can be challenging. By understanding their unique characteristics and tailoring distribution strategies accordingly, financial brands can effectively engage and connect with their target investors. Partnering with an agency like Ext. Marketing can help you create specialized marketing strategies and attract investors. Contact us today to reach your ideal investor audiences at info@ext-marketing.com.

Consistency and Commitment: Finding Success in Financial Marketing

Our CEO and Co-Founder, Jillian Bannister, recently sat on a panel at the Gramercy Institute to discuss “Content Marketing: Today’s Best Practices in Financial Marketing.” She spoke about what it takes to find success in financial marketing and communications.

Her biggest takeaways: consistency and commitment.

Consistency

A strong brand identity requires consistency, not only in your visual elements, such as logo, colours and fonts, but also in your overall communication strategy. How you communicate is an extension of your brand identity that reinforces your credibility and professionalism.

Always-on content

It is easy for brands to lose credibility with their audience when content takes a back seat and becomes sporadic or infrequent. Whether in the form of videos, infographics or blog posts, maintaining regularity is crucial. With a digitally connected world that never sleeps, integrating an ‘always on’ strategy is imperative to establishing your brand as a reliable and trustworthy source of information. Developing an editorial calendar is a great way to achieve ‘always on’ content. Learn how to develop your editorial calendar here.

Commitment

To excel in content marketing, you must prioritize your editorial calendar. Setting a schedule and committing to it will ensure successful, consistent and targeted distribution over time.

The right team and resources

Jillian emphasized the importance of having the right people and resources to ensure your content is distributed effectively. Whether you’re working with an internal or external team, commitment to content is imperative. Partnering with an agency like Ext. Marketing is the right way to ensure your content marketing strategy succeeds.

Contact us today at info@ext-marketing.com and commit to consistent content marketing.

GET MICRO: THE POWER OF MICRO-INTERACTIONS

If recorded in 2023, Madonna would be singing about living in a digital world … rather than a material world. With so much choice and competition, getting your website to stand out to visitors and make an impression can be difficult. One way to delight users and connect with your audience is with micro-interactions. Let’s look at the different types of micro-interactions that engage and elevate the user experience.

Button Animations: meaning animations that occur when a user hovers over a button, which can include button colour or arrow shape changes. Noticeable animations can evoke interest and/or emotion in users.

Carousels: meaning slider or slideshow of images or content. Carousels can help lay out content and important information in smaller amounts of space to reduce scrolling.

Accordions: meaning a heading that expands with more relevant information. Accordions help condense information so your target investor audience doesn’t miss important information.

Hover Effects: when a user hovers over a tile, text or image, additional information pops up – before the user clicks on that tile, etc. and is taken to a new page. This is a great way to lay out content, but the downside is that search engine optimization isn’t captured this way.

Parallax: means layering the background and foreground to give space, depth and movement when a user scrolls through the site. A great example is the visual in our Careers page. Parallax keeps users engaged and on the page longer, while not overpowering content.

Shortcuts: can include quickly sharing articles on social media, providing the ability to scroll back to the top of the page or other content, among others. Shortcuts allow you to direct users to important information.

Mobile: with so many people visiting websites on their phones, micro-interactions make viewing content easier on a smaller screen. Accordions and carousels are great for the mobile experience. Learn more about optimized mobile content here.

Modest functional animations evoke engagement and enhance the overall user experience of a website. These might seem like small changes, but they make a big difference in user retention if they are sprinkled throughout a website. Micro-interactions are also measurable in Google Analytics, since you can track where users are spending their time.

Contact us today at info@ext-matketing.com to ensure your website is making a lasting impression.

HOW TO TURN YOUR DIGITAL STRATEGY INTO A BUSINESS GAME CHANGER

An interview with Cesar Lugo, Managing Director, Digital, Ext. Marketing

From the growing influence of TikTok to the emergence of AI-powered chatbots, the digital landscape has quickly evolved over the past year. To help us navigate the digital noise, we spoke with Ext. Marketing Digital Managing Director, Cesar Lugo (CL), to identify which trends demand further exploration. He shared with us why establishing a clear digital strategy can help companies easily navigate these changes and generate the best-possible business outcomes.

Q: How can a defined digital strategy help a company respond to emerging trends in technology?

CL: The digital ecosystem is vast and constantly changing. It’s easy to get swept up in the latest trends, without having a complete understanding of the problem you’re facing and the key drivers that will generate the desired outcome. Your digital strategy should include an audit of your current digital touchpoints, assets and tools; short-, medium- and long-term objectives; success measures; and a digital roadmap that can keep you on track.

A digital strategy is more than just a one-off project or a one-size-fits-all approach. It should reflect a long-term commitment to using digital tools to achieve your business objectives. Defining this foundational framework allows you to make strategic decisions about these emerging trends.

Q: What digital marketing and social media activation trends should companies be aware of heading into 2023?

CL: Here are some trends I believe will be game changers we should all be watching:

- Individuals 45 years old and younger are turning to social media platforms rather than traditional search engines to find the information they need. There’s evidence of the same growth in buying and shopping on these social media platforms.

