Microcontent: what it is and how it can help your marketing

Microcontent hasn’t really found its legs in the financial services industry. We think that’s going to change.

Microcontent is primarily visual content distributed on media such as a blog, Facebook or LinkedIn to bolster your content efforts and draw your audience’s attention toward a more robust piece of content. These may include in-depth whitepapers, infographics or a new video on your website.

What sets microcontent apart from other types of content? It’s short, “snackable” and relatively cheap to produce.

What’s microcontent?

While this isn’t a complete list, the key types of microcontent include:

- Charts

- Diagrams

- Facts and figures

- GIFs

- Graphics

- Illustrations

- Images

- Quotes

- Tips

What’s best for financial services?

Financial services marketers tend to use charts, graphs and tables in their materials. But these tools are used a lot, and your content may lose its impact among the vast amount of charts, graphs and tables that are already out there.

It’s good to look beyond these forms of microcontent when you can. Some types of microcontent that we think are ideal for the financial services industry include:

- Images are a great way to capture your audience’s attention (think about taking elements from larger, more detailed infographics)

- Quotes are always eye-catching. If you use quotes, don’t forget to use compelling and complementary images or graphic designs to draw more attention to them

- Tips that help people excel at their job and life will always be near the top of the sharable content list

From a production standpoint, the best thing about microcontent is that it’s relatively quick to produce, so you can experiment a little more than you would with lengthier or more costly content. This can be a huge benefit for content teams that are stretched to the limit.

If you want to boost your marketing efforts, this is the perfect time to start producing microcontent. Contact us today at 1.844.243.1830 or info@ext-marketing.com to learn how.

10 reasons why hedge funds need a great pitchbook

Whether you’re an established or emerging manager, a stellar pitchbook summarizes the most compelling reasons to invest in your fund, and forms the foundation of your sales and engagement strategy with stakeholders.

If you’re in the process of launching a fund or looking to revamp your marketing efforts, here are the biggest reasons why you need to create the best-possible pitchbook content and design.

1. Highlights the opportunity

Great pitchbooks clearly define the market areas your fund is focused on, support the opportunity through stats and figures and emphasize why now is the time to invest.

2. Sets your fund apart

There may be a long list of distinguishing factors, but honing in on the most appealing competitive advantages that your fund brings will enhance your pitch to investors.

3. Showcases the team

Investors want to see that there is relevant professional experience backing everything up. Effectively highlighting career accomplishments, expertise and high-level skills is essential.

4. Underscores your philosophy

Your overall process is driven by a distinct set of beliefs, otherwise known as an investment philosophy. This should be sharply outlined and served as the rationale for how you will succeed.

5. Breaks down the process

Piecing together all the vital components of the approach – e.g., sourcing, screening, investment selection, etc. – in a compelling investment process is critical to helping investors understand how you’ll generate returns.

6. Tells your origin story

Every hedge fund has a story. Whether it is founded upon a particular investment belief, driven by leadership’s illustrious skillset or represents a “meeting of advanced minds” – sharing this with investors will convey a strong foundation.

7. State your mission

Pitchbooks are a chance to succinctly communicate your commitment to investors and how you’ll consistently deliver results – through a concise mission or value statement.

8. Plug your culture

Perhaps it’s through collaboration, debate or proprietary research – sharing what makes your work environment unique and how you come up with great investment ideas is worthy of mention.

9. Emphasize your track record

If you have a solid track record, then sharing it is a given. Great pitchbooks isolate the most appealing aspects of performance history – through a creative design and persuasive content.

10. Call out potential

If you’re growing or launching your fund, you may not have a track record to share. But you can still call out performance from previous roles or professional accomplishments that directly lend to potential performance ahead.

If you would like to begin planning, writing and designing an amazing pitchbook, we can help. Contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Labour market faces challenges

International securities regulators focused on COVID-19. Many executives planning acquisitions in the next year. Handling client data with care. And much more in this week’s briefing.

Economic/industry news

Canada loses 1 million jobs: Canada sheds record 1.01 million jobs in March

The impact of short-term losses on long-term value: So how much wealth destruction has truly occurred since February?

Be careful trading based on Fed actions: Investors need to be selective in following the Fed

International securities regulators focused on COVID-19: Global regulators all-in on pandemic perils

A look at the similarities and differences between current conditions and the 2008 financial crisis: Comparing the current crisis to 2008

How governments can get people back to work, but keep them safe: How to restart national economies during the coronavirus crisis

Chart of the week: Labour market faces challenges

Canada’s job report for March showed a significant deterioration in its labour market. In an effort to contain the spread of COVID-19, many businesses were shuttered, at least temporarily, resulting in mass layoffs across many industries. In March, the Canadian economy lost over one million jobs, pushing the unemployment rate to 7.8%, its highest level since 2010. Markets will be carefully watching how the federal government’s wage subsidy program helps businesses, and if it keeps people employed. Let us know if you think this will be enough to bolster Canada’s labour market.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

A look at some strong and weak performing hedge funds in March: The winning and losing hedge funds of the March pandemic

Hedge funds’ returns declined in March: Hedge funds down 4.40 per cent in March, says Eurekahedge

Capital raised by private debt funds declined in the first quarter: Private debt funds struggle to raise capital in pandemic

Many executives planning acquisitions in the next year: While M&A grinds to a halt, many executives plan for future deals

Target-date funds experience declines amid extreme market volatility: Target date funds not immune to COVID-19 selloff: Morningstar

News and notes (Canada)

Canadian government relaxing restrictions on accessing wage subsidy program: Trudeau promises ‘relaxed’ rules for wage subsidy, more support for student jobs

A look at the impact of COVID-19 on the cannabis industry: Can pot stocks weather the COVID-19 hurdle?

How DB plans can navigate through the current market environment: A coronavirus game plan for defined benefit pension plans

Canada’s oil industry challenged by a confluence of factors: Alberta’s Kenney sees negative oil prices, $20 billion deficit

On the pulse – New frontiers in fintech

The use of fintech apps has risen in response to COVID-19: Coronavirus drives 72% rise in use of fintech apps

Now may be the time for financial institutions to improve its digital platforms: COVID-19 provides opportunity for digital transformation

Digitalization requires effective communication among different teams and departments: How to break down team and department silos for digital transformation

Helping banks and other organizations with customers’ COVID-19 questions: Google launches bot to help organizations answer COVID-19 questions

Handling client data with care: Why tech vendors must start taking our user data seriously

Insurers turning to digital tools for the sales application process: Insurers adapt underwriting, digital channels in pandemic response

High-net-worth topics

How the wealthy are navigating through the choppy markets (video): Tiger 21 Chairman Michael Sonnenfeldt on how his clients are navigating coronavirus-driven volatility

The wealthy should return to U.S. equities: Goldman tells rich clients U.S. stocks still offer best returns

Polls & surveys – What financials are saying

Canada’s economic recovery may not be rapid (CIBC): No quick recovery in sight, CIBC economists say

Financial advisors in the U.S. see more downside in stocks (Ned Davis): 4 in 5 advisors say stocks haven’t hit bottom: Survey

In this time of rising uncertainty, please know that ext. is closely monitoring COVID-19 and its impact – current and potential – on our firm, our clients’ businesses and the overall financial services industry.

We remain committed to seamless service for our clients and the well-being of our employees during this time. If you have any questions about business continuity at ext. – or how you can effectively communicate these and other timely issues with your clients, please reach out to your account manager or contact us 1.844.243.1830 or info@ext-marketing.com.

Monday afternoon briefing: Small caps vs. large caps

A look at the top performing hedge fund strategies. The holdings of different generations. Europe is seeing a large increase in wearable payments. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held interest rates steady at 1.75%: Bank of Canada holds rates steady, citing ‘intact’ global recovery

Canada’s unemployment rate rose: Canada posts largest job loss since 2009 on full-time drop

U.S. labour markets were strong in November: Jobs growth surges in November, beating Wall Street expectations

Institutional investors’ looking to protect their portfolios: Global institutional investors sober as markets rally: survey

The challenges 2020 may bring: What headwinds do stocks face going into 2020?

