Monday morning briefing: 25 years of value vs. growth

Value versus growth over the past 25 years. Private debt fundraising down in 2019. Working on an approach to DSC. And much more in this week’s briefing.

Economic/industry news

Canadian GDP grew 1.3% in third quarter: Canada’s economy slows in third quarter even as demand jumps

Europe continues to favour active management: McKinsey: Where active management survives

There’s still a place for value investing: Has value investing stopped working?

Why small-cap stocks may be set to soar: Small may turn mighty as strategists see Russell strength ahead

M&A deals in financial services was US$57 billion in the third quarter: Financial sector M&A jumps in Q3, GlobalData

Why private equity can help a portfolio during a market downturn: Worried about a downturn? Consider private equity

Investors concerned about interest rates: Global investors cite interest rates as key portfolio risk: survey

Current market conditions may require a unique approach to active management: Revisiting active management and asset allocation

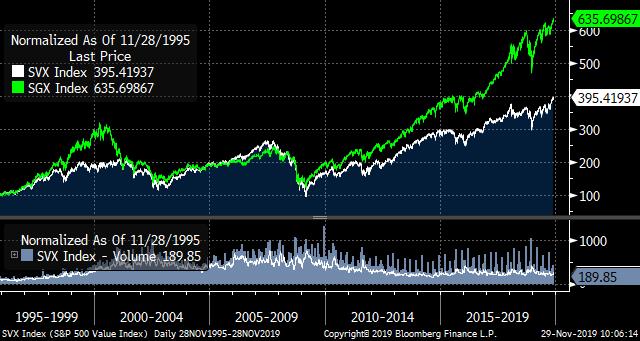

Chart of the week

Let’s look at value versus growth stocks on the S&P 500 Index since 1995. Toward the end of the 1990s and early 2000s, growth stocks surged higher in response to the dot-com bubble. After moving in lockstep until the 2008 financial crisis, growth stocks began outpacing value stocks. Is value investing in trouble or is it primed for a comeback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The Volcker Rule’s impact on hedge funds: The great hedge fund retreat

Private debt fundraising down in 2019: Against expectations, private debt fundraising saw a decline in 2019

The risks of unitranches: A booming corner of private credit has some investors on edge

Why it’s important to invest across vintages: In private equity, vintage diversification matters

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 26 edition

New rules proposed to make it easier for leveraged funds to come to market: SEC proposes new rule to ease the market entry of leveraged funds

Charles Schwab to purchase TD Ameritrade: Schwab to acquire TD Ameritrade in US$26-billion deal

Looking to allow private companies to raise money through a direct listing: NYSE proposes big change to direct listings

News and notes (Canada)

TD launches 10 new ETFs: TD Asset Management introduces new ETFs

CI takes stake in U.S. RIA firm: CI Financial buys US advisory firm

Canadian ETF assets rose to $192.3 billion in October: ETF sales rebound, mutual fund sales hold steady in October

Working on an approach to DSC: OSC decision on DSCs to come – eventually

Here are the winners from the Women in Wealth Management awards: Women in Wealth Management award winners revealed

IIROC provides updated guidance on AML requirements: IIROC steps up AML guidance

On the pulse – New frontiers in fintech

The importance of customer engagement: Reinventing retail banking customer experience in a digital world

How the entry of Big Techs into banking may impact fintech companies: Should ‘fintech’ fear big tech’s push into banking?

Customers are demanding a better digital experience: Banks losing customers who want seamless digital experiences

Why data science skills will be crucial for businesses to thrive: Analytics skills essential for business survival in ‘data decade’

The importance of IT infrastructure in developing AI capabilities: Big data LDN: Why you need to modernize your IT infrastructure for AI

Data analysis will be the focus in 2020: Why data will change the game again in 2020

Ant Financial looking to invest in the payments space: Ant Financial preps $1bn investment fund

New platform for independent advisors: Pascal Financial launches wealth management platform for advisors

High-net-worth topics

The wealthy want quality information from their advisor: What ultra high net worth clients want from wealth managers

The money habits of the rich: 5 things rich people do with their money

Polls & surveys – What financials are saying

During a recession, people want help from advisors (MDRT): Clients want you to help them through a recession: MDRT survey

Where are the female portfolio managers? (Goldman Sachs): Investment management is still a boys’ club: Goldman

Canadians are looking to eliminate debt (Manulife): Canadians agree they have too much debt

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 18, 2019

Private equity looking at the financial advisory industry. Government and companies must work together to combat cyber risks. Asset allocation among alternative investments is changing. And much more in this week’s briefing.

Economic/industry news

U.S. inflation rate rose in October: U.S. consumer prices rise most in 7 months on higher gas prices

Economic growth in Japan stalled: Japan’s economic growth slumps to 1-year low in third quarter as trade war bites

The U.K. unemployment rate declined in September: U.K. unemployment falls while wages slow in September

VC funding had another strong quarter: Global VC funding remains strong in Q3

A look at the top research firms: The top research firm in the world is…

How to navigate through a market of lower expected returns: Navigating a slow growth market environment

Understanding the new economy: Understanding the 21st century economy

News and notes (U.S.)

A look at the hedge fund industry in October: State of the industry: October 2019

According to SS&C, hedge funds returned 1.15% in October: SS&C GlobeOp Hedge Fund Performance Index up 1.15 per cent in October

Private equity looking at the financial advisory industry: Private equity investors are zeroing in on financial advice business

JPMorgan invests in Limeglass: JPMorgan invests in financial research startup Limeglass

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 12 edition

News and notes (Canada)

iA Clarington goes fossil-fuel free in Inhance SRI funds: iA Clarington ensures certain funds are fossil-fuel free

A look at liquidity levels across Canadian funds: Currency & sector liquidity analysis report: Q3 2019

Lower mortgage rates helping housing affordability: Housing affordability improves thanks to lower rates, higher incomes

Looking for safety: The safest bet in Canada is also one of the hottest ETF trades

Taking a flexible approach to title reform: What’s next for title reform in Ontario

On the pulse – New frontiers in fintech

Security a concern for digital-only banking: More consumers will leave banks if digital offerings don’t improve

Why banks and big tech partnerships may work: Big banks and big tech (not versus)

A chequing account from Google: Google to offer checking accounts in partnership with banks starting next year

Customer experience should be at the forefront to combat disruptors: How to thrive in financial services in the age of digital disruption

How to better help small businesses: Big changes ahead for small business banking

A look at possible trends in the financial services industry over the next 10 years: Financial services in the 2020s: From open banking to open finance

Government and companies must work together to combat cyber risks: Bank of Canada urges public-private co-operation on cybersecurity

The data curation challenge: The challenge of data curation

Bringing cryptocurrency payment services to Swiss businesses: Bitcoin Suisse and Worldline to offer crypto payments acceptance in Switzerland

The CME will offer bitcoin options in the new year: Bitcoin options coming to the CME

High-net-worth topics

The wealthy are moving to cash: Geopolitics clouding the outlook for wealthy investors, UBS finds

Wealthy investors making direct investments in private firms: Wealthy families using 600-year-old plan to disrupt PE

How advisors can build trust with the high-net-worth: How to get wealthy people to trust you

Polls & surveys – What financials are saying

Institutional investors have an eye on China (Invesco): 80% of institutional investors planning to raise allocations to China: survey