- It is all about TikTok these days. There were nearly 1 billion active users in September 2022, which is impressive growth from 700 million users in July 2021.1 It will be important to stay up to date on U.S. regulations in the coming year, as lawmakers continue to scrutinize this platform.2

- Short-form or ”snackable” videos are still crucial for driving views and generating richer engagement on social media. However, long-form content is making a comeback with the 25-and-under crowd.

- Artificial Intelligence has grown in relevance in the tech industry, with expectations that it will grow by 23% from 2023 to 2028.3 ChatGPT is just the latest revolution worth exploring. This AI-generated natural language processing tool crossed one million users within one week of its November 30, 2022, launch.4 Spoiler alert: all these solutions will need human involvement to ensure quality and accuracy.

- The metaverse, non-fungible tokens (NFTs) and Web3 are on the horizon. Depending on your industry, these technologies might help your company grow in the future. We recommend you monitor the progress and adoption of NFTs and Web3 within your industry.

Q: How can companies capitalize on those opportunities in 2023?

CL: Most of these emerging trends could be very important to the success of your company. If your digital efforts need to catch up, now is the time to roll up your sleeves and develop a strategy. Establishing an effective digital ecosystem will provide you with the foundation to determine how these trends can benefit your business.

Whether you are increasing brand awareness, generating leads or raising capital, it is important you remember that your digital strategy should be diversified across digital platforms and mediums, and include regular A/B testing to determine whether or not you are achieving your business goals.

Q: What advice or takeaway do you want to leave companies with?

CL: It is important to be nimble and agile so you can respond to change. Digital spaces can open avenues and create a broader perspective on available opportunities, changing circumstances and even better ways to operate.

Contact us today at info@ext-marketing.com to start developing your digital strategy and to respond to the key emerging technology trends of 2023!

1 TikTok reveals U.S., global user growth numbers for first time (cnbc.com)

2 TikTok has become a global giant. The US is threatening to rein it in | TikTok | The Guardian

4 ChatGPT Statistics for 2023: Comprehensive Facts and Data (demandsage.com)

Notes: From an Ext. perspective – these are trends we recommend you watch.

Your 2023 Website Spring Cleaning Checklist

Does your website need a refresh? Are you dealing with lengthy load times, missing meta-tags or dated messaging? Even a few minor issues could be cluttering your website performance. Making some small tweaks can make a big difference in optimizing user experience and attracting investors. Check out our checklist to help spring clean your website:

- Define your goals: Your website is a powerful tool. If you are an issuer undergoing a capital raise, your goal might be lead generation. If you are an asset manager, you might use your website more for informational or brand awareness among advisors and retail investors. Keep your goals in mind when reviewing your website analytics.

- Leverage analytics: Review your website metrics to understand and benchmark its performance. Evaluate your website audience to see where visitors are coming from, how long they stay on it and what pages they tend to go to. Your analytics can tell if you are attracting your target investor audience, and what content is resonating most. If you don’t know where to find the analytics you need, you can start by Googling “Google Analytics.”

- Refresh your content: Apply the insights you get from your analytics to update content that speaks specifically to your target audience. This will help decrease your Readers prefer easily accessible information, so you might want to change how your content is laid out by making your website’s hero banner a conversion superhero. Take inventory of high-performing content (the stuff that is most viewed or shared) and move it to the home page to increase engagement. Having a user journey and distinct call-to-action will also increase engagement and conversion.

- Revitalize SEO: Search engine optimization (SEO) is an important step in your cleaning process. It makes it easier for your target audience to find you. Here are a few technical items that are often overlooked:

- Broken links: Remove any that go to removed pages with error messages.

- Meta descriptions and alt-text: All pages should have meta-descriptions. Alt-text shouldn’t be too long or too short. This is a great place to insert keywords to improve your overall SEO rating.

- Page speeds: Reduce page speeds to one to three seconds to increase user retention. You can eliminate any code that isn’t being used to increase your website’s speed.

- Leverage plug-ins: Tools like Imagify for image compression can free up a lot of time, enhancing your website performance.

- Maintain regularly: Websites are meant to be kept current and should be frequently updated. Find a cadence that works for you to update your website and stick to it.

Looking to improve your web metrics or create content optimized for search? Ext. Marketing can help you develop targeted web content to help boost your conversion rates. Check out our web design services or contact us today at info@ext-marketing.com.

5 Tips For NexGen Pitchbooks

There’s no doubt the last few years have fundamentally changed how we communicate. The global pandemic, restricted mobility and the necessity of remote working environments have fuelled expanded technology applications. With fewer in-person interactions, people have become more comfortable with virtual meetings and pitching on online platforms, including Zoom or Microsoft Teams.

While more meetings are happening online, the financial services industry is still quite traditional, and so too is its preference for printed pitchbooks. The result can be challenging because pitching in person is quite different from an online pitch. You can make eye contact and detect body language in-person to gauge interest, but capturing and retaining a potential investor’s attention online is much harder.