Understanding the screening process of responsible investments: Lifting the veil on RI screening

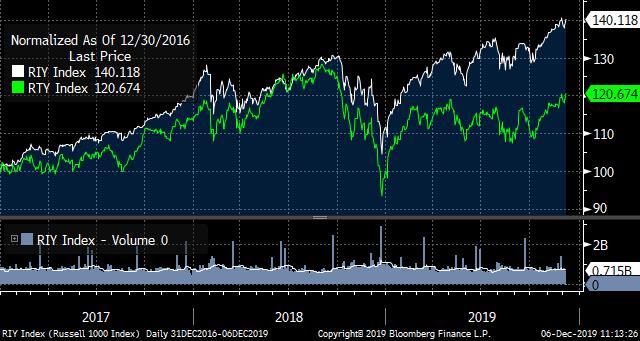

Chart of the week

Since the end of 2016, small-caps have underperformed large-caps, as measured by the Russell 2000 Index and Russell 1000 Index, respectively. It’s not surprising given global trade tensions and their influence on equity market volatility. Investors have largely turned to larger-cap securities given their relative safety. If the U.S. and China reach a phase-one trade pact, will small-caps stocks take the lead? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Helping first-time managers raise money: These firms are helping managers beat their private capital fundraising goals

A look at the top performing hedge fund strategies: Equity long bias strategy tops hedge fund performance in 2019

Co-CEO of Bridgewater to leave firm: Murray to leave Bridgewater Associates

J.P. Morgan launches new ETF: J.P. Morgan Asset Management expands BetaBuilders suite

News and notes (Canada)

Horizons completes its corporate class reorganization: Horizons reorganizes 44 ETFs as corporate-class funds

Novacap launches Novacap Financial Services I: Private equity firm Novacap launches financial services fund

PE activity in Canada has slowed in 2019: Canadian PE industry on pace for investment slump

Onto the next step for a bitcoin fund: 3iQ files preliminary prospectus for Bitcoin fund

On the pulse – New frontiers in fintech

How changing technology will impact banking in 2020: The biggest technology trends that will disrupt banking in 2020

How tech and analytics are helping PE companies: Progressive VCs and private equity are using tech and analytics to revolutionize investing

Why regulators need to accept fintech in the banking industry: BankThink Charter or not, fintechs are already ‘banking’

Broadridge launches new AI tool: Broadridge launches new AI and machine learning platform for reconciliation, matching and exception management operations

A spotlight on emerging cities and fintech: Global fintech ranking shows importance of emerging cities

Europe is seeing a large increase in wearable payments: Wearable payments show sharp rise in uptake

High-net-worth topics

European private equity firms eyeing technology investments: Why Europe’s wealthy are betting on tech like never before

Younger U.S. high-net-worth investors showing interest in ESG: Wealthy, young investors driving shift to ESG, Cerulli reports

How the 2020 tax changes may impact the wealthy in the U.S.: What wealthy clients need to know about 2020 tax changes

Polls & surveys – What financials are saying

A look at the holdings of different generations (Charles Schwab): Self-directed millennials invested more in cash, ETFs than older investors

Business leaders uncertain about the outlook for the Canadian economy (CPA): Survey uncovers growing pessimism about Canada’s economy

A look at the struggles facing those who entered the labour market during the financial crisis (RBC): The struggle really is real for young investors

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 11, 2019

U.S. PE funds’ capital raising reaches record high. Businesses looking to Canada for expansion. U.S. institutional investors are turning to liquid alternative ETFs. And much more in this week’s briefing.

Economic/industry news

Canada’s unemployment rate was 5.5% in October: Canadian economy lost 1,800 jobs in October, unemployment rate steady

The BoE held rates steady at 0.75%: Sterling falls after Bank of England split on interest rate cut

Expecting weaker growth in Europe: Eurozone forecast for long period of weak economic growth

How to access private markets: Smart ways to access private capital markets

U.S. institutional investors are turning to liquid alternative ETFs: Use of liquid alternative ETFs on the rise among institutional investors: study

Why defined contribution plans can benefit from alternative investments: Fundamental reasons for adding alternatives to DC pension portfolios

A look at Morningstar’s new rating system: Morningstar rolls out new ratings system

News and notes (U.S.)

Hedge funds returned 0.4% in October, according to HFR: Hedge funds in positive territory in October, says HFR

How technology can help hedge funds manage their operating expenses: Technology can act as a growth enabler to help hedge funds cope with increased margin pressures

U.S. PE funds’ capital raising reaches record high: Private equity fundraising in the US hits all-time high

Private equity investment model shifting: The shifting nature of private equity

Fidelity launches new funds: Fidelity rolls out four thematic funds

The SEC is looking to make changes to its advertising rule: SEC issues plan to modernize RIA ad rules

News and notes (Canada)

iA announces fund and ETF launches: iA Clarington launches new fund, adds ETF versions of existing funds

CI acquires asset management firm: CI Financial acquires WisdomTree’s Canadian business

Tracking cannabis stocks: Pot indexes to launch this month

ETFs in Canada saw inflows of $3.5 billion in October: Canadian equities ETFs had a ‘stellar’ October

On the pulse – New frontiers in fintech

Improving data security measures: 3 steps banks & credit unions should take as data privacy gets hotter

How active managers can benefit from machine learning: Can machine learning help active managers outperform passive peers?

How fintech will help the “underbanked”: The ‘underbanked’ is the next trillion-dollar opportunity in fintech

Looking at what’s in store for the fintech industry: The future of fintech

Employees must also accept digital transformation: Digital transformation will flop if you don’t also transform staff

Charles Schwab is looking to eliminate forms: Schwab’s plan to kill forms and expand integrations

Selling through messaging platforms: The convergence of messaging apps and payments

Canadian banks take interest in Mylo: Canadian banks invest in spare change app Mylo

What a single digital currency could mean for the finance industry: How worldwide digital currency adoption could change the finance sector

A look at Canadians’ awareness of bitcoin: Bitcoin awareness no guarantee of ownership, finds BOC

High-net-worth topics

The high-net-worth need to protect against debt too: Why ultra-high-net-worth clients need a financial cushion

The total wealth of billionaires fell in 2018: Billionaire wealth declines in 2018

Polls & surveys – What financials are saying

Expect weaker investment returns in the future (JP Morgan): Weak global growth ahead, J.P. Morgan says

Businesses looking to Canada for expansion (HSBC): Foreign businesses eyeing Canada for expansion: report

U.S. advisors are bullish on the industry (Schwab): Advisors are (mostly) upbeat about the future: Schwab

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 21, 2019

Digital-only banks succeeding through a robust customer experience. ESG adoption by institutional investors may be slowing. Venture capital mega-deals continue to grow. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate was 1.9% in September: Canadian inflation holds steady at 1.9%, core measures inch up

China’s economic growth slowed in the third quarter: China says its economy grew 6% in the third quarter, slower than expected

Retail sales in the U.S. declined: U.S. retail sales dip 0.3% in September

The end of the 60/40 portfolio?: Bank of America says 60-40 portfolios are dead. They’re right

Show a bit of pessimism towards a trade deal: Morgan Stanley tells stock bulls not to kid themselves on trade

The IMF predicts weaker economic growth in 2019: Global conflicts could lead to weakest growth since 2008: IMF

News and notes (U.S.)

