Monday morning briefing: Markets rise while economies struggle

Potential COVID-19 drug showed positive results. The keys to running a successful remote meeting. Could M&A be banned during the pandemic? And much more in this week’s briefing.

Economic/industry news

U.S. economic expansion ends: US GDP shrank 4.8% in the first quarter amid biggest contraction since the financial crisis

Europe’s GDP contracts: Europe’s economy just had its worst quarter since records began

Canada’s GDP unchanged in February: Canada’s GDP growth was already flat in February, StatsCan data shows

Fed keeps its central interest rate steady: Fed holds near-zero rate, Powell sees severe impact from pandemic

Investments in real estate could decline in 2020: Institutional investors set to pull back on real estate investments in 2020: survey

A look at the benefits of a merger arbitrage strategy: Five reasons why merger arbitrage is a must-own strategy

Five tips for investing during this crisis: T. Rowe offers 5 rules for investing during time of pandemic

People are turning to financial advisors for help: How a surprise pandemic reinforced the need for financial advice

Reasons for hope

Potential COVID-19 drug showed positive results: Gilead says early results of coronavirus drug trial show improvement with shorter remdesivir treatment

Some stories of human compassion: 5 uplifting stories of people showing up for each other during the coronavirus pandemic

Looking for faster tests: Federal government launches $500 million ‘Shark Tank’ style challenge to speed development of better coronavirus tests

Assisting your clients

How companies should plan for the future: How to plan your company’s future during the pandemic

Taking a proactive approach with clients: Acting, not reacting, during the pandemic

The keys to running a successful remote meeting: How to host remote meetings without chaos

Keeping track of actions by federal regulators: Better Markets launches COVID-19 regulatory tracker

Chart of the week

The S&P 500 Index, NASDAQ Composite Index and Dow Jones Industrial Average posted their strongest monthly returns in 20 years, after reaching multi-year lows in March as a result of the spread of COVID-19. All 11 sectors on the S&P 500 Index advanced, with over 90% of stocks on the index finishing higher. This comes despite a significant drop in economic activity across the U.S. and around the world. In the U.S., initial jobless claims continue to be in the millions, while first-quarter gross domestic product fell by 4.8%. Lower valuations and hope that economies will soon begin reopening boosted the performance of equity markets. Will the expectations of getting past this crisis drive market performance in May, or will investors demonstrate concern over weak incoming economic data? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Could M&A be banned during the pandemic?: Elizabeth Warren, Alexandria Ocasio-Cortez want mergers halted due to COVID-19

VC funds under pressure from the COVID-19 pandemic: VC funds face bigger risk than in financial crisis

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 29 edition

News and notes (Canada)

Oak Trust purchased by Raymond James: Investment firm Raymond James Ltd. acquires Oak Trust Co.

Horizons Canada makes changes to oil ETFs: Horizons announces effort to save troubled oil ETFs

Canadian DB plans had a significant decline in the first quarter: Canadian DB plans return negative 7.1% in first quarter

Canada’s fund industry lagging behind other countries in tax and regulations: Canada’s fund regulation, taxation falling short for investors: Morningstar

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Tech stocks that shine during COVID-19 crisis

Thank you for reading Monday Morning Briefing. For this edition, and going forward, we have decided to change the format of the briefing to provide you with relevant information you will need to weather the new realities we face today – and the challenges that will likely continue over the coming months. As small business owners ourselves, we know that access to timely news, human stories and tools to help you operate better, can be invaluable at times like these. Please let us know if you have any feedback on our new format or want more information on our stories. We want to hear from you, our readers.

Jillian Bannister, CEO

Richard Heft, President

Economic/industry news

The BoC kept its central interest rate at 0.25%: BoC sees risk of ‘structural damage,’ ramps up bond-buying

Economic growth in Canada slumped in March: Data indicate economy plunged in March: StatsCan

China’s GDP contracted over the first quarter: China says its economy shrank by 6.8% in the first quarter as the country battled coronavirus

The value of alternatives through volatile markets: Alternatives can smooth market bumps

Cash levels among fund managers rising: Fund managers at highest cash levels since 9/11: BofA survey

COVID-19 has resulted in more cashless payments: Contactless payments skyrocket because no one wants to handle cash

Reasons for hope

A look at the potential cures for COVID-19: Handicapping the most promising of 267 potential coronavirus cures

Private equity firms stepping up to help first responders and portfolio company employees: Private equity firms promise millions for coronavirus relief

Restaurant changes operations to help community: Vaughan restaurant now making hand-sanitizer, keeps staff employed

Assisting your clients

Generation Z reconsidering how they view money: Why COVID-19 is rebooting how Gen Z feels about money and banking

Best practices to follow when RIAs are working from home: Key tech steps for RIAs working from home

Eight principles to keep in mind with your marketing efforts in the current market environment: PR and marketing: How to communicate during COVID-19

It is important to remain in constant contact with your clients: Communicate with clients clearly and often, consultant says

Looking after yourself while working from home: Pandemic, stress and luxury

Chart of the week

Despite significant volatility in financial markets over the past two months, there have been a number of stocks that have performed well. Some stocks have benefited from higher expectations for sales given that more people are at home. Here are a few of these “stay-at-home” stocks, which have outperformed the broader market, even producing share price gains. Netflix Inc., Amazon.com Inc., Peloton Interactive Inc. and Zoom Video Communications Inc. are all seeing gains. As people eventually return to work, and social distancing measures are relaxed, what will be in store for the share prices of these companies? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The hedge fund industry experienced net outflows in February: Hedge funds see USD8.1bn in outflows in February

BlackRock raised US$5.1 billion for its latest alternative fund: BlackRock just closed its largest alternative fund yet

Allocators demonstrating cautious sentiment toward private market investments: Investors are cautious on private markets during shutdowns, Pitchbook survey shows

Investment funds experienced significant outflows in March: Funds saw largest ever exodus in March, Morningstar says

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 15 edition

News and notes (Canada)

Purpose Investments launches new fund: Purpose unveils new structured equity yield portfolio

A look at the federal government’s assistance programs: Understanding CERB, EI and the feds’ wage subsidy

CI Financial partnering with private-market investment company: CI Financial forges private-market investment partnership

IIROC is delaying fee collection: IIROC gives dealers a breather on fees

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Labour market faces challenges

International securities regulators focused on COVID-19. Many executives planning acquisitions in the next year. Handling client data with care. And much more in this week’s briefing.

Economic/industry news

Canada loses 1 million jobs: Canada sheds record 1.01 million jobs in March

The impact of short-term losses on long-term value: So how much wealth destruction has truly occurred since February?

Be careful trading based on Fed actions: Investors need to be selective in following the Fed

International securities regulators focused on COVID-19: Global regulators all-in on pandemic perils

A look at the similarities and differences between current conditions and the 2008 financial crisis: Comparing the current crisis to 2008

How governments can get people back to work, but keep them safe: How to restart national economies during the coronavirus crisis

Chart of the week: Labour market faces challenges

Canada’s job report for March showed a significant deterioration in its labour market. In an effort to contain the spread of COVID-19, many businesses were shuttered, at least temporarily, resulting in mass layoffs across many industries. In March, the Canadian economy lost over one million jobs, pushing the unemployment rate to 7.8%, its highest level since 2010. Markets will be carefully watching how the federal government’s wage subsidy program helps businesses, and if it keeps people employed. Let us know if you think this will be enough to bolster Canada’s labour market.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

A look at some strong and weak performing hedge funds in March: The winning and losing hedge funds of the March pandemic

Hedge funds’ returns declined in March: Hedge funds down 4.40 per cent in March, says Eurekahedge

Capital raised by private debt funds declined in the first quarter: Private debt funds struggle to raise capital in pandemic

Many executives planning acquisitions in the next year: While M&A grinds to a halt, many executives plan for future deals

Target-date funds experience declines amid extreme market volatility: Target date funds not immune to COVID-19 selloff: Morningstar

News and notes (Canada)

Canadian government relaxing restrictions on accessing wage subsidy program: Trudeau promises ‘relaxed’ rules for wage subsidy, more support for student jobs

A look at the impact of COVID-19 on the cannabis industry: Can pot stocks weather the COVID-19 hurdle?