If you are looking to elevate your pitchbooks to the next generation (NexGen), consider these five tips. And remember, a great pitchbook is important to every hedge fund manager’s success because great pitchbooks always tell great stories:

1. Tell an exceptional story

When considering a pitch, today’s investors need context – the “why,” “what” and “how” behind who you are as a fund, organization and team. Investors are looking for a solid narrative that differentiates you from the many pitchbooks that cross their desks – and screens – every day. Strong storytelling can help them see your potential more effectively, resulting in a stronger connection with you.

2. Clean and clear content

Investors don’t have time to dig around for what they need. Great pitchbook stories are tied together in ways that make sense. Designing them as intuitively as possible starts with a smart page-flow supported by a strong narrative. Cut down on copy to get right to the point and organize your hierarchy of information so your audience can more easily follow along.

3. Capture attention

Most people, including potential investors, are visual learners and will be better able to digest your content if it is illustrated creatively. So go ahead and slide some design tricks into your repertoire, allowing you to bring your pitch to life. Here are some design tips you can start with to keep investor attention on screen:

• Keep your visuals simple and clean, while tying them into the rest of your brand and marketing materials. Stick to one graph per slide.

• Use large fonts in dark colours. Avoid copy that is too small or light, as this will be too hard to read on a screen.

4. Use bold colours

Take advantage of brighter colours that you might not typically use. They might not print as well, but they can be ideal in a digital format. You can also use shades of colours to create a deeper visual experience. Shading allows for a sophisticated monochromatic approach.

5. Size matters

Most pitchbooks are 8.5×11 (the size required for printing). Instead, consider designing your pitchbook using a 16×9 aspect ratio, which is optimal for online presentations.

Creating an effective NexGen pitchbook – one that connects with your investor audience in a clear, compelling way, will always come down to how succinct, relevant and readable your message is. Telling a story that’s simple, logical and genuine is a great place to start.

Whether you are an issuer, hedge fund or private equity firm, it’s never been more important to have a great pitchbook help tell your story. Contact Ext. Marketing at info@ext-marketing.com to get started on your NexGen pitchbook.

Redesign or overhaul? Some tips for extending your visual brand’s longevity.

Although logos are generally considered the entirety of a company’s brand, they are actually really more of the tip of the iceberg. A well-designed logo is important, but a brand’s visual identity includes much more. If you are contemplating a brand redesign, consider how a more holistic approach can add value and longevity to your overall brand.

Your logo is only the beginning

Your logo and visual identity system go hand-in-hand. A strong logo makes it easier for your target audience to recognize and remember your brand. But a less cohesive visual identity system can undermine a good logo. Since a logo (even a great one) is only part of your overarching brand, it can be equated with a poorly articulated visual identity.

What is a visual identity system?

A visual identity system is a collection of graphics, colours, fonts, icons and imagery that includes your logo in your brand guideline. When used and deployed consistently, these guidelines become the visual identity associated with your brand. Your logo is the first impression your audience sees, while your visual identity system is the personality behind your brand and logo that reinforces your message. Read about the importance of creating clear brand guidelines.

Best practices for creating a resilient visual brand identity

To ensure your brand is resilient over the long term, here are a few tips from Ext. Marketing’s creative team:

- Do some upfront work

• Brainstorm with your internal team to share your company’s vision and what you are hoping to achieve by creating a strategy document.

• Research logos and visual identity systems that you like (and why) to guide your creative team.

• Look at competitors and other creatives to see how they are being perceived compared to how you want to be seen. - Bring ideas back to the strategy document

• The first step in creating a logo starts with a meeting between you and your designers. Before the designers can visually represent the brand; they need to understand your organization’s vision and personality.

• If you want a logo that stands the test of time, think beyond immediate timeframes, and focus instead on where you want to be in five years.

• Your logo’s value should address all key strategic elements. - Try to avoid design fads

Some recent trends in design include “retro” concepts or gradients that might look great now, but they could quickly date your brand. - Accessibility is key

People need to clearly see your logo. How discernible is it? Does it stand up with contrast checkers, across all mediums? Read more about the importance of accessible design.

Time for a redesign?

If you think your visual identity does not ideally encompass your brand personality, strategy, or your company has evolved and your logo is no longer an accurate representation of your company, this might be the right time for a redesign or refresh. This is especially true if your logo looks dated, or if there are technical issues and it doesn’t perform well either digitally or in print.

Although you can choose to completely redo your logo, a thorough logo or visual redesign could mean you’ll lose your hard-earned brand equity and recognition. You might want to do a refresh to elevate your logo, rather than a complete redesign. Or you might keep the logo as-is, and update the visual identity system for a brand refresh (while maintaining your brand equity).

Brilliantly designed marketing material – whether it’s a brochure, website, pitchbook or anything else – doesn’t just happen. Developing stunning visuals that truly differentiate brands requires design thinking, or a strong methodology for developing creative ideas.

Whether you are an emerging manager kickstarting your brand or an established firm ready for a redesign, Ext. Marketing is the financial services marketing and brand consultant that can help your investor-focused brand succeed long-term. Contact us today at info@ext-marketing.com to get started.

Why diversity matters in marketing

A Q&A with Ext. Marketing CEO & Co-founder Jillian Bannister

How does DEI shape Ext.’s business?