The Eurekahedge Hedge Fund Index declined 0.30% in September: Hedge funds down 0.30 per cent in September

A look at hedge funds’ favourite research firms: The research hedge funds want to pay for

Why private markets will continue to flourish: The company of the future is private

How debt financing companies are attracting businesses: How debt financing is adapting to compete with equity financing

VC mega-deals continue to grow: 2019 on pace for another $100B invested as VC exit value tops $200B for the first time [datagraphic]

A look at how much the U.S. green economy is worth: America’s ‘green economy’ is now worth $1.3 trillion

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 15 edition

News and notes (Canada)

Waypoint launches liquid alternatives fund: Liquid alternatives: The Waypoint All Weather Liquid Alternative Mutual Fund

Desjardins launches ETF portfolios: Desjardins adds ETF portfolios to its roster

National Bank launches the NBI Unconstrained Fixed Income ETF: National Bank launches fixed-income ETF

Canaccord Genuity expands into Australia: Canaccord Genuity to acquire Australian firm for $23.3 million

Canadian M&A activity down in the third quarter: Mergers and acquisitions slow in third quarter: report

Michael Lee-Chin discusses the challenges impacting advisors: Adapt or become irrelevant, Lee-Chin warns advisors

On the pulse – New frontiers in fintech

Using technology to focus on consumer engagement: Digitizing banking is all about engagement and CX, not ‘tech’

Digital-only banks succeeding through a robust customer experience: Look to your customers for the key to banking success

Searching for innovative new technology: Where do incumbents look for game-changing innovation?

Canadians’ use of fintech on the rise: More Canadians using fintech, in spite of privacy concerns

The majority of U.K. financial institutions are using machine learning technology: Machine learning advancing in financial sector – Bank of England

Emerging challenger banks can be found all around the globe: Some challengers really are challenging … but not where you’re looking

Appealing to wealthier millennials: How upscale millennials’ money views impact their banking habits

How to keep up with regulatory change: How to approach modern regulatory change management in financial services

NatWest piloting a fingerprint credit card: Technology-based banking products launched

A look at what technologies are impacting advisors most: 10 female leaders share top tech trends that’ll change your practice

High-net-worth topics

Millennials’ wealth is expected to grow: There are more than 600,000 millennial millionaires in the US, according to report

What a wealth tax could mean for the high-net-worth: Explaining a wealth tax to clients

Polls & surveys – What financials are saying

Preparing portfolios for an economic slowdown (Aviva): Proceed with caution on asset allocation: report

ESG adoption by institutional investors may be slowing (RBC): Survey finds ESG adoption tapering off among institutional investors

There may not be a global recession until 2021 (HSBC): Global recession unlikely until 2021: HSBC

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 9, 2019

Helping smaller clients with their financial planning needs. Private equity firms are taking an interest in physician practices. Four phases of a successful digital transformation. It’s time to listen to the lesser known managers. And much more in this week’s briefing.

Economic/industry news

The BoC held its central interest rate steady at 1.75%: Bank of Canada balks at joining global rate-cutting trend

The Canadian unemployment rate was unchanged at 5.7% in August: Canada sees jobs surge in August with 81K new positions

The U.S. unemployment rate was 3.7% in August: U.S. creates just 130,000 news jobs in August, keeping Fed on track to cut rates

Manufacturing states suffering from trade uncertainty: Trump’s trade war inflicts pain on manufacturing states

What happens if the global consumer stops spending?: Trade-war damage piles weight of global economy onto consumers

Assets under management fell for the world’s largest pension funds in 2018: World’s largest pension funds’ AUM decreased in 2018

Fund costs will impact Morningstar’s analyst ratings: How Morningstar’s new ratings reality will affect funds, ETFs

BlackRock’s outlook for the Canadian economy in the fourth quarter: Outlook for final quarter of 2019

News and notes (U.S.)

Time to listen to the lesser known managers: With Sohn Conference bets, pay attention to the no-name managers

PE firms are taking an interest in physician practices: Why are PE firms hot for physician practices?

How the biggest VCs are investing: Breaking down early- and late-stage deals for the top 20 US VC investors (datagraphic)

Why 401(k) sponsors must understand mutual fund fee structures: Fiduciary responsibility and mutual fund fees

ACI to launch five active ETFs: American Century to launch five active equity ETFs under new Avantis banner

Investing in an NBA team: NBA considers vehicle to bring new investors to soaring team values

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: September 3 edition

News and notes (Canada)

Dynamic launches the Dynamic Credit Absolute Return II Fund: Dynamic Funds launches fourth liquid alternative offering

Waratah launches the Waratah Alternative Equity Income Fund: Waratah Capital launches liquid alternative mutual fund

FP Portfolios launches new ETF: Firm launches ETF alternative to structured products

Canadian ETF assets rose to $186 billion in August: Canadian ETF inflows hit $2.7B in August

Banking leaders are set to adapt to the changing financial landscape: Big bank CEOs talk lower rates, living in ‘unprecedented times’

First-time homebuyers believe new incentive plan may be helpful: First-time homebuyers optimistic about new government incentive: poll

On the pulse – New frontiers in fintech

A look at how fintech is changing the financial services industry: 5 ways fintech is reshaping the financial services industry

Three best practices to help banks become leaders in personalization: How banks and credit unions can take the lead in personalization

Four phases of a successful digital transformation: We just haven’t got a clue what to do!

How AI can help back-office functions: The future of finance is powered by artificial intelligence

Understanding the ethics of AI: Filtering the ethics of AI

A look at five industries being transformed by AI: AI predictions: how AI is transforming five key industries

Helping smaller clients with their financial planning needs: Bringing financial planning to the masses

Plans for a crypto fund-of-funds for institutional investors: Hedge fund manager plans $1bn crypto fund

High-net-worth topics

The high-net-worth are looking for more than just strong investment performance: For HNW clients, digital convenience is no substitute for a personal connection

Managing the high-net-worth’s digital wealth: What you need to know about managing clients’ digital wealth

Polls & surveys – What financials are saying

Canadian productivity hurt by financial stress (Canadian Payroll Association): 43% of Canadians say financial stress is hurting work productivity: Study

Institutional investors not yet fully adopting ESG (CoreData): Institutional investors yet to fully embrace ESG, says new research

Client expectations are the top challenge for wealth and asset management firms (RBC): Client demands overtake regulation as the top challenge for firms

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Tuesday morning briefing – August 6, 2019

Activist investors from the U.S. having an impact in Europe. IT attracting one-fifth of all U.S. private equity investment. Some thoughts on keeping data clean. And much more in this week’s briefing.

Economic/industry news

The Fed reduced its central interest rate: Fed cuts key rate, pledges to sustain expansion

Economic growth in Europe slowed in the second quarter: Euro zone second-quarter growth halves, inflation slows despite jobless at 11-year low

The Bank of Japan held its central rate steady at -0.10%: Bank of Japan commits to easing further if inflation sputters, keeps policy steady

BoE held its central bank rate steady at 0.75%: Bank of England cuts UK growth forecast

Taking a proactive approach with company management to follow ESG values: Turning a light on company behavior

Some asset classes that may help your portfolio: Assets to consider when traditional diversification fails

Fixed income ETFs should continue to see robust growth: ETF product trends to watch

Sustainable funds having a strong 2019 so far: Sustainable funds are winning at halftime, says Morningstar

News and notes (U.S.)

Hedge funds recorded a positive month in June: Hedge funds up 1.75 per cent in June

Element Capital increases performance fee: Top hedge fund sets 40% performance fee as assets hit $18bn

Activist investors from the U.S. having an impact in Europe: US activist investors’ aggressive strategies are starting to force change in Europe

Helping small businesses land even bigger government contracts: With PE backing, government contractors strive for bigger awards

IT attracting one-fifth of all U.S. PE investment: For the fifth straight year, PE’s appetite for IT continues to grow

A look at the top-performing PE fund of funds: These are the best performing funds of funds in private equity

Goldman Sachs to expand its business in South Africa: Goldman Sachs bets on South Africa’s strong economic growth

News and notes (Canada)

Emerge launches actively managed thematic ETFs: Emerge launches five ETFs

New CI fund to invest in high-interest savings accounts: CI launches high interest savings fund

Number of deals and funding of VCs fell in the first half of 2019: Canadian VC funding down in H1: Report

Canadian DB plans experience a positive return in the second quarter: Canadian DB plans post median 2.5% return for Q2

Canadian small business confidence declined in July: Small biz optimism drops in July

On the pulse – New frontiers in fintech

Digital transformation can ward off potential threats: The case for transforming banking (even when profits are strong)

A look at how financial advisors are benefiting from fintech: How advances in fintech are helping financial advisors

Why banks should be adopting AI now: Building an AI-powered financial institution

Keeping your data clean: How clean is your data?

