Monday morning briefing: Tech stocks that shine during COVID-19 crisis

Thank you for reading Monday Morning Briefing. For this edition, and going forward, we have decided to change the format of the briefing to provide you with relevant information you will need to weather the new realities we face today – and the challenges that will likely continue over the coming months. As small business owners ourselves, we know that access to timely news, human stories and tools to help you operate better, can be invaluable at times like these. Please let us know if you have any feedback on our new format or want more information on our stories. We want to hear from you, our readers.

Jillian Bannister, CEO

Richard Heft, President

Economic/industry news

The BoC kept its central interest rate at 0.25%: BoC sees risk of ‘structural damage,’ ramps up bond-buying

Economic growth in Canada slumped in March: Data indicate economy plunged in March: StatsCan

China’s GDP contracted over the first quarter: China says its economy shrank by 6.8% in the first quarter as the country battled coronavirus

The value of alternatives through volatile markets: Alternatives can smooth market bumps

Cash levels among fund managers rising: Fund managers at highest cash levels since 9/11: BofA survey

COVID-19 has resulted in more cashless payments: Contactless payments skyrocket because no one wants to handle cash

Reasons for hope

A look at the potential cures for COVID-19: Handicapping the most promising of 267 potential coronavirus cures

Private equity firms stepping up to help first responders and portfolio company employees: Private equity firms promise millions for coronavirus relief

Restaurant changes operations to help community: Vaughan restaurant now making hand-sanitizer, keeps staff employed

Assisting your clients

Generation Z reconsidering how they view money: Why COVID-19 is rebooting how Gen Z feels about money and banking

Best practices to follow when RIAs are working from home: Key tech steps for RIAs working from home

Eight principles to keep in mind with your marketing efforts in the current market environment: PR and marketing: How to communicate during COVID-19

It is important to remain in constant contact with your clients: Communicate with clients clearly and often, consultant says

Looking after yourself while working from home: Pandemic, stress and luxury

Chart of the week

Despite significant volatility in financial markets over the past two months, there have been a number of stocks that have performed well. Some stocks have benefited from higher expectations for sales given that more people are at home. Here are a few of these “stay-at-home” stocks, which have outperformed the broader market, even producing share price gains. Netflix Inc., Amazon.com Inc., Peloton Interactive Inc. and Zoom Video Communications Inc. are all seeing gains. As people eventually return to work, and social distancing measures are relaxed, what will be in store for the share prices of these companies? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The hedge fund industry experienced net outflows in February: Hedge funds see USD8.1bn in outflows in February

BlackRock raised US$5.1 billion for its latest alternative fund: BlackRock just closed its largest alternative fund yet

Allocators demonstrating cautious sentiment toward private market investments: Investors are cautious on private markets during shutdowns, Pitchbook survey shows

Investment funds experienced significant outflows in March: Funds saw largest ever exodus in March, Morningstar says

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 15 edition

News and notes (Canada)

Purpose Investments launches new fund: Purpose unveils new structured equity yield portfolio

A look at the federal government’s assistance programs: Understanding CERB, EI and the feds’ wage subsidy

CI Financial partnering with private-market investment company: CI Financial forges private-market investment partnership

IIROC is delaying fee collection: IIROC gives dealers a breather on fees

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Labour market faces challenges

International securities regulators focused on COVID-19. Many executives planning acquisitions in the next year. Handling client data with care. And much more in this week’s briefing.

Economic/industry news

Canada loses 1 million jobs: Canada sheds record 1.01 million jobs in March

The impact of short-term losses on long-term value: So how much wealth destruction has truly occurred since February?

Be careful trading based on Fed actions: Investors need to be selective in following the Fed

International securities regulators focused on COVID-19: Global regulators all-in on pandemic perils

A look at the similarities and differences between current conditions and the 2008 financial crisis: Comparing the current crisis to 2008

How governments can get people back to work, but keep them safe: How to restart national economies during the coronavirus crisis

Chart of the week: Labour market faces challenges

Canada’s job report for March showed a significant deterioration in its labour market. In an effort to contain the spread of COVID-19, many businesses were shuttered, at least temporarily, resulting in mass layoffs across many industries. In March, the Canadian economy lost over one million jobs, pushing the unemployment rate to 7.8%, its highest level since 2010. Markets will be carefully watching how the federal government’s wage subsidy program helps businesses, and if it keeps people employed. Let us know if you think this will be enough to bolster Canada’s labour market.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

A look at some strong and weak performing hedge funds in March: The winning and losing hedge funds of the March pandemic

Hedge funds’ returns declined in March: Hedge funds down 4.40 per cent in March, says Eurekahedge

Capital raised by private debt funds declined in the first quarter: Private debt funds struggle to raise capital in pandemic

Many executives planning acquisitions in the next year: While M&A grinds to a halt, many executives plan for future deals

Target-date funds experience declines amid extreme market volatility: Target date funds not immune to COVID-19 selloff: Morningstar

News and notes (Canada)

Canadian government relaxing restrictions on accessing wage subsidy program: Trudeau promises ‘relaxed’ rules for wage subsidy, more support for student jobs

A look at the impact of COVID-19 on the cannabis industry: Can pot stocks weather the COVID-19 hurdle?