Asset allocation among alternative investments is changing (EY): Investors are taking money out of hedge funds and putting in private equity

Canadians need help managing investments in retirement (Mackenzie): Value of advice more important as Canadians near retirement: study

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 4, 2019

VCs may benefit from investing in more women- and multicultural-led companies. Top 10 trends that will impact family offices. A look at how the digital economy is changing real estate. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held its central interest rate at 1.75%: Bank of Canada holds rates, warns economy will be ‘tested’

The Fed lowered its central interest rate: Fed cuts rates by quarter point while hinting at a policy pause

The U.S. economy grew 1.9% in the third quarter: US GDP rose a better-than-expected 1.9% in the third quarter as consumers continued to spend

Is there an opportunity in alternative fixed income?: Alternative fixed income seen as market opportunity

Competition in the ETF space is fierce: Cutthroat competition has come in the ETF industry

A look at how the digital economy is changing real estate: How the digital economy is reshaping real estate

Global ETF assets rose 2.52% over the third quarter: Global ETF assets extend lead over hedge fund industry to USD2.54 trillion at the end of Q3 2019, says ETFGI

News and notes (U.S.)

It was a tough month for hedge funds, according to Eurekahedge: Hedge funds lag, lose clients in September despite lower fees

Newer hedge funds outperforming their more established counterparts: These hedge funds do better

CFOs’ pay at private companies growing: A look at CEO vs. CFO compensation at late-stage private companies

VCs may benefit from investing in more women- and multicultural-led companies: Morgan Stanley: VCs neglect women and minorities, and it’s hurting returns

Looking to simplify limited partnership agreements: Private equity contracts are expensive and complex. This group wants to change that.

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 29 edition

Why investing in a 401(k) is so important: This is the biggest retirement mistake Americans are afraid of

News and notes (Canada)

3iQ gets approval for Bitcoin investment fund: OSC approves Bitcoin investment fund

CIBC launches three fixed income pools: CIBC launches fixed income pools

TD introduces MyTD: TD announces AI-driven advice service

AIMA looks at alternative investment market in Canada: AIMA publishes handbook on Canada’s alternative investment landscape

ICE launches platform to improve standardization and efficiency in an ETF primary market: New platform aims to boost ETF growth

Canadian DB plans advanced 1.6% in the third quarter: Canadian DB plans post 1.6 per cent median return in third quarter: survey

On the pulse – New frontiers in fintech

Combining humans with digital to help customers: Best customer experience in banking blends digital with human touch

How financial services companies can benefit from AI: Unleashing AI’s potential in financial services

Improving conversational AI: Overcoming the barriers to conversational AI

How deep learning can reach its potential: Deep learning is overtaking classic machine learning methods, study finds

FSRA joins the Global Financial Innovations Network: FSRA steps into global sandbox

Looking for a European digital currency: German banks calls for digital euro

Developing policy for crypto assets: IIROC launches crypto advisory group

The International Investment Funds Association (IIFA) releases Cybersecurity Program Basics: IFIC unveils updated cybersecurity guide

CI partners with d1g1t Inc.: CI Financial partners with fintech firm

High-net-worth topics

Top 10 trends that will impact family offices: Family office insights: 10 trends that will affect family offices in 2020

The wealthy are looking for safety in cash: Wealthiest investors are holding more cash says UBS

Polls & surveys – What financials are saying

North American investor confidence fell in October (State Street): Geopolitical turmoil dents investor confidence, State Street says

Interest in responsible investing rising (RIA): Canadians want more support on responsible investing

Even high income earners are struggling financially (TD): Earning power doesn’t necessarily equate to better financial health, survey finds

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 23, 2019

A bitcoin yield fund for the high-net-worth. Private equity and venture capital outperforming public equities. Why international co-operation is needed to combat cybercrime. And much more in this week’s briefing.

Economic/industry news

The Fed reduced its central interest rate: Fed lowers interest rate by a quarter-point, and is open to the idea of more easing

Canadian inflation rate was 1.9% in August: Canadian inflation slows to 1.9% on lower gas, vegetable prices

The BoE held its Bank Rate steady at 0.75%: Bank of England holds rates, warns another Brexit delay could hurt economic growth

The BoJ kept its key interest rate at -0.10%: BOJ keeps policy steady, signals chance of easing in October

A look at how liquidity affects an ETF’s trading costs: Why liquidity matters in ETF cost minimization

Does the value of benchmark data justify the cost?: Fund managers seek more insight from benchmark data

News and notes (U.S.)

Hedge fund net exposure at highest level since 2018: Goldman: Hedge fund exposure to stock market at 15-month high

A conversation with Josh Harris on private markets: Apollo’s Josh Harris talks private markets at delivering alpha

PE and VC outperforming public equities: Private equity outperforms and captures institutional flows

Private equity net cash flow was over US$150 billion in 2018: Eight years in the black for private equity cash flows

Vanguard to launch Digital Advisor: Vanguard preparing to offer digital-only robo-advisor

Rockefeller Capital eyes Silicon Valley: Rockefeller Capital buys wealth firm for Silicon Valley rich

The Fed took action in money markets for first time in a decade: Fed intervenes in money markets for first time in 10 years

Looking for more customized target-date funds: Interest rising in active/passive hybrid strategies for TDFs

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: September 17 edition

News and notes (Canada)

Horizons launches the Horizons Growth TRI ETF Portfolio: Horizons ETFs expands lineup of portfolio ETFs

CI Investments launches ESG funds: CI introduces debut ESG funds

Combining mutual funds and ETFs could be beneficial: Mutual funds and ETFs in harmony

Canada ranks “below average” in fund costs, according to Morningstar: Canada rates poorly in Morningstar survey of mutual fund costs

Foreign investors moving out of Canadian securities: Foreign investors continue to divest Canadian securities

On the pulse – New frontiers in fintech

Five fintech trends to watch in 2020: Five trends shaping fintech into 2020

How to navigate through customers’ fear of open banking: Open banking scares customers, but they want what APIs can deliver

A look at Canadians’ comfort with AI: How Canadians feel about AI in financial services

We’re in the early innings of AI’s impact on the financial services industry: The beginning of the road for AI in finance, the best is yet to come

Building a branch as an advice centre: Transforming branches into advice centers: The long road ahead

How technology is impacting capital markets: Buyers’ brief: Fintech drives capital markets

Why international co-operation is needed to combat cybercrime: Cyber-crime best tackled by international co-operation

Arab Bank launches custody and brokerage services for digital assets: Leading Swiss private bank launches full suite of digital asset services

High-net-worth topics

Family offices incorporating ESG principles: Wealthy families pour fortunes into $31 trillion ESG opportunity

A bitcoin yield fund for the high-net-worth: Wealth manager launches world-first bitcoin yield fund

Polls & surveys – What financials are saying

38% of fund managers expect a recession over the next year (Bank of America Merrill Lynch): Recession fears among fund managers rise to highest level in a decade

Immigration wage gap impacting Canada’s economy (RBC): Immigrant wage gap costing Canada $50 billion a year in GDP: RBC study

Millennials are starting to save early (E*Trade): Young investors are doin’ it for the ‘Gram

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 9, 2019

Helping smaller clients with their financial planning needs. Private equity firms are taking an interest in physician practices. Four phases of a successful digital transformation. It’s time to listen to the lesser known managers. And much more in this week’s briefing.