Sorting through randomness: Facebook AI research is a game-changer

Helping small businesses with electronic payments: Mastercard and SumUp team to bolster SME offering

A look at a few fintech firms and how they are succeeding: Three global fintech innovations that created real value

Why the Fed should be looking at faster payments: Go slow on Libra. Speed up on faster payments.

Investing in drone technology: Retail investors interested in drone technology can now invest in it

High-net-worth topics

How the high-net-worth can discuss their estate planning: Heirs of HNW families in the dark on family wealth decisions

When is the best time for the high-net-worth to transfer their wealth: Dead or alive: When is the right time to transfer wealth?

The wealthy value their privacy: 10 ways the wealthy buy privacy

Polls & surveys – What financials are saying

Are those with a lower level of assets receiving financial planning information? (OSC): Many investors receive little advice for fees, survey finds

Eight out of 10 financial advisors are bullish on U.S. equities (NDR): Financial advisors remain upbeat about economy, markets

Financial advisors are getting younger (TD Ameritrade): ‘Graying trend’ in advisory industry is reversing: FA insight

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – July 15, 2019

Hedge funds are changing their fee structures. A new climate change index from FTSE Russell. Turning the branch into an advice center. And much more in this week’s briefing.

Economic/industry news

The BoC held its rate steady at 1.75%: Poloz flags growing trade risks but keeps rates firmly on hold

The U.S. inflation rate fell to 1.6% in June: Consumer prices edge up in June, CPI shows, but inflation is still quite tame

Canadian housing starts rose to 246,000 in June: Canadian housing starts rise in June: CMHC

The debt ceiling may need to be raised by September: U.S. debt ceiling fears surface in “kink” in Treasury bill yield curve as drop-dead date approaches

A new climate change index from FTSE Russell: FTSE Russell launching climate change index for sovereign bonds

MSCI to provide ESG ratings on funds and ETFs: MSCI adds ESG ratings to 32,000 funds and ETFs

New guidelines on performance reporting from the CFA Institute: CFA Institute unveils new global investment standards

A look at the benefits of using multifactor ETFs: Why use multifactor ETFs?

News and notes (U.S.)

A look at the hedge fund industry in June: State of the industry – June, 2019

Hedge funds soared higher in the first half of 2019: Hedge funds post best first half in decade

Will there be a rebound in PE-backed exits?: Will US PE exits make up for lost time in the second half of 2019?

PE funds selling at a premium: The private equity funds selling for more than they’re worth

Charles Schwab adds more funds to its commission-free ETF platform: Schwab adds 25 ETFs to commission-free platform

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: July 9 edition

News and notes (Canada)

CIBC purchases U.S. investment banking firm: CIBC signs deal to buy Milwaukee-based boutique investment bank Cleary Gull

RBC purchases WayPay: RBC buys accounts payable specialist WayPay

Mercer and Wealthsimple partner to create a savings and advice solution: Mercer partners with Wealthsimple for digital investing solution

Canadians finding it difficult to move into higher income brackets: Canadian families are increasingly stuck in their income niche, StatsCan finds

Canadian ETFs experienced outflows in June: ETF flows flat in June as investors get defensive

On the pulse – New frontiers in fintech

A look at five fintech trends: Here is a look at where fintech is leading us and why

Understanding the bank-fintech partnership: Banks and fintech partnerships: A clash of extremes

Banking customers still demand human contact: Financial services customers set to embrace AI but human contact still vital

Turning the branch into an advice center: Branches should be advice centers, but are banks ready?

Creating highly personalized products and services: The market of one

Keeping AI ethical in corporate finance: Preventing unethical use of AI in corporate finance transactions

Advisors should be adopting new technologies: Why more advisors are embracing financial planning technology

JPMorgan enters robo-advice arena: JPMorgan rolls out robo-advisor

High-net-worth topics

The way the wealthy spend their money may be surprising: How do the wealthy spend their money?

The net worth of high-net-worth individuals fell: Wealth declines among the global rich after seven years of growth

A look at some traits of billionaires: The secrets of self-made billionaires

Polls & surveys – What financials are saying

Hedge funds are changing their fee structures (AIMA): Hedge funds replacing ‘2 and 20’ with more flexible fees: study

U.S., Canadian and Japanese investors typically hold their investments for over four years (Schroders): U.S. investors most patient, and demanding, in world, study says

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – July 8, 2019

Bitcoin’s volatile June may impede the possibility of an ETF. Funds-of-hedge funds are making a comeback. Ontario to get 50 more cannabis retail stores. 5G technology will enhance digital banking capabilities. And much more in this week’s briefing.

Economic/industry news

The Canadian unemployment rate rose to 5.5% in June: Canada’s jobs market pauses in June after monster start to year

The unemployment rate in the U.S. rose to 3.7% in June: Hiring rebounds as U.S. economy adds 224,000 jobs in June, unemployment rate inched up to 3.7 percent

Global equity issuance slow in the first half of 2019: Global equity issuance dives in the first half, Refinitiv reports

State Street launches ESG money market fund: State Street Global Advisors launches its first ESG money market fund

Christine Lagarde will become president of the ECB: Christine Lagarde: Key issues she must address at the ECB

Will more tariffs come to the EU?: U.S. proposes more tariffs on EU goods in Airbus-Boeing dispute

MSCI plans to add Kuwait to its emerging markets index: MSCI set to classify Kuwait as emerging market, subject to certain conditions

News and notes (U.S.)

Funds-of-hedge funds are making a comeback: They’re baaaaack: The investment that’s making an unlikely comeback

Europe’s interest in alternative investments growing: Interest in alternative investments on the rise in Europe

PE firms looking to raise US$1 trillion in fundraising efforts: Private equity seeks almost $1 trillion globally

Venture capitalists keeping a keen eye on companies that move people and things: Wheeling & dealing: In 2019, VCs can’t stop funding mobility startups

Fixed income ETFs see record inflows in June: Fixed income ETF inflows surpassed $25B during June

Understanding the rules of Reg BI: SEC’s Reg BI adds unexpected fiduciary hurdle for retirement advisors

News and notes (Canada)

Canadian banks meeting global regulatory standards on net stable fund ratio: Reports find Canadian banks meet global standards

Ontario to get 50 more cannabis retail stores: Ontario to issue 50 new cannabis store licences, eight to go to First Nations

Value of Canadian defined benefit pension plans stable in the second quarter: Strong equity market performance helped DB plans in Q2

Project Reconciliation preparing bid for the Trans Mountain pipeline: Indigenous group says Trans Mountain bid could be ready next week

On the pulse – New frontiers in fintech

Using data to drive the personalized customer experience: Digital changes customer engagement playbook for financial institutions

New associations will be important to drive fintech forward: We’re all in this together – The Value of associations in fintech

5G technology will enhance digital banking capabilities: Banking in 5G: Why financial marketers should care (now)

A look at the challenges and opportunities of AI in banking: AI in banking: The pitfalls and opportunities (research paper)

Understanding Intelligent Spend Management: Intelligent Spend Management and the evolution of procurement

Here are 10 payment start-up companies that you need to know about: 10 payments start-ups to watch

NatWest experiments with live chats on mobile, tablet and PC: NatWest trials video banking service for business customers

Online payment startups are focusing on these sectors: What sectors do online payment startups try to target?