How DB plans can navigate through the current market environment: A coronavirus game plan for defined benefit pension plans

Canada’s oil industry challenged by a confluence of factors: Alberta’s Kenney sees negative oil prices, $20 billion deficit

On the pulse – New frontiers in fintech

The use of fintech apps has risen in response to COVID-19: Coronavirus drives 72% rise in use of fintech apps

Now may be the time for financial institutions to improve its digital platforms: COVID-19 provides opportunity for digital transformation

Digitalization requires effective communication among different teams and departments: How to break down team and department silos for digital transformation

Helping banks and other organizations with customers’ COVID-19 questions: Google launches bot to help organizations answer COVID-19 questions

Handling client data with care: Why tech vendors must start taking our user data seriously

Insurers turning to digital tools for the sales application process: Insurers adapt underwriting, digital channels in pandemic response

High-net-worth topics

How the wealthy are navigating through the choppy markets (video): Tiger 21 Chairman Michael Sonnenfeldt on how his clients are navigating coronavirus-driven volatility

The wealthy should return to U.S. equities: Goldman tells rich clients U.S. stocks still offer best returns

Polls & surveys – What financials are saying

Canada’s economic recovery may not be rapid (CIBC): No quick recovery in sight, CIBC economists say

Financial advisors in the U.S. see more downside in stocks (Ned Davis): 4 in 5 advisors say stocks haven’t hit bottom: Survey

In this time of rising uncertainty, please know that ext. is closely monitoring COVID-19 and its impact – current and potential – on our firm, our clients’ businesses and the overall financial services industry.

We remain committed to seamless service for our clients and the well-being of our employees during this time. If you have any questions about business continuity at ext. – or how you can effectively communicate these and other timely issues with your clients, please reach out to your account manager or contact us 1.844.243.1830 or info@ext-marketing.com.

Monday afternoon briefing: Services sink

We may not see a v-shaped recovery. Why PE firms may be looking at publicly listed companies. How COVID-19 may change banking. And much more in this week’s briefing.

Economic/industry news

Canada’s economy grew 0.1% in January: Economic growth slowed in January to 0.1%, Statistics Canada says

U.S. unemployment rate rises to 4.4%: US payrolls plunge 701,000 in March amid the start of a job market collapse

We may not see a v-shaped recovery: Economists are losing hope in a ‘v-shaped’ post-virus recovery

The Fed is stepping up to help global debt markets: Fed steps in once again to try to smooth out lending markets

How pension plans are approaching rebalancing amid the market volatility: Investment portfolio rebalancing in the time of coronavirus

Happy birthday to ETFs: Getting better with age: ETFs turn 30

Chart of the week

As COVID-19 continues to spread around the world, the services sector has been particularly hard hit. Travel, accommodation and food services, among others, have all come to a halt. In its most recent results from IHS Markit, services across the U.S. and Europe have had their steepest decline ever. Even if the spread of COVID-19 is flat-lines and people quickly return to work, it will likely take some time for the services industry to fully recover. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Stay defensive in down markets: Billionaire Howard Marks pitches a defensive investing outlook

Why PE firms may be looking at publicly listed companies: Private equity will go after listed companies. And corporations will welcome it.

The impact of the U.S. government’s stimulus package on private markets: What $2T in stimulus does – and doesn’t do – for private markets

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 1 edition

News and notes (Canada)

From skates to medical equipment: How private equity-owned Bauer pivoted from hockey gear to medical masks

Tax planning for business owners in the current environment: Tax tips for business owners navigating the pandemic

Real estate market in Canada could see significant declines: Distancing, economic uncertainty to hurt home sales: RBC

Counsel Portfolio Services makes changes to pricing: Counsel enhances tiered pricing program

On the pulse – New frontiers in fintech

With challenges come opportunities: Coronavirus: New challenges and opportunities for fintech

How COVID-19 may change banking: Reimagining banking during and after COVID-19

Fintechs can benefit from partnerships with private banks: Private banks may prove profitable partners for fintechs

Improving cash management systems: Firms look to better cash management capabilities

Answering questions about a digital transformation: Banks questions about doing digital transformation

Improving the process for online account openings: When opening accounts in branches becomes impossible

Helping advisors with remote client engagement tools, free until July: Wealthtech firm offers tool free of charge

High-net-worth topics

Reviewing your estate plan: How to take advantage of new estate planning opportunities caused by the coronavirus

The wealthy still bullish on the economy over the long term: Wealthy U.S. investors and business owners look hopefully to long term

Polls & surveys – What financials are saying

Canada’s stimulus measures could help ease the impact of COVID-19 (DBRS): Thumbs up for Canada’s large stimulus effort: DBRS

24% of millennials bought stocks despite volatile markets (Bankrate): Quarter of millennials bought stocks amid recent volatility: Bankrate

In this time of rising uncertainty, please know that ext. is closely monitoring COVID-19 and its impact – current and potential – on our firm, our clients’ businesses and the overall financial services industry.

We remain committed to seamless service for our clients and the well-being of our employees during this time.

If you have any questions about business continuity at ext. – or how you can effectively communicate these and other timely issues with your clients, please reach out to your account manager or contact us 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: A look at the current equity run

What could be in store for the hedge fund industry in 2020? A look at the remarkable return of Bitcoin. A survey of some federal tax changes in 2020. And much more in this week’s briefing.

Economic/industry news

Canadian manufacturing pulls back in December: IHS Markit Canada Manufacturing PMI

China’s central bank reduces the reserve requirement ratio: China cuts banks’ reserve ratios again, frees up $115 billion to spur economy

Underwriting of global debt surged higher in 2019: A record year for global debt issuance

M&A activity across the world slowed last year: M&A activity declined in 2019

Millennials’ interest in ESG investing will impact markets: Millennials’ ESG investing will transform markets, DeVere Group says

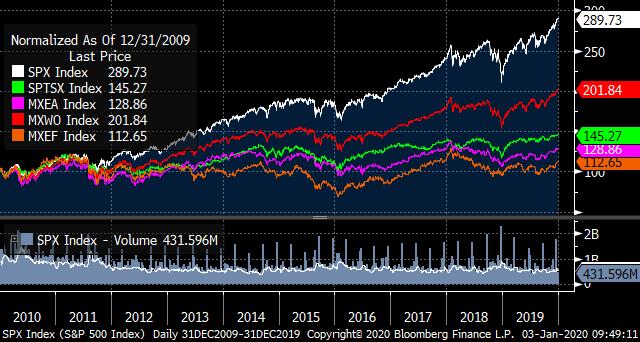

Chart of the week – A look at the current equity run

What a decade it’s been for equities. The prolonged bull market has rewarded those investors who stayed the course with steady gains. Will the next decade bring more of the same, or are we due for a pullback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds’ performance fees fell in 2019: Hedge fund fees plummeted further in 2019

An overview of the mutual fund industry in 2019: Mutual funds scorecard: 2019 in review

What could be in store for the hedge fund industry in 2020?: 20/20 foresight for hedge funds in 2020?