How DB plans can navigate through the current market environment: A coronavirus game plan for defined benefit pension plans

Canada’s oil industry challenged by a confluence of factors: Alberta’s Kenney sees negative oil prices, $20 billion deficit

On the pulse – New frontiers in fintech

The use of fintech apps has risen in response to COVID-19: Coronavirus drives 72% rise in use of fintech apps

Now may be the time for financial institutions to improve its digital platforms: COVID-19 provides opportunity for digital transformation

Digitalization requires effective communication among different teams and departments: How to break down team and department silos for digital transformation

Helping banks and other organizations with customers’ COVID-19 questions: Google launches bot to help organizations answer COVID-19 questions

Handling client data with care: Why tech vendors must start taking our user data seriously

Insurers turning to digital tools for the sales application process: Insurers adapt underwriting, digital channels in pandemic response

High-net-worth topics

How the wealthy are navigating through the choppy markets (video): Tiger 21 Chairman Michael Sonnenfeldt on how his clients are navigating coronavirus-driven volatility

The wealthy should return to U.S. equities: Goldman tells rich clients U.S. stocks still offer best returns

Polls & surveys – What financials are saying

Canada’s economic recovery may not be rapid (CIBC): No quick recovery in sight, CIBC economists say

Financial advisors in the U.S. see more downside in stocks (Ned Davis): 4 in 5 advisors say stocks haven’t hit bottom: Survey

In this time of rising uncertainty, please know that ext. is closely monitoring COVID-19 and its impact – current and potential – on our firm, our clients’ businesses and the overall financial services industry.

We remain committed to seamless service for our clients and the well-being of our employees during this time. If you have any questions about business continuity at ext. – or how you can effectively communicate these and other timely issues with your clients, please reach out to your account manager or contact us 1.844.243.1830 or info@ext-marketing.com.

Monday afternoon briefing: Services sink

We may not see a v-shaped recovery. Why PE firms may be looking at publicly listed companies. How COVID-19 may change banking. And much more in this week’s briefing.

Economic/industry news

Canada’s economy grew 0.1% in January: Economic growth slowed in January to 0.1%, Statistics Canada says

U.S. unemployment rate rises to 4.4%: US payrolls plunge 701,000 in March amid the start of a job market collapse

We may not see a v-shaped recovery: Economists are losing hope in a ‘v-shaped’ post-virus recovery

The Fed is stepping up to help global debt markets: Fed steps in once again to try to smooth out lending markets

How pension plans are approaching rebalancing amid the market volatility: Investment portfolio rebalancing in the time of coronavirus

Happy birthday to ETFs: Getting better with age: ETFs turn 30

Chart of the week

As COVID-19 continues to spread around the world, the services sector has been particularly hard hit. Travel, accommodation and food services, among others, have all come to a halt. In its most recent results from IHS Markit, services across the U.S. and Europe have had their steepest decline ever. Even if the spread of COVID-19 is flat-lines and people quickly return to work, it will likely take some time for the services industry to fully recover. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Stay defensive in down markets: Billionaire Howard Marks pitches a defensive investing outlook

Why PE firms may be looking at publicly listed companies: Private equity will go after listed companies. And corporations will welcome it.

The impact of the U.S. government’s stimulus package on private markets: What $2T in stimulus does – and doesn’t do – for private markets

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 1 edition

News and notes (Canada)

From skates to medical equipment: How private equity-owned Bauer pivoted from hockey gear to medical masks

Tax planning for business owners in the current environment: Tax tips for business owners navigating the pandemic

Real estate market in Canada could see significant declines: Distancing, economic uncertainty to hurt home sales: RBC

Counsel Portfolio Services makes changes to pricing: Counsel enhances tiered pricing program

On the pulse – New frontiers in fintech

With challenges come opportunities: Coronavirus: New challenges and opportunities for fintech

How COVID-19 may change banking: Reimagining banking during and after COVID-19

Fintechs can benefit from partnerships with private banks: Private banks may prove profitable partners for fintechs

Improving cash management systems: Firms look to better cash management capabilities

Answering questions about a digital transformation: Banks questions about doing digital transformation

Improving the process for online account openings: When opening accounts in branches becomes impossible

Helping advisors with remote client engagement tools, free until July: Wealthtech firm offers tool free of charge

High-net-worth topics

Reviewing your estate plan: How to take advantage of new estate planning opportunities caused by the coronavirus

The wealthy still bullish on the economy over the long term: Wealthy U.S. investors and business owners look hopefully to long term

Polls & surveys – What financials are saying

Canada’s stimulus measures could help ease the impact of COVID-19 (DBRS): Thumbs up for Canada’s large stimulus effort: DBRS

24% of millennials bought stocks despite volatile markets (Bankrate): Quarter of millennials bought stocks amid recent volatility: Bankrate

In this time of rising uncertainty, please know that ext. is closely monitoring COVID-19 and its impact – current and potential – on our firm, our clients’ businesses and the overall financial services industry.

We remain committed to seamless service for our clients and the well-being of our employees during this time.