Giving businesses unlimited access to their PayPal account: PayPal launches its first UK debit card with unlimited cash back for businesses

Bitcoin’s volatile June may impede the possibility of an ETF: Bitcoin’s wild June is ‘slam dunk’ against crypto ETF approval

High-net-worth topics

Ways business owners can save for retirement: Eight things business owners can do to build up funds for after retirement

Financial planning for families with assets in multiple countries: Cultivating foreign clients

How insurance can mitigate some of the risk for high-net-worth investors: The secret key to protecting your client’s wealth

Polls & surveys – What financials are saying

Professional accountants are bullish on the Canadian economy (CPA): Business leaders feel better about the economy: survey

Canada’s economic growth is dependent on global economic conditions (Russell Investments): Canadian economy not immune to outside forces: report

Why India might be a good source of investment returns (Manulife): Investors chasing higher returns can’t skip India, Manulife says

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Tuesday morning briefing – July 2, 2019

Spotting a financial bubble. The rising stars of the hedge fund industry. The benefits of advisors adopting technology. The affluent market is expected to grow. And much more in this week’s post.

Economic/industry news

U.S. GDP growth confirmed at 3.1% in the first quarter: US economy grew at a solid 3.1% rate in the first quarter

Optimism regarding small– and medium–sized businesses in the U.S. waning: Optimism hits nine-year low at U.S. small, midsize companies

Spotting a financial bubble: Can you spot a bubble before it bursts?

What’s hurting value investing: Two suspects behind value’s apparent death

New climate change indices announced: MSCI launches climate change indexes: Portfolio products

The number of global IPOs declined in the first half of the year: A weak first half for global IPOs, EY reports

News and notes (U.S.)

Forward Redemption Indicator was 3.81% in June 2019, lower than June 2018: SS&C GlobeOp Forward Redemption Indicator at 3.81 per cent for June

Equity leverage rising fast for hedge funds: Hedge funds boost equity leverage at fastest rate in three years

Alternative investment managers expect moderate economic growth for 2019: Alternative investment professionals bullish on prospects for remainder of 2019

A look at the most powerful hedge fund managers: The 10 most powerful hedge fund managers this year

The rising stars of the hedge fund industry: Hedge funds might be under scrutiny – but these rising stars are their future

Will Vanguard enter private equity space?: Vanguard mulling move into private equity: report

Another strong year for PE cashflows: Global PE cashflows eye eighth consecutive year in the black

U.S. tech firms reduced hiring in China amid trade dispute: Silicon Valley cools Chinese growth plans during trade war

Average wage earners having difficulty purchasing a home in many U.S. markets: Homebuying difficult for Americans in three-fourths of markets

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: June 25 edition

News and notes (Canada)

Mutual funds experienced $719 million of net sales in May: Mutual fund sales rebound, despite retreat in AUM, IFIC reports

Steve Hawkins takes over as board chair for the Canadian ETF Association: CETFA welcomes new board chair

Advisor title reform to be reviewed by new provincial regulator: FSRA to lead advisor title reform, while OSC works on other reforms

Tax proposal could hurt Canadian ETFs: Tax proposals get pushback from ETF industry

On the pulse – New frontiers in fintech

Wall Street is learning from Silicon Valley: Wall Street is taking cues from Silicon Valley to innovate fintech

The top trends in retail banking: The Top 5 retail banking technology trends of 2019 (so far)

Why it’s imperative that traditional banks adopt AI usage: Banking brands can’t keep pace with digital giants without AI

What is Facebook’s future in fintech?: Facebook’s Libra cryptocurrency is the future of fintech

Consumer use of fintech growing: More than half of global consumers use fintech

The benefits of advisors adopting technology: Five ways advisors can leverage technology

Welcome to the new Chase retail branch: Chase makes bold statement with stunning new flagship branch

Helping VCs make investment decisions: VCs double down on data-driven investment models

A look at how the investment banking industry can benefit from AI: How AI could shape the future of investment banking

High-net-worth topics

The affluent market is expected to grow: The growing promise from affluent individuals

How to respond to the traits of wealthy investors: 12 surprising traits of the wealthy

Sotheby’s to merge with BidFair USA: Sotheby’s goes private: What it means for the art market

Polls & surveys – What financials are saying

U.S. investor confidence falling (Wells Fargo/Gallup): Investors are battening down the hatches for a recession: Wells Fargo

Geopolitical and market risks affecting the outlook for institutional investors (Manulife): Uncertainty clouding institutional investor outlook: report

Canadians trust financial advisors for their retirement planning (Fidelity): Advisors top list of retirement planning resources: survey

A look at the contributors to growth in robo-advice (BMO): ETFs played a role in robo growth, fee-based shift: report

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – June 24, 2019

Can the Fed Chairman be replaced? How geopolitical risks impact emerging markets. Facebook is planning a new cryptocurrency. Advisors are preparing for a possible recession. Plus much more news in this week’s briefing.

Economic/industry news

The Fed holds steady, raises expectations of rate cut: Fed holds rates steady, but opens the door for a rate cut in the future

The Bank of England kept its Bank Rate steady at 0.75%: BOE warns on global economic outlook as it holds rates steady

The inflation rate in Canada rises to 2.4% in May: Canadian ‘inflation is back’ as rate rises most since October

Can Fed Chairman Powell be replaced?: Trump believes he has the authority to replace Powell at Fed

The impact of geopolitical risk on emerging markets investments: Geopolitical tensions high on investors’ list when examining emerging markets

News and notes (U.S.)

Hedge funds fell 0.71% in May: Eurekahedge Hedge Fund Index down 0.71 per cent in May

Hedge fund redemptions were US$9.4 billion in April: Hedge fund redemptions slow in April

Paulson & Co. to exit London: John Paulson’s hedge fund scales back operations

Goldman Sachs increasing its PE presence: Goldman Sachs looks to become the next private equity giant

The use of subscription credit facilities rising: Private capital funds increasingly turning to subscription credit facilities

How IPOs backed by PE and VC have fared in 2019: Here’s how much VC- and PE-backed IPOs have raised in 2019

Will the SEC open up hedge funds and PE funds to retail investors?: Hedge funds for all: SEC ponders letting in the not-so-rich

U.S. retirement assets rebounded in the first quarter: Retirement assets recover from fourth-quarter swoon

News and notes (Canada)

First Asset launches the CI First Asset High Interest Savings ETF: First Asset launches high-interest savings ETF

SSQ launches Smart Beta Plus Portfolios: SSQ delivers Canadian first with turnkey portfolio products

Sun Life launches SLC Management: Here comes a new $160 billion asset manager

Manulife partners with Mahindra and Mahindra of India: Manulife enters joint venture in market of more than 1 billion people

Stifel Financial purchases GMP Capital’s capital markets business: Deal throws shackles off ambitious Richardson GMP

The Trans Mountain pipeline expansion gets approved, again: Trans Mountain expansion gets second green light from Ottawa

On the pulse – New frontiers in fintech

A look at AI in the financial services industry: What the age of AI means for Wall Street

Four trends that will lead to more innovation in fintech: 4 trends that will rewire the inner workings of the fintech industry

A look at the growth of point-of-sale financing: POS finance growth is threat and opportunity for banking providers

Fintech having a positive effect on consumers: Fintech boom has consumers reaping the benefits

Some key financial marketing trends that you need to know: 6 financial marketing takeaways from the 2019 Internet Trends Report

Looking at the impact of GDPR on AI: GDPR – How does it impact AI?

A look at the industries that could be transformed by blockchain: Banking is only the beginning: 55 big industries blockchain could transform

Blockchain company Ripple to invest in MoneyGram: Ripple buys stake in MoneyGram

Facebook to enter cryptocurrency space: Facebook plans its own currency for 2-billion-plus users

High-net-worth topics

A look at how to better serve the wealthy: How advisors can improve service for affluent clients

A digital experience in wealth management is important to the wealthy: Wealth managers and high-net-worth clients embrace digitization

Polls & surveys – What financials are saying

Over half of fund managers believe trade is the top risk to the market (BoAML): Bears are everywhere, Merrill investor poll finds

Advisors are preparing their business for a possible recession (Schwab): Advisors are bearish on markets, bullish on their own growth

Many millennial self-directed investors may move their business to another platform (J.D. Power): Millennials less satisfied with self-directed investing: report

Impact investors are meeting their financial goals (Global Impact Investing Network): Survey: 91% of impact investors happy with performance

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Wednesday morning briefing – June 19, 2019

A look at the hedge fund industry in May. How investors can survive the trade wars. Use of fintech services on the rise. High-net-worth investors are looking to forests. And much more in this week’s briefing.

