Monday afternoon briefing: Small caps vs. large caps

A look at the top performing hedge fund strategies. The holdings of different generations. Europe is seeing a large increase in wearable payments. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held interest rates steady at 1.75%: Bank of Canada holds rates steady, citing ‘intact’ global recovery

Canada’s unemployment rate rose: Canada posts largest job loss since 2009 on full-time drop

U.S. labour markets were strong in November: Jobs growth surges in November, beating Wall Street expectations

Institutional investors’ looking to protect their portfolios: Global institutional investors sober as markets rally: survey

The challenges 2020 may bring: What headwinds do stocks face going into 2020?

Understanding the screening process of responsible investments: Lifting the veil on RI screening

Chart of the week

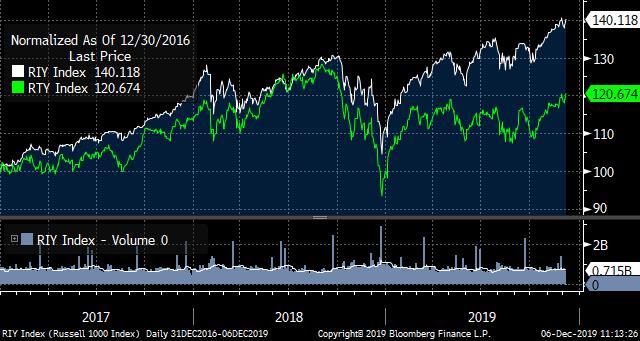

Since the end of 2016, small-caps have underperformed large-caps, as measured by the Russell 2000 Index and Russell 1000 Index, respectively. It’s not surprising given global trade tensions and their influence on equity market volatility. Investors have largely turned to larger-cap securities given their relative safety. If the U.S. and China reach a phase-one trade pact, will small-caps stocks take the lead? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Helping first-time managers raise money: These firms are helping managers beat their private capital fundraising goals

A look at the top performing hedge fund strategies: Equity long bias strategy tops hedge fund performance in 2019

Co-CEO of Bridgewater to leave firm: Murray to leave Bridgewater Associates

J.P. Morgan launches new ETF: J.P. Morgan Asset Management expands BetaBuilders suite

News and notes (Canada)

Horizons completes its corporate class reorganization: Horizons reorganizes 44 ETFs as corporate-class funds

Novacap launches Novacap Financial Services I: Private equity firm Novacap launches financial services fund

PE activity in Canada has slowed in 2019: Canadian PE industry on pace for investment slump

Onto the next step for a bitcoin fund: 3iQ files preliminary prospectus for Bitcoin fund

On the pulse – New frontiers in fintech

How changing technology will impact banking in 2020: The biggest technology trends that will disrupt banking in 2020

How tech and analytics are helping PE companies: Progressive VCs and private equity are using tech and analytics to revolutionize investing

Why regulators need to accept fintech in the banking industry: BankThink Charter or not, fintechs are already ‘banking’

Broadridge launches new AI tool: Broadridge launches new AI and machine learning platform for reconciliation, matching and exception management operations

A spotlight on emerging cities and fintech: Global fintech ranking shows importance of emerging cities

Europe is seeing a large increase in wearable payments: Wearable payments show sharp rise in uptake

High-net-worth topics

European private equity firms eyeing technology investments: Why Europe’s wealthy are betting on tech like never before

Younger U.S. high-net-worth investors showing interest in ESG: Wealthy, young investors driving shift to ESG, Cerulli reports

How the 2020 tax changes may impact the wealthy in the U.S.: What wealthy clients need to know about 2020 tax changes

Polls & surveys – What financials are saying

A look at the holdings of different generations (Charles Schwab): Self-directed millennials invested more in cash, ETFs than older investors

Business leaders uncertain about the outlook for the Canadian economy (CPA): Survey uncovers growing pessimism about Canada’s economy

A look at the struggles facing those who entered the labour market during the financial crisis (RBC): The struggle really is real for young investors