Vanguard to offer free online trading for stocks and options: Vanguard joins the crowd, drops commissions on stocks and options trades

News and notes (Canada)

Will Ontario eliminate the DSC?: Investor advocate group expects Ontario to buckle on DSCs

A look at some federal tax changes in 2020: Lower taxes, new RRSP rules and digital news tax credit among 2020 changes

IIROC looking to support its dealer members: IIROC vows to support industry transformation

On the pulse – New frontiers in fintech

Some fintech predictions for the year ahead: Five fintech predictions for 2020, according to Kleiner Perkins

The path to becoming a digital institution: How to make your financial institution digital-first in 2020

Three trends in open source storage: Open source storage: driving intelligence in the small data sprawl era

A look at the remarkable return of Bitcoin: Bitcoin’s 9,000,000% rise this decade leaves the skeptics aghast

How fintech partnerships can help advisors: Taking a 2020 view of fintech in wealth management

High-net-worth topics

The number of high-net-worth individuals in Canada expected to grow: When it comes to wealth opportunity, Canada’s perfectly average

How the high-net-worth maintain their wealth across generations: 100 families’ secrets to staying wealthy for 100 years

Polls & surveys – What financials are saying

Canadians looking to eliminate debt in 2020 (CIBC): Getting out of debt remains Canadians’ top financial priority in 2020: poll

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: The inverted yield curve

A new way to analyze equity investment funds. Why smaller could be better for private equity. Many aspiring investors don’t know how to get started. And much more in this week’s briefing.

Economic/industry news

The Fed held its federal funds rate steady: Fed holds rates steady and indicates no changes through at least 2020

Canadian and U.S. consumers in much different positions: U.S. consumers buoy global economy, while Canadians face debt

A new way to analyze equity investment funds: Morningstar launches a new framework to analyze equity funds

Why advisors need to frequently review their pricing structure: Advisors need to regularly reassess their fees, TD Exec says

The need to cross boundaries to drive growth: Investment managers must cross boundaries, says Deloitte

Chart of the week

In late August, the two- and 10-year yield curve inverted, seeing its spread dip into negative territory. This inversion was brought on by concerns about the global economy in response to escalating U.S.-China trade tensions. This sparked fears that a recession was imminent as was the case with previous inversions. While the global economy has been sluggish, the U.S. and China appear to be closing in on a phase-one trade deal that might help reignite global growth. According to a recent report by Goldman Sachs, the possibility of a recession in 2020 is low. Will we see a recession in the next year or two? Or, will a recession be avoided and slow growth continue? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds rose 0.84% in November: Eurekahedge Hedge Fund Index up 0.84 per cent in November

Conversation with Stephen Schwarzman: Stephen Schwarzman doesn’t stop: An exclusive Q&A with Blackstone’s chief

Why smaller could be better for private equity: The truth about private equity fund size

A look at some year-end financial planning tips: Sixteen year-end financial planning tips

Remembering Paul Volcker: There’s the legend of Paul Volcker and the man I got to know

News and notes (Canada)

How Canada may benefit from the new USMCA: ‘A really good deal for Canada’: Former ambassadors on new NAFTA

Looking to eliminate redundancies in investor disclosure documents: IFIC asks CSA to reconsider fund disclosure rules

BoC Governor will not seek a second-term: Bank of Canada says Poloz will not seek a second term as governor

The potential impact from a higher tax-exempt basic personal amount: How the federal tax cut will impact clients

On the pulse – New frontiers in fintech

Banks should disrupt themselves before others do: How banking can avoid being disrupted in 2020 … disrupt themselves

Why partnerships are key for traditional and challenger banks: The growing trend of ecosystems within financial services

Preparing for augmented analytics: Augmented analytics: Are you ready?

Driving growth through new technology: Wealth manager using technology to drive next phase of growth

A look at the possible risks posed by BigTech firms entering the financial services industry: Rise of the machines: BigTech poses risks to financial system, FSB says

Helping businesses manage receipts: Metro Bank trials digital business receipts

High-net-worth topics

Why family offices should take a deeper look at sustainable investments: As high-net-worth families shift wealth to the next generation, family offices should lean in on sustainable investments

A look at the blockchain-related investments available to high-net-worth investors: Blockchain investment opportunities for HNW clients

Polls & surveys – What financials are saying

Many aspiring investors don’t know how to get started (IIROC): Aspiring investors don’t know where to find advice: survey

A look at Americans’ top financial priorities next year (Fidelity): Here are Americans’ financial goals for 2020: Fidelity

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday afternoon briefing: Small caps vs. large caps

A look at the top performing hedge fund strategies. The holdings of different generations. Europe is seeing a large increase in wearable payments. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held interest rates steady at 1.75%: Bank of Canada holds rates steady, citing ‘intact’ global recovery

Canada’s unemployment rate rose: Canada posts largest job loss since 2009 on full-time drop

U.S. labour markets were strong in November: Jobs growth surges in November, beating Wall Street expectations

Institutional investors’ looking to protect their portfolios: Global institutional investors sober as markets rally: survey

The challenges 2020 may bring: What headwinds do stocks face going into 2020?

Understanding the screening process of responsible investments: Lifting the veil on RI screening

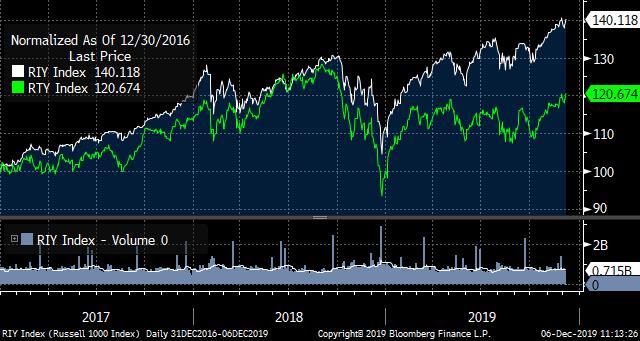

Chart of the week

Since the end of 2016, small-caps have underperformed large-caps, as measured by the Russell 2000 Index and Russell 1000 Index, respectively. It’s not surprising given global trade tensions and their influence on equity market volatility. Investors have largely turned to larger-cap securities given their relative safety. If the U.S. and China reach a phase-one trade pact, will small-caps stocks take the lead? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Helping first-time managers raise money: These firms are helping managers beat their private capital fundraising goals

A look at the top performing hedge fund strategies: Equity long bias strategy tops hedge fund performance in 2019

Co-CEO of Bridgewater to leave firm: Murray to leave Bridgewater Associates

J.P. Morgan launches new ETF: J.P. Morgan Asset Management expands BetaBuilders suite

News and notes (Canada)

Horizons completes its corporate class reorganization: Horizons reorganizes 44 ETFs as corporate-class funds

Novacap launches Novacap Financial Services I: Private equity firm Novacap launches financial services fund

PE activity in Canada has slowed in 2019: Canadian PE industry on pace for investment slump

Onto the next step for a bitcoin fund: 3iQ files preliminary prospectus for Bitcoin fund

On the pulse – New frontiers in fintech

How changing technology will impact banking in 2020: The biggest technology trends that will disrupt banking in 2020

How tech and analytics are helping PE companies: Progressive VCs and private equity are using tech and analytics to revolutionize investing

Why regulators need to accept fintech in the banking industry: BankThink Charter or not, fintechs are already ‘banking’

Broadridge launches new AI tool: Broadridge launches new AI and machine learning platform for reconciliation, matching and exception management operations

A spotlight on emerging cities and fintech: Global fintech ranking shows importance of emerging cities

Europe is seeing a large increase in wearable payments: Wearable payments show sharp rise in uptake

High-net-worth topics

European private equity firms eyeing technology investments: Why Europe’s wealthy are betting on tech like never before

Younger U.S. high-net-worth investors showing interest in ESG: Wealthy, young investors driving shift to ESG, Cerulli reports

How the 2020 tax changes may impact the wealthy in the U.S.: What wealthy clients need to know about 2020 tax changes

Polls & surveys – What financials are saying

A look at the holdings of different generations (Charles Schwab): Self-directed millennials invested more in cash, ETFs than older investors

Business leaders uncertain about the outlook for the Canadian economy (CPA): Survey uncovers growing pessimism about Canada’s economy

A look at the struggles facing those who entered the labour market during the financial crisis (RBC): The struggle really is real for young investors

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: 25 years of value vs. growth

Value versus growth over the past 25 years. Private debt fundraising down in 2019. Working on an approach to DSC. And much more in this week’s briefing.