Economic/industry news

The U.S. inflation rate fell to 1.8% in May: US consumer prices barely rise; underlying inflation muted

How alternative investments can help retirement portfolios: The case for alternatives in retirement portfolios

Preparing for modern monetary theory: Don’t dismiss modern monetary theory, research affiliates warns

The outlook for the euro and pound given Brexit uncertainty: How is Brexit affecting currencies?

The importance of international diversification: Diversification means investing overseas too

News and notes (U.S.)

A look at the hedge fund industry in May: State of the industry – May, 2019

The Barclay Hedge Fund Index fell 1.47% in May: Hedge funds’ four-month run in the black ends in May with 1.47 per cent fall

A look at the growth of GP stakes fundraising: GP stakes fundraising is starting to boom

Blackstone raises US$4.5 billion for its second energy fund: Blackstone raises $4.5 billion for energy fund

How investors can survive the trade wars: Trade wars and tariff-mania: An investor survival guide

BlackRock focuses on launching thematic ETFs: BlackRock looks to 5 ‘megatrends’ to expand its ETF business

Legg Mason to make its strategies available to retail investors in Mexico: Legg Mason to offer funds to Mexican retail investors

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: June 11 edition

News and notes (Canada)

BMO launches a health care banking program: BMO launches program aimed at healthcare professionals

Evolve launches the Evolve Global Materials & Mining Enhanced Yield Index ETF: New global materials and mining ETF launched

Canada had a net outflow of foreign investment in April: Foreign investment in Canadian securities declined in April: StatsCan

Market value of trusteed pension assets fell 1.3% in the fourth quarter of 2018: Market value of trusteed pension assets declined in Q4 2018: StatsCan

On the pulse – New frontiers in fintech

Use of fintech services on the rise: Consumer use of fintechs for banking services skyrockets

Uber entering the fintech space: Uber is making a fintech push with a New York hiring spree

Why traditional banks need to prioritize a digital transformation: The logic of digital change

Use of digital wallets expected to grow by 2024: Half of world’s population to use digital wallets by 2024

How to combat financial crime: Joining the fight against financial crime

What you need to know about Gen Z: 15 things banks & credit unions must know before targeting Gen Z

Visa enters the cross-border, business-to-business transaction market: Visa enters the $125 trillion global money transfer market with new blockchain product

HSBC partners with Canadian firm to enhance AI use: HSBC ramps up artificial intelligence efforts with Element AI partnership

Shoppers Drug Mart to use blockchain technology to monitor quality of medical cannabis: Shoppers to use blockchain technology to track medical cannabis quality

High-net-worth topics

The high-net-worth are investing in forests: Wealthy families are adding forests to their portfolios

Luxury watch prices are increasing: Time is money: How luxury watch collectors show off their precious investments

Polls & surveys – What financials are saying

58% of institutional investors are utilizing smart beta strategies (FTSE Russel): More than half of institutional investors using smart beta strategies: survey

The ability to express empathy is important for financial advisors (STEP Canada): Do you really know how to express empathy to clients?

There is a retirement savings gap around world (WEF): Retirees risk running out of money a decade before death

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – June 10, 2019

Banks can make privacy a competitive advantage. High-net-worth investors are looking for private equity. The difficulties facing fintech firms as they cross borders. And much more in this week’s briefing.

Economic/industry news

The U.S. unemployment rate was steady at 3.6% in May: Jobs report: U.S. economy adds disappointing 75,000 jobs in May, unemployment rate holds at 3.6%

Canadian unemployment rate fell to its lowest level since 1976: Canada added 27,700 jobs in May; unemployment rate hit record low

ECB holds rate steady, pushes out possible rate increase: Euro rises as ECB pushes back rate hike deadline; raises inflation forecast

Would the Fed be willing to cut rates?: Powell hints Fed will cut rates if needed over trade wars

What the next recession could look like: Gauging the next recession’s severity

The benefits of farmland in a pension portfolio: A look at the role of farmland in pension portfolios

Sustainalytics launches ESG screening product: Sustainalytics launches new ESG screening tool and engagement service

News and notes (U.S.)

Who can replace a legend?: The race to replace Larry Fink

What to look for in an outsourced trading partner: Key considerations when choosing an outsourced trading partner

Regrets about going public: Apollo founder ‘absolutely’ regrets taking the firm public

A look at the next CIOs: II’s most wanted allocators: First team

The largest PE firms have been able to diversify across asset types: A new era of scale in the private capital markets

Fidelity reduces fees on target-date funds: Fidelity cuts target-date mutual fund fees as price war spreads

The SEC passed the Regulation Best Interest proposal: SEC passes regulation best interest by 3-1 vote

Household wealth in the U.S. up, growth rate of debt slowed: U.S. first-quarter household wealth hits record as stocks surge

News and notes (Canada)

Fidelity launches ESG funds: Fidelity launches 3 funds aimed at positive change

May was the best month in 2019 for ETF inflows: Canadian ETF inflows in May are the year’s strongest so far

The Canadian ETF industry still has a lot of room to grow: Why Canada’s ETF industry hasn’t peaked yet

An in-depth look at the Canadian mutual fund industry: Mutual Fund Guide 2019

Looking at the compliance challenges facing investments: OSC to launch new advisory committee

Protection of vulnerable investors a top priority of IIROC: IIROC sets strategy through 2022

On the pulse – New frontiers in fintech

Regulators and fintech firms need to coordinate efforts to create a better environment for innovation: BankThink Fintechs, regulators need more common ground

Making money in mobile banking using big data: Data can move mobile banking from ‘convenient’ to ‘monetized’

The difficulties facing fintech firms as they cross borders: 3 challenges of scaling a fintech company across borders

Creighton University introduces a degree in fintech: Creighton University among the first to create a fintech degree

The opportunity and risks of deploying AI: The potentials and pitfalls of applying AI in the financial industry

The U.K. has seen a rise in mobile banking, less use of cash: Rise in mobile banking and contactless as consumers take pick ‘n’ mix approach to payments

Banks can make privacy a competitive advantage: Why now is the ideal time for banking brands to assert their privacy role

Banks’ adoption of open banking will take time and trust: Mastercard’s Wadsworth: Banks need time to fit into open banking future

Why tech talent should consider banking: The war for (banking tech) talent

High-net-worth topics

How to advise people who come into sudden wealth: Advising ‘Jeopardy!’ champ Holzhauer on his $2.5 million payday

The high-net-worth rank trust as the number one requirement in an advisor: Satisfaction and loyalty just the start for high-net-worth clients

The high-net-worth are looking for private equity: Russ Prince: Wealthy investors want more private equity

Polls & surveys – What financials are saying

Asset managers are looking at creating ESG products (Cerulli): More than half of asset managers considering ESG products, Cerulli says

Some doctors are worried about unexpected expenses (MD Management): Is your doctor client worried about finances?

Combining human advice with robo may become the best approach (IFIC): Hybrid distribution channels set to rise: IFIC

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Dig deep to build your hedge fund’s value proposition

There are a vast number of hedge funds hitting the scene every year – 735 were launched in 20171 – with a total of US$3.6 trillion in AUM by the hedge fund industry overall.2 That’s a lot of funds vying for investors’ attention.

To elevate your hedge fund above the fray and pique more interest from investors, you should start with a compelling, well-thought-out value proposition. A value proposition summarizes what makes your offering unique and why it’s well-positioned to deliver performance for investors. It can form the foundation for all your sales and marketing efforts, including your pitchbook and website.