The principle of DEI is central to Ext. Marketing philosophy because we believe diverse perspectives lead to better creativity and superior client solutions. On my executive team, some of the top senior leaders are women, and they help drive the organization forward every day. Their expertise and unique voices give us a competitive edge. But diversity goes beyond gender – we believe that the fabric of an organization is stronger with different voices that transcend gender, race, sexual orientation or ethnic background. Each individual has distinct life experiences that shape their perspectives in unique ways. We want to embrace and harness these viewpoints. We have always encouraged a workplace with diverse voices because we believe it promotes fresh thinking. Great ideas don’t come from any one specific area of the organization. They can originate from anywhere. Inclusivity helps ignite the creative spark that is essential to all of Ext.’s marketing projects. This approach promotes empathy – which helps us develop better solutions for our clients by encouraging us to see the world from their point of view.

Why is it so important?

Ext. Marketing operates in a diverse global financial services ecosystem that exhibits varying stages of DEI adoption. But many have realized that there is a wealth of opportunity for community building by actively engaging and speaking to audience segments and constituencies, including women, the LGBTQ+ community, people with disabilities and other underserved communities.

We work hard with our clients to help them understand that diversity and inclusivity build more resilient companies and marketing strategies. Every client is unique, so it all starts with listening and understanding client goals. Our clients tend to see the value of integrating DEI initiatives and strategies into their businesses and marketing messages. It’s important to be authentic to your company and brand if you want to develop messages and creative collateral that resonate.

How does DEI help Ext. Marketing create more engaging marketing strategies?

We work in an omni-channel digital environment. That is especially relevant, given this year’s International Women’s Day theme embraces equity by recognizing technology’s transformative nature. Technology can break down barriers, establish new opportunities for women, and give underserved communities a voice. From a marketing perspective, activating strategies across diverse channels means reaching different audiences, offering clients an opportunity to amplify their voice and deliver tailored, targeted and relevant content. Today, content encompasses everything from AI chatbots to long-form thought leadership. Therefore, clients should be granular with their messages and target specific personas. A diverse marketing toolkit helps you reach an eclectic audience, leading to a more effective and efficient spend of marketing dollars.

I’m a big believer in championing women. The glass ceiling is far from being broken. We’ve helped clients in the financials sector develop numerous campaigns focusing on women in investing – a vastly underserved segment. Interestingly, we are seeing a transition from women-focused campaigns to campaigns that aren’t so “single-note”. The idea is to avoid biases and stereotyping, and integrate more nuanced perspectives and intersectionality.1

How did it affect your decision to support Ernestine’s Women’s Shelter?

We’re passionate about giving back to our community. I’ve been involved with Ernestine’s Women’s Shelter in Toronto, since I was a child, and Ext. Marketing has supported Ernestine’s since our first day in business over 14 years ago. Combatting violence against women and helping women find a safe place is a stark necessity in our society. Post-COVID-19, we’ve seen a huge uptick in mental health issues, which has escalated cases of violence against women. Ernestine’s is playing a more important societal role than ever before. Tackling gender bias and facilitating an environment of inclusion starts with safety. This can’t happen without ensuring women have achieved security at the most basic level. That’s why Ext. Marketing’s support of Ernestine’s continues to be an important part of how we give back and facilitate the important journey toward equality.

1https://kindredmembers.com/insights/intersectionality-marketing/

Looking for innovative and creative ways to bring your marketing to the next level? Ext. Marketing has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

HOW DATA METRICS CAN HELP YOUR MARKETING DOLLARS GO FURTHER

Marketing costs are likely to remain a focus at many firms in 2023. During leaner times like these, the ability to embrace digital transformation and the power of data could give your firm the boost it needs. Metrics help inform sound marketing decisions and make it easier to understand which channels are worth your marketing dollars.

Knowing how and where to spend your marketing dollars can be challenging because of shifting customer behaviours. Have attitudes changed based on people’s current financial situations? Are they facing a wider range of investment options? Do they seek easier ways of doing business with you? Keeping a close eye on how prospects engage with you, and what’s prompting their conversions, will help you pivot your marketing spend to where it can be most effective.

While each campaign is unique, here are some key metrics you should always track to know how efficient and practical you are being with your marketing spend.

Top 5 tips & trends for financial marketers in 2023

Social, geopolitical and economic uncertainties that characterized 2022 aren’t likely to abate any time soon. Prompted by those challenges, forward-thinking business leaders are adapting their marketing strategies.

If you are a business strategist looking to jumpstart your 2023 marketing campaigns, consider these five marketing trends and best practices:

1. AI starts to step up

Everyone is talking about artificial intelligence (AI) technology and automation tools (like ChatGPT and DALL-E). You may wonder what AI technology can do, how it works, and how it might help your business. Many of us have the same questions. While AI tools are mostly in beta testing, the technology matures quickly. Essentially, the tools streamline time-consuming creative and content tasks, including research and image searches, freeing up valuable time for strategic work, like branded story development. The Wall Street Journal calls this approach “post-creation.” We believe that, over the long term and with proper set-up and governance, AI can play a vital role in speeding up more basic tasks and enabling agencies to focus their resources on strategic, higher-value client work.