If you have any questions about business continuity at ext. – or how you can effectively communicate these and other timely issues with your clients, please reach out to your account manager or contact us 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Jobless claims go vertical

Providing help to small businesses. Protecting cryptocurrencies from theft. PE firms facing uncertainty between helping portfolio firms and making acquisitions. And much more in this week’s briefing.

Economic/industry news

The BoC makes another emergency rate cut: Bank of Canada cuts key rate to 0.25% as virus, oil fallout deepens

Canadian government’s stimulus plan becomes law: Federal bill with more than $100B in COVID-19 aid is now law

Breaking down the US$2 trillion stimulus package: What’s in Congress’s $2 trillion coronavirus stimulus package

How banks can help small businesses: COVID-19 is crushing small business: Can banks move fast enough?

Understanding the underperformance of value stocks: Moving beyond the naive definition of value investing

How COVID-19 may impact the asset allocation of DB plans: The impact of coronavirus on DB pension funding status, asset mix

Bond ETFs trading at large discounts to NAV: Bond ETFs’ liquidity tested amid market stress

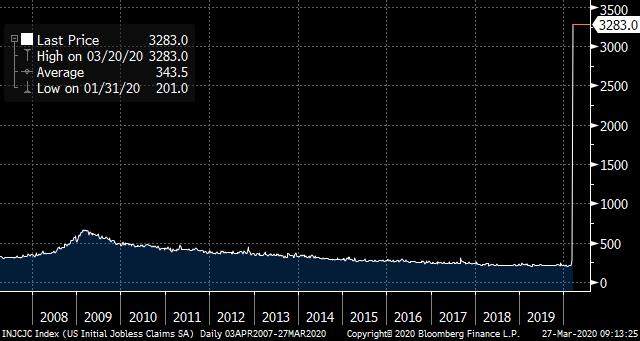

Chart of the week

Initial jobless claims in the U.S. rose to 3.28 million for the week ended March 21. This sharply surpassed market expectations of 1.70 million jobless claims, and is the highest amount ever recorded. COVID-19 is causing a massive disruption to the U.S. economy, which is causing many Americans to find themselves out of work and running out of money. The US$2 trillion spending plan may provide some assistance to those hurt by COVID-19, but will it be enough? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

COVID-19’s impact on commonly held hedge fund stocks: How COVID-19 is impacting popular hedge fund stocks

For some, it’s buying time: Hedge funds legends quietly contacting investors, citing historic buying opportunity

PE firms facing uncertainty between helping portfolio firms and making acquisitions: Flush with cash, PE firms confront their new reality

Providing support to registered funds: SEC provides temporary flexibility to funds hurt by coronavirus crisis

News and notes (Canada)

CSA announces temporary blanket relief: Securities regulators get flexible in face of COVID-19 concerns

Providing help to small businesses: BMO offers relief to small businesses

Mutual funds and ETFs saw strong net sales in February: ETF and mutual fund sales neck and neck in February

JR Shaw passes away at 85: ‘Titan of business and philanthropy’: Telecom giant JR Shaw dead at 85

On the pulse – New frontiers in fintech

Mobile video banking usage increasing: Will the pandemic catapult mobile video banking into the big time?

Some virtual tools for working from home: 5 tools for remote working

Understanding low-code: What’s low-code all about? An interview with Mike Heffner, Appian

Trade processing can benefit from new technology: In pursuit of trade processing perfection

Protecting cryptocurrencies from theft: The most proven ways to protect crypto money from hackers

The self-employed need protection: COVID-19 exposes urgent need to protect the self-employed

High-net-worth topics

How the wealthy are responding to COVID-19: Billionaire tracker: Actions the world’s wealthiest are taking in response to the coronavirus pandemic

Family offices hopeful a recovery will come soon: Family offices see market recovery within 12 months: Survey

Polls & surveys – What financials are saying

Many plan sponsors expect a recession (NEPC): Plan sponsors expect recession, negative S&P 500 returns in 2020

Canada likely headed for a recession (CIBC): Recession is inevitable, but how long will it last?

In this time of rising uncertainty, please know that ext. is closely monitoring COVID-19 and its impact – current and potential – on our firm, our clients’ businesses and the overall financial services industry.

We remain committed to seamless service for our clients and the well-being of our employees during this time. If you have any questions about business continuity at ext. – or how you can effectively communicate these and other timely issues with your clients, please reach out to your account manager or contact us 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: A lost decade?

Spotlight on fintech as more people stay home. ESG funds performing relatively well. Private equity will be challenged by the spread of COVID-19. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate was 2.2% in February: Annual pace of inflation cools to 2.2% in February

The BoE reduces its Bank Rate by 15 basis points: Coronavirus: UK interest rates cut to lowest level ever

More stimulus measures from the ECB: European Central Bank announces massive stimulus plan to calm markets

Will actions by central banks help?: Liquidity measures abound, but markets remain spooked

ESG funds performing relatively well: ESG investments performing well on relative basis during downturn

NYSE to move to all-electronic trading: NYSE to shut equities, options trading floors