Value propositions can take on many forms and vary in length, but an ideal structure consists of a powerful headline, sub-head and bullet points of all the factors that separate you from the pack. It should take on a tone and use language that resonates with your audience and, above all, be easy to understand.

Understanding your edge may take some soul searching

Figuring out the most compelling competitive advantages of your hedge fund isn’t a quick process. It requires profound self assessment and, perhaps, wider feedback from your team and partners. While these distinguishing factors may not seem apparent at first, if you dig deep enough, you may be surprised with what you find. Here are some avenues you may not have fully explored yet:

- Exceptional leadership. Your management core’s pedigree, pioneering ideas, accomplishments or shared work experience with other leaders may demonstrate a sound foundation and unique formula for success

- Productive culture. A collaborative environment, rigorous debate, uniquely structured team meetings or other distinct cultural traits may help to generate great investment ideas and attract investors

- Proven or potential success. A strong track record of performance immediately elevates your hedge fund above others. If you’re growing, you can still differentiate yourself by calling out past accomplishments that highlight the fund’s potential

- Distinct opportunity. The particular sectors/subsectors, regions, special situations, etc. your hedge fund is focused on – and how you capture this potential – may point to enhanced opportunity

- Special parts of your process. It may seem pretty standard from your vantage point, but your research methodology, proprietary technology, selection criteria or other tactics you integrate are compelling – and may directly delineate you from the rest

Contact us at 1.844.243.1830 or info@ext-marketing.com today if you would like to explore and communicate your hedge fund’s distinct qualities through a persuasive value proposition.

Sources:

1 Hedge Fund Research, Inc., HFR Market Microstructure Report, March 2018.

2 Hedge Fund Research, Inc., HFR Global Hedge Fund Industry Report, Q2 2017.

Monday morning briefing – May 27, 2019

Socially responsible investing by hedge funds on the rise. Using branches to help with a bank’s digital strategy. Institutional investors prepared for a market downturn. And much more in this week’s briefing.

Economic/industry news

The Japanese economy expanded 0.5% in the first quarter of 2019: Japan’s Q1 GDP: The details are worrisome

Will we see an interest rate cut by the Fed?: David Rosenberg says U.S. will cut rates by end of summer

Assets in passive and active U.S. equity funds at US$4.3 trillion each: Passive fund assets draw even with active incumbents in U.S.

U.S. ETF that pays investors will put pressure on fund fees: Fund fees face added pressure with first U.S. fund that pays investors

There were US$45.94 billion of net inflows into global ETFs in April: Global ETF assets reached US$5.57 trillion last month

News and notes (U.S.)

Asian, emerging markets and event driven hedge funds attracting assets: Event driven, Asia, emerging markets hedge funds are big asset winners in April and YTD

Socially responsible investing by hedge funds on the rise: Hedge funds start to figure out socially responsible investing

Appaloosa LP to convert to a family office: David Tepper’s hedge fund days are coming to a close (one day)

PE exits declined in the first quarter of 2019: Exit activity nosedives for PE firms in 1Q

Investors concerned about the return potential from private markets: Private equity loses luster

Possible changes expected to the tax treatment of carried interest profits: Mnuchin says no plan to change carried interest tax treatment

Vanguard launches first actively managed ESG fund: Vanguard’s first actively managed ESG fund now open for investment

News and notes (Canada)

Allianz Group invests $100 million in Wealthsimple: Allianz makes ‘landmark’ investment in Wealthsimple

Purpose launches options ETF: Purpose launches new options ETF

Canadian mutual funds experienced $1.0 billion of outflows in April: ETF sales trump mutual funds in April

Canadian debt levels continue to rise: CMHC says Canadian debt levels hit record highs at end of last year

Canadian executives expect strong revenue growth this year: Economic optimism underpins strong M&A market

On the pulse – New frontiers in fintech

Using branches to help with a bank’s digital strategy: Don’t abandon branches to favor digital banking channels

Outages causing problems for open banking: Open banking revolution on hold as banks fail to prioritise fixing outages

Banks spending heavily in digital transformation to ward off the threat from fintech firms:Banks waking up to fintech threat throw billions into digital

How artificial intelligence can help banks: How AI will supercharge bank and credit union innovation

The top 20 countries in AI readiness: UK near top of AI index

Attracting the Gen Z client: Are you focused on the right customer?

Trade AI Engine will provide a better experience for trade processing: Standard Chartered rolls out Trade AI Engine

Revolut launches group feature for its vault account: Revolut launches Group Vaults as an alternative to joint accounts

HSBC opens artificial intelligence lab: HSBC opens global data lab in Toronto

High-net-worth topics

What wealthy clients want from an advisor: How advisors can stand out to wealthy clients

A look at philanthropy from the CEO of the Center for Effective Philanthropy: What Wall Street gets wrong about giving

Cash holdings on the rise for the ultra-wealthy: A group of superrich investors, spooked by China and potential ‘black swans,’ raises cash to levels not seen in years

Polls & surveys – What financials are saying

Institutional investors prepared for a market downturn (Wilshire): Institutional investors think they’re ready for the next downturn

Approximately 50% of investment managers are using alternative data (IHS Markit): Half of investment managers use alternative data: report

Investment professionals bullish on U.S. equity markets (SPDR): Investors still confident in mid-2019, but risk tolerance dips

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Four quick tips for creating great client personas

We recently updated our client personas. Not that the old ones were bad, they just weren’t entirely accurate. Some vital concepts were missing. The personas weren’t … well … alive enough for us.

We don’t think we’re the only ones in the financial services industry who’ve dealt (or are dealing) with this issue. Firms across our industry are uncovering more and more meaningful insights about their clients and prospects.

In a sentence, our industry is changing and our clients are changing. If you haven’t revisited your client personas recently, we think now is the time. Changes demand it.

“Our industry is changing and our clients are changing. If you haven’t revisited your personas recently, we think now is the time.”

During our persona exercises, these tips helped guide our work. We believe they’ll apply to your work as well.

1. Hear “straight from the horse’s mouth”

Interview actual clients and prospects. You’ll be amazed at all the little things you pick up. These subtle details are often very important.

2. Create more than one … but not too many

It’d be easy to say that three is the perfect number. But two or four might be just right. Maybe one really is all you need. Just make sure you’ve clearly identified your primary targets. And in the age of micro-targeting, don’t be afraid to go a little deeper too, if your audience warrants.

3. Think hard about needs

What drives your persona to do what they do? Try and dig as deep as you can into their psyche. What makes them tick? Starbucks or Dunkin’ Donuts? Hopefully, you solve one or more of their needs and challenges. If you don’t, they may not be an ideal client/prospect.

4. Always include info about content

Try to uncover where your persona finds the content they need … and what format they like it in. Your content team will be forever grateful if they can tailor their work to the right audience.

“Your content team will be forever grateful if they can tailor their work to the right audience.”

Bonus: Create a persona for your firm

Who are you? What are you all about? You might surprise yourself and find that all these honest answers reveal something you didn’t know was there.

There’s more to say, but we think this is a good start to get you thinking about whether your personas are as robust and up to date as they need to be.

Creating personas can take a lot of time. But what we have found, and what we know you’ll find as well, is that the up-front investment always pays off.

Let us help you segment your client base, create your firm’s personas and strengthen your brand. Contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – April 8, 2019

A look at why fintech firms’ valuations are surging in Latin America. New hedge funds are raising minimum investment amounts. A look at how liquid alts can add value to an investor’s portfolio. How to establish digital trust. And much more in this week’s briefing.