2. Aligning CSR & ESG with marketing strategies

Investing time in your corporate social responsibility (CSR) and contributing to causes that align with your company’s values can win favour with clients and employees. Recent surveys show that Millennials and Gen Z cohorts have high levels of climate change engagement, with 90% of Millennials actively pursuing sustainable investments.2 More regulators are taking a closer look at portfolios to ensure that stated environmental, social & governance (ESG) actions can be verified. With the critical importance of value articulation, marketers need to align their CSR and ESG messaging carefully. Recently, Ext. Marketing helped a major multi-billion-dollar global asset manager successfully benchmark and align the messaging for their ESG solutions, while also helping their messaging to better reflect their corporate CSR positioning.

3. Social media continues to skyrocket

It’s estimated that by 2026, social media, community and virtual platform engagement will influence over 68% of brand revenue.2 Firms need to become savvier than ever about leveraging their social media platforms. However, social media success starts with having a solid content pillars and editorial strategy. In 2022, Ext. Marketing led a number of social engagement strategy projects that enabled our clients to connect with their audiences on organic channels, as well as paid channels like LinkedIn, TikTok and YouTube. With our strategic guidance, clients achieved strong engagement and exceeded target expectations with social media audiences.

4. Video frames your messaging

Video is a terrific addition to your brand storytelling toolkit. Research by Cisco discovered that video accounts for 82% of all online traffic.3 Today, Cisco estimates that 84% of consumers have been influenced or convinced to purchase a product after watching a video. Visual content can help keep content fresh and deliver on performance goals. Ext. Marketing engages in video storytelling for a wide variety of firms across different mediums. We recently helped a real estate firm underscore important key messages to investors at their annual Investor Day through videos that demonstrated the lifecycle of a key property. The videos helped convey how the addition of thoughtful design and amenities delivered value to investors, tenants and the surrounding community.

5. Data drives good marketing decisions

Analytics are a marketer’s best friend. All successful marketing strategies employ a digital component – organic social posts, blogs, email, paid digital ads or a combination of channels. Each activity can track data to support your marketing plan (and your budget). Metrics give stakeholders a valuable understanding of their return on investment – and this will be more important than ever as marketers look to use their dollars wisely and more efficiently in the coming years. Ext. Marketing has deep experience applying data analytics to quickly pivot tactics and drive successful campaign results. Metrics can be a bit of an alphabet soup (think: CTR, CPC, CPM), and working with the right partner can help you sort through the data noise and use it in the right context to support your strategy.

1 Will AI Make Creative Workers Redundant

2 https://www.nasdaq.com/articles/how-millennials-and-gen-z-are-driving-growth-behind-esg

3 https://stefanini.com/en/insights/news/global-digital-marketing-outlook-for-2023-and-beyond

4 https://www.cisco.com/c/dam/m/en_us/solutions/service-provider/vni-forecast-highlights/pdf/Global_Device_Growth_Traffic_Profiles.pdf

If you’re interested in exploring these trends further or just want to better align your messaging, Ext. Marketing can help! Call 1.844.243.1830 or email us to book a time with our team.

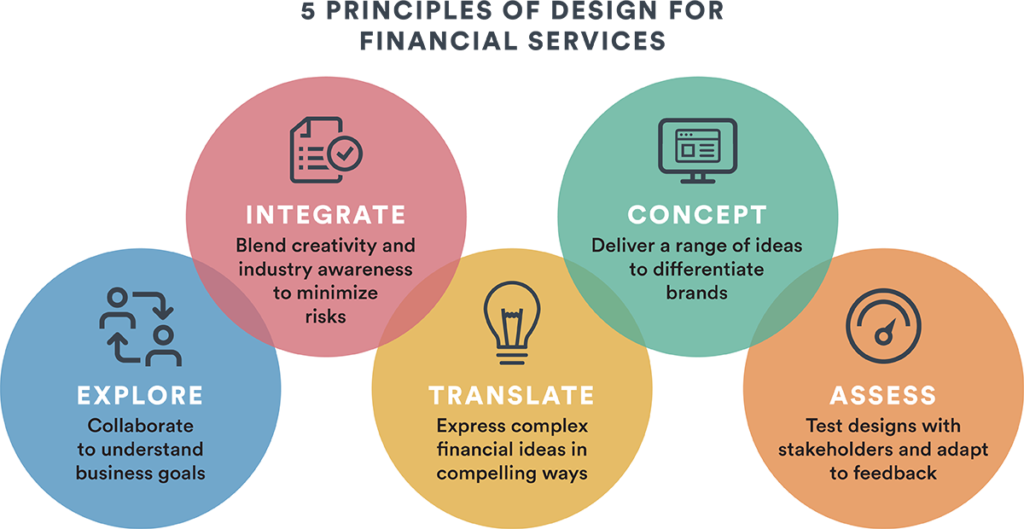

Is design thinking part of your marketing strategy?

Brilliantly designed marketing material – whether it’s a brochure, website, pitchbook or anything else – doesn’t just happen. Developing stunning visuals that truly differentiate brands requires design thinking,1 or a strong methodology for developing creative ideas.