Economic/industry news

Canadian GDP grew 1.3% in third quarter: Canada’s economy slows in third quarter even as demand jumps

Europe continues to favour active management: McKinsey: Where active management survives

There’s still a place for value investing: Has value investing stopped working?

Why small-cap stocks may be set to soar: Small may turn mighty as strategists see Russell strength ahead

M&A deals in financial services was US$57 billion in the third quarter: Financial sector M&A jumps in Q3, GlobalData

Why private equity can help a portfolio during a market downturn: Worried about a downturn? Consider private equity

Investors concerned about interest rates: Global investors cite interest rates as key portfolio risk: survey

Current market conditions may require a unique approach to active management: Revisiting active management and asset allocation

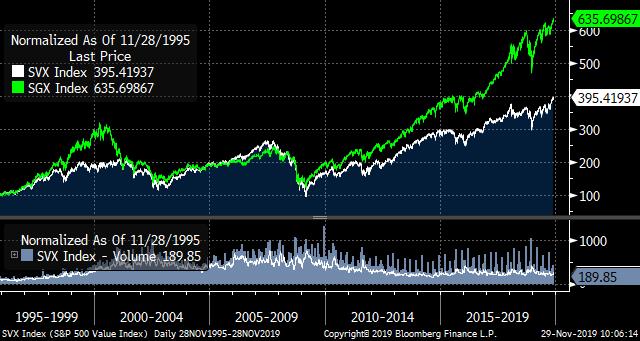

Chart of the week

Let’s look at value versus growth stocks on the S&P 500 Index since 1995. Toward the end of the 1990s and early 2000s, growth stocks surged higher in response to the dot-com bubble. After moving in lockstep until the 2008 financial crisis, growth stocks began outpacing value stocks. Is value investing in trouble or is it primed for a comeback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The Volcker Rule’s impact on hedge funds: The great hedge fund retreat

Private debt fundraising down in 2019: Against expectations, private debt fundraising saw a decline in 2019

The risks of unitranches: A booming corner of private credit has some investors on edge

Why it’s important to invest across vintages: In private equity, vintage diversification matters

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 26 edition

New rules proposed to make it easier for leveraged funds to come to market: SEC proposes new rule to ease the market entry of leveraged funds

Charles Schwab to purchase TD Ameritrade: Schwab to acquire TD Ameritrade in US$26-billion deal

Looking to allow private companies to raise money through a direct listing: NYSE proposes big change to direct listings

News and notes (Canada)

TD launches 10 new ETFs: TD Asset Management introduces new ETFs

CI takes stake in U.S. RIA firm: CI Financial buys US advisory firm

Canadian ETF assets rose to $192.3 billion in October: ETF sales rebound, mutual fund sales hold steady in October

Working on an approach to DSC: OSC decision on DSCs to come – eventually

Here are the winners from the Women in Wealth Management awards: Women in Wealth Management award winners revealed

IIROC provides updated guidance on AML requirements: IIROC steps up AML guidance

On the pulse – New frontiers in fintech

The importance of customer engagement: Reinventing retail banking customer experience in a digital world

How the entry of Big Techs into banking may impact fintech companies: Should ‘fintech’ fear big tech’s push into banking?

Customers are demanding a better digital experience: Banks losing customers who want seamless digital experiences

Why data science skills will be crucial for businesses to thrive: Analytics skills essential for business survival in ‘data decade’

The importance of IT infrastructure in developing AI capabilities: Big data LDN: Why you need to modernize your IT infrastructure for AI

Data analysis will be the focus in 2020: Why data will change the game again in 2020

Ant Financial looking to invest in the payments space: Ant Financial preps $1bn investment fund

New platform for independent advisors: Pascal Financial launches wealth management platform for advisors

High-net-worth topics

The wealthy want quality information from their advisor: What ultra high net worth clients want from wealth managers

The money habits of the rich: 5 things rich people do with their money

Polls & surveys – What financials are saying

During a recession, people want help from advisors (MDRT): Clients want you to help them through a recession: MDRT survey

Where are the female portfolio managers? (Goldman Sachs): Investment management is still a boys’ club: Goldman

Canadians are looking to eliminate debt (Manulife): Canadians agree they have too much debt

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 25, 2019

Could charities suffer from higher taxes for the wealthy? OSC introduces new recommendations to reduce regulatory burden. Some important points to know from Congress’ PE hearings. And much more in this week’s briefing.

Economic/industry news

The Canadian inflation rate was 1.9% in October: Canadian inflation holds steady at 1.9% in October, remains on target

Capturing your clients’ attention with a story: How storytelling bolsters financial plans & client relationships

Why alternative investments could benefit a portfolio in current market conditions: Fitting alternatives into a 60-40 portfolio

Global ETF assets continue to soar: Global ETF assets surpass $6T

A look at Morningstar’s sustainability ratings: Understanding Morningstar’s new sustainability ratings

Why private investments can help DC plans: DC plans need private investments, Neuberger Berman says

News and notes (U.S.)

Hedge funds experienced outflows in September: Hedge fund redemption trend extends to four months in September

Helping hedge funds with their cold-calling efforts: Match.com for hedge funds or low-rent telemarketing service? Cold-calling firm Murano Connect has many fans, but just as many detractors.

Hedge funds preparing for a trade deal: Hedge funds are buying stocks exposed to US-China trade on hopes for a deal

Louis Bacon to close hedge funds: Billionaire Louis Bacon is closing legendary hedge fund to clients

Some important points to know from Congress’ PE hearings: 4 key takeaways from Congress’ private equity hearing

Two Sigma raises US$1.2 billion for first PE fund: Two sigma is getting into private equity

A brokerage powerhouse could be in the works: Charles Schwab in talks to buy TD Ameritrade, create brokerage giant: report

Still some concern from SEC on non-transparent ETFs: Fresh concerns raised on novel ETF structure

News and notes (Canada)

Evolve launches new ETF: Evolve launches high interest savings account ETF

iA Clarington launches new segregated funds: iA Financial expands seg fund lineup

The Financial Planning Association of Canada was launched: New association aims to elevate financial planning

OSC introduces new recommendations to reduce regulatory burden: OSC says firms will save millions in compliance costs

Capital growth being driven by real estate: Outside housing, Canadian capital growth is near a 60-year low

On the pulse – New frontiers in fintech

Fintech trends to watch for in 2020: Top fintech trends entrepreneurs must watch in 2020

Fintech needs principles-based regulation: Fintech regulation needs more principles, not more rules

The five trends you need to know for digital banking transformation: Top 5 digital banking transformation trends shaping 2020

A look at regtech’s impact on compliance: How regtech is transforming compliance

Making the most of customer analytics: How to maximise insight from your customer analytics

Teaching the ethics of AI: Scotiabank to train execs on AI ethics

PayPal purchases Honey Science Corporation: PayPal to acquire shopping and rewards platform Honey for $4B

Essential Portfolios lowers its minimum investment: TD Ameritrade lowers minimum for robo-advisor accounts

What’s in store for digital currencies: The high stakes of the coming digital currency war

Fidelity gets licence for its virtual currency business: Fidelity granted licence to operate virtual currency business in New York state

High-net-worth topics

A look at key-person insurance: How to protect your business from upheaval if the owner suddenly dies

Could charities suffer from higher taxes for the wealthy?: Tax the wealthy and their charities will suffer

The wealthy are looking for a secure location to store their precious metals: World’s rich are rattled and looking for old-fashioned security

Polls & surveys – What financials are saying

Millennials have a better understanding of fixed income’s role in a portfolio (BNY Mellon): Millennials understand fixed income better than do older investors: survey

Canadians’ concerned about the stock market, economy (IG Wealth Management): Canadians’ financial confidence dims: IG survey

Many Canadians are worried about outliving their retirement savings (Sun Life): 72% say retirement isn’t what they expected

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 11, 2019

U.S. PE funds’ capital raising reaches record high. Businesses looking to Canada for expansion. U.S. institutional investors are turning to liquid alternative ETFs. And much more in this week’s briefing.