Economic/industry news

The BoC held its central interest rate steady at 1.75%: Bank of Canada balks at joining global rate-cutting trend

The Canadian unemployment rate was unchanged at 5.7% in August: Canada sees jobs surge in August with 81K new positions

The U.S. unemployment rate was 3.7% in August: U.S. creates just 130,000 news jobs in August, keeping Fed on track to cut rates

Manufacturing states suffering from trade uncertainty: Trump’s trade war inflicts pain on manufacturing states

What happens if the global consumer stops spending?: Trade-war damage piles weight of global economy onto consumers

Assets under management fell for the world’s largest pension funds in 2018: World’s largest pension funds’ AUM decreased in 2018

Fund costs will impact Morningstar’s analyst ratings: How Morningstar’s new ratings reality will affect funds, ETFs

BlackRock’s outlook for the Canadian economy in the fourth quarter: Outlook for final quarter of 2019

News and notes (U.S.)

Time to listen to the lesser known managers: With Sohn Conference bets, pay attention to the no-name managers

PE firms are taking an interest in physician practices: Why are PE firms hot for physician practices?

How the biggest VCs are investing: Breaking down early- and late-stage deals for the top 20 US VC investors (datagraphic)

Why 401(k) sponsors must understand mutual fund fee structures: Fiduciary responsibility and mutual fund fees

ACI to launch five active ETFs: American Century to launch five active equity ETFs under new Avantis banner

Investing in an NBA team: NBA considers vehicle to bring new investors to soaring team values

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: September 3 edition

News and notes (Canada)

Dynamic launches the Dynamic Credit Absolute Return II Fund: Dynamic Funds launches fourth liquid alternative offering

Waratah launches the Waratah Alternative Equity Income Fund: Waratah Capital launches liquid alternative mutual fund

FP Portfolios launches new ETF: Firm launches ETF alternative to structured products

Canadian ETF assets rose to $186 billion in August: Canadian ETF inflows hit $2.7B in August

Banking leaders are set to adapt to the changing financial landscape: Big bank CEOs talk lower rates, living in ‘unprecedented times’

First-time homebuyers believe new incentive plan may be helpful: First-time homebuyers optimistic about new government incentive: poll

On the pulse – New frontiers in fintech

A look at how fintech is changing the financial services industry: 5 ways fintech is reshaping the financial services industry

Three best practices to help banks become leaders in personalization: How banks and credit unions can take the lead in personalization

Four phases of a successful digital transformation: We just haven’t got a clue what to do!

How AI can help back-office functions: The future of finance is powered by artificial intelligence

Understanding the ethics of AI: Filtering the ethics of AI

A look at five industries being transformed by AI: AI predictions: how AI is transforming five key industries

Helping smaller clients with their financial planning needs: Bringing financial planning to the masses

Plans for a crypto fund-of-funds for institutional investors: Hedge fund manager plans $1bn crypto fund

High-net-worth topics

The high-net-worth are looking for more than just strong investment performance: For HNW clients, digital convenience is no substitute for a personal connection

Managing the high-net-worth’s digital wealth: What you need to know about managing clients’ digital wealth

Polls & surveys – What financials are saying

Canadian productivity hurt by financial stress (Canadian Payroll Association): 43% of Canadians say financial stress is hurting work productivity: Study

Institutional investors not yet fully adopting ESG (CoreData): Institutional investors yet to fully embrace ESG, says new research

Client expectations are the top challenge for wealth and asset management firms (RBC): Client demands overtake regulation as the top challenge for firms

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Top ESG trends in 2019, and beyond

The popularity of investment products managed through an environmental, social and governance (ESG) lens continues to grow. And the ESG space is evolving to fit the needs of increasingly diverse investors – both retail and institutional.

The biggest change we’ve seen in the past few years is the growing recognition that the ESG investment approach isn’t going away and that the old tropes about weaker performance have been proven incorrect.

Although predictions about the direction of ESG abound, there are a few core themes about the future of this space that we’ve identified during our work with investment professionals across North America.

Brand and governance beats financials

According to an Ocean Tomo study, approximately 83% of a company’s share price on the S&P 500 Index in 1975 was based on tangible assets, meaning things like past earnings results, real estate and equipment. This meant that a company’s reputation didn’t matter nearly as much to its stock price as its last quarter’s earnings results.

In 2015, a full 84% of a company’s valuation was based on intangible assets, meaning things like brand, intellectual property, goodwill and reputation. And this number has continued to rise since 2015. What this tells us is that, today, it’s more important to maintain a strong reputation and brand, and to be viewed in a positive light, than to simply have a solid quarter.

Why does this matter in the context of ESG trends? Because ESG screens – particularly those that focus on governance – are specifically designed to improve performance by screening out companies that are at higher levels of reputational risk for any number of reasons.

Increasing access to information

The top trend in the ESG space is access to – and reliance on – different data sources for ESG research and investment direction.

In the past, investment managers usually had access to one or two sources of ESG research/information that they would base their investment decisions on. Today, many investment managers pull information from multiple leading sources including Bloomberg, Dow Jones, Morningstar and MSCI, which all offer different, but meaningful, ESG insights based on largely unique methodologies.

This additional information is being leveraged by many of the largest asset managers around the world as they build out their ESG-related product shelf and service offering.

With more information comes more regulations

Although there’s an increasing amount of information available in the ESG space, not all of it is created equal.

Given the amount of money flowing into this space, guidelines as to how information is gathered and distributed have been driving providers of this information to follow stricter parameters. Regulators want to ensure the information being provided comes as advertised based on an agreed-upon framework.

Transparency isn’t just a good idea

Investors no longer blindly assume company management will always make the right decisions to drive their company’s valuation higher. Weak governance has repeatedly been shown to detract from share prices.

As stock prices continue to be driven less by financials and more by intangibles like brand and governance, investors are demanding corporate leadership avoid decisions that negatively impact their investments’ longer-term performance.

Company leadership is taking notice of this demand, with c-suite executives and board members being replaced faster when missteps occur. Diversity is also continuing to grow in company management, as this is what is widely expected by investors today.

These are just a few changes unfolding in the ESG space. We’re seeing many other trends as well, including better marketing and evolving sales opportunities, and we’d be happy to discuss them with you.

If you’d like to learn more about the trends driving ESG growth (and how you can benefit from those trends), contact us today at 1.844.243.1830 or info@ext-marketing.com.

U.S. regulatory trends – 2019 and beyond

Are financial services regulatory issues exciting? Not always. Are they important? Absolutely.

We’re living in an era of heightened legal scrutiny – as well as heightened scrutiny in the court of public opinion. As a result, financial services firms and marketers must track regulatory changes and prepare for the consequences of these changes.

It is turning into a busy year for U.S. financial services regulators. Here are a few themes that we’re tracking:

Cybersecurity a serious threat to human civilization

Cyber threats are a serious issue to all businesses, especially those in the financial services industry. Staying ahead of these threats is an important issue in 2019 and will continue to be for many years to come.

As firms try their best to stay ahead of the criminals, regulatory bodies must provide supportive, thoughtful and measured leadership to firms in the financial services industry.

Currently, various legislative bodies are looking to introduce new cybersecurity and privacy laws. Meanwhile, regulators are exploring ways to help their firms protect against cyber threats and maintain proper disclosure requirements should an attack occur.