Applying a systematic approach to design is especially important when marketing financial products or services, given how dynamic and complex the industry can be. Here are some ways Ext. Marketing integrates design thinking into our creative process:

Collaborate to unearth business goals

The roots of all strong creative solutions stem from a thorough review of the goals a business would like to achieve through design. The review process involves all creative professionals instrumental to a project, including writers, editors, designers, and digital and analytical experts. This integrated, all-hands-on-deck approach to exploring key stakeholders’ needs can help address a wide range of factors that may shape or inspire design.

Blend creativity and industry awareness

Conceptualizing financial services requires a multidimensional lens. Along with creative expertise, this process needs to integrate deep industry knowledge. For instance, financial services organizations must remain aware of compliance/regulatory standards or uphold certain levels of transparency throughout the marketing process. If these requirements aren’t met, there is a risk of conveying a wrong or inappropriate message. Consulting creative professionals experienced in financial services can help manage these priorities and minimize the risks unique to this highly regulated industry.

Translate complexity in compelling ways

Financial organizations are often challenged by how to communicate technical information to clients. It takes wide-ranging perspectives from creative and analytical experts to come up with differentiated design solutions that use data visualization and other devices to illustrate the concepts in new, compelling ways without sacrificing meaning. One example of this could include creating a concise, engaging infographic that clearly captures the benefits of a complex product or illustrates the steps required for an intricate investment process.

Deliver a range of differentiating concepts

Concepting is a vital step in our design process. We try to avoid getting stuck on one or a few design samples. It’s wise to build a range of preliminary concepts and iterate to see what will resonate best with a given audience.

Traditionally, the financials sector has been relatively conservative when it comes to design (often using more subdued colours, graphics, branding). But that is changing. Our clients are no longer limited by these options. In an increasingly competitive environment, differentiating brands is crucial, and visuals are an important way to achieve that goal.

It’s okay to test the boundaries at this phase of your design thinking. Try providing various representations, perhaps through bolder, more unconventional approaches, to challenge your stakeholders and highlight your brands in different ways.

Test, learn and adapt design

The creative process is never static and should remain highly iterative until the best possible outcome is achieved. Once initial drafts of your design are built, you need to test them with stakeholders and adapt to feedback, sometimes across multiple rounds. The status quo, especially in financial services, is always shifting, and you might need to modify your design in real-time. There are several feedback mechanisms you can try, including A/B testing, social polls or surveys to see if you are moving in the right direction.

Ext. Marketing is on top of the trends shaping the financial services industry, and we pride ourselves on helping our clients succeed. As an integrated marketing agency, we are known for creative content, design expertise and strategic digital distribution. Our creative team loves to bring left- and right-brain ideas together to give our clients a creative edge.

Are you looking to market your message through innovative design? Ext. Marketing takes design thinking to a whole new level and can help elevate your brand.

Interested in learning more? Contact us today at 1.844.243.1830 or info@ext-marketing.com.

1Nielsen Norman Group, Design Thinking 101, 2016

Tune up for 2023 with our happy songs playlist!

What a year it’s been. Did music help you get through 2022? It did for us.

So to say thank you for the high notes we shared, the Ext. Marketing team created a Spotify playlist of happy songs to help you ring in 2023. We hope you enjoy it!

On behalf of our clients and partners, Ext. Marketing made a donation to Ernestine’s Women’s Shelter. Ernestine’s plays a critical role in helping women and children break the cycle of domestic abuse, and our support has never been more crucial.

~The Ext. Marketing Team

*The inclusion of this playlist does not imply any endorsement or commercial relationship between Ext. Marketing and any of the featured artists/songwriters.

Providing a helping hand

On any given night in Canada, over 6,000 women and children sleep in shelters because it isn’t safe for them to return home. It’s what makes the November 25th United Nations International Day for the Elimination of Violence Against Women so important. It’s also what led Ext. Marketing co-founders Jillian Bannister and Richard Heft to lend their support to Ernestine’s Women’s Shelter.

“It takes a lot of guts for women in situations of abuse to leave their partner and, when they do, it’s often with little more than the clothes on their backs.”

Jillian Bannister, CEO Ext. Marketing

“When we launched Ext. Marketing, we had a strong focus on three things,” says Heft: “building an industry-leading team of the best people we knew in the financial industry, doing amazing work for our valued clients, and supporting those in our community who needed that help the most. We’ve been incredibly proud to support Ernestine’s since the day we started Ext. Marketing, and plan to do so for as long as women and children need us.”

As a woman in business and financial services, Bannister says she’s particularly honoured to support an organization that, in addition to being a safe haven, provides a helping hand for women to move forward with their lives.

“It takes a lot of guts for women in situations of abuse to leave their partner and, when they do, it’s often with little more than the clothes on their backs,” added Bannister. “Ernestine’s provides counselling, a food bank, transitional housing and legal support to help these brave women successfully rebuild their lives.”

Laurie Lupton, Ext. Marketing’s General Manager, a board member at Ernestine’s, as well as a leader of Ernestine’s fundraising committee, says the holidays are a particularly difficult time of year for families who depend on Ernestine’s programs and services. It’s why Ernestine’s hosts an annual Winterfest event to recognize culturally relevant festivities during the holiday season, while also delivering items that these families could not otherwise afford.