Economic/industry news

Canada’s unemployment rate was 5.5% in October: Canadian economy lost 1,800 jobs in October, unemployment rate steady

The BoE held rates steady at 0.75%: Sterling falls after Bank of England split on interest rate cut

Expecting weaker growth in Europe: Eurozone forecast for long period of weak economic growth

How to access private markets: Smart ways to access private capital markets

U.S. institutional investors are turning to liquid alternative ETFs: Use of liquid alternative ETFs on the rise among institutional investors: study

Why defined contribution plans can benefit from alternative investments: Fundamental reasons for adding alternatives to DC pension portfolios

A look at Morningstar’s new rating system: Morningstar rolls out new ratings system

News and notes (U.S.)

Hedge funds returned 0.4% in October, according to HFR: Hedge funds in positive territory in October, says HFR

How technology can help hedge funds manage their operating expenses: Technology can act as a growth enabler to help hedge funds cope with increased margin pressures

U.S. PE funds’ capital raising reaches record high: Private equity fundraising in the US hits all-time high

Private equity investment model shifting: The shifting nature of private equity

Fidelity launches new funds: Fidelity rolls out four thematic funds

The SEC is looking to make changes to its advertising rule: SEC issues plan to modernize RIA ad rules

News and notes (Canada)

iA announces fund and ETF launches: iA Clarington launches new fund, adds ETF versions of existing funds

CI acquires asset management firm: CI Financial acquires WisdomTree’s Canadian business

Tracking cannabis stocks: Pot indexes to launch this month

ETFs in Canada saw inflows of $3.5 billion in October: Canadian equities ETFs had a ‘stellar’ October

On the pulse – New frontiers in fintech

Improving data security measures: 3 steps banks & credit unions should take as data privacy gets hotter

How active managers can benefit from machine learning: Can machine learning help active managers outperform passive peers?

How fintech will help the “underbanked”: The ‘underbanked’ is the next trillion-dollar opportunity in fintech

Looking at what’s in store for the fintech industry: The future of fintech

Employees must also accept digital transformation: Digital transformation will flop if you don’t also transform staff

Charles Schwab is looking to eliminate forms: Schwab’s plan to kill forms and expand integrations

Selling through messaging platforms: The convergence of messaging apps and payments

Canadian banks take interest in Mylo: Canadian banks invest in spare change app Mylo

What a single digital currency could mean for the finance industry: How worldwide digital currency adoption could change the finance sector

A look at Canadians’ awareness of bitcoin: Bitcoin awareness no guarantee of ownership, finds BOC

High-net-worth topics

The high-net-worth need to protect against debt too: Why ultra-high-net-worth clients need a financial cushion

The total wealth of billionaires fell in 2018: Billionaire wealth declines in 2018

Polls & surveys – What financials are saying

Expect weaker investment returns in the future (JP Morgan): Weak global growth ahead, J.P. Morgan says

Businesses looking to Canada for expansion (HSBC): Foreign businesses eyeing Canada for expansion: report

U.S. advisors are bullish on the industry (Schwab): Advisors are (mostly) upbeat about the future: Schwab

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 4, 2019

VCs may benefit from investing in more women- and multicultural-led companies. Top 10 trends that will impact family offices. A look at how the digital economy is changing real estate. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held its central interest rate at 1.75%: Bank of Canada holds rates, warns economy will be ‘tested’

The Fed lowered its central interest rate: Fed cuts rates by quarter point while hinting at a policy pause

The U.S. economy grew 1.9% in the third quarter: US GDP rose a better-than-expected 1.9% in the third quarter as consumers continued to spend

Is there an opportunity in alternative fixed income?: Alternative fixed income seen as market opportunity

Competition in the ETF space is fierce: Cutthroat competition has come in the ETF industry

A look at how the digital economy is changing real estate: How the digital economy is reshaping real estate

Global ETF assets rose 2.52% over the third quarter: Global ETF assets extend lead over hedge fund industry to USD2.54 trillion at the end of Q3 2019, says ETFGI

News and notes (U.S.)

It was a tough month for hedge funds, according to Eurekahedge: Hedge funds lag, lose clients in September despite lower fees

Newer hedge funds outperforming their more established counterparts: These hedge funds do better

CFOs’ pay at private companies growing: A look at CEO vs. CFO compensation at late-stage private companies

VCs may benefit from investing in more women- and multicultural-led companies: Morgan Stanley: VCs neglect women and minorities, and it’s hurting returns

Looking to simplify limited partnership agreements: Private equity contracts are expensive and complex. This group wants to change that.

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 29 edition

Why investing in a 401(k) is so important: This is the biggest retirement mistake Americans are afraid of

News and notes (Canada)

3iQ gets approval for Bitcoin investment fund: OSC approves Bitcoin investment fund

CIBC launches three fixed income pools: CIBC launches fixed income pools

TD introduces MyTD: TD announces AI-driven advice service

AIMA looks at alternative investment market in Canada: AIMA publishes handbook on Canada’s alternative investment landscape

ICE launches platform to improve standardization and efficiency in an ETF primary market: New platform aims to boost ETF growth

Canadian DB plans advanced 1.6% in the third quarter: Canadian DB plans post 1.6 per cent median return in third quarter: survey

On the pulse – New frontiers in fintech

Combining humans with digital to help customers: Best customer experience in banking blends digital with human touch

How financial services companies can benefit from AI: Unleashing AI’s potential in financial services

Improving conversational AI: Overcoming the barriers to conversational AI

How deep learning can reach its potential: Deep learning is overtaking classic machine learning methods, study finds

FSRA joins the Global Financial Innovations Network: FSRA steps into global sandbox

Looking for a European digital currency: German banks calls for digital euro

Developing policy for crypto assets: IIROC launches crypto advisory group

The International Investment Funds Association (IIFA) releases Cybersecurity Program Basics: IFIC unveils updated cybersecurity guide

CI partners with d1g1t Inc.: CI Financial partners with fintech firm

High-net-worth topics

Top 10 trends that will impact family offices: Family office insights: 10 trends that will affect family offices in 2020

The wealthy are looking for safety in cash: Wealthiest investors are holding more cash says UBS

Polls & surveys – What financials are saying

North American investor confidence fell in October (State Street): Geopolitical turmoil dents investor confidence, State Street says

Interest in responsible investing rising (RIA): Canadians want more support on responsible investing

Even high income earners are struggling financially (TD): Earning power doesn’t necessarily equate to better financial health, survey finds

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 21, 2019

Digital-only banks succeeding through a robust customer experience. ESG adoption by institutional investors may be slowing. Venture capital mega-deals continue to grow. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate was 1.9% in September: Canadian inflation holds steady at 1.9%, core measures inch up

China’s economic growth slowed in the third quarter: China says its economy grew 6% in the third quarter, slower than expected

Retail sales in the U.S. declined: U.S. retail sales dip 0.3% in September

The end of the 60/40 portfolio?: Bank of America says 60-40 portfolios are dead. They’re right

Show a bit of pessimism towards a trade deal: Morgan Stanley tells stock bulls not to kid themselves on trade

The IMF predicts weaker economic growth in 2019: Global conflicts could lead to weakest growth since 2008: IMF

News and notes (U.S.)

The Eurekahedge Hedge Fund Index declined 0.30% in September: Hedge funds down 0.30 per cent in September

A look at hedge funds’ favourite research firms: The research hedge funds want to pay for

Why private markets will continue to flourish: The company of the future is private

How debt financing companies are attracting businesses: How debt financing is adapting to compete with equity financing

VC mega-deals continue to grow: 2019 on pace for another $100B invested as VC exit value tops $200B for the first time [datagraphic]

A look at how much the U.S. green economy is worth: America’s ‘green economy’ is now worth $1.3 trillion

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 15 edition

News and notes (Canada)

Waypoint launches liquid alternatives fund: Liquid alternatives: The Waypoint All Weather Liquid Alternative Mutual Fund

Desjardins launches ETF portfolios: Desjardins adds ETF portfolios to its roster

National Bank launches the NBI Unconstrained Fixed Income ETF: National Bank launches fixed-income ETF

Canaccord Genuity expands into Australia: Canaccord Genuity to acquire Australian firm for $23.3 million

Canadian M&A activity down in the third quarter: Mergers and acquisitions slow in third quarter: report

Michael Lee-Chin discusses the challenges impacting advisors: Adapt or become irrelevant, Lee-Chin warns advisors

On the pulse – New frontiers in fintech

Using technology to focus on consumer engagement: Digitizing banking is all about engagement and CX, not ‘tech’

Digital-only banks succeeding through a robust customer experience: Look to your customers for the key to banking success

Searching for innovative new technology: Where do incumbents look for game-changing innovation?