Fiduciary rule is dead, long live the best interest rule

In the U.S., the Department of Labor’s Fiduciary Rule appears to have come to an end. After numerous delays, the Fiduciary Rule proposal was finally abolished in 2018.

Eliminating conflict of interest issues remains a priority. As a result, some state regulators, as well as the U.S. Securities and Exchange Commission (“SEC”) and Financial Industry Regulatory Authority (“FINRA”), have created their own proposals that are similar, in theory, to the Fiduciary Duty, in an effort to eliminate or reduce conflicts of interest. The SEC has also come forward with a proposed best interest rule. This will continue to be an important topic for regulators until an acceptable resolution is found.

Tales from the cryptocurrency

Will we see cryptocurrency and, more specifically, bitcoin go mainstream?

The SEC declined bitcoin exchange-traded funds in 2018, given the risk of market manipulation and liquidity issues that accompany these investment options. Will the SEC’s stance change in 2019? Various regulators within the U.S. are looking to standardize cryptocurrencies, which could help them become more mainstream.

There are many unknowns that remain regarding cryptocurrencies, and regulators will try to stay on top of these potential pitfalls by developing regulations for cryptocurrencies as they transition into a new asset class. Regardless, regulators’ focus will continue to be protecting investors and financial markets.

Overall, 2019 is turning into a busy year for U.S. regulators as the financial services industry continues to evolve.

Regulatory changes have a direct impact on your marketing efforts in both the short and long terms. We can help you stay on top of all these changes. Contact us today at 1.844.243.1830 or info@ext-marketing.com to learn more.

Monday morning briefing – March 11, 2019

What client on-boarding will look like in the future. The global banking sector has the most exposure to cyber risks. Private equity mandates in emerging markets raised US$90 billion in 2018. And much more in this week’s briefing. Enjoy!

Economic/industry news

International Economic Data Snapshot – includes aggregated data of the worldwide economy: Snapshot: International economic data

The U.S. unemployment rate fell to 3.8% in February: Job creation grinds to a near-halt in February; wages still on the rise

The Canadian unemployment rate was 5.8% in February: Canada’s economy gains 55,900 jobs, beating expectations

The BoC held its central interest rate steady at 1.75%: Bank of Canada waters down rate conviction amid growth slowdown

The ECB held its central interest rate steady: ECB pushes back rate hike, announces new stimulus to revive growth

Tariffs are imposing great costs on American businesses and consumers: Evidence grows that Trump’s trade wars are hitting U.S. economy

The S&P 500 Index bottomed on March 9, 2009. Where does the market stand now?: 10 years after the market hit bottom, where are we now?

Different strategies for ethical investing: How to invest ethically

It’s time to look at the opportunities, not just the risks, from energy transition: Lessons in measuring carbon risk and opportunities in public equities

What Millennials are looking for in a financial advisory firm: Successful millennials want real advice

Why alternative investments should be included in all portfolios: Why alternative investments have a place in your portfolio

The world’s best banks: The world’s best banks: ING and Citibank lead the way

News and notes (U.S.)

JP Morgan’s “2019 Guide to Alternatives”: J.P. Morgan releases 2019 Guide to Alternatives

The market cycle of PE buyouts is quick: Downturn opportunities don’t last long in the world of PE buyouts

Hiring increasing at private capital firms: Private capital firms are beefing up their fundraising teams

How PE can benefit from the qualified opportunity fund: Private equity and the opportunity zone gold rush: Who will seize the opportunity?

PE mandates in emerging markets raised $90 billion in 2018: Private capital fundraising in emerging markets hits record levels in 2018

Interest in PE continues: Blackstone nears $20 billion for flagship buyout fund

Goldman Sachs launches ETFs tracking indices created by Motif: Goldman Sachs and Motif launch 5 ETFs focused on innovation

U.S. individual investors’ allocation to equities increased in February:Asset allocation survey: Equities rebound in February

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: March 5 edition

A look at target-date funds’ performance over the past 10 years: Target-date funds: The grades are in

Vanguard announces its upcoming launch of the Global ESG Select Stock Fund: Vanguard plans its first actively managed ESG mutual fund

Apex bolsters its U.S. expansion: Apex acquires Atlantic Fund Services

Coin will allow investors to invest in one or multiple causes: John Hancock startup opens impact investing to the masses

News and notes (Canada)

IA Clarington launches liquid alternative fund: IA Clarington launches liquid alt, international equity funds

Desjardins launches two ETFs with responsible investing mandates: Desjardins launches two RI ETFs

Canadian ETFs experienced $1.3 billion in net inflows in February: In Canada, 23 ETFs launched in February

Empire Life launches tool to help plan participants track their retirement goals: Empire Life launching retirement and savings tool

IFIC and BEworks provide suggestions on how to improve client statements:How to improve CRM2 statements

Could we see a slowdown in Canadian dividend growth in 2019?: Canadian dividend growth will slow this year

On the pulse – New frontiers in fintech

The global banking sector has the most exposure to cyber risks: Banking is most exposed sector to cyber risks: Moody’s

Regulatory sandboxes are great for innovation, but there are some limitations: Sandboxes offer key to fintech innovation

Financial services firms have steps to take towards their digital transformation: Financial-services firms falling behind in tech transformation

Customer data vital to the success of digital transformation: Power of customer insights will separate digital banking winners & losers

The adoption of open banking has been limited: Open banking – build it and they will come?

How fintech is helping people meet their financial goals: The effect of fintech on wealth management

Ant Financial launches tool to help financial services firms with their digital challenges: Ant Financial launches core banking product

What client on-boarding will look like in the future: The future of client onboarding for financial institutions

Start with tech, then the financial side: Are banks customer focused?

Tech firms engaged in blockchain development projects: Big tech’s blockchain projects haven’t disrupted banks – yet

One-third of Canadians used a robo-advisor to open or fund an RRSP: Robo advisor RRSP stats a ‘wake-up call’ to firms

High-net-worth topics

The high-net-worth should increase their exposure to private placements: Cambridge Associates: HNW investors should have 40 percent in private placements

Here is where the ultra-high-net-worth live: The top 10 cities where the mega rich live

Stock market volatility hurt U.S. household wealth in the fourth quarter: U.S. household wealth slumped in fourth quarter amid stocks rout

Polls & surveys – What financials are saying

Canadian businesses may be missing an opportunity to increase revenue through global trade (RBC): Despite opportunity, Canadian businesses see barriers to global trade: RBC poll

More than half of Millennials use or are willing to try using a robo-advisor (Angus Reid): Millennials more likely to try robo-advice, says Angus Reid

Financial assets held by women expected to rise (CIBC): Canadian women to control nearly $4 trillion by 2028

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Upcoming macroeconomic events – February/March 2019

Do you write or edit portfolio manager commentaries? Do you want to stay on top of the macroeconomic events that shape your day-to-day life as a financial services marketer?

Knowing what’s happening and why it matters is important. To help you stay on track, here are the big macro events the ext. team is keeping an eye on over the coming weeks.