Consider supporting the Stand up for Ernestine’s campaign by visiting the SU4E page to make your donation!

Interested in learning more? Contact us today at 1.844.243.1830 or info@ext-marketing.com.

How to make your marketing language inclusive

Is your language opening or closing doors?

The words you use and the way you communicate is a personal choice. Your brand voice has considerable influence on your marketing strategy. Increasingly, marketers recognize the currency of inclusive language and its power to make a positive impact on a wider range of audiences. But what is inclusive language?

At its core, inclusion is about recognizing that your potential customers comprise diverse groups of people. In content creation, inclusion respects diversity in all forms, including ethnicity, gender identity, religion/spirituality, physical/mental ability and more. If your brand doesn’t convey a sense of inclusivity, you may inadvertently exclude some audiences. Millennials and Generation Z, with their substantial spending power, have done much to accelerate the inclusive language movement.1

Why it matters

Language is powerful — it can deepen and strengthen relationships, or it can confuse or even cause avoidable harm. Inclusive language encompasses words and phrases that can spark conversations with new clients and unlock valuable doors. Deloitte, Boston Consulting Group and Harvard Business Review research shows the same truth. Is your language tapping into that relationship-building potential?

Evolve with your customers

What’s great about language is that it’s flexible, expressive and evolves over time. Ultimately, we understand the bottom-line value of keeping pace with changing demographics and preferences. The Merriam-Webster Dictionary added 370 new words in 2022 and suggested that when many people use a word in the same way over a long enough period, that word becomes eligible for inclusion.

Make it a brand practice

Everyone’s brand is unique. By considering how inclusion fits into your brand, you’ll expand your reach and visibility into the future, earning audience loyalty and trust. The key is to make inclusive content an ongoing process that adapts with your stakeholders and audiences.

Ways to make language more inclusive

You might want to start with ensuring your marketing materials, websites and all your other assets reflect the varied population and voices around us. Here are some inclusive language options to consider:

Use plain language versus jargon

- Rather than “piece of cake,” say “straightforward,” “easy” or “simple”

- A phrase like “in light of” turns more succinctly into “because of”

- We are not “in the loop” but we “are aware”

Pay attention to pronouns

- According to The Associated Press Stylebook, it’s preferable to refer to a person as “they” instead of “he” or “she”

- Rather than “man” or “woman,” use “person” or “individual”

- It’s not “his” or “her” document, but “their” document

Put everyone in the picture

- Make sure your images and emojis include a wide cross-section of people and groups

- Consider using both colours and labels in design for people who can’t distinguish hues

- On websites, use both images and text so that everyone gets the message

Adopt gender-neutral family labels

- Use “parent” or “guardian” versus “mom” and “dad”

- Replace “husband” and “wife” with “spouse” or “partner”

- “Pibling” has become popular when referring to aunts and uncles (stands for parent’s sibling)

Be mindful of accessibility-inclusive language

- Commonplace expressions like “turning a blind eye” could be perceived as insensitive

- A person is “hard of hearing” rather than “hearing impaired”

- Rather than “wheelchair bound,” a person “uses a wheelchair” to assist with mobility

It’s a good idea for companies and their brands to craft their own approach toward using inclusive language to create messages that resonate with each audience segment.

Interested in learning more? Let Ext. help you integrate inclusive language so you can connect with more people, communities and opportunities. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

How to use testimonials to boost your marketing strategy

If you’ve ever had to search for a new restaurant or book a hotel in a new city, you’ve likely read reviews (also known as testimonials) to make your decision. In the world of financial services marketing, testimonials can be just as powerful in creating a connection with your prospective customers. Studies have shown that 97% of business-to-business customers cited testimonials and peer recommendations as the most reliable type of content,1 while 72% of consumers say positive testimonials and reviews increase their trust in a business.2

Why testimonials work

When a person is faced with an uncertain decision, they naturally look to others for guidance. This “social proof” is rooted in our psychological need for validation from others who have experienced a company’s products and services.

There is a truism when it comes to marketing that says – “show, don’t tell”. You can have the best words to describe your value proposition and how you help your customers. However, there is nothing like having your own customers convey that message through their personal stories and experiences with your company.

If your purpose is to solve customers’ problems or challenges, testimonials show that you understand what they need and demonstrate how your company can help.

How to make sure your testimonials resonate

Be specific and focused

Stay away from generalities and draw on the details (metrics) that bring the reader into the story. Keep the testimonial focused on one problem or challenge and have your customer explain exactly how your company helped.

Use video

An effective testimonial is essentially a compelling narrative about how your company helped a customer. Videos are a great way to deliver that story, especially through social media.

Put a face to the name

Where possible, use a photo of the customer to create authenticity and a stronger connection to their story.

Case studies

Create a longer-form version of a testimonial with a case study, leveraging the context and complexity of the customer’s challenge to build a strong narrative.