Canadians’ use of fintech on the rise: More Canadians using fintech, in spite of privacy concerns

The majority of U.K. financial institutions are using machine learning technology: Machine learning advancing in financial sector – Bank of England

Emerging challenger banks can be found all around the globe: Some challengers really are challenging … but not where you’re looking

Appealing to wealthier millennials: How upscale millennials’ money views impact their banking habits

How to keep up with regulatory change: How to approach modern regulatory change management in financial services

NatWest piloting a fingerprint credit card: Technology-based banking products launched

A look at what technologies are impacting advisors most: 10 female leaders share top tech trends that’ll change your practice

High-net-worth topics

Millennials’ wealth is expected to grow: There are more than 600,000 millennial millionaires in the US, according to report

What a wealth tax could mean for the high-net-worth: Explaining a wealth tax to clients

Polls & surveys – What financials are saying

Preparing portfolios for an economic slowdown (Aviva): Proceed with caution on asset allocation: report

ESG adoption by institutional investors may be slowing (RBC): Survey finds ESG adoption tapering off among institutional investors

There may not be a global recession until 2021 (HSBC): Global recession unlikely until 2021: HSBC

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Tuesday afternoon briefing – October 15, 2019

Hedge funds are moving away from oil. More companies raising private money. U.S. venture capital slowed in the third quarter. And much more in this week’s briefing.

Economic/industry news

U.S. inflation rate steady in September: US consumer prices were unchanged in September, the weakest reading since January

The Canadian unemployment rate fell in September: Canada’s job market produces another surprise gain in September

Progress was made on a U.S.-China trade deal: U.S., China reach partial trade deal, boosting market back near-record highs

The Fed will buy short-term T-bills: Fed to buy Treasury bills in effort to control lending rates

Interest in money markets rising: Investors are flocking to money markets at the highest rate since the financial crisis

A look at EBITDA for private companies: Why EBITDA is just BS

More companies raising private money: The changing landscape of public and private equity investing

New indexes to track megatrends: MSCI launches megatrends indexes

News and notes (U.S.)

Hedge fund industry returns declined 0.11% in September: Hedge funds see two consecutive months of negative returns, says eVestment

Hedge funds moving away from oil: Column: Hedge funds turn bearish on oil as economy slows

Add-ons a growing portion of U.S. PE buyouts: This year could set another record for US PE add-on activity

Retirement portfolios can benefit from private equity: Private equity a must for retirement portfolios, Panel Argues

A new asset class?: The hot new alternative investment: Lego?

Stephen Schwarzman comments on job loss study: Stephen Schwarzman on the key ‘flaw’ in the private equity job loss study

U.S. venture capital slowed in the third quarter: Venture Capital – Unicorn blood on the street

Fidelity offers free trading: Fidelity joins price war with zero commissions

News and notes (Canada)

The impact of fund-of-funds on the ETF industry: How fund-of-funds could be puffing up Canada’s ETF industry

VC investment in Canada continues to rise: Canadian VC investment hits record in Q3

Advisors satisfied with their brokerages: Where the industry is succeeding, and falling short

A look back at Canada’s first year of legalized marijuana: The good, the bad and the ugly from Canada’s first year of legal pot

On the pulse – New frontiers in fintech

A look at what’s ahead for fintech: What’s next for fintech growth?

Customers are concerned about using voice-assisted technology for bank transactions: Insurers and banks face battle to overcome security fears over voice-assisted tech

Consolidation in fintech expected to continue: More fintech consolidation expected after Broadridge’s Fi360 purchase

How to improve onboarding: Two ways to quickly elevate your financial institution’s onboarding

Companies start abandoning the Libra project: Facebook’s Libra loses Mastercard, Visa in cascade of exits

An in-depth look at the term “challenger”: What does the term ‘challenger’ really mean?

Digital asset firms must comply with AML rules: Digital assets face anti-money laundering rules too

Another bitcoin ETF rejection: SEC rejects Bitwise Bitcoin ETF

RBC looking to help address climate change: RBC backs AI-based climate change research

High-net-worth topics

The high-net-worth are looking to protect their wealth: Long-term planning can help allay Canadian investors’ concerns for the future

A look at how the high-net-worth are investing: Tiger 21 Founder addresses macroeconomic concerns for high-net-worth investors on CNBC Europe

Polls & surveys – What financials are saying

Many investors see a recession ahead for the U.S. economy (E-Trade): Bearish investors say US economy has peaked: E-Trade survey

Canadians are looking for retirement help (HOOPP): 80% of Canadians would take pension over salary hike: Poll

Those working with an advisor feel more prepared for a recession (CFP): Advisors instill confidence in face of recession

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 7, 2019

A look at hedge funds’ approaches to Brexit. The benefits and challenges of moving to the cloud. How AI will change the job market. And much more in this week’s briefing.

Economic/industry news

The U.S. unemployment rate hit a 50-year low: September unemployment rate falls to 3.5%, a 50-year low, as payrolls rise by 136,000

The Canadian economy was flat in July: StatsCan says economy flat in July as oil and gas sector down

More tariffs placed on Europe: U.S. to slap tariffs on European planes, whiskey after WTO ruling

How markets could be affected by an impeachment: What impeachment could mean for U.S. markets

Why now could be the time for alternatives: Is the tide turning for alternatives?

The benefits of investing in farmland: A look at the diversification benefits of farmland investing for pension funds

News and notes (U.S.)

Hedge fund launches rose in the second quarter: Number of new hedge fund launches up for second consecutive quarter

A look at hedge funds’ approaches to Brexit: How the hedge funds are really playing Brexit

Interest in private assets is high and will continue to grow: The unstoppable allure of private assets

A look at the PE middle market during the second quarter: 7 charts illustrating the US PE middle market in 2Q

Vanguard looking to enter the currency trading market: Vanguard to challenge banks’ grip on $6 trillion currency market

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 1 edition

The SEC is looking to modernize ETF regulations: The SEC says it’s making ETFs more accessible – here’s what that could mean for investors

More firms move to commission-free trading: TD Ameritrade announces zero commissions in tit-for-tat move

News and notes (Canada)

Purpose to incorporate ESG across all strategies: Purpose announces full ESG integration

National Bank launches green bond: National Bank issues sustainability bond

Canadian pension solvency fell to 98.6% in the third quarter: Canadian DB pension solvency declined in third quarter: surveys

CSA looking to improve its client-focused reforms: CSA introduces revised version of client-focused reforms

Responsible investing important to Canadian institutional investors: Canadian institutional investment pros say RI is important

On the pulse – New frontiers in fintech

A look at some fintech trends you may not already know about: Three overlooked trends in fintech

How to build a personalized experience: Secrets to building one-to-one digital experiences

How AI will change the job market: Artificial intelligence driving the next generation of jobs in the UK

Helping companies trade globally: Banks join forces on digital platform to help firms trade globally

Improving the branch experience: Interactive tech drives bank’s new experiential branch

The benefits and challenges of moving to the cloud: Interview with Bloomberg’s CIO: What’s driving financial services to the cloud?