- On February 27, Canada’s inflation rate for January will be announced. The inflation rate rose from 1.7% to 2.0% in December, led higher by a rise in the price of food and air transportation. Inflation has slowed recently primarily as a result of the pullback in oil prices, easing some of the inflationary pressures building within the Canadian economy

- Canada will announce its fourth quarter gross domestic product (“GDP”) growth rate on March 1. The Canadian economy grew 2.0% annualized in the third quarter, a slowdown from the second quarter. Consumer spending and real estate, both susceptible to the impact of higher interest rates, experienced weakness during the third quarter. These factors and the prolonged slump in oil prices could weigh heavily on fourth quarter results

- Also on March 1, the final reading of the U.S. Manufacturing Purchasing Managers’ Index (“PMI”) for February will be announced. Following a decline from mid-2018, PMI rose from 53.8 to 54.9 in January. This increase was driven by higher new orders and robust manufacturing production levels, while employment also expanded. PMI will be closely watched to get an early reading on the health of the U.S. economy

- The Bank of Canada’s (“BoC”) interest rate decision will be announced on March 6. The BoC held its benchmark overnight interest rate steady at 1.75% at its most recent meeting in January, and is expected to do the same again in March. Global economic conditions appear to be weakening, while domestically, lower oil prices, a decline in business spending and slower inflation may be enough to keep the BoC from raising rates

- China will announce its exports, imports and balance of trade for February on March 8. China’s trade surplus widened in December. A decline in exports was offset by a significant drop in imports. Trade disruptions with the U.S. are having an impact on Chinese exports. Given the recent slowdown in this export-driven economy, this is sure to be a closely watched measure to gauge the impact from the trade dispute with the U.S.

- On March 12, the U.S. inflation rate for February will be announced. U.S. inflation fell from 2.2% to 1.9% in December. U.S. inflation has not been immune from the effects of lower energy prices, as inflation fell over the fourth quarter of 2018. While the U.S. Federal Reserve Board (“Fed”) is closely monitoring inflation, especially the pullback in recent months, the Fed’s outlook for inflation over the long-term remains intact

For investment commentary support (including monthly and quarterly commentaries, as well as MRFPs), contact us today at 1.844.243.1830 or info@ext-marketing.com.

10 books to add to your mid-winter reading list

Saying we’re avid readers would be an understatement. That’s why, when the cold sets in, we grab a good book or two. Here’s a list of 10 books recommended by the ext. team:

The Fifth Risk by Michael Lewis

From the publisher: “Michael Lewis’s brilliant narrative takes us into the engine rooms of a government under attack by its own leaders.”

The Amazing Adventures of Kavalier & Clay by Michael Chabon

From the publisher: “A young escape artist and budding magician named Joe Kavalier arrives on the doorstep of his cousin, Sammy Clay. While the long shadow of Hitler falls across Europe, America is happily in thrall to the Golden Age of comic books.”

The Little Book of Common Sense Investing by John C. Bogle

From the publisher: “The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds.”

The Clockwork Dynasty by Daniel H. Wilson

From the publisher: “When a young anthropologist specializing in ancient technology uncovers a terrible secret concealed in the workings of a three-hundred-year-old mechanical doll, she is thrown into a hidden world that lurks just under the surface of our own.”

Antifragile by Nassim Nicholas Taleb

From the publisher: “Just as human bones get stronger when subjected to stress and tension, and rumors or riots intensify when someone tries to repress them, many things in life benefit from stress, disorder, volatility, and turmoil.”

Washington Black by Esi Edugyan

From the publisher: “From the blistering cane fields of Barbados to the icy plains of the Canadian Arctic, from the mud-drowned streets of London to the eerie deserts of Morocco, Washington Black teems with all the strangeness of life.”

Co-Opetition by Adam M. Brandenburger

From the publisher: “Intel, Nintendo, American Express, NutraSweet, American Airlines, and dozens of other companies have been using the strategies of co-opetition to change the game of business to their benefit.”

Mason & Dixon by Thomas Pynchon

From the publisher: “We follow the mismatched pair – one rollicking, the other depressive; one Gothic, the other pre-Romantic – from their first journey together to the Cape of Good Hope, to pre-Revolutionary America and back.”

How to Change Your Mind by Michael Pollan

From the publisher: “A unique and elegant blend of science, memoir, travel writing, history, and medicine, How to Change Your Mind is a triumph of participatory journalism.”

I Heard You Paint Houses by Charles Brandt

From the publisher: “”I heard you paint houses” are he first words Jimmy Hoffa ever spoke to Frank ‘the Irishman’ Sheeran.”

What are you planning on reading this year? Let us know!

Contact us at 1.844.243.1830 or info@ext-marketing.com to discuss your financial marketing and investment commentary needs.

Upcoming macroeconomic events – January/February 2019

Do you write or edit portfolio manager commentaries? Do you want to stay on top of the macroeconomic events that shape your day-to-day life as a financial services marketer?

If so, here are the big macro events that the ext. team is keeping an eye on over the coming weeks.

- Canada’s inflation rate for December will be announced on January 18. Inflation in Canada declined to 1.7% in November, from 2.4% in October. The decline was primarily the result of the fall in gasoline prices caused by lower oil prices. The Bank of Canada (“BoC”) expects the impact on inflation from lower oil prices to linger for most of 2019

- The European Central Bank (“ECB”) will announce its interest rate decision on January 24. The ECB concluded its asset purchase program at the end of 2018, thus removing some stimulus from the European economy. The ECB felt that strong consumer spending and rising inflation could withstand the negative effects from tightening conditions. The ECB expects to hold its benchmark refinancing rate steady until at least the fall of 2019

- The United States’ fourth quarter advanced gross domestic product (“GDP”) growth rate will be announced on January 30. U.S. GDP grew 3.4% (annualized) in the third quarter, down from 4.2% in the second quarter. This advanced figure will give an indication as to the performance of the U.S. economy, which faced a number of headwinds including trade tensions with China and higher interest rates

- Also on January 30, the U.S. Federal Reserve Board (“Fed”) will announce its interest rate decision. At its final meeting of 2018 held in December, the Fed raised its federal funds target range to 2.25% to 2.50%. However, the committee lowered its forecast on the number of rate increases expected in 2019. The Fed is expected to hold rates steady at this meeting, but investors will no doubt scrutinize the meeting notes to try to anticipate the timing of the next interest rate increase

- The Bank of England’s (“BoE”) interest rate decision will be announced on February 7. The BoE maintained its Bank Rate at 0.75% at its last meeting in December. While the BoE is looking to gradually increase its interest rate, uncertainty around a Brexit deal weighs heavily on its decision. Additionally, inflation has pulled back in recent months and may drop further given the significant decline in oil prices

- Canada’s unemployment rate for January will be announced on February 8. The labour market ended the year strong as jobs were added in both November and December, with the unemployment rate falling to 5.6%

For investment commentary support (including monthly and quarterly commentaries, as well as MRFPs), contact us today at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 26. 2018

The names you need to know in fintech. Activist investors in Europe keying in on the U.K. industrials sector. Why states around the world should consider issuing cryptocurrencies supported by their central bank. And much more in this week’s briefing.

Economic/industry news

International Economic Data Snapshot – includes aggregated data of the worldwide economy: Snapshot: International economic data

Canada’s inflation rate rises again:Canada inflation ticks up, central bank seen keeping rates steady

Japan’s economy contracts in the third quarter: Japan GDP: Natural disasters hit economic growth

Could there be changes to the BoC’s mandate to keep prices stable?: Bank of Canada plans thorough review of inflation targeting

Protecting your portfolio against the next recession: The next recession is coming: Here’s how to protect your portfolio

A look at the currency market: How currency differs from other asset classes

Canadian ETF assets fell in October: Canadian ETF assets lower in October

The number of distinct indexes rose by 12% in 2018: Number of indexes on the rise, led by fixed income: report

Sir Ronald Cohen on the importance and outlook for impact investing: Impact investing: A multitrillion-dollar market in the making

Businesses should focus on the new, “circular economy”: ING Portfolio focuses on financing for sustainable economy

On the pulse – New frontiers in fintech

Fully transitioning to digital is much more than just a mobile app: Are you really ‘doing digital’?

