How to use testimonials to boost your marketing strategy

If you’ve ever had to search for a new restaurant or book a hotel in a new city, you’ve likely read reviews (also known as testimonials) to make your decision. In the world of financial services marketing, testimonials can be just as powerful in creating a connection with your prospective customers. Studies have shown that 97% of business-to-business customers cited testimonials and peer recommendations as the most reliable type of content,1 while 72% of consumers say positive testimonials and reviews increase their trust in a business.2

Why testimonials work

When a person is faced with an uncertain decision, they naturally look to others for guidance. This “social proof” is rooted in our psychological need for validation from others who have experienced a company’s products and services.

There is a truism when it comes to marketing that says – “show, don’t tell”. You can have the best words to describe your value proposition and how you help your customers. However, there is nothing like having your own customers convey that message through their personal stories and experiences with your company.

If your purpose is to solve customers’ problems or challenges, testimonials show that you understand what they need and demonstrate how your company can help.

How to make sure your testimonials resonate

Be specific and focused

Stay away from generalities and draw on the details (metrics) that bring the reader into the story. Keep the testimonial focused on one problem or challenge and have your customer explain exactly how your company helped.

Use video

An effective testimonial is essentially a compelling narrative about how your company helped a customer. Videos are a great way to deliver that story, especially through social media.

Put a face to the name

Where possible, use a photo of the customer to create authenticity and a stronger connection to their story.

Case studies

Create a longer-form version of a testimonial with a case study, leveraging the context and complexity of the customer’s challenge to build a strong narrative.

Be credible

Avoid the perception of any conflict of interest or the notion that the customer is being compensated for their story. For U.S. investment advisors, be aware of the SEC disclosure requirements for testimonials and endorsements that came into effect in 2021 (the transition period for compliance ends on November 4, 2022).3

Need advice on how to incorporate testimonials into your marketing? Ext. Marketing can help you add this powerful tool to your digital platforms. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

1 Why B2B customer reviews matter as much as consumer reviews. Manya Chylinkski, Momentum, November 5, 2014.

2 How to Use Customer Testimonials to Generate 62% More Revenue From Every Customer, Every Visit, Emily Cullinan, Big Commerce, April 6, 2017.

3 SEC’s New Marketing Rule for Investment Advisers Goes into Effect, Arnold & Porter, May 14, 2021.

How solid are your marketing personas?

Who is this for? Why are we doing this? Are you sure we’re saying the right thing? Those are just three of the many questions you may ask yourself when working on a marketing project. Finding the answers is much easier when you have robust and relevant marketing personas.

What’s a marketing persona?

A marketing persona represents a group of clients with similar profiles, personal goals and client journeys.

Personas are a powerful way of embodying not only demographics (e.g., “our clients tend to be women in their 30s) but also user needs (e.g., “needs to prioritize risk management in their portfolio”). A persona can be viewed as a composite of attitudes, motivations, pain points and goals.

How customer personas add to your marketing strategy

The main benefit of developing personas is that they’ll help you adjust your brand messaging. Well-developed personas are powerful tools that can illuminate how a customer or prospect might interpret your offering. You can focus on marketing your messages and developing products based on those personas.

What to watch out for

Here are some pitfalls to avoid when creating your marketing personas:

- Making the personas too broad: You want them to address your clients’ specific likes, dislikes, goals, pain points, etc.

- Lack of research: You can build strong personas by interviewing a cross-section of your clients and prospects. Remember, it’s important to gather qualitative data to layer onto and complement quantitative data and insights.

- Making assumptions: If you’ve identified a blind spot in your personas, resist the urge to fill it up with something that may or may not be true. For example, if you’re not sure what your persona’s pain points are, don’t invent them, as you might be flavouring your content with incorrect assumptions. Do more research until your personas are truly useful.

The list could go on, but it’s a good start and reveals that building personas takes a bit of work.

Are your personas up to date? This is important. Over the years, your business may grow, expanding into new segments and regions and serving new clients. That’s why your marketing personas should also evolve.

Personas can help you tailor your messaging to optimize your clients’ experience and provide maximum value. As such, they should be essential tools in every marketer’s toolbox.

Need help creating or updating your user personas? Ext. Marketing can help. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Why interns are good for business

How many interns get to work with billion-dollar indirect lenders, multinational banks, and life-altering non-profits, while helping with everything from design, writing, client support and project management? Here at Ext., we love exposing our interns to a diverse range of projects, giving them a chance to infuse their boundless energy and fresh ideas into our client work.

This year we welcomed five accomplished students into our four-month-long Internship Program – and they didn’t disappoint. The 2022 team was our largest contingent and most diverse group of interns yet.

If you’re looking to fuel innovation and raise productivity, consider an internship program at your company.

Before wrapping up their time with us, we asked each intern about their ambitions, and how their experience at Ext. may help shape their future careers.

Tell us a little about yourself and your role at Ext.

Christy Chan

I just finished my undergraduate degree at TMU and now I’m doing my Master of Information degree at the University of Toronto. This summer I worked with Ext.’s Creative Studio as a graphic design intern, helping to generate original design concepts for clients.

Diksha Gattani

I graduated from Seneca College in August of 2021, having studied marketing and project management. During my time at Ext., I interned as a coordinator in the Project Management Office.

Selin Cinemre

I am going into my fourth year at the University of Toronto, Rotman Commerce. I am specializing in marketing and strategy with a minor in economics. I worked with the Ext. Communications department as the marketing, investment and communications intern.

Ella Stoyan

I am going into my fourth year at Queens University, majoring in sociology and minoring in social studies. I have also completed a certificate in law. This summer, I worked for Ext.’s Account Management team.

Matthew Drumonde

I attend Toronto Metropolitan University (TMU) and I am in my third year in the Business Technology Management program. My program brings communications and technology together to help solve business-related problems by analyzing large sets of market data. During my internship, I worked on two projects that involved gathering client and prospect insights.

How did your role at Ext. align with your future goals?

Selin Cinemre

Exposure to financial services marketing and working on many different projects in communications helped me learn about the broad range of essential marketing skills that can be applied to offer the best solutions for clients. It reaffirmed my passion for every aspect of marketing. Furthermore, my biggest gain was the opportunity to test, discover and hone my marketing skills.

Ella Stoyan

The opportunity to be an intern at Ext. gave me the chance to be more visible and vocal, building both my profile and relationships with clients. It allowed me to see what the professional services world is like. Being exposed to clients helped me better understand customer needs and preferences, which is essential for delivering the right product or service.

Diksha Gattani

My goal is to have a career in project management and this internship was a perfect steppingstone. The management pros at Ext. taught me about the various responsibilities tied to this role. I learned that for better execution and client outcomes, sound management of the project cycle is essential.

Matthew Drumonde

My role at Ext. was sales focused, which gave me the opportunity to better understand the company, as well as potential customers we were targeting. I got to see what it takes to sell and how to problem solve through effective communication. Seeing the ins and outs of how a successful business operates has helped me shape my own path.

Christy Chan

As the graphic design intern, I loved brainstorming and coming up with creative concepts for projects. I also got to see the end-to-end design process, from initial client briefs to completion. Ext. included me in client interactions and the exposure helped grow my professional experience.

What was your favourite part about working at Ext.?

Ella Stoyan

The people at Ext. have strong backgrounds in marketing and are eager to teach and impart their knowledge. Being able to shadow everybody and learn about all aspects that go into B2B marketing was very stimulating. Seeing the organizational structure, communication and collaboration that happens between departments was invaluable.

Selin Cinemre

Working directly with the directors and getting that exposure and knowledge from people who have been in the industry for a long time was my favourite part. Receiving support and feedback from my team made me feel very accomplished.

Diksha Gattani

Ext. has the charm and strength of a family. Everyone is very supportive; I had a lot to learn as an intern and all the teams were very helpful and friendly throughout the process.

Christy Chan

I liked working with different departments and getting to know a lot of people. I enjoyed the weekly meetings where I could get creative and hear other people’s insights, while also having fun.

Matthew Drumonde

The whole team is incredibly close-knit. When someone needs support, everyone pitches in to solve the problem at hand and get stuff done. People share the same goals and the genuine desire to help each other grow.

We thank our talented interns for joining us at Ext. for the 2022 Summer Internship Program. You were an amazing cohort. We hope you valued your experience as much as we valued your contributions!

Looking for support with your marketing initiatives? Ext. has the innovative and creative expertise to take your marketing to the next level. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Microcontent: what it is and how it can help your marketing

Microcontent hasn’t really found its legs in the financial services industry. We think that’s going to change.

Microcontent is primarily visual content distributed on media such as a blog, Facebook or LinkedIn to bolster your content efforts and draw your audience’s attention toward a more robust piece of content. These may include in-depth whitepapers, infographics or a new video on your website.

What sets microcontent apart from other types of content? It’s short, “snackable” and relatively cheap to produce.

What’s microcontent?

While this isn’t a complete list, the key types of microcontent include:

- Charts

- Diagrams

- Facts and figures

- GIFs

- Graphics

- Illustrations

- Images

- Quotes

- Tips

What’s best for financial services?

Financial services marketers tend to use charts, graphs and tables in their materials. But these tools are used a lot, and your content may lose its impact among the vast amount of charts, graphs and tables that are already out there.

It’s good to look beyond these forms of microcontent when you can. Some types of microcontent that we think are ideal for the financial services industry include:

- Images are a great way to capture your audience’s attention (think about taking elements from larger, more detailed infographics)

- Quotes are always eye-catching. If you use quotes, don’t forget to use compelling and complementary images or graphic designs to draw more attention to them

- Tips that help people excel at their job and life will always be near the top of the sharable content list

From a production standpoint, the best thing about microcontent is that it’s relatively quick to produce, so you can experiment a little more than you would with lengthier or more costly content. This can be a huge benefit for content teams that are stretched to the limit.

If you want to boost your marketing efforts, this is the perfect time to start producing microcontent. Contact us today at 1.844.243.1830 or info@ext-marketing.com to learn how.

10 reasons why hedge funds need a great pitchbook

Whether you’re an established or emerging manager, a stellar pitchbook summarizes the most compelling reasons to invest in your fund, and forms the foundation of your sales and engagement strategy with stakeholders.

If you’re in the process of launching a fund or looking to revamp your marketing efforts, here are the biggest reasons why you need to create the best-possible pitchbook content and design.

1. Highlights the opportunity

Great pitchbooks clearly define the market areas your fund is focused on, support the opportunity through stats and figures and emphasize why now is the time to invest.

2. Sets your fund apart

There may be a long list of distinguishing factors, but honing in on the most appealing competitive advantages that your fund brings will enhance your pitch to investors.

3. Showcases the team

Investors want to see that there is relevant professional experience backing everything up. Effectively highlighting career accomplishments, expertise and high-level skills is essential.

4. Underscores your philosophy

Your overall process is driven by a distinct set of beliefs, otherwise known as an investment philosophy. This should be sharply outlined and served as the rationale for how you will succeed.

5. Breaks down the process

Piecing together all the vital components of the approach – e.g., sourcing, screening, investment selection, etc. – in a compelling investment process is critical to helping investors understand how you’ll generate returns.

6. Tells your origin story

Every hedge fund has a story. Whether it is founded upon a particular investment belief, driven by leadership’s illustrious skillset or represents a “meeting of advanced minds” – sharing this with investors will convey a strong foundation.

7. State your mission

Pitchbooks are a chance to succinctly communicate your commitment to investors and how you’ll consistently deliver results – through a concise mission or value statement.

8. Plug your culture

Perhaps it’s through collaboration, debate or proprietary research – sharing what makes your work environment unique and how you come up with great investment ideas is worthy of mention.

9. Emphasize your track record

If you have a solid track record, then sharing it is a given. Great pitchbooks isolate the most appealing aspects of performance history – through a creative design and persuasive content.

10. Call out potential

If you’re growing or launching your fund, you may not have a track record to share. But you can still call out performance from previous roles or professional accomplishments that directly lend to potential performance ahead.

If you would like to begin planning, writing and designing an amazing pitchbook, we can help. Contact us at 1.844.243.1830 or info@ext-marketing.com.

8 social media tips during these challenging times

We are living in unprecedented times. And investors need guidance from their advisors more than ever before. The value of advice is clear – and a great path to adding more value is through your social media accounts.

Here are eight tips for using social media to inform and help your clients:

1. Limit your opinions about COVID-19

Leave the health policies and science to the experts. Your thoughts on this pandemic might end up being wrong – and could make your clients more anxious in the process.

2. Focus on long-term trends

Rather than focusing too much on short-term market events, try to steer your clients’ attention to their longer-term financial goals, such as retirement and education savings.

3. Use LinkedIn as intended

LinkedIn was created to help advance peoples’ careers. During the COVID-19 pandemic – which has become an era of high unemployment – you might want to share interesting tips and articles about job hunting in the current work-from-home reality.

4. Share with a strategy

Here at ext., we recommend resharing content that has been written by your centres of influence. This is a win-win because you are sharing trustworthy content (we do, however, recommend you review anything you share regardless). And if your clients engage with this content, you can make an introduction, which will strengthen your network and reputation.

5. Connect, connect, connect

Now is the time to connect with as many of your clients and peers as possible on social media. While this should be part of every advisor’s growth strategy, now is a good time to offer to help clients and prospect any way you can.

6. Focus your efforts

If you have been struggling to find success on a social media platform, this is a good time to decide if it is even worth the effort. For example, if Facebook is a dud for your business development while LinkedIn is showing potential, consider doubling down on your LinkedIn networking efforts.

7. Vet your sources

As a corollary to #4 above, be sure you are sharing content from trusted sources. By only sharing high-quality content, you will become a trusted source for informed content.

8. Offer to answer financial questions

There are many investors out there who aren’t getting the advice they need or the attention they deserve. Use this to your advantage by offering to answer questions via direct message or inviting these individuals to leave comments to your post. You can also offer to set up calls or answer questions over email.

A final thought. Periods of great adversity also tend to be times of great opportunity – and we are here to help you succeed.

Contact us today at 1.844.243.1830 or info@ext-marketing.com for any of your marketing questions.

YOUR HEDGE FUND CLIENTS DESERVE REASSURANCE AMID COVID-19

Communicating through a crisis is always difficult, but communicating through COVID-19 presents new challenges that many hedge fund managers haven’t faced before.

With travel restrictions and physical distancing measures still in being enforced, in-person pitches are out of the question. Instead, managers have to rely on their marketing materials to speak for them. But those materials might seem a bit stale today as a result of the speed and severity of the impact from COVID-19.

To stand out, hedge fund managers need a marketing strategy that can differentiate them as much as their strategy does. Managers who can be agile and find effective ways to capitalize on all available marketing channels will improve their chance of success in the post-COVID-19 world.

Here are some key areas to strengthen your communications strategy during (and after) this crisis:

Be clear about losses, while highlighting your recovery

When it comes to performance, it’s critical to be upfront about any large redemptions or material impacts to your firm as a result of the pandemic.

The chaotic market reaction to the virus caught many fund managers off-guard. Use this opportunity to talk about the lessons you have learned from this event, as well as the steps you have taken to reposition and/or recover losses.

If you have halted redemptions or if there were delays in filing requirements, be sure to state why that happened and how you are making improvements that are in your investors’ best interests. Along with your pitchbook, website or any marketing materials, it is important to have a strong, updated due diligence questionnaire to address any important changes you have made.

Demonstrate strength going forward

Be sure to describe any changes you have made – or additions you are going to make – to your team to help you navigate any future volatility that may occur. It may also be valuable to highlight whether you have more than one prime broker, or you are planning to add another prime, in an effort to minimize counterparty risk or diversify relationships in advance of any future market turmoil.

While COVID-19 has created unprecedented volatility, it has also shed light on new opportunities. If applicable to your fund, it’s important to convey how your strategy aligns with the evolving climate and can capitalize on potential growth opportunities. Is your strategy able to capitalize on market instability or identify companies unfairly punished by the pandemic? Do current or newer holdings have strong fundamentals that may lead to their potential rebound? If so, make sure your investors and prospects know that.

Diversify your connection with investors

The COVID-19 crisis has underscored the importance of using technology to communicate, particularly when it comes to keeping investors informed about their holdings. You might want to consider how you can make your marketing materials more dynamic and flexible enough to address any concerns your investors might have.

Beefing up investor-communication pages in your pitchbook or on your website is one way to accomplish this. These pages can provide details about the importance of regular communications and your commitment to keeping clients up to date.

Providing virtual reporting and Q&As on an annual or quarterly basis are great ways to engage investors. For a personal touch, your marketing can include links to infographics or short video clips of your founders or CIOs, providing assurance or illustrating how your strategy is managing this crisis.

Articulate operational strength

During uncertain periods, hedge funds need to re-visit and improve any language related to disaster recovery and business interruption. Is your team able to communicate in real-time via work-from-home tools, such as secure video conferencing, file sharing and so on? It may also be worthwhile to note any insurance you have for business interruption.

Key-person risk is another factor that should be noted. While the risk of an unexpected death and disability to a key decision-maker is always an important consideration, COVID-19 has added a new level of complexity to the story. If there is one key person at your firm, it is important to articulate your succession plan.

Our firm is experienced in helping hedge funds communicate their key messages.

Contact us today at info@ext-marketing.com or 1-844-243-1830 today for help with your pitchbook or other marketing strategies and tools.

Monday morning briefing: Markets rise while economies struggle

Potential COVID-19 drug showed positive results. The keys to running a successful remote meeting. Could M&A be banned during the pandemic? And much more in this week’s briefing.

Economic/industry news

U.S. economic expansion ends: US GDP shrank 4.8% in the first quarter amid biggest contraction since the financial crisis

Europe’s GDP contracts: Europe’s economy just had its worst quarter since records began

Canada’s GDP unchanged in February: Canada’s GDP growth was already flat in February, StatsCan data shows

Fed keeps its central interest rate steady: Fed holds near-zero rate, Powell sees severe impact from pandemic

Investments in real estate could decline in 2020: Institutional investors set to pull back on real estate investments in 2020: survey

A look at the benefits of a merger arbitrage strategy: Five reasons why merger arbitrage is a must-own strategy

Five tips for investing during this crisis: T. Rowe offers 5 rules for investing during time of pandemic

People are turning to financial advisors for help: How a surprise pandemic reinforced the need for financial advice

Reasons for hope

Potential COVID-19 drug showed positive results: Gilead says early results of coronavirus drug trial show improvement with shorter remdesivir treatment

Some stories of human compassion: 5 uplifting stories of people showing up for each other during the coronavirus pandemic

Looking for faster tests: Federal government launches $500 million ‘Shark Tank’ style challenge to speed development of better coronavirus tests

Assisting your clients

How companies should plan for the future: How to plan your company’s future during the pandemic

Taking a proactive approach with clients: Acting, not reacting, during the pandemic

The keys to running a successful remote meeting: How to host remote meetings without chaos

Keeping track of actions by federal regulators: Better Markets launches COVID-19 regulatory tracker

Chart of the week

The S&P 500 Index, NASDAQ Composite Index and Dow Jones Industrial Average posted their strongest monthly returns in 20 years, after reaching multi-year lows in March as a result of the spread of COVID-19. All 11 sectors on the S&P 500 Index advanced, with over 90% of stocks on the index finishing higher. This comes despite a significant drop in economic activity across the U.S. and around the world. In the U.S., initial jobless claims continue to be in the millions, while first-quarter gross domestic product fell by 4.8%. Lower valuations and hope that economies will soon begin reopening boosted the performance of equity markets. Will the expectations of getting past this crisis drive market performance in May, or will investors demonstrate concern over weak incoming economic data? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Could M&A be banned during the pandemic?: Elizabeth Warren, Alexandria Ocasio-Cortez want mergers halted due to COVID-19

VC funds under pressure from the COVID-19 pandemic: VC funds face bigger risk than in financial crisis

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 29 edition

News and notes (Canada)

Oak Trust purchased by Raymond James: Investment firm Raymond James Ltd. acquires Oak Trust Co.

Horizons Canada makes changes to oil ETFs: Horizons announces effort to save troubled oil ETFs

Canadian DB plans had a significant decline in the first quarter: Canadian DB plans return negative 7.1% in first quarter

Canada’s fund industry lagging behind other countries in tax and regulations: Canada’s fund regulation, taxation falling short for investors: Morningstar

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Will Shopify rise above them all?

Leading your business out of the COVID-19 crisis. Helping businesses calculate the wage subsidy. The environment has benefited from widespread business shutdowns. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate falls to 0.9%: Inflation in Canada slows to lowest since 2015 on oil glut

Could COVID-19 change capitalism?: Leon Cooperman says the coronavirus crisis will change capitalism forever and taxes have to go up

Fitch expects the global economy to contract by 3.9% this year: Global economy takes harder hit: Fitch

COVID-19 could force change in the wealth management industry: We are in the midst of a ‘total reboot’ of wealth management

Prices for WTI crude went negative last week: Covid-19 cripples demand for oil

ESG investments may gain even more interest: COVID-19 will boost interest in ESG investing: Nuveen

Reasons for hope

60 uplifting stories you need to know: 60 positive news stories you may have missed during the coronavirus outbreak

Helping the families of front-line workers who have lost their lives: Fund to help the survivors of workers who die fighting COVID-19

How to help support COVID-19 relief efforts: Giving in the time of COVID-19

The environment has benefited from widespread business shutdowns: The surprise emerging from the pandemic

Assisting your clients

The increased importance of video conferencing: Zooming in on the remote workplace

Leading your business out of the COVID-19 crisis: Five keys to the decisive action you need to accelerate out of COVID-19

A look at how financial advisors can grow their business amid COVID-19: 3 ways to maintain and grow your financial advisory practice during the coronavirus crisis

Setting up bank branches post COVID-19: Retail banking reboot: How COVID will force branch changes for safety

Handling clients while in self-isolation (video): How advisors can manage their business in self-isolation

Brands should adapt to a new reality: Want to save your brand? Adapt now

Chart of the week

Last week, Shopify surpassed The Toronto-Dominion Bank to become the second-largest company in Canada. The company’s market capitalization passed $100 billion. The share price for the e-commerce platform has already risen approximately 69% so far in 2020, and the company’s website has seen a strong uptick in traffic since people began to stay home. Can Shopify surpass Royal Bank of Canada as the largest company in Canada in 2020? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Secondary market trading for private equity has slowed: Trading of private equity stakes will plummet this year

Tax benefits from the CARES Act: How the CARES Act impacts your clients’ taxes

Fidelity launches eight new thematic funds: Fidelity launches thematic funds with time-based fee discounts

Morningstar to purchase remaining 60% of Sustainalytics: Morningstar to take full control of Sustainalytics

News and notes (Canada)

CI Financial takes a position in Cabana Group: CI Financial acquires strategic interest in Cabana Group

Helping businesses calculate the wage subsidy: CRA launches wage subsidy calculator for employers

It was a tough market environment for hedge funds in Canada: Hedge fund wipeout in Canada leaves only 5 gainers in Q1

Mutual fund assets under management fell 10% in March: Mutual funds, ETFs lose assets in March

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: The trillion dollar club

BlackRock will ask companies to disclose climate-related risks. The fintech industry could be squeezed by a market downturn. Private equities fundraising may decline in 2020. And much more in this week’s briefing.

Economic/industry news

The U.S. inflation rate was 2.3% in December: US consumer prices gain slightly; underlying inflation tame

China’s economy grew 6.0% (annualized) in the fourth quarter: China just reported its weakest annual growth in 29 years

JPMorgan’s outlook for alternative investments in 2020: What J.P. Morgan sees for hedge funds, real estate, other alt investments in 2020

ICE to enter ESG data business: ICE to launch ESG data service

Sustainable funds had flows of US$20.6 billion in 2019, setting a record: Sustainable fund flows smashed records in 2019: Morningstar

Chart of the week – The trillion dollar club

Alphabet (Google) surpassed a market capitalization of US$1 trillion last week, joining an exclusive club. So far, only tech firms have joined the club. Currently, three firms – Apple, Microsoft and Google – have trillion dollar valuations. Amazon hit the $1 trillion mark in 2019, but a subsequent decline in its share price pulled its market cap back to $929 billion. The next largest firms by market cap are Facebook and Berkshire Hathaway, but both have a long way to go in order to join the club.

Let us know who you think may be next?

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

A look at the hedge fund industry in December: State of the industry: December 2019

The keys to success of top-performing hedge fund managers: This is what sets top-performing hedge fund managers apart

PE fundraising may decline in 2020: After record-breaking 2019, US PE fundraising expected to dip in 2020

The evolving environment for traders: Bonus culture on Wall Street is coming to an end

BlackRock will ask companies to disclose climate-related risks: BlackRock makes climate change a top priority

News and notes (Canada)

Picton Mahoney completes acquisition of certain alternative fund assets from Vertex One: Picton Mahoney expands further into alternatives with acquisition

Canadian VC investment reached US$1.17 billion in 2019: Canadian VC investment had a record year in 2019

The TSX is set to release the S&P/TSX Cannabis Index: TSX sparks up new pot index

Mortgage borrowing slowed in November: Household credit growth slows in November

On the pulse – New frontiers in fintech

Learning from the new banking environment in China: The future of banking has arrived

Using technology to enhance the customer experience: Driving emotional transformation

Big firms are benefiting from fintech companies: How the largest firms depend on fintech startups

Reducing loan default risks using machine learning: How machine learning is reducing loan defaults and easing debt recovery

Understanding some of the limitations of personalization: How personalization strategies can backfire on financial marketers

Visa purchases Plaid: Visa buys financial technology company Plaid for $5.3B

The fintech industry could be squeezed by a market downturn: Bye-bye fintech

High-net-worth topics

Helping the high-net-worth access blockchain investments: Guiding HNW clients on blockchain investment options

Is now the time to sell a private, family-owned business?: Family-owned businesses urged to sell before the party ends

Polls & surveys – What financials are saying

Longer lifespan linked to education and income (StatsCan): Gains in lifespan, health not equal: StatsCan study

Less U.S. investors are worried about a recession (Allianz): U.S. investors’ concerns over market volatility eased in Q4: Allianz

Younger Canadians are spending more time worrying about money (Scotiabank): Millennials worry more about money than older Canadians: poll

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Emerging markets equities poised for a comeback?

Why the 40 in 60/40 needs to change for investors. A look back at the decade in VC. The importance of data ethics. And is too much choice bad for advisors? These stories and much more in this week’s briefing.

Economic/industry news

Canadian inflation rate was 2.2% in November: Canadian inflation accelerates to 2.2%, core highest in a decade

The BoE holds Bank Rate steady at 0.75%: Bank of England keeps interest rates on hold

Why the 40 in 60/40 needs to change: Hey 60/40 investors: You need a new ‘40’

Three trends for investors and financial advisors: 3 trends investors and financial advisors should heed in 2020

Why corporate debt could be problematic for the global economy: China corporate debt flagged as ‘biggest threat’ to global economy

Chart of the week – Emerging markets poised for a comeback?

Let’s take a look at emerging markets stocks over the past five years. Emerging markets have underperformed developed markets over the past five years, particularly over the last couple of years as trade tensions intensified. As emerging markets countries are often export-heavy economies, the slowdown in the global economy has hurt performance. However, the partial trade agreement between the U.S. and China on December 13 has sparked a surge in performance among emerging markets equities. If trade tensions ease further and global economic growth ticks higher, will emerging markets equities gain traction and outperform developed markets? It may be time. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

A look at the hedge fund industry in November: State of the industry: November 2019

Risk-on sentiment among fund managers is back: Why fund managers are cranking up the risk

A look back at the decade that was in VC: VC’s decade in data: How the 2010s reshaped a market

Money market funds attracting a substantial amount of inflows: Investors favor money markets over stock and bond funds: Morningstar

Retail investors will gain more exposure to private markets: SEC votes to give retail investors more access to private markets

News and notes (Canada)

29 liquid alternative funds were launched in 2019: Fund managers have jumped into liquid alts, DBRS reports

Sun Life takes majority interest in InfraRed Capital Partners: Sun Life to expand infrastructure expertise with investment in InfraRed

What may be in store for Canadian alternative investments: A 2020 vision for Canadian alternative investments

A look at the changes to the Basic Personal Amount: New basic personal amount for 2020

On the pulse – New frontiers in fintech

Be prepared for a bigger adoption of mobile wallets: Why banks should care about mobile wallets (even if consumers don’t)

A look at some trends in cybersecurity for the year ahead: 10 cyber security trends to look out for in 2020

The importance of data ethics: Data ethics – what is it good for?

Why demand for regtech is expected to grow: Capital markets regtech in review

PayPal enters the Chinese payments market: PayPal completes GoPay acquisition, allowing payments platform to enter China

Why too much choice may be bad for advisors: Advisers are drowning in fintech choices

High-net-worth topics

UBS makes changes to its ultra-high-net-worth unit: UBS Group to revamp unit for ultra-high net worth clients

High-net-worth individuals are increasing their exposure to real estate, cash: Here’s where the wealthiest investors are finding opportunities

Polls & surveys – What financials are saying

Contributions to TFSA accounts grew in 2019 (BMO): Annual TFSA contributions up 10% on average: survey

74% of investors want financial advice from a human (IIROC): Investors prefer human advice: survey

The percentage of women directors on boards rose in 2019 (MSCI): Slow gains for female board membership: report

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: The inverted yield curve

A new way to analyze equity investment funds. Why smaller could be better for private equity. Many aspiring investors don’t know how to get started. And much more in this week’s briefing.

Economic/industry news

The Fed held its federal funds rate steady: Fed holds rates steady and indicates no changes through at least 2020

Canadian and U.S. consumers in much different positions: U.S. consumers buoy global economy, while Canadians face debt

A new way to analyze equity investment funds: Morningstar launches a new framework to analyze equity funds

Why advisors need to frequently review their pricing structure: Advisors need to regularly reassess their fees, TD Exec says

The need to cross boundaries to drive growth: Investment managers must cross boundaries, says Deloitte

Chart of the week

In late August, the two- and 10-year yield curve inverted, seeing its spread dip into negative territory. This inversion was brought on by concerns about the global economy in response to escalating U.S.-China trade tensions. This sparked fears that a recession was imminent as was the case with previous inversions. While the global economy has been sluggish, the U.S. and China appear to be closing in on a phase-one trade deal that might help reignite global growth. According to a recent report by Goldman Sachs, the possibility of a recession in 2020 is low. Will we see a recession in the next year or two? Or, will a recession be avoided and slow growth continue? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds rose 0.84% in November: Eurekahedge Hedge Fund Index up 0.84 per cent in November

Conversation with Stephen Schwarzman: Stephen Schwarzman doesn’t stop: An exclusive Q&A with Blackstone’s chief

Why smaller could be better for private equity: The truth about private equity fund size

A look at some year-end financial planning tips: Sixteen year-end financial planning tips

Remembering Paul Volcker: There’s the legend of Paul Volcker and the man I got to know

News and notes (Canada)

How Canada may benefit from the new USMCA: ‘A really good deal for Canada’: Former ambassadors on new NAFTA

Looking to eliminate redundancies in investor disclosure documents: IFIC asks CSA to reconsider fund disclosure rules

BoC Governor will not seek a second-term: Bank of Canada says Poloz will not seek a second term as governor

The potential impact from a higher tax-exempt basic personal amount: How the federal tax cut will impact clients

On the pulse – New frontiers in fintech

Banks should disrupt themselves before others do: How banking can avoid being disrupted in 2020 … disrupt themselves

Why partnerships are key for traditional and challenger banks: The growing trend of ecosystems within financial services

Preparing for augmented analytics: Augmented analytics: Are you ready?

Driving growth through new technology: Wealth manager using technology to drive next phase of growth

A look at the possible risks posed by BigTech firms entering the financial services industry: Rise of the machines: BigTech poses risks to financial system, FSB says

Helping businesses manage receipts: Metro Bank trials digital business receipts

High-net-worth topics

Why family offices should take a deeper look at sustainable investments: As high-net-worth families shift wealth to the next generation, family offices should lean in on sustainable investments

A look at the blockchain-related investments available to high-net-worth investors: Blockchain investment opportunities for HNW clients

Polls & surveys – What financials are saying

Many aspiring investors don’t know how to get started (IIROC): Aspiring investors don’t know where to find advice: survey

A look at Americans’ top financial priorities next year (Fidelity): Here are Americans’ financial goals for 2020: Fidelity

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

New Market Outlook: 20/20 Vision

Check out our new Market Outlook: 20/20 Vision.

It’s that time of the year again: when intelligent and experienced investors and economists – and the ext. team – predict what’s going to happen over the next 12 months.

This coming year is a tough one to predict. The health of financial markets and economies around the world will likely be severely impacted by political uncertainty in North America and abroad.

Trade tensions that never seem to end, the unexpected rise of populism in the West, ongoing mixed messages from equity and bond markets, and the upcoming U.S. election in November – these are the issues that send jitters up the spine of even the most stoic investors globally.

What’s our conclusion? Markets this year will be driven more by politics than fundamentals.

Monday morning briefing: 25 years of value vs. growth

Value versus growth over the past 25 years. Private debt fundraising down in 2019. Working on an approach to DSC. And much more in this week’s briefing.

Economic/industry news

Canadian GDP grew 1.3% in third quarter: Canada’s economy slows in third quarter even as demand jumps

Europe continues to favour active management: McKinsey: Where active management survives

There’s still a place for value investing: Has value investing stopped working?

Why small-cap stocks may be set to soar: Small may turn mighty as strategists see Russell strength ahead

M&A deals in financial services was US$57 billion in the third quarter: Financial sector M&A jumps in Q3, GlobalData

Why private equity can help a portfolio during a market downturn: Worried about a downturn? Consider private equity

Investors concerned about interest rates: Global investors cite interest rates as key portfolio risk: survey

Current market conditions may require a unique approach to active management: Revisiting active management and asset allocation

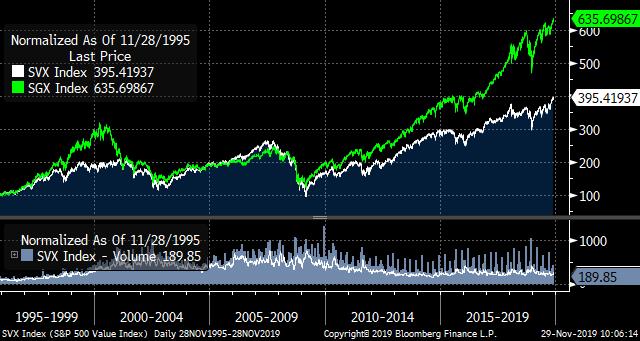

Chart of the week

Let’s look at value versus growth stocks on the S&P 500 Index since 1995. Toward the end of the 1990s and early 2000s, growth stocks surged higher in response to the dot-com bubble. After moving in lockstep until the 2008 financial crisis, growth stocks began outpacing value stocks. Is value investing in trouble or is it primed for a comeback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The Volcker Rule’s impact on hedge funds: The great hedge fund retreat

Private debt fundraising down in 2019: Against expectations, private debt fundraising saw a decline in 2019

The risks of unitranches: A booming corner of private credit has some investors on edge

Why it’s important to invest across vintages: In private equity, vintage diversification matters

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 26 edition

New rules proposed to make it easier for leveraged funds to come to market: SEC proposes new rule to ease the market entry of leveraged funds

Charles Schwab to purchase TD Ameritrade: Schwab to acquire TD Ameritrade in US$26-billion deal

Looking to allow private companies to raise money through a direct listing: NYSE proposes big change to direct listings

News and notes (Canada)

TD launches 10 new ETFs: TD Asset Management introduces new ETFs

CI takes stake in U.S. RIA firm: CI Financial buys US advisory firm

Canadian ETF assets rose to $192.3 billion in October: ETF sales rebound, mutual fund sales hold steady in October

Working on an approach to DSC: OSC decision on DSCs to come – eventually

Here are the winners from the Women in Wealth Management awards: Women in Wealth Management award winners revealed

IIROC provides updated guidance on AML requirements: IIROC steps up AML guidance

On the pulse – New frontiers in fintech

The importance of customer engagement: Reinventing retail banking customer experience in a digital world

How the entry of Big Techs into banking may impact fintech companies: Should ‘fintech’ fear big tech’s push into banking?

Customers are demanding a better digital experience: Banks losing customers who want seamless digital experiences

Why data science skills will be crucial for businesses to thrive: Analytics skills essential for business survival in ‘data decade’

The importance of IT infrastructure in developing AI capabilities: Big data LDN: Why you need to modernize your IT infrastructure for AI

Data analysis will be the focus in 2020: Why data will change the game again in 2020

Ant Financial looking to invest in the payments space: Ant Financial preps $1bn investment fund

New platform for independent advisors: Pascal Financial launches wealth management platform for advisors

High-net-worth topics

The wealthy want quality information from their advisor: What ultra high net worth clients want from wealth managers

The money habits of the rich: 5 things rich people do with their money

Polls & surveys – What financials are saying

During a recession, people want help from advisors (MDRT): Clients want you to help them through a recession: MDRT survey

Where are the female portfolio managers? (Goldman Sachs): Investment management is still a boys’ club: Goldman

Canadians are looking to eliminate debt (Manulife): Canadians agree they have too much debt

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 18, 2019

Private equity looking at the financial advisory industry. Government and companies must work together to combat cyber risks. Asset allocation among alternative investments is changing. And much more in this week’s briefing.

Economic/industry news

U.S. inflation rate rose in October: U.S. consumer prices rise most in 7 months on higher gas prices

Economic growth in Japan stalled: Japan’s economic growth slumps to 1-year low in third quarter as trade war bites

The U.K. unemployment rate declined in September: U.K. unemployment falls while wages slow in September

VC funding had another strong quarter: Global VC funding remains strong in Q3

A look at the top research firms: The top research firm in the world is…

How to navigate through a market of lower expected returns: Navigating a slow growth market environment

Understanding the new economy: Understanding the 21st century economy

News and notes (U.S.)

A look at the hedge fund industry in October: State of the industry: October 2019

According to SS&C, hedge funds returned 1.15% in October: SS&C GlobeOp Hedge Fund Performance Index up 1.15 per cent in October

Private equity looking at the financial advisory industry: Private equity investors are zeroing in on financial advice business

JPMorgan invests in Limeglass: JPMorgan invests in financial research startup Limeglass

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 12 edition

News and notes (Canada)

iA Clarington goes fossil-fuel free in Inhance SRI funds: iA Clarington ensures certain funds are fossil-fuel free

A look at liquidity levels across Canadian funds: Currency & sector liquidity analysis report: Q3 2019

Lower mortgage rates helping housing affordability: Housing affordability improves thanks to lower rates, higher incomes

Looking for safety: The safest bet in Canada is also one of the hottest ETF trades

Taking a flexible approach to title reform: What’s next for title reform in Ontario

On the pulse – New frontiers in fintech

Security a concern for digital-only banking: More consumers will leave banks if digital offerings don’t improve

Why banks and big tech partnerships may work: Big banks and big tech (not versus)

A chequing account from Google: Google to offer checking accounts in partnership with banks starting next year

Customer experience should be at the forefront to combat disruptors: How to thrive in financial services in the age of digital disruption

How to better help small businesses: Big changes ahead for small business banking

A look at possible trends in the financial services industry over the next 10 years: Financial services in the 2020s: From open banking to open finance

Government and companies must work together to combat cyber risks: Bank of Canada urges public-private co-operation on cybersecurity

The data curation challenge: The challenge of data curation

Bringing cryptocurrency payment services to Swiss businesses: Bitcoin Suisse and Worldline to offer crypto payments acceptance in Switzerland

The CME will offer bitcoin options in the new year: Bitcoin options coming to the CME

High-net-worth topics

The wealthy are moving to cash: Geopolitics clouding the outlook for wealthy investors, UBS finds

Wealthy investors making direct investments in private firms: Wealthy families using 600-year-old plan to disrupt PE

How advisors can build trust with the high-net-worth: How to get wealthy people to trust you

Polls & surveys – What financials are saying

Institutional investors have an eye on China (Invesco): 80% of institutional investors planning to raise allocations to China: survey

Asset allocation among alternative investments is changing (EY): Investors are taking money out of hedge funds and putting in private equity

Canadians need help managing investments in retirement (Mackenzie): Value of advice more important as Canadians near retirement: study

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Upcoming macroeconomic events, November 2019

Do you write or edit portfolio manager commentaries? Do you want to stay on top of the macroeconomic events that shape your day-to-day life as a financial services marketer?

If so, here are the big macro events that the ext. team is keeping an eye on over the coming weeks.

- On November 29, Canada will announce its gross domestic product (“GDP”) growth rate for the third quarter. Canada’s GDP grew 3.7%, annualized, in the second quarter, an improvement from the 0.5% growth in the previous quarter. Canada’s economy benefited from a rise in exports and real estate. However, personal spending slowed, which may be indicative of a weaker consumer

- The Bank of Canada (“BoC”) will announce its interest rate decision on December 4. At its last meeting in October, the BoC held its benchmark overnight interest rate steady at 1.75%. Despite leaving its central interest rate steady, the BoC stated that future rate decisions will be largely dependent on the strength of the Canadian economy, which could be “tested” by global economic weakness

- Canada’s unemployment rate for November will be announced on December 6. In October, the Canadian economy lost 1,800 jobs. Still, the unemployment rate remained unchanged at 5.5%. Canada’s unemployment rate remains close to its lowest level in decades, which is contributing to the relative strength of the Canadian economy

- The U.S. Federal Reserve Board (“Fed”) will announce its interest rate decision on December 11. The Fed reduced its central interest rate to a target range between 1.50%-1.75% at its most recent meeting. The Fed’s third reduction of the year was due in part to weaker inflation and global economic risks. The Fed appears to be done adjusting its central interest rate but will closely monitor incoming economic data ahead of future meetings

- On December 19, the Bank of England (“BoE”) will announce its interest rate decision. The BoE has held its Bank Rate steady at 0.75% throughout 2019. At its most recent meeting at the beginning of November, the BoE lowered its outlook given concerns about the global economy and Brexit. Two members of the BoE also voted to reduce its central interest rate, which could signal the BoE is ready to adjust interest rates should economic conditions warrant

For investment commentary support (including monthly and quarterly commentaries, as well as MRFPs), contact us today at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 11, 2019

U.S. PE funds’ capital raising reaches record high. Businesses looking to Canada for expansion. U.S. institutional investors are turning to liquid alternative ETFs. And much more in this week’s briefing.

Economic/industry news

Canada’s unemployment rate was 5.5% in October: Canadian economy lost 1,800 jobs in October, unemployment rate steady

The BoE held rates steady at 0.75%: Sterling falls after Bank of England split on interest rate cut

Expecting weaker growth in Europe: Eurozone forecast for long period of weak economic growth

How to access private markets: Smart ways to access private capital markets

U.S. institutional investors are turning to liquid alternative ETFs: Use of liquid alternative ETFs on the rise among institutional investors: study

Why defined contribution plans can benefit from alternative investments: Fundamental reasons for adding alternatives to DC pension portfolios

A look at Morningstar’s new rating system: Morningstar rolls out new ratings system

News and notes (U.S.)

Hedge funds returned 0.4% in October, according to HFR: Hedge funds in positive territory in October, says HFR

How technology can help hedge funds manage their operating expenses: Technology can act as a growth enabler to help hedge funds cope with increased margin pressures

U.S. PE funds’ capital raising reaches record high: Private equity fundraising in the US hits all-time high

Private equity investment model shifting: The shifting nature of private equity

Fidelity launches new funds: Fidelity rolls out four thematic funds

The SEC is looking to make changes to its advertising rule: SEC issues plan to modernize RIA ad rules

News and notes (Canada)

iA announces fund and ETF launches: iA Clarington launches new fund, adds ETF versions of existing funds

CI acquires asset management firm: CI Financial acquires WisdomTree’s Canadian business

Tracking cannabis stocks: Pot indexes to launch this month

ETFs in Canada saw inflows of $3.5 billion in October: Canadian equities ETFs had a ‘stellar’ October

On the pulse – New frontiers in fintech

Improving data security measures: 3 steps banks & credit unions should take as data privacy gets hotter

How active managers can benefit from machine learning: Can machine learning help active managers outperform passive peers?

How fintech will help the “underbanked”: The ‘underbanked’ is the next trillion-dollar opportunity in fintech

Looking at what’s in store for the fintech industry: The future of fintech

Employees must also accept digital transformation: Digital transformation will flop if you don’t also transform staff

Charles Schwab is looking to eliminate forms: Schwab’s plan to kill forms and expand integrations

Selling through messaging platforms: The convergence of messaging apps and payments

Canadian banks take interest in Mylo: Canadian banks invest in spare change app Mylo

What a single digital currency could mean for the finance industry: How worldwide digital currency adoption could change the finance sector

A look at Canadians’ awareness of bitcoin: Bitcoin awareness no guarantee of ownership, finds BOC

High-net-worth topics

The high-net-worth need to protect against debt too: Why ultra-high-net-worth clients need a financial cushion

The total wealth of billionaires fell in 2018: Billionaire wealth declines in 2018

Polls & surveys – What financials are saying

Expect weaker investment returns in the future (JP Morgan): Weak global growth ahead, J.P. Morgan says

Businesses looking to Canada for expansion (HSBC): Foreign businesses eyeing Canada for expansion: report

U.S. advisors are bullish on the industry (Schwab): Advisors are (mostly) upbeat about the future: Schwab

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 4, 2019

VCs may benefit from investing in more women- and multicultural-led companies. Top 10 trends that will impact family offices. A look at how the digital economy is changing real estate. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held its central interest rate at 1.75%: Bank of Canada holds rates, warns economy will be ‘tested’

The Fed lowered its central interest rate: Fed cuts rates by quarter point while hinting at a policy pause

The U.S. economy grew 1.9% in the third quarter: US GDP rose a better-than-expected 1.9% in the third quarter as consumers continued to spend

Is there an opportunity in alternative fixed income?: Alternative fixed income seen as market opportunity

Competition in the ETF space is fierce: Cutthroat competition has come in the ETF industry

A look at how the digital economy is changing real estate: How the digital economy is reshaping real estate

Global ETF assets rose 2.52% over the third quarter: Global ETF assets extend lead over hedge fund industry to USD2.54 trillion at the end of Q3 2019, says ETFGI

News and notes (U.S.)

It was a tough month for hedge funds, according to Eurekahedge: Hedge funds lag, lose clients in September despite lower fees

Newer hedge funds outperforming their more established counterparts: These hedge funds do better

CFOs’ pay at private companies growing: A look at CEO vs. CFO compensation at late-stage private companies

VCs may benefit from investing in more women- and multicultural-led companies: Morgan Stanley: VCs neglect women and minorities, and it’s hurting returns

Looking to simplify limited partnership agreements: Private equity contracts are expensive and complex. This group wants to change that.

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 29 edition

Why investing in a 401(k) is so important: This is the biggest retirement mistake Americans are afraid of

News and notes (Canada)

3iQ gets approval for Bitcoin investment fund: OSC approves Bitcoin investment fund

CIBC launches three fixed income pools: CIBC launches fixed income pools

TD introduces MyTD: TD announces AI-driven advice service

AIMA looks at alternative investment market in Canada: AIMA publishes handbook on Canada’s alternative investment landscape

ICE launches platform to improve standardization and efficiency in an ETF primary market: New platform aims to boost ETF growth

Canadian DB plans advanced 1.6% in the third quarter: Canadian DB plans post 1.6 per cent median return in third quarter: survey

On the pulse – New frontiers in fintech

Combining humans with digital to help customers: Best customer experience in banking blends digital with human touch

How financial services companies can benefit from AI: Unleashing AI’s potential in financial services

Improving conversational AI: Overcoming the barriers to conversational AI

How deep learning can reach its potential: Deep learning is overtaking classic machine learning methods, study finds

FSRA joins the Global Financial Innovations Network: FSRA steps into global sandbox

Looking for a European digital currency: German banks calls for digital euro

Developing policy for crypto assets: IIROC launches crypto advisory group

The International Investment Funds Association (IIFA) releases Cybersecurity Program Basics: IFIC unveils updated cybersecurity guide

CI partners with d1g1t Inc.: CI Financial partners with fintech firm

High-net-worth topics

Top 10 trends that will impact family offices: Family office insights: 10 trends that will affect family offices in 2020

The wealthy are looking for safety in cash: Wealthiest investors are holding more cash says UBS

Polls & surveys – What financials are saying

North American investor confidence fell in October (State Street): Geopolitical turmoil dents investor confidence, State Street says

Interest in responsible investing rising (RIA): Canadians want more support on responsible investing

Even high income earners are struggling financially (TD): Earning power doesn’t necessarily equate to better financial health, survey finds

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 28, 2019

Will active managers become more activist? A look at volatility in the private markets. Interest in impact investing continues to rise. And much more in this week’s briefing.

Economic/industry news

The ECB held its central interest rate steady: ECB holds rates at historic lows as Mario Draghi waves farewell to Frankfurt

Canadian retail sales dropped in August: Retail sales fell slightly in August, Statistics Canada reports

Why growth has outperformed value: The real reason value has been lagging growth

A look at what will impact markets over the next few decades: Aging population top global investment trend, institutional investors say

Interest in factor investing on the rise: Factor investing strategies becoming more popular for fixed income: survey

Will active managers become more activist?: A Wall Street revolution: Why active fund managers have ‘stopped yawning and started flexing their muscles’

Gold’s comeback: The story behind gold’s resurgence

News and notes (U.S.)

A look at the hedge fund industry in September: State of the industry: September 2019

Hedge funds have experienced net redemptions in 2019: Hedge fund industry sees 6th consecutive quarter of outflows

Charles Schwab launches the Schwab Alternative Investment Marketplace: Schwab launches alts marketplace for advisors

Jeffrey Vinik closes hedge fund: Billionaire investor Jeffrey Vinik closes hedge fund less than a year after its relaunch

A look at volatility in the private markets: KKR: Private markets are much more volatile than they appear

U.S. executives believe M&A activity will be better next year: US M&A remains resilient despite market fears

A look at ETF flows in 2019: Where the ETF money flowed in 2019

News and notes (Canada)

Picton Mahoney to acquire funds from Vertex One: Picton Mahoney gains five funds from Vertex One

New ETF from Mackenzie: Mackenzie launches emerging markets bond ETF

Mutual funds were in favour in September: Mutual fund sales soared in September

A look at the possible financial impact from a Liberal minority government: How a Liberal minority government could help, or hit, Canadians’ wallets

Learn about the head of the Canada Infrastructure Bank: A profile of Janice Fukakusa, chair of the Canada Infrastructure Bank

On the pulse – New frontiers in fintech

How finance can benefit from AI: What can AI and big data do for finance?

Four principles to launch unique products: 4 crucial steps to transform banking products for a fintech world

Partnership formed to launch fintech research unit: Fintech research unit founded by AMF, Finance Montreal

Why improving the onboarding process is crucial: Research shows banks could lose $22.75bn to slow onboarding

Alberta Investment Management Corp. using AI to predict stock price movements: Institutional investors turning to AI, data science to improve processes, yield alpha

Using API to better your business: How can organizations take advantage of the API economy?

Cyberattack discovered, focused on institutional investors: Cyber attack hits prominent hedge fund, endowment, and foundation

Wealthscope launched to help investors look at total portfolio diversification: New tool to help those accumulating and decumulating retirement assets

WealthBar acquires Snap Projections: WealthBar deepens financial-planning commitment with acquisition

Is there a place for blockchain in fintech?: Blockchain: Is it the future of fintech?

High-net-worth topics

The high-net-worth in the U.K. are concerned about the political landscape: Politics is more worrying than Brexit for Britain’s wealthy

Wealthy executives have specific needs from a financial advisor: What high-earning executives need, and aren’t getting, from advisors

A look at the world’s ultrawealthy: Who are the ultrawealthy? These charts will give you an idea

Polls & surveys – What financials are saying

Interest in impact investing continues to rise (American Century): US, UK millennials embrace impact, ESG investing: Survey

Lacking knowledge of fixed income securities (BNY Mellon): Survey reveals severe lack of awareness on fixed income

Canada falling behind in dealing with climate risk (FTSE Russell): Canada’s climate readiness gets a thumb-down

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Tuesday afternoon briefing – October 15, 2019

Hedge funds are moving away from oil. More companies raising private money. U.S. venture capital slowed in the third quarter. And much more in this week’s briefing.

Economic/industry news

U.S. inflation rate steady in September: US consumer prices were unchanged in September, the weakest reading since January

The Canadian unemployment rate fell in September: Canada’s job market produces another surprise gain in September

Progress was made on a U.S.-China trade deal: U.S., China reach partial trade deal, boosting market back near-record highs

The Fed will buy short-term T-bills: Fed to buy Treasury bills in effort to control lending rates

Interest in money markets rising: Investors are flocking to money markets at the highest rate since the financial crisis

A look at EBITDA for private companies: Why EBITDA is just BS

More companies raising private money: The changing landscape of public and private equity investing

New indexes to track megatrends: MSCI launches megatrends indexes

News and notes (U.S.)

Hedge fund industry returns declined 0.11% in September: Hedge funds see two consecutive months of negative returns, says eVestment

Hedge funds moving away from oil: Column: Hedge funds turn bearish on oil as economy slows

Add-ons a growing portion of U.S. PE buyouts: This year could set another record for US PE add-on activity

Retirement portfolios can benefit from private equity: Private equity a must for retirement portfolios, Panel Argues

A new asset class?: The hot new alternative investment: Lego?

Stephen Schwarzman comments on job loss study: Stephen Schwarzman on the key ‘flaw’ in the private equity job loss study

U.S. venture capital slowed in the third quarter: Venture Capital – Unicorn blood on the street

Fidelity offers free trading: Fidelity joins price war with zero commissions

News and notes (Canada)

The impact of fund-of-funds on the ETF industry: How fund-of-funds could be puffing up Canada’s ETF industry

VC investment in Canada continues to rise: Canadian VC investment hits record in Q3

Advisors satisfied with their brokerages: Where the industry is succeeding, and falling short

A look back at Canada’s first year of legalized marijuana: The good, the bad and the ugly from Canada’s first year of legal pot

On the pulse – New frontiers in fintech

A look at what’s ahead for fintech: What’s next for fintech growth?

Customers are concerned about using voice-assisted technology for bank transactions: Insurers and banks face battle to overcome security fears over voice-assisted tech

Consolidation in fintech expected to continue: More fintech consolidation expected after Broadridge’s Fi360 purchase

How to improve onboarding: Two ways to quickly elevate your financial institution’s onboarding

Companies start abandoning the Libra project: Facebook’s Libra loses Mastercard, Visa in cascade of exits

An in-depth look at the term “challenger”: What does the term ‘challenger’ really mean?

Digital asset firms must comply with AML rules: Digital assets face anti-money laundering rules too

Another bitcoin ETF rejection: SEC rejects Bitwise Bitcoin ETF

RBC looking to help address climate change: RBC backs AI-based climate change research

High-net-worth topics

The high-net-worth are looking to protect their wealth: Long-term planning can help allay Canadian investors’ concerns for the future

A look at how the high-net-worth are investing: Tiger 21 Founder addresses macroeconomic concerns for high-net-worth investors on CNBC Europe

Polls & surveys – What financials are saying

Many investors see a recession ahead for the U.S. economy (E-Trade): Bearish investors say US economy has peaked: E-Trade survey

Canadians are looking for retirement help (HOOPP): 80% of Canadians would take pension over salary hike: Poll

Those working with an advisor feel more prepared for a recession (CFP): Advisors instill confidence in face of recession