A look at some examples of industry convergence: Industry convergence: Going beyond business boundaries

Robinhood adding well-known content to its app: Stock trading app Robinhood revamps its newsfeed with the Wall Street Journal and ad-free videos

The cost of fighting climate change: Americans fear climate change and the cost of fighting it

High-net-worth topics

Initiating the wealth transfer discussion between the high-net-worth and their children: How a UBS exec gets families to open up about wealth transfer

Goldman looking to attract the high-net-worth in Europe: Goldman is taking another stab at serving Europe’s rich

High-net-worth millennials believe they may need to work past retirement age: Survey: Many affluent millennials don’t think they can retire by 65

Polls & surveys – What financials are saying

Only 4% of CEO positions are held by women (CSA): Women gain share of board seats but not executive roles

Many Americans are concerned about their finances (NAPFA): Americans in need of some good financial advice: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 30, 2019

People want more ESG transparency by companies. Fintech firms facing challenges finding good talent. The high-net-worth are raising cash levels. Can a passive player enter the PE space? And much more in this week’s briefing.

Economic/industry news

U.S. GDP growth confirmed at 2.0%: Second-quarter U.S. GDP left at 2%, slower economic growth seen persisting

Signs may point to an economic slowdown: Is the end of economic expansion near?

People want more ESG transparency by companies: Pressure piling on for companies to provide ESG disclosure

The trade war is the biggest threat to global economic growth: Lagarde says trade main global growth risk, recession unlikely

Why asset managers need to consider alternative investments: Asset managers must adapt to democratization of alternatives

A look at how much should be allocated to alternative investments: Here’s how much financial advisors should invest in alternatives to make a difference

Is there a future for non-transparent ETFs?: Non-transparent ETFs … a glimpse into the future?

News and notes (U.S.)

Global hedge funds experienced redemptions in August: Investors have pulled $63 billion from hedge funds this year – but these strategies are raking in cash

Many hedge funds are negotiating their management fees: Almost 39 per cent of hedge fund managers willing to negotiate management fees, says report

Can a passive player enter the PE space?: Why private equity is ripe for Vanguard-style disruption

The PE space will continue to expand: Research suggests there’s no stopping the private-equity train

Transitioning from Washington to PE: Politicians continue push into PE

Participation rate in retirement plans on the rise: Retirement Plan Sponsors report record 83% participation rate

Morningstar concerned about public availability of private investments in retirement plans: Don’t relax private investment regs for retirement funds: Morningstar

News and notes (Canada)

Fidelity launches five fixed income ETFs: Fidelity rolls out five fixed income ETFs on TSX

Evolve launches the Evolve Dividend Preferred Share Index ETF: Evolve launches preferred share ETF

Wealthsimple acquires SimpleTax: Wealthsimple expands into tax software with SimpleTax acquisition

What title regulation will mean for Ontario financial advisors: What to expect as title regulation extends to Ontario

Mutual fund and ETF assets rose in August: ETF sales eclipse mutual funds in August, IFIC reports

Canadian asset managers must innovate in a challenging environment: Asset managers must innovate: KPMG

On the pulse – New frontiers in fintech

Visa launches Visa Partner, looking to help fintech firms: Visa opens resource portal for fintechs

Banks must blend the old with the new to thrive: Where banking-fintech partnerships fall short

Developing products your consumers want most: How to build banking products consumers will love

Regtech spending to increase substantially in next five years: Regtech spending to reach $127 billion by 2024, as AI drives cost savings

HSBC introduces system to detect financial crimes: HSBC introduces industry leading financial crime detection systems

Combatting deepfakes: Can AI and blockchain be used in fight against deepfake?

Fintech firms facing challenges finding good talent: UK fintech sector faces talent shortfall

Increasing the use of blockchain: Can blockchain become more accessible?

High-net-worth topics

The top 1% in Canada saw their effective tax rates decline: Tax rates down, incomes up for the 1%

The high-net-worth are raising cash levels: Wealthy families are preparing for a downturn

The high-net-worth should have a plan to handle requests for money: How wealthy people handle requests to give away their money

Polls & surveys – What financials are saying

Investors in mutual funds and ETFs are confident in these products (IFIC): IFIC survey shows strong satisfaction with advisors, fund products

Supersavers are willing to make sacrifices to save more (Principal): These 5 money habits put young workers on track for retirement

Investors interested in sustainable investing, but don’t do it (Schroder): Investors talk the talk, don’t walk the walk, on sustainability

Why people engage with a financial advisor (Merrill Lynch): Top 5 reasons clients turn to a financial advisor: Merrill

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 16, 2019

Is there a major flaw with internal rate of return? The increasing use of alternative data. The top traits exhibited by leading advisors. And much more in this week’s briefing.

Economic/industry news

The U.S. inflation rate fell to 1.7% in August: Cheaper gas puts a cap on consumer prices in August, but inflation appears to be rising, CPI shows

The ECB lowered its central interest rate to -0.50%: ECB cuts key rate for first time since 2016 as recession fears grow

OPEC should be closely monitoring demand, along with supply: Where does OPEC+ go from here?

Could there be changes to the U.S. capital gains tax?: Trump to revisit capital gains tax cut in White House Meeting

Will value investing bounce back?: Value investing’s heady days aren’t coming back, study says

Fixed income continues to attract significant ETF flows: Global ETF flows continue to favour fixed income in August: ETFGI

News and notes (U.S.)

A look at the hedge fund industry in August: State of the industry – August, 2019

The Eurekahedge Hedge Fund Index rose 0.31% in August: Hedge fund managers up 0.31 per cent in August

The increasing use of alternative data: Hedge funds plan to pour more money into alternative data

PE drawdown rates are still slow: Despite an active PE industry, drawdown rates have remained slow since 2012

Dry powder continues to rise: Alternative investment managers still building up dry powder

Is there a major flaw with internal rate of return?: The faulty metric at the center of private equity’s value proposition

Bitcoin ETFs could still be a bit away: SEC’s Clayton still troubled by potential manipulation of bitcoin prices

Directors and senior officers are selling shares: Insiders at US firms are selling shares at fastest pace since 2007

News and notes (Canada)

RBC launches five U.S. single-factor ETFs: RBC iShares expands lineup of factor ETFs

Stone Asset Management launches PTF: Stone Asset Management announces platform-traded fund

Why family businesses are important for the Canadian economy: Canada’s economy dependent on family businesses: report

Canadian pension assets grew 5% in the first quarter: Pension assets surged in Q1, StatsCan says

The Canada Pension Plan is opening an office in San Francisco: CPPIB opening San Francisco office, hiring head of VC funds

Canada’s first Pay Equity Commissioner announced: Canada now has a federal pay equity commissioner

On the pulse – New frontiers in fintech

Why banks should embrace and partner with fintech: Fintech and banks: collaboration or competition?

Using AI to fuel deposit growth: How banks and credit unions can grow deposits with AI

AI should complement the human process: Where the AI rubber hits the banking road

The need to enable open banking in Canada: Feds must act on open banking, senators say

How banks can attract Millennials: What millennials want from banks & credit unions

Small investment firms have cybersecurity deficiencies: Small firms less prepared for cyber risks: report

Morningstar launches Goal Bridge: Morningstar launches new goal-based advisor software

JPMorgan Chase helping small businesses with cash flow: JPMorgan Chase introduces same-day deposits for merchants

Issuing bonds through blockchain: Santander launches the first end-to-end blockchain bond

High-net-worth topics

The high-net-worth should stay invested in U.S. equities, according to Goldman: Goldman manager tells rich clients to put American stocks first

Canadian high-net-worth are focused on preserving their wealth: Canada’s wealthiest shifting focus toward future-proofing

TD launches new alternative fund for high-net-worth clients: TD Asset Management adds alternative fund

Polls & surveys – What financials are saying

60% of investors believe board diversity is important (ISS): Most investors support climate disclosure, board diversity, ISS finds

Expect slower growth for Canadians’ wealth (Investor Economics): Canadians’ wealth declines for first time since 2008

The top traits exhibited by leading advisors (Nationwide): 4 things successful advisors do differently: Nationwide

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 9, 2019

Helping smaller clients with their financial planning needs. Private equity firms are taking an interest in physician practices. Four phases of a successful digital transformation. It’s time to listen to the lesser known managers. And much more in this week’s briefing.