Customer centricity vital for the banks of the future: It pays to be personalised

How to manage your cloud infrastructure: Managing cloud infrastructure post-migration – a CTO guide

The names you need to know in fintech: Fintech finance’s power players

Technology could help private bankers become more productive: Making private bankers more productive

Open banking not well known or understood by end consumers: Open banking slow burn means just 22% of consumers have heard of the concept

Starling Bank launches Client Money Accounts, helping professional practices that hold money on behalf of their clients: Starling Bank launches CASS-compliant accounts helping firms manage third-party funds

Regtech will be an important component for the future success of financial institutions: Saxo Bank on why regtech is key to scalability in financial services

How to be innovative in the insurance industry: How to become an innovator in insurtech

Capital One purchases WikiBuy: Capital One buys online shopping comparison startup

Many firms don’t believe that they are resilient enough to combat cyberattacks: Cyber security implementation: firms want it, but less do it, finds survey

BitSpread launches BitSpread Financial Solutions, designed for investing in blockchain assets: BitSpread launches new financial solutions division

Why states around the world should consider issuing cryptocurrencies supported by their central bank: IMF: Nations need to consider a central bank backed cryptocurrency

Cryptocurrencies may not be banned in India: A ray of hope for cryptocurrencies as India readies draft regulations

News and notes (U.S.)

The Barclay CTA Index fell in October: Barclay CTA Index loses 1.29 per cent in October

Hedge fund assets fell to $3.06 trillion in September: Hedge funds redemptions surge to $39.1 billion in September, highest in more than 5 years

Management expenses no longer a tax break for hedge fund investors: Hedge fund investors lose key tax break for management expenses

Activist investors in Europe keying in on the U.K. industrials sector: Industrials are No1 target sector for activist investors in Europe

Secondaries still generating a lot of interest: Why secondaries fundraising is surging

Morgan Stanley launches new advisory platform, WealthDesk: Morgan Stanley unveils new advisory platform

AllianceBernstein to purchase Autonomous Research: AllianceBernstein announces offer to acquire Autonomous Research

Further trade tensions between the U.S. and China could hurt the stock market: Expect more stock market losses if US-China trade war worsens

Long-term funds experienced $29.1 billion of outflows in October: Morningstar: Passive equity funds gain, actives lose big

An interview with Abigail Johnson and Kathleen Murphy of Fidelity: The most powerful woman in fund management gives a rare interview

High-net-worth topics

High-net-worth investors expect further equity market declines: The equity party’s ending, say wealthy investors

How Tiger 21 helps the ultra-rich: Tiger 21 philosophy: Learn from your (very wealthy) peers

Life insurance can help reduce estate taxes, but not eliminate taxes entirely: Can HNW clients still use life insurance as a tax and financial tool?

Polls & surveys – What financials are saying

Canadian investors have trouble understanding the concept of risk and return (Natixis): Investors may have an unrealistic understanding of risk and return: survey

Over the next 25 years, $68 trillion of wealth will be passed on to younger generations (Cerulli): Generational wealth transfer to hit $68 trillion over 25 years: Cerulli

Correlating share value with ESG ratings (MSCI): Are ESG ratings the new credit rating for stock prices?

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Liquid alternatives: challenges and opportunities for the financial services industry

Liquid alternatives – hedge fund strategies delivered to retail investors in a mutual fund or ETF – are coming to Canada. And they’re going to be disruptive.

By opening up a whole new asset class to retail investors, mutual fund managers and alternative investment managers are going to face plenty of challenges and opportunities. Liquid alternatives will be good for the industry and investors, but investment managers must do things right.

The big challenge: understanding

Helping investors and advisors to truly understand liquid alternatives (from the different strategies to the benefits) is a two-step challenge for the industry: there will be confusion about the strategies and they may not be adopted if the benefits aren’t deeply understood.

Liquid alternatives are not simply a new investment solution, they’re not even a new strategy. Rather, they’re a new asset class consisting of a new set of strategies.

It seems likely that liquid alternatives will be labelled “higher risk” and “ideal for more experienced investors.” Neither is 100% accurate.

Liquid alternatives have a wide range of strategies, some of which are less risky than a typical equity mutual fund. Other strategies could benefit less experienced investors if they allocate a smaller percentage of their broadly diversified portfolio to liquid alternatives.

The big opportunity: a new and/or bigger market

Investment managers can provide access to this asset class to every investor, helping them diversify their investments and better manage the risk-return profile of their portfolios.

We expect most of the major mutual fund and alternative investment managers to launch retail-friendly liquid alternative funds and ETFs in the coming years.

Mutual fund managers can expand into the alternative investment space using their brand recognition to help grow the liquid alternatives asset class. At the same time, alternative investment managers can enter the retail investment space using their experience and expertise as a key value proposition.

But offering liquid alternatives is not just about increasing assets under management. Investment managers can better engage their clients and prospects by taking an educational approach. This approach will help investment managers strengthen their brand because they will be providing value … not just products.

Given liquid alternatives is a relatively new asset class to many investors in the retail space, educating the retail audience about the language/terms, investment strategies, differentiators, etc. of this asset class will likely be key to widespread understanding and acceptance of liquid alternatives. It will also help position manufacturers that provide this information as leaders in the space.

Ext. is on the front lines of financial services marketing. We can help your firm market new strategies, such as liquid alternatives, to the broad retail and advisor markets in an engaging, educational manner that positions you and your clients for success. Contact us at 1.844.243.1830 or info@ext-marketing.com.

Liquid alternatives are coming. Are you ready?

The financial services industry is no stranger to disruption. Those on the outside may think the industry is slow to respond and driven by the status quo. But those on the inside know that every week brings a dramatic change, and that we’re always adapting to what’s coming next.

Case in point: there are new investment approaches on the horizon for retail investors. They’re called liquid alternatives. They’re different from more traditional mutual funds and exchange-traded funds (ETFs). And we believe they’re going to become very popular, very quickly.

So, what are liquid alternatives? Simply, they’re hedge fund strategies delivered to retail investors in a mutual fund or ETF.

Timelines are vague … but companies are acting

In the past, alternative investments were only available to high-net-worth investors. However, with the Canadian Securities Administrators’, Modernization of Investment Fund Product Regulation – Alternative Funds notice, all retail investors will soon have access to liquid alternatives in their portfolios.

Why such a bold proposal? To give investors more diversification opportunities with an asset class that has historically had little correlation to stocks and bonds.

While there’s no hard date regarding finalization, companies are launching liquid alternative funds and ETFs as we speak. Get ready for a flood of launches.