Economic/industry news

The U.S. unemployment rate was 3.8% in March: Job market bounces back in March with 196,000 gain in payrolls

The Canadian unemployment rate was steady at 5.8% in March: Canada’s job run stalls in March with first drop in seven months

Financial institutions need to be prepared for a possible no-deal Brexit: Financial firms should prep for “no deal” Brexit: report

Europe holds the largest amount of sustainable investing assets: Global sustainable investment assets grew by a third in 2 years: report

Preparing investors’ portfolios for a slowing global economy, possible recession: Why investors shouldn’t panic over the yield curve inversion

Regulation is required to protect retail investors: Behavioural economics are useful, but regulation is essential: report

News and notes (U.S.)

New hedge funds are raising minimum investment amounts: New hedge fund study shows funds placing premium on strong start

Institutional investors may increase allocation to private capital: Stock market fears push investors toward alternative assets

Blackstone closing in on largest PE fund ever: Blackstone surpasses $22B mark for what could be biggest PE fund ever

BlackRock undergoes massive organizational changes: BlackRock starts big reorg of leadership, units

A review of M&A activity in 2018: 10 charts detailing the state of M&A in 2018

Year-to-date, 73 funds added ESG criteria to their investment strategy: More funds are formally considering ESG in their investment process

Fixed income ETFs continue to attract investor money: Fixed income ETFs received over $34B in flows during Q1

Mutual fund sales and performance figures over the past two weeks: Mutual funds scorecard: April 2 edition

SEC extends deadline for two bitcoin ETF applications: SEC delays decision on 2 bitcoin ETF filings

News and notes (Canada)

A look at how liquid alts can add value to an investor’s portfolio: Investing in liquid alts

Dynamic launches another liquid alt: Dynamic Funds expands its liquid alt offerings

Russell Investments launches liquid alternative fund: Russell Investments launches new Yield Opportunities Pool

Robust equity markets this year have helped defined benefit plans: Canadian pension plans in strong solvency position in Q1 off surging equity markets

Fiera Capital purchases majority stake in Palmer Capital: Fiera acquires 80% stake in Palmer Capital

Canadian ETFs had net inflows in March, led by fixed income: Net inflows for Canadian ETFs hit $1.9 billion in March

On the pulse – New frontiers in fintech

Banks must remain flexible to adapt to the changing technological landscape: Bank strategy in the world of fintech

The time is now for digitalization: Banks’ digital experiments need to produce results

A look at how banks and fintech firms can work together: Banks and fintech: Why the future looks brighter together

Why machine learning can help in the stock selection process: Machine learning can help with stock selection: study

A look at why fintech firms’ valuations are surging in Latin America: Why fintech startups are rapidly becoming unicorns in Latin America

How to establish “digital trust”: How to empower secure collaboration, communication and sharing in financial services

Interest in cryptocurrencies on the rise in private banks: How private banks are demonstrating interest in digital currencies

Bitcoin’s price spikes: Bitcoin surges as cryptocurrency market suddenly springs to life

High-net-worth topics

Careful estate planning an absolute must for high-net-worth families: U.S. billionaires are living longer, making heirs wait

High-net-worth investors show preference for independent advisors: HNW clients favour independents

Polls & surveys – What financials are saying

Most retirement plan participants aren’t saving enough for retirement (Natixis): What retirement plan participants want, need

Canadians need to focus on better tax planning throughout the year (CIBC): CIBC poll finds 63% of Canadians view tax refunds as an unexpected ‘windfall’

Advisors should strive to create a great client experience (Cerulli): How focusing on client experience helps advisors get ahead

Teens not confident about their financial futures (Junior Achievement USA and Citizens Bank): When it comes to finance, the kids are not all right: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – March 4, 2019

An in-depth look at how Amazon is entering the financial services industry. Eleven fintech firms to keep an eye on. How to attract high-net-worth investors. The four key pillars to help protect your company against cyberattacks. And much more in this week’s briefing.

Economic/industry news

International Economic Data Snapshot – includes aggregated data of the worldwide economy: Snapshot: International economic data

U.S. GDP grew 2.6%, annualized, in the fourth quarter: Fourth-quarter GDP increases 2.6%, better than expected

Canadian GDP growth slowed to 0.4%, annualized, in the fourth quarter: Canadian economic growth slowed in the fourth quarter

Canada’s inflation rate fell to 1.4% in January: Canada’s inflation rate falls to 15-month lows on lower gas prices

Global ESG ETFs experienced $730 million of inflows during January: Global inflows into ESG ETFs steady in January

The Financial Conduct Authority found fee disclosures lacking: U.K. Regulator zeroes in on asset managers’ fee disclosures

Bondholders could benefit as companies fear a downgrade: No BBB bust as $140 billion bet on fallen angels is ‘overpriced’

What retirement will look like in the future: 5 trends that could reshape retirement

The challenges of an index becoming more concentrated: S&P 500? More like the S&P 50

A look at four major real estate markets: What’s driving demand in global real estate

News and notes (U.S.)

The Eurekahedge Hedge Fund Index rose 2.35% in January: Hedge funds record best January since 2006

Hedge funds more concentrated in managers’ best ideas: Never before has the fate of hedge funds turned on so few stocks

Hedge fund assets rose despite redemptions: Hedge fund assets up in January as performance offsets investor redemptions

It could be another strong year for PE fundraising: Here’s why 2019 could be another fundraising boom year for US PE

Cost-cutting alone cannot help companies grow: The lesson of The Kraft Heinz nosedive: Radical cost-cutting is out, brands are back

A comprehensive look at women in VC: The VC female founders dashboard

Fidelity has expanded its multi-factor ETF lineup: Fidelity debuts three multifactor ETFs

Another vote on Brexit could be helpful: Carlyle’s David Rubenstein wants second Brexit vote as UK PE deals dwindle

Mutual fund assets rose 5.3% in January: Mutual funds add $947 billion in assets in January

News and notes (Canada)

Mackenzie launched three more liquid alt funds: Mackenzie introduces liquid alt funds

Franklin Templeton launched three ETF portfolios: Franklin Templeton enters ETF portfolio fray

The BoC proposed reforms to the Canadian Dollar Overnight Repo Rate Average: Bank of Canada unveils benchmark reform proposals

The OSC declined a Bitcoin fund application from 3iQ: Regulators refuse proposed Bitcoin fund amid investor protection concerns

Canadian mutual fund assets grew in January, despite net redemptions: Mutual funds saw $53 million in net redemptions for January

Tips to successfully invest in your RRSP: 6 rules for successful RRSP investing

On the pulse – New frontiers in fintech

Automating testing can have a big impact on the success of a digital transformation: Driving a successful digital transformation strategy

Canadian’s usage of alternative payment tools has increased 14% since 2016: Canadians are increasingly choosing alternative payment tools

The growth of payment alternatives will bring new and complex regulatory requirements: Harnessing regtech to build payments reputation

An in-depth look at how Amazon is entering the financial services industry: Everything you need to know about what Amazon is doing in financial services

Financial services companies are expanding their use of AI: The world’s biggest banks are doubling down on artificial intelligence

Cybersecurity spending expected to grow: Cybersecurity spending to reach $223.7 billion by 2024, says Rethink

The four key pillars to help protect your company against cyberattacks: Four steps in cyber risk management

UOB integrating AI to speed up loan process: UOB applies AI to transactional data to speed up loan approvals for SMEs

11 fintech firms to keep an eye on: Fintech focus – 11 to watch now

Retail shopping through virtual reality and blockchain: The convergence of blockchain and online VR retailing

High-net-worth topics

The high-net-worth demand personalization: Themes from the 2019 U.S. Millionaire Report: Personalization

How to attract high-net-worth investors: You don’t need a Super Bowl ad to attract high-net-worth clients

Polls & surveys – What financials are saying

Global corporate debt reached $13 trillion at the end of 2018 (OECD): Why corporate debt is a risk to the global economy

The majority of economists expect a recession in the U.S. by the end of 2021 (National Association for Business Economics): 75% of business economists expect a US recession by 2021: survey

Women don’t believe they will be able to afford their desired lifestyle in retirement (RBC): A third of Canadian women not confident about maintaining lifestyle in retirement: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – February 4, 2019