Economic/industry news

The BoC held its central interest rate steady at 1.75%: Bank of Canada balks at joining global rate-cutting trend

The Canadian unemployment rate was unchanged at 5.7% in August: Canada sees jobs surge in August with 81K new positions

The U.S. unemployment rate was 3.7% in August: U.S. creates just 130,000 news jobs in August, keeping Fed on track to cut rates

Manufacturing states suffering from trade uncertainty: Trump’s trade war inflicts pain on manufacturing states

What happens if the global consumer stops spending?: Trade-war damage piles weight of global economy onto consumers

Assets under management fell for the world’s largest pension funds in 2018: World’s largest pension funds’ AUM decreased in 2018

Fund costs will impact Morningstar’s analyst ratings: How Morningstar’s new ratings reality will affect funds, ETFs

BlackRock’s outlook for the Canadian economy in the fourth quarter: Outlook for final quarter of 2019

News and notes (U.S.)

Time to listen to the lesser known managers: With Sohn Conference bets, pay attention to the no-name managers

PE firms are taking an interest in physician practices: Why are PE firms hot for physician practices?

How the biggest VCs are investing: Breaking down early- and late-stage deals for the top 20 US VC investors (datagraphic)

Why 401(k) sponsors must understand mutual fund fee structures: Fiduciary responsibility and mutual fund fees

ACI to launch five active ETFs: American Century to launch five active equity ETFs under new Avantis banner

Investing in an NBA team: NBA considers vehicle to bring new investors to soaring team values

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: September 3 edition

News and notes (Canada)

Dynamic launches the Dynamic Credit Absolute Return II Fund: Dynamic Funds launches fourth liquid alternative offering

Waratah launches the Waratah Alternative Equity Income Fund: Waratah Capital launches liquid alternative mutual fund

FP Portfolios launches new ETF: Firm launches ETF alternative to structured products

Canadian ETF assets rose to $186 billion in August: Canadian ETF inflows hit $2.7B in August

Banking leaders are set to adapt to the changing financial landscape: Big bank CEOs talk lower rates, living in ‘unprecedented times’

First-time homebuyers believe new incentive plan may be helpful: First-time homebuyers optimistic about new government incentive: poll

On the pulse – New frontiers in fintech

A look at how fintech is changing the financial services industry: 5 ways fintech is reshaping the financial services industry

Three best practices to help banks become leaders in personalization: How banks and credit unions can take the lead in personalization

Four phases of a successful digital transformation: We just haven’t got a clue what to do!

How AI can help back-office functions: The future of finance is powered by artificial intelligence

Understanding the ethics of AI: Filtering the ethics of AI

A look at five industries being transformed by AI: AI predictions: how AI is transforming five key industries

Helping smaller clients with their financial planning needs: Bringing financial planning to the masses

Plans for a crypto fund-of-funds for institutional investors: Hedge fund manager plans $1bn crypto fund

High-net-worth topics

The high-net-worth are looking for more than just strong investment performance: For HNW clients, digital convenience is no substitute for a personal connection

Managing the high-net-worth’s digital wealth: What you need to know about managing clients’ digital wealth

Polls & surveys – What financials are saying

Canadian productivity hurt by financial stress (Canadian Payroll Association): 43% of Canadians say financial stress is hurting work productivity: Study

Institutional investors not yet fully adopting ESG (CoreData): Institutional investors yet to fully embrace ESG, says new research

Client expectations are the top challenge for wealth and asset management firms (RBC): Client demands overtake regulation as the top challenge for firms

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – August 19, 2019

First vegan ETF set for launch. U.S. household debt hits its highest level ever. Teens prefer fintech to manage their money. Plus much more news in this week’s briefing.

Economic/industry news

The U.S. inflation rate rose to 1.8% in July: Higher gasoline prices, rent boost cost of living in July, CPI shows, but inflation still mild

The U.K. economy contracted in the second quarter: UK economy shrinks for first time since 2012. Brexit could tip into recession

The U.K. unemployment rate rose to 3.9% in June: UK unemployment rate on the rise as fears grow ‘glory years over’

Understanding the 2020 version of GIPS: GIPS 2020: Everything you need to know

Why faith-based investors can benefit from impact investing: GIIN: Why impact investing is a natural fit for faith-based investors

Reconsidering the target-date glide path: Building better target-date fund glide paths

Bond markets still show signs of risk in the global economy: Equities on ‘borrowed time’ as recession signal nears inversion

News and notes (U.S.)

A look at the hedge fund industry in July: State of the industry – July, 2019

The Eurekahedge Hedge Fund Index returned 0.69% in July: Hedge fund managers recorded another positive month in July following strong H1 performance

SEC looking to make changes to alternatives regulation: Opportunities ahead as SEC pushes to modernize alternatives regulation

BlackRock finds first investment for long-term PE strategy: BlackRock begins PE foray with $875M bet on Sports Illustrated backer

A look at the most consistent top performers in the PE space: These private equity managers are the most consistent top performers

CBS and Viacom have agreed to merge: CBS, Viacom enter streaming wars with $30B combination

The first-ever vegan ETF to be launched: World’s first vegan ETF launches next month

U.S. household debt is at its highest level ever: Household debt sets new record: New York Fed

News and notes (Canada)

RBC launches three new ETF portfolios: RBC iShares expands lineup of portfolio ETFs

Invesco introduces investment portfolios: Invesco launches new suite of investment portfolios

CI launches asset allocation ETF: CI launches global asset allocation fund

Will the yield curve inversion force the BoC to lower its central interest rate?: Can BoC ignore blaring yield-curve inversion alarm?

OSC branch sees rise in enforcement referrals: Sales practices, suitability remain concerns for OSC

Canadian ETF assets rose to $183.7 billion in July: Canadian ETF assets continue to advance

On the pulse – New frontiers in fintech

Fintech is moving across many sectors of the economy: How fintech is eating the world

The importance of getting digital banking right: Make digital banking both seamless and secure or consumers will walk

Teens using technology to manage money: Fintech gains favor among teens

Successful automation will require quality data: Reliable data identified as key to successful automation

Securities lending through the use of machine learning: Northern Trust applies machine learning to securities lending

A look at the best fintech startups in Europe: The best fintech startups in Europe

A look at some business uses for blockchain technology: Five blockchain use cases: from property to sustainability

How the insurance industry can adapt to the future: How can the insurance industry face its challenges?

Another delay to the decision on a Bitcoin ETF: Bitcoin ETF decision delayed by SEC again

High-net-worth topics

Wealthsimple partners with Grayhawk to access the high-net-worth market: Wealthsimple announces partnership, looks to attract high-net-worth investors

How to transfer wealth: The art of transitioning wealth

Polls & surveys – What financials are saying

Asset managers believe a recession is on the horizon (Bank of America): Recession fears spike to 2011 high as risk of bubbles spreads

Generation Z may need some guidance on managing money (Northwestern Mutual): Gen Zers lack clarity on how to handle money, study says

Caring for elders is putting financial strain on Canadians (Angus Reid): Canadian caregivers worry about financial burden

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – August 12, 2019

The top fintech trends for 2020 that you need to know. Taking a long-term view of the hedge fund industry. Geopolitics will hurt some emerging markets countries. And much more in this week’s briefing.

Economic/industry news

Canada’s unemployment rate rose to 5.7% in July: Canada loses over 24,000 jobs in July, but wage growth reaches highest level since 2009

The U.K. economy contracted in the second quarter: Recession fears grow as UK economy shrinks on back of Brexit chaos

Chinese exports rose in July: China exports rise despite simmering US trade row

Could the U.S. consumer be the biggest loser in the trade dispute?: The real cost of Trump’s trade wars

Avoiding firms that pose climate risks: Big money starts to dump stocks that pose climate risks