Liquid alternative strategies

In the U.S., where liquid alternatives have been available to retail investors for a number of years, the big liquid alternatives categories include:

- Equity hedge – buy securities that are expected to increase in value and short sell those expected to decline (a.k.a. long-short strategies)

- Event-driven – seek to capitalize on price inefficiencies that may exist before a corporate event (e.g., M&A activity, bankruptcy or an unexpected announcement during an earnings call)

- Global macro – choose investments based on the overall economic and political situations in various geographic regions

- Relative value – capitalize on the price or rate (if bonds) differences between similar securities, typically taking a long position on the undervalued security and a short position on the overvalued security

- Multi-strategy – allocates assets to different investment strategies for diversification purposes and to lower overall risk

We expect Canada will adopt similar liquid alternative categories as those in the U.S., so be prepared to hear a lot more about this in the near future.

Ext. is on the front lines of financial services marketing. We can help your firm market new strategies, such as liquid alternatives, to the broad retail market in an engaging, educational manner that positions you and your clients for success. Contact us at 1.844.243.1830 or info@ext-marketing.com to learn more.

Technology spending heats up in the financials sector

Many insiders believe the long-term success of financial services firms depends on them becoming technology-driven companies. With the rise of robo-advisors, the inroads made by blockchain and the success of regtech, to name just a few developments, it’s hard to deny the rising dominance of technology in financial services.

If you doubt the scale of change taking place in the financial services industry, check out these numbers. They may change your mind.

Members of the “Big 5” are spending big

- In 2017, The Bank of Nova Scotia spent C$1 billion on technology – 40% of which went to “change-the-bank” projects versus traditional operating expenses in tech. (Source: Financial Post)

- The Royal Bank of Canada spent C$3 billion on tech in 2017 – transformative projects garnered 30% of that spending. (Source: Financial Post)

Insights from the International Data Corporation

- IT spending in general will hit US$2.7 trillion by 2021, with banks, manufacturers and telecommunication services providers among the spending leaders. (Source: Channelnomics)

- Financial services IT spending was estimated at US$480 billion worldwide in 2016 with a five-year compound annual growth rate of 4.2%. (Source: IDC)

- The drive to increase tech spending is partly the result of the expanding investment industry, which is set to grow to approximately US$2.65 trillion by 2020. Financial services, namely banking, insurance, securities and investment services companies, will lead industry spending. (Source: Arnnite)

Focus on fintech

- Fintech spending more than tripled in 2014, reaching over US$12 billion. (Source: PwC)

- Fintech spending in 2017 was estimated to be approximately US$19.9 billion in North America, US$15.3 billion in Europe and US$22.1 billion in Asia. (Source: Statistica)

Is it worth it?

- Not everyone believes this spending is a smart allocation of assets. PwC has reported that financial institutions could be spending up to twice as much as they need to on IT. (Source: PwC)

The technological change unfolding in the financial services industry is unprecedented – and it represents some incredible challenges and opportunities for everyone who works in this space.

Contact us today at 1.844.243.1830 or info@ext-marketing.com for financial marketing and investment commentary help.

Keeping track of the regulations affecting hedge fund managers and institutional investors

Just in case you didn’t already know the investment industry is managing never-before-seen levels of regulations, we wanted to provide you with a list of the regulations affecting investment managers in the hedge fund, private equity and alternative management spaces.

You need to be aware of these regulations, as they will directly impact your chances of attracting capital from institutional investors.

Dodd-Frank Wall Street Reform and Consumer Protection Act

Another law that was passed in light of the financial crisis, this Act’s objective is to protect consumers from potentially harmful financial products, regulate financial markets and limit the likelihood of another financial meltdown. Please note: the Senate recently passed legislation that could eliminate some aspects of Dodd-Frank.

Foreign Account Tax Compliance Act

The Foreign Account Tax Compliance Act (“FATCA”) is looking to eliminate tax evasion by requiring U.S. taxpayers to report financial assets held outside of the U.S.

Alternative Investment Fund Managers Directive (“AIFMD”)

A European Union law enacted following the financial crisis that regulates alternative investment managers, including private equity and hedge funds, and mandating they be authorized with regulators and provide various disclosures to remain in business.

Basel III Proposal (banks)

Formed by the Basel Committee on Banking Supervision, this framework was developed to strengthen the global banking industry by requiring banks to maintain adequate capital levels, liquidity and risk management systems to decrease systemic risk.

Financial Transaction Tax

The Financial Transaction Tax (“FTT”) would seek to tax EU financial transactions, including the sales of stocks, bonds and derivatives, to recoup taxpayer dollars used to support banks during the financial crisis and eliminate speculative transactions that do not support a positive economic well-being.

Institutions for Occupational Retirement Provision II (pension funds)

The Institutions for Occupational Retirement Provision (“IORP”) seeks to protect pension members and establish rules to maintain the quality and sustainability of workplace pensions through disclosure requirements, governance, cross border transfers, etc.

Markets in Financial Instruments Directive II

The Markets in Financial Instruments Directive’s (“MiFID”) objective is to offer investor protection and further the transparency of all EU financial markets by making them more structured as well as mandating easier to observe trading costs, access lower cost data and improved transaction execution.

Find out more about MiFID here: Are you MiFID by regulatory changes?

Undertakings for Collective Investment in Transferable Securities V and VI

Undertakings for Collective Investment in Transferable Securities (“UCITS”) V looks to improve investor protection by enhancing depository duties, fund manager remuneration rules and sanctions for breaches, while giving regulators an adequate level of power to impose those rules. UCITS VI will tackle the use of derivatives, portfolio management techniques, long-term investments and money market funds.

Solvency II (insurance companies)

Solvency II was designed to protect insurance customers throughout the EU by instituting a regulatory framework around financial requirements, reporting and disclosure, as well as governance and supervision for the insurance industry.

To learn more about how we can help you successfully launch and manage your fund in this complex regulatory environment, contact us at 1.844.243.1830 or info@ext-marketing.com.

The rise of robo-advice. And what comes next.

The rise of robo-advisors is moving fast. The automation and algorithms behind it are advancing, all kinds of investors are using it, and more and more firms are launching their own platforms.

Simply put, robo is impacting the entire financial services industry in ways people never imagined.

To help get you oriented with robo’s wild journey so far, here’s a rundown of how it began, where it’s at now and where it will be soon.

Where robo-advice was – Humble beginnings

When the first robo-advisors launched back in 2008, they were generally limited to simple automated tasks, such as rebalancing assets in target-date funds. Because of the so-called lack of personalized service and human connection, many supposed robo’s basic role would continue.

But it would soon make major inroads. By the end of 2015, assets under management for robo-advisor platforms was at US$55-$60 billion.1

The general thinking around the growth of robo, however, was still low key. Many in the industry believed it could only serve the needs of tech-savvy millennials or those with little money to invest. In 2016, a Prudential Financial report found that only 17% of advisors believed robo-advice could help clients meet their financial-planning needs.2

Robo-advisors today – Prospects and adoption growing

Fast forward to now. That Prudential report found the same view among advisors changed dramatically in 2017, with 69% now believing robo-advice could meet financial-planning needs.2

Adoption of robo-advice has also grown considerably, with US$224 billion in AUM as at October 2017.3

“Adoption of robo-advice has also grown considerably, with US$224 billion in AUM as at October 2017.”

The typical profile of robo-advisor investors has changed in interesting ways too. Innovative fintech firms, such as True Link Financial, are even finding success among elderly investors by blending digital advice with over-the-phone service and prepaid debit cards.