Chart of the week

The S&P/TSX Composite Index declined 14% last week alone. Since the beginning of February, when concerns heightened over the spread of COVID-19, the S&P/TSX is down approximately 32%. As a result, the S&P/TSX Composite Index has lost almost all of the gains achieved over the past 10 years. While the global economy is going to suffer in response to the spread of COVID-19, we expect quality companies to recover and persevere over the long term. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds had positive inflows in January: Hedge funds reverse two-month redemption trend with USD21.2bn inflows in January

PE will be challenged by the spread of COVID-19: How COVID-19 is shaping up to be a major test for PE

A look at the value of PE managers: Private equity essentials: How private equity managers create value

Guaranteeing safety of money market funds: Treasury proposes to guarantee money market funds in stimulus

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: March 19 edition

Bond fund flows increased in February: Investors fled to bonds in February: Morningstar

News and notes (Canada)

Canadian federal government introduces massive spending plan: Liberals pledge up to $82 billion in spending, deferred taxes

Caldwell Investment Management launches first ETF: Caldwell enters Canadian ETF market

The CSA announced extension to its filing deadlines: CSA extends filing, comment deadlines

Canada may be headed towards a recession: Canada facing recession: TD Economics

On the pulse – New frontiers in fintech

Bigger spotlight on fintech as more people stay home: Fintechs getting a boost from coronavirus outbreak

Is America ready for open banking?: Is it finally time for open banking’s debut in America?

Understanding the ethics of AI: The Ethics of AI: AI in the financial services sector: grand opportunities and great challenges

It’s important that companies maintain their focus on customers: Even in the age of COVID-19, you need to stay focused on the customer

Helping kids develop good money habits: Revolut launches app for kids

Why COVID-19 could speed up the digital revolution: Ad mogul Martin Sorrell says coronavirus will “accelerate the digital revolution”

High-net-worth topics

Preparing to put cash back into the market: Ultra-rich families poised for spending splurge after stock rout

Structured notes gaining popularity among the wealthy: Citigroup’s wealthy clients are snapping up structured notes

Polls & surveys – What financials are saying

Fund managers’ sentiment falling fast (Bank of America): Historic collapse in global fund manager sentiment: BofA survey

Spread of COVID-19 affecting the finances of Americans (LendingTree): 63% of Americans say virus outbreak has impacted their finances

In this time of rising uncertainty, please know that ext. is closely monitoring COVID-19 and its impact – current and potential – on our firm, our clients’ businesses and the overall financial services industry.

We remain committed to seamless service for our clients and the well-being of our employees during this time. If you have any questions about business continuity at ext. – or how you can effectively communicate these and other timely issues with your clients, please reach out to your account manager or contact us 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing

Private equity could get more aggressive. The wealthy are focused on minimizing losses. SEC looking to confirm adherence to ESG principles. And much more in this week’s briefing.

Economic/industry news

The Fed reduces its central interest rate to 0%–0.25%: Federal Reserve cuts rate to zero and launches massive $700 billion quantitative easing program

The BoC makes emergency rate cut: Bank of Canada cuts key interest rate to 0.75%

The ECB announces stimulus measures: ECB to let banks run lower capital levels to deal with virus

BoE lowers Bank Rate to 0.25%: Bank of England cuts interest rate to 0.25%

The economic growth of G20 nations slowed in the fourth quarter of 2019: G20 growth was sluggish prior to COVID-19

How to help the U.S. economy: Cut payroll taxes? No, Trump should stimulate ventilator companies

SEC looking to confirm adherence to ESG principles: ESG funds might soon have to prove to SEC they’re actually ESG

Managing investors amid volatile markets: How advisors manage market volatility

News and notes (U.S.)

Private equity could get more aggressive: Private equity firms won’t waste another crisis

How COVID-19 will change the environment for M&A: Coronavirus alters the merger playbook for dealmakers

It’s time to buy, according to Howard Marks: Oaktree’s Howard Marks says he’s starting to find bargains to buy

Reforming insurance investment disclosures: SEC reforms insurance investment disclosure

News and notes (Canada)

Harvest launches unhedged units of three ETFs: Harvest announces unhedged units of three ETFs

Total value of Canadian PE deals declined last year: Private equity investment dipped in 2019: report

IIROC may loosen some regulatory requirements: Compliance requirements may be eased amid COVID-19 concerns

Private pension assets grew in the third quarter of 2019: Pension assets up: StatsCan

On the pulse – New frontiers in fintech

Moving to the cloud: Run your bank in the cloud: Crazy or fintech smart?

How COVID-19 could impact the fintech sector: How the coronavirus could positively and negatively affect fintechs

The challenges facing a fintech startup: 4 hurdles every fintech startup must overcome

Could branches go obsolete?: Why customers won’t set foot in banks in the future

AI is contributing positively to the sales process: Making the sale with AI and data

What you need to know about PSD2: The PSD2 deadline: 8 things businesses needs to know

High-net-worth topics

The wealthy are focused on minimizing losses: How wealthy investors are managing their portfolios amid the coronavirus scare

Here are the best cities for the high-net-worth: Top 12 global cities for the ultra-wealthy

Polls & surveys – What financials are saying

Private equity allocations set to rise in 2020 (Torys LLP): Pension funds set to increase private equity allocations: survey

Younger generation struggling to get quality advice (Betterment): Millennials, Gen Z try to build retirement savings but face obstacles: Betterment

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: How low can yields go?

Who does the data belong to? Start young to generate wealth. How to serve women’s financial needs. And much more in this week’s briefing.

Economic/industry news

The Fed announces an emergency rate reduction: Federal Reserve announces first emergency rate cut since the financial crisis

The BoC cut its rate by 50 basis points: Bank of Canada follows Fed with rate cut as virus fears mount

COVID-19 to impact trade activity: Coronavirus to become bigger trade barrier than U.S.-China spat

Institutional investors prefer private markets for investment: Institutional investors planning to allocate more to private assets: survey

Is a comeback due for value ETFs?: When will value ETFs emerge from their prolonged slump?

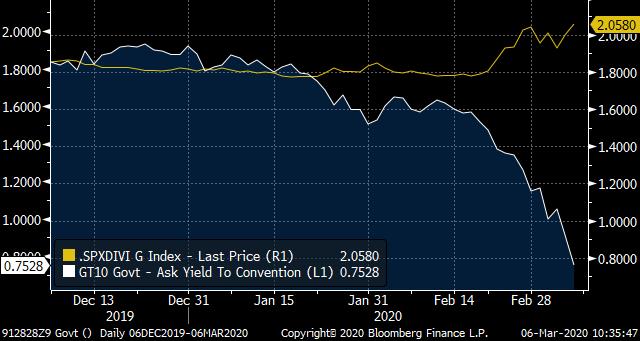

Chart of the week

An emergency interest rate reduction by the U.S. Federal Reserve Board of 50 basis points, alongside an investor flight to safety, has pushed the 10-year U.S. Treasury yield to record-low levels. The S&P 500 Index was volatile again last week, as concern about COVID-19’s potential impact on the global economy was heightened. With equity prices falling, the dividend yield of the S&P 500 Index rose, and is now more than two times higher than the 10-year Treasury yield. How low can Treasury yields go? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Finding yield in private markets: Finding safe havens in private markets

Staying invested in the winners: PE firms are holding on to winners longer

Active fund managers’ returns relatively strong in February: Active fund managers outperformed as coronavirus shook stock market

Pershing adds two new fee options: Pershing announces subscription and zero-fee options for RIAs

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: March 3 edition

News and notes (Canada)

National Bank launches five new ETFs: National Bank introduces new ETFs

Invesco launches U.S. equity ESG ETF: Invesco ETF filters S&P 500 companies through ESG criteria

Banks reduce their prime rates: Several banks match Bank of Canada with 50-basis-point cut to prime interest rate

Understanding the RDSP: Common RDSP misconceptions

CWB expands presence in high-net-worth market: CWB buying T.E. Wealth and Leon Frazer from iA Financial

On the pulse – New frontiers in fintech

Who does the data belong to?: Fight over consumer data ownership pits banks against fintechs

Preparing to meet compliance standards: Transformative regulation finds its feet in 2020

The outlook for banking and capital markets, according to Deloitte: 2020 banking and capital markets outlook

Digital currency adoption could impact the U.S. dollar: ING economist: The US has most to lose in war of digital currencies

The challenges of succeeding in emerging markets: The unique challenges to scaling fintechs in emerging markets

Fintech sector being impacted by COVID-19: How coronavirus is disrupting the fintech sector

High-net-worth topics

Start young to generate wealth: It’s easier to become a millionaire if you’re a millennial – not in your 50s or 60s, says money expert

Improving your family office: 4 practical tips to transform your family office into a proactive organization

Polls & surveys – What financials are saying

How to serve women’s financial needs (CIBC): Tips for meeting women’s financial needs

Retirement savers not deviating from their plan (American College of Financial Services): Retirement investors staying the course despite coronavirus worries: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Volatility spikes

Is a global recession on the horizon? Encouraging the high-net-worth to buy amid volatility. The PE industry can benefit from AI. And much more in this week’s briefing.

Economic/industry news

Canada’s GDP grew 0.3% (annualized) in Q4: Canada’s output stalls as exports and business investment drop

U.S. economic growth was 2.1% in Q4 19: U.S. economy grew at 2.1% rate in Q4 but virus threat looms

PRI reporting deadline quickly approaching: PRI reporting deadline: A race to the finish line in 2020

The benefits of staying private: Why more businesses are choosing to stay private

M&A can help portfolios in volatile markets: Turning M&A deals into a stable source of returns

Is a global recession on the horizon?: How the coronavirus could help “push the world to the brink” of recession

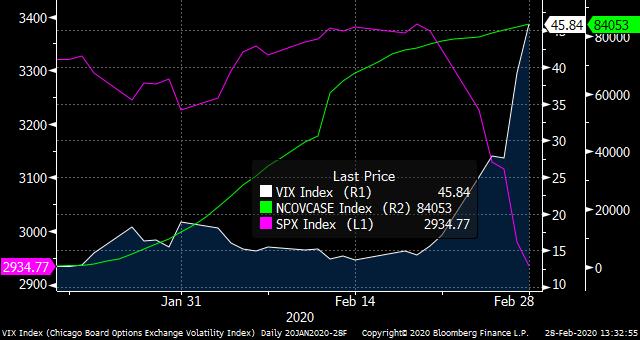

Chart of the week

The number of cases of COVID-19 around the world is rising, and the VIX Index has spiked to reflect he uncertainty this has caused. Countries such as South Korea, Italy and Iran experienced a jump in confirmed cases, and there are over 83,000 confirmed cases of Covid-19 across the world. Major global indices are now in negative territory for the year. Clinical trials of a potential drug to combat the virus are underway, but those trials may not be completed for another month. How deep will losses extend? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds rose 0.07% in January: Hedge funds off to a weak 2020 start as COVID-19 outbreak weighs on global growth outlook

Looking to allocate more assets into alternative investments: Health-care systems want more alternative assets. But can they get them?

A bitcoin ETF is unlikely in 2020: SEC quashes dreams of bitcoin ETF with another rejection

JPMorgan Chase looking to address climate change: JPMorgan to stop financing arctic drilling, coal mining

Franklin Templeton launches three thematic ETFs: Franklin Templeton joins thematic ETF party with three new funds

Schwab to purchase fixed income SMA firm: Schwab to buy $10.5B RIA focused on fixed income

News and notes (Canada)

Sun Life launches five private pools: Sun Life launches new private pools

Mackenzie introduces new small- and mid-cap fund: Mackenzie launches new mutual fund

Harmonizing rules for crowdfunding: CSA floats enhanced Canadian crowdfunding rules

How the new mortgage stress test could impact banks: Report sounds alarm over softer mortgage stress tests

On the pulse – New frontiers in fintech

How to choose the best fintech partner: A vetting guide for banks mulling fintech partnerships

Ensuring a successful digital transformation: How to avoid digital transformation failures in banking

The PE industry can benefit from AI: How AI can bring new insight to private equity deals

Cybersecurity starts in the C-Suite: The c-suite and cyber security: taking the blame and taking action

New technology can help solve climate change: How to use technology to solve climate change and cloud waste

The BoC looking at a digital currency, just in case: Bank of Canada to create its own digital currency as ‘contingency,’ deputy says

High-net-worth topics

Encouraging the high-net-worth to buy amid volatility: Advisors to rich pitch equities, private markets after plunge

The vacation destinations for the young high-net-worth: How the young and rich are now spending their vacations

Polls & surveys – What financials are saying

Executives in the U.S. anticipate a higher tax liability in 2020 (BDO): Most businesses expect their taxes to go up this year: survey

Most people don’t like talking about money (FP Canada): Let’s not talk about sex – or money

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Retail sales are still weak

Fund managers are less optimistic. Being wealthy is more than just having a lot of money. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate was 2.4% in January: Inflation rises 2.4% amid higher gas prices; core measures decelerate

Will ESG indices become more popular than traditional indexes?: MSCI says ESG indexes will be bigger than traditional gauges

Which banks have the most female directors?: Top 12 big banks for female board membership

Looking at the performance of low-volatility ETFs: Are low-volatility equity ETFs performing as planned?

The changing nature of financial advice: McKinsey on wealth management – the “Netflixing” of advice

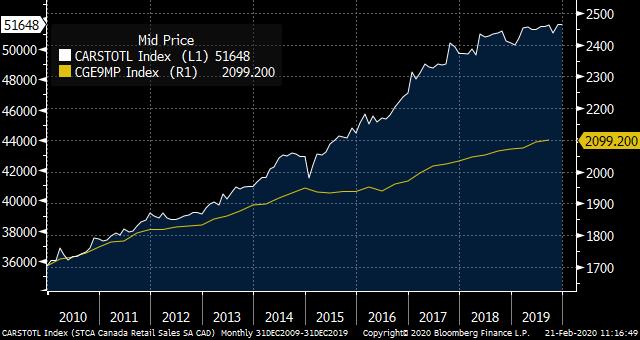

Chart of the week

Canadian retail sales grew 1.6% in 2019, the weakest pace since 2009. This chart demonstrates the clear slowdown in retail sales across the Canadian economy over the past year. This signals weakness in personal spending. Rising debt, higher insolvencies and pressure on household finances in response to higher prices for staples, such as food, are weighing on Canadians’ pocketbooks. Do you believe Canadian retail sales will weaken further? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Analyzing Q4 filings: Q4 2019 filings insights

Hedge funds rose 8.67% last year: Eurekahedge Hedge Fund Index up 8.67 per cent in 2019

Handing out 2019 PE awards: 2019 Pitchbook private equity awards

Morgan Stanley to acquire E*Trade: Morgan Stanley dives deeper into retail with E*Trade deal

Franklin Templeton to purchase Legg Mason: Franklin Templeton buying Legg Mason for US$4.5 billion

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: February 18 edition

Michael Milken has been pardoned: Michael Milken pardoned by President Trump

News and notes (Canada)

Restrictions proposed on DSC back-end fees: DSC ban coming in mid-2022

Dynamic launched new ETFs: Dynamic launches two active ETFs

A new designation for financial advisors: Advocis launches new advisor designation

Fairstone Financial to be acquired by Duo Bank: Duo Bank buying Fairstone Financial

On the pulse – New frontiers in fintech

Fintech firms to watch in 2020: The Forbes Fintech 50: The most innovative fintech companies in 2020

Retail banking trends for the upcoming year: Top 10 retail banking trends and priorities for 2020

Why big tech could enter financial services: The role of big tech in financial services

What may be in store for bank branches: The future of the branch experience

Developing a strategy for data and AI: EU sets out plans for big data and AI

OTPP invests in cybersecurity firm: Ontario Teachers’ buys stake in cybersecurity firm, Caisse portfolio companies make acquisitions

AI financial planning firm receives investment: Financial planning startup scores seed funding

High-net-worth topics

Being wealthy is more than just having a lot of money: Beyond money: 4 ways advisors help clients achieve personal wealth

Insuring Australia’s high-net-worth against cybercrimes: AIG puts cyber into new policy for high net worth families

Polls & surveys – What financials are saying

Fund managers are less optimistic (BofA): Fund managers’ bullishness tapers off in February: BofA survey

Number of RRSP contributors rises in 2018 (Statistics Canada): RRSP contributions are up, but their popularity with taxpayers is down

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Tuesday morning briefing: Germany continues to struggle

Private equity’s success in the NBA. Helping companies eliminate wasteful spending. Family offices favour PE and real estate. And much more in this week’s briefing.

Economic/industry news

The U.S. inflation rate was up in January: US underlying consumer prices rise in January

Thematic funds could be beneficial in portfolios: Where do thematic funds fit in a portfolio?

Will hedge funds see more outflows this year?: Hedge funds to lose $20 billion from investors this year

Advisors do a better job of constructing portfolios: Using advisors improves portfolio diversification for 90% of investors: Vanguard

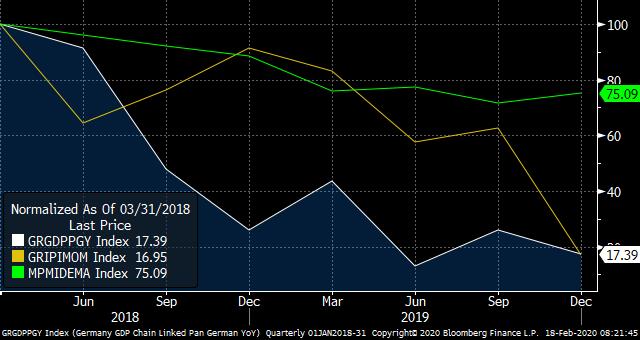

Chart of the week

Germany just announced that its economic growth slowed in the fourth quarter of 2019. Ongoing trade tensions and the slowdown in global economic growth have negatively impacted the German economy. Since the beginning of 2018, there has been a clear slowdown in economic growth in Germany. Manufacturing, one of the nation’s most important sectors, dropped markedly. Industrial production has also weighed on growth. Please tell us where you think the German economy is headed.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds fell 0.18% in January: Hedge funds down 0.18 per cent in January

Private equity’s success in the NBA: Private equity is dominating the NBA in 2020

The rise of direct lending: Following a decade-long uptick, direct lending continues to rise

Co-investment funds benefit from lower fees: Why co-investment funds outperform in private equity

BlackRock had US$298 billion in global flows in 2019: BlackRock steals top spot for 2019 global inflows from Vanguard

News and notes (Canada)

BMO introduces new ETFs: BMO launches 5 new ETFs

RBC iShares looking to launch three green ETFs: RBC iShares pushing further into ESG

Canadian DB plans returned 14% last year: Canadian DB funds generate second-highest returns in a decade: RBC

A look at who is driving the housing boom in Canada: Young, well-heeled immigrants drive Canadian housing boom

CFA Level 1 can be used in place of the CSC: CFA meets IIROC licensing standards

On the pulse – New frontiers in fintech

Banks are looking at partnerships with fintech firms: Fintech deals seen as innovation shortcut by financial institutions

A look at what may be next for fintech: Building the next stage of fintech

How to handle the expectations of the modern customer: Customer experience in the 2020s

Helping companies eliminate wasteful spending: Fintech startup Ramp aims to disrupt the corporate credit market

Could AI help boost retirement savings?: Tick, tick, tick…

Enhancing the popularity of Eno: Capital One doubles down on chatbot with new features and marketing

High-net-worth topics

Family offices are favouring private equity and real estate: Family offices disrupting traditional investment models

How advisors can attract the high-net-worth: 3 things the wealthy need from their advisors

Polls & surveys – What financials are saying

Debt can ruin relationships (Credit Canada): It’s not you, it’s your debt: couples call it quits over finances

Canadians are worried about a retirement savings shortfall (Scotiabank): More than half of Canadians fear not having enough for retirement, says poll

Canadians are delaying saving for retirement (Oaken Financial): Half of Canadians put off retirement saving, survey finds

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Tesla in overdrive

Why value may not bounce back as high as some think. Not so fast on a cashless society. Don’t assume that all high-net-worth individuals are the same. And much more in this week’s briefing.

Economic/industry news

U.S. economy added jobs in January: January adds a much stronger-than-expected 225,000 jobs, with a boost from warm weather

Canadian unemployment rate moved lower in January: Canada’s labour market picks up steam for second straight month

Why value may not bounce back as high as some think: Why value investors shouldn’t expect a ‘massive’ comeback

Why factor ETFs could become more popular: After trailing market, factor ETFs may shine in a low-return environment

Don’t overlook farmland as an asset class: A high-return, often overlooked, asset class is getting easier to invest in

Chart of the week

What a ride it’s already been in 2020 for Tesla Inc. Shares of the electric car company have risen almost 80% thus far in 2020, hitting an intra-day high of $969 on February 4. Why the huge run up in share price? Many believe the company should ramp up production in the coming years, while others believe it is rising on pure momentum and investors’ fear of missing out. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Two Sigma looking to attract outside investors for its private equity fund: Inside Two Sigma’s billion-dollar private-markets gambit

Not enough consistent data for ESG decisions: Why hedge fund managers say they avoid sustainable investing

Fund giant to enter private equity: Vanguard to enter private equity space

Future popularity of nontransparent ETFs unknown: Nontransparent ETFs: Transformational or just another product?

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: February 4 edition

News and notes (Canada)

TD launches real estate alternative fund: TDAM launches real estate fund

First Trust launches new ETF: First Trust launches buffer ETF

Horizons launches three total return ETFs: Horizons ETFs launches three new total return ETFs

ETFs inflows were $4.1 billion in January: Flows into Canadian ETFs top $4B for third straight month

Are annuities coming to the TFSA?: CLHIA recommends TFSAs be allowed to hold life annuities

Canadian DB plans rose 2.52% in the fourth quarter: Canadian DB plan returns rise in fourth quarter as equity markets rebound

On the pulse – New frontiers in fintech

The difficulty in completing a digital transformation: Digital transformation requires more than technology upgrades

Potential trends in data for 2020: Is data our most valuable commodity? 2020 data trends

Not so fast on a cashless society: Cashless shopping may be here … but a cashless society? Nah!

Considering the development of a cloud-based platform specifically for financial institutions: Goldman mulls industry-specific financial cloud

The state of cybersecurity: The state of the cyber security market, according to BlackBerry’s CTO

Silicon Valley Bank partners with Mastercard on virtual card launch: Silicon Valley Bank launches virtual cards in the UK

High-net-worth topics

Don’t assume that all high-net-worth individuals are the same: Avoid the ‘assumption trap’ with your high-net-worth clients

The importance of cash for the high-net-worth: Founder of investment club for ultra-wealthy sees value in cash despite Dalio calling it ‘trash’

Polls & surveys – What financials are saying

Bank customers receptive to digital advice (J.D. Power): Retail bank customers keen to receive advice digitally: study

More Canadians have RRSP accounts (BMO): RRSP account size rose in 2019, finds BMO study

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: China’s GDP

Due diligence key in offering PE to retail investors. Family offices’ top investments are private equity and hedge funds. SEC releases best practices for cybersecurity. And much more in this week’s briefing.

Economic/industry news

U.S. Federal Reserve Board held rates steady at 1.50%-1.75%: Fed holds rates steady, affirms commitment to higher inflation

USMCA signed into law in the U.S.: Trump signs new NAFTA into law, sealing political win

Negative debt still rising: World’s pile of negative debt surges by the most since 2016

Financial advisors should be proud of their role and impact: 17 reasons financial advisors should be proud of their profession

Why ETFs need fees: ETF issuers defend need for fees

Understanding the differences within ESG: Defining ESG investing and understanding its uses

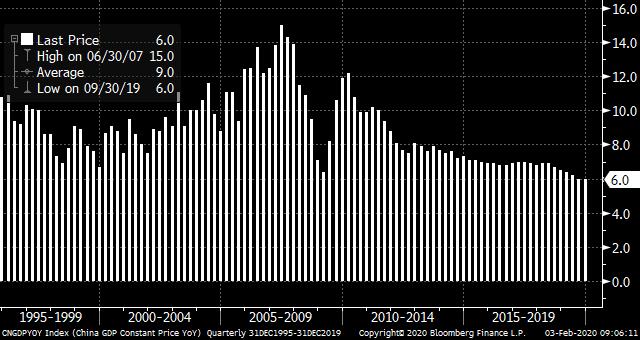

Chart of the week

In recent years, trade tensions with the U.S., weaker manufacturing and high debt levels have weighed on China’s economic growth. Now, the spread of the coronavirus could put further pressure on economic conditions in 2020. Many global companies such as Apple Inc. and Starbucks Corp. have temporarily shut down manufacturing facilities and stores in China. Given that the Chinese economy is such an important linchpin to global economic growth, what will the impact be on the global economy over the first and second quarters of 2020? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Interest in hedge funds still high: Investors pulled nearly $100 billion from hedge funds in 2019, but UBS insists popularity isn’t waning

Understanding private equity returns: Red flags in alluring private equity track records

Due diligence key in offering PE to retail investors: Private equity needs due diligence help to go mainstream

Sovereign wealth funds and pensions may invest more heavily in PE in 2020: Pensions and sovereign wealth funds to become more sophisticated investors in 2020

VC interest in cannabis was strong in 2019: Even as overall deals declined, VC investments in cannabis nearly doubled over 2