Be credible

Avoid the perception of any conflict of interest or the notion that the customer is being compensated for their story. For U.S. investment advisors, be aware of the SEC disclosure requirements for testimonials and endorsements that came into effect in 2021 (the transition period for compliance ends on November 4, 2022).3

Need advice on how to incorporate testimonials into your marketing? Ext. Marketing can help you add this powerful tool to your digital platforms. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

1 Why B2B customer reviews matter as much as consumer reviews. Manya Chylinkski, Momentum, November 5, 2014.

2 How to Use Customer Testimonials to Generate 62% More Revenue From Every Customer, Every Visit, Emily Cullinan, Big Commerce, April 6, 2017.

3 SEC’s New Marketing Rule for Investment Advisers Goes into Effect, Arnold & Porter, May 14, 2021.

How solid are your marketing personas?

Who is this for? Why are we doing this? Are you sure we’re saying the right thing? Those are just three of the many questions you may ask yourself when working on a marketing project. Finding the answers is much easier when you have robust and relevant marketing personas.

What’s a marketing persona?

A marketing persona represents a group of clients with similar profiles, personal goals and client journeys.

Personas are a powerful way of embodying not only demographics (e.g., “our clients tend to be women in their 30s) but also user needs (e.g., “needs to prioritize risk management in their portfolio”). A persona can be viewed as a composite of attitudes, motivations, pain points and goals.

How customer personas add to your marketing strategy

The main benefit of developing personas is that they’ll help you adjust your brand messaging. Well-developed personas are powerful tools that can illuminate how a customer or prospect might interpret your offering. You can focus on marketing your messages and developing products based on those personas.

What to watch out for

Here are some pitfalls to avoid when creating your marketing personas:

- Making the personas too broad: You want them to address your clients’ specific likes, dislikes, goals, pain points, etc.

- Lack of research: You can build strong personas by interviewing a cross-section of your clients and prospects. Remember, it’s important to gather qualitative data to layer onto and complement quantitative data and insights.

- Making assumptions: If you’ve identified a blind spot in your personas, resist the urge to fill it up with something that may or may not be true. For example, if you’re not sure what your persona’s pain points are, don’t invent them, as you might be flavouring your content with incorrect assumptions. Do more research until your personas are truly useful.

The list could go on, but it’s a good start and reveals that building personas takes a bit of work.

Are your personas up to date? This is important. Over the years, your business may grow, expanding into new segments and regions and serving new clients. That’s why your marketing personas should also evolve.

Personas can help you tailor your messaging to optimize your clients’ experience and provide maximum value. As such, they should be essential tools in every marketer’s toolbox.

Need help creating or updating your user personas? Ext. Marketing can help. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Start using video in your marketing campaigns!

The rise of video in marketing seems unstoppable. Worldwide, video streaming grew by 10% in the first quarter of 2022 alone.1 People are watching and sharing videos on almost every social media platform. Cisco reports that 82% of global internet traffic will come from either video streaming or downloads this year.2 While you’ve been told that video is powerful, effective and necessary for taking your marketing to the next level, several myths might be keeping you from getting on board. Let’s separate fact from fiction.

Myth #1: Video is costly to produce

Even if video is the way to go, one of the biggest misconceptions is that video production is expensive. But, in recent years, new technology has made the cost of producing simple videos more affordable than ever before. A simple yet impactful video suitable for sharing online doesn’t have to break the bank. However, costs will go up or down depending on the format and the potential need for direction, scripting, voice or acting talent and music.

Myth #2: Video only appeals to younger audiences

Gen Xers and their predecessors may not be digital natives, but that doesn’t make them old-school in their media consumption habits. From 2019 to 2021, the share of Americans ages 50 to 64 who said they ever used YouTube increased from 70% to 83%. Among those 65 and older, YouTube use increased from 38% to 49%.4 Bottom line: people of all ages are significantly more likely to watch a video than read a block of text.

Myth #3: Video ROI is hard to measure

Measuring the return on investment for video marketing goes beyond simply counting views and conversions. You need to factor in audience behaviour, such as social sharing, that can help increase brand awareness. For the best read on what’s working, consider not just quantitative but qualitative factors, including surveys and polls, anecdotal feedback and viewer comments.

Myth #4: Video content creation is daunting

Don’t know where to start? Skilled video writers can work seamlessly with creative directors and production teams to storyboard your concept and develop a video script that will bring it to life. Developing a partnership with a content agency like Ext. can be a faster, smarter and more cost-effective way to manage your video production.

Myth #5: Video doesn’t work for my industry

Once immensely popular in niche creative industries, video is now at the forefront of marketing campaigns across all industries, including financial services and B2B and B2C channels. When striving to cut through a “sea of sameness,” video can be invaluable in telling your brand story and connecting with your target market.

Videos that are on-brand and on budget are within reach. Get the cameras rolling by calling us today for a quote at 1.844.243.1830 or info@ext-marketing.com.

1 www.forbes.com/sites/dbloom/2022/05/18/online-video-viewing

2 www.cisco.com/c/en/us/solutions/service-provider/index.html

3 https://dmakproductions.com/blog/how-much-does-video-production-cost

4www.pewresearch.org/internet/2021/04/07/social-media-use-in-2021