What comes next for robo-advice – Beyond automation and ETFs

Looking forward, expectations for growth are high. A Business Insider report projects that robo-advisor AUM will hit US$1 trillion by 2020 and about US$4.6 trillion by 2022. While the North American market is expected to lead the way in the near term, Asia’s robo segment is expected to outperform by 2022.4

Yet, like any vastly growing space with new players hitting the scene, saturation of the market is inevitable. Robo’s strongest features – automated tax management, goals-based advice and exchange-traded fund (ETF) portfolio construction – are becoming basic commodities.

For financial firms to truly differentiate themselves, robo-advisors will have to do more than simply offer lower fees. The next leap forward – which is beginning to take shape among fintech firms – will be artificial intelligence (AI) and machine learning driving a more holistic robo solution that is specifically tailored to investors’ needs.

“The next leap forward – which is beginning to take shape among fintech firms – will be artificial intelligence (AI) and machine learning driving a more holistic robo solution that is specifically tailored to investors’ needs.”

In other words, robo’s future lies beyond automated portfolio management and low-cost ETFs. Making sustainable gains among all age groups, those with greater investable assets and, ultimately, the high-net-worth segment will come down to offering new, proprietary investment solutions that are not only cost-effective but can outperform, too.

For more insights into the future of financial services, contact us at 416.925.1700, 1.844.843.1830 or info@ext-marketing.com.

Sources:

1 Aite Research, Digital Wealth Management Market Update: A Mosaic of Models Emerges, March 2015

2 Prudential Assurance Company, Adviser Barometer report, Embracing opportunities in the adviser market, 2017

3 U.S. News & World Report, 9 Things to Know About Robo Advisors, 2017

4 Business Insider, The Evolution of Robo-Advising Report, 2017

Market outlook 2018

January’s coming to an end and we have just one question: did you read our Market outlook 2018?

If you haven’t yet, check it out here. In it, we cover U.S., European, Canadian and Chinese equity markets and economies. We also look at fixed income markets.

While predicting the future is a fool’s game, we couldn’t resist making a few bold claims along the way. We talk about:

- The next phase of the Canadian housing boom

- The unexpected result of legalizing marijuana

- Is “this time it’s different” the right approach to the U.S. information technology sector?

- Central bank decisions … and indecision

- The European political situation

- Energy and materials sector volatility

- Interest rates, inflation, flights to safety, corporate headwinds and more

Read our Market outlook 2018 today!

Contact us at 416.925.1700, 1.844, 243.1830 or info@ext-marketing.com for financial marketing and investment commentary support.

Read more:

Are you MiFID by regulatory changes?

European and North American investment dealers and asset managers have even more regulatory obligations today.

How come? Markets in Financial Instruments Directive II (“MiFID II”), the largest set of financial reforms to hit the European Union (“EU”) in over a decade, came into force on January 3, 2018. Regulators want MiFID II to accomplish three goals1:

- To govern all aspects of the financial services industry across the 31 EU member states, using a single set of rules

- To ensure financial services firms work in the best interests of their clients

- To greatly expand transparency around investor costs and trading execution

MiFID II’s seismic impact

From 1.4 million paragraphs of legislation, we’ve distilled things down to a few of the most important reforms you should take note of2:

Unbundling of research fees

Broker/dealers must charge separate fees for trading commissions and research. Traditionally both had been bundled under one cost, referred to as “soft dollars”.

Greater real-time pre- and post-trade transparency

Exchanges and firms must release real-time order information, including best bids and offers, trade price, time and volume. The new rules also apply to other markets, like foreign exchange and commodities.

Expanded Over-the-Counter derivatives trading on electronic exchanges

Over the Counter derivatives trading is being pushed from phones to electronic exchanges, where transaction data can be audited for proof of best execution.

Increased measures to protect clients’ best interests

More product information is now required to meet client suitability criteria. Also in place are broader procedures to avoid conflicts of interest.

Aftershocks – MiFID II’s impact on North America

Who is most affected by MiFID II in North America? Global investment dealers and asset managers with global mandates. Here are three areas where we believe there’ll be an impact3:

- Global investment dealers headquartered in North America with European offices may adapt, for the sake of operational efficiency, a company-wide, unbundled research fee model even though soft dollar payments are the norm in North America

- North American asset managers trading European securities will have to decide if the cost of research will be passed onto clients or absorbed into their bottom lines

- North American fixed income dealers who trade in European debt or have European clients will have to spend more on regulatory technology (“regtech”) to comply with the real-time trading rules

Will MiFID II be beneficial in the long run? We think so.

Any regulations that increase market transparency and investor protection are always a good thing in our books, especially if it eliminates the opaque practice of soft dollars. But we believe there will be a transition period as firms grapple with the new rules – and new costs.

To stay on top of regulatory change and regtech, contact us today at 416.925.1700, 1.844.243.1830 or info@ext-marketing.com.

Sources:

3 https://www.investmentexecutive.com/-/mifid-ii-represents-a-challenge-for-canadian-dealers

Read more:

Breaking down blockchain’s progress and potential

Blockchain is certainly entering the conversation more and more. But given how fast fintech news and trends change these days, we understand it may be tough to gauge its true impact or understand what, exactly, has industry experts so excited.

Based on what we’re hearing from our clients, the impact of blockchain will indeed be real and profound. However, it’s important to remember that the current technology is in a nascent stage and not ready for large scale adoption.

Momentum building among key blockchain players

Just about every major bank around the world is testing blockchain. Many are partnering with fintech companies that use blockchain or are investing in start-ups.

A number of global banks – such as Morgan Stanley, UBS and Goldman Sachs – have released research papers on the technology.

Most recently, RBC announced a partnership with JPMorgan and Australia and New Zealand Banking Group to move international payments using a blockchain system. Plus, the Toronto-based Blockchain Research Institute just added 16 new founding members, including Deloitte Canada, the Depository Trust & Clearing Corporation (“DTCC”) and Interac/Acxsys.

“Most recently, RBC announced a partnership with JPMorgan and Australia and New Zealand Banking Group to move international payments using a blockchain system.”

Decentralization driving potential

What, precisely, has all these key players buying in at such a frenetic pace? In a nutshell: decentralization and huge enhancements to the transaction process.

Let’s break this down a little more. Blockchain doesn’t rely on any centralized third parties (like banks or governments) to process and record transactions. It can reconcile transactions nearly instantaneously between two parties, as the data is shared and continually validated through millions of collaborative “processing nodes.”

“Blockchain doesn’t rely on any centralized third parties (like banks or governments) to process and record transactions.”

By cutting out third-party intermediaries and decentralizing the transaction process, it holds the potential for much faster settlement times, lower operating costs, and more secure and accessible financial services.

Decentralization may slow progress

However, blockchain can’t merely be added to existing systems. Its core characteristic – decentralization – may slow its own progress, for now.

The blockchain shared format works with no central location but each network node existing on the blockchain may be subject to different legal requirements. Pinpointing jurisdictions and territoriality issues, then, will impede the regulatory process needed for greater adoption.

“It’s important to remember that blockchain can’t merely be added to existing systems.”

It will take some time to fully understand its benefits and risks, but leading firms won’t sit on the sidelines. Expect the pace of innovation and integration to pick up as blockchain’s future meets today’s financial services.

For more insights into the future of the financial industry, contact us at 416.925.1700, 844.843.1830 or info@ext-marketing.com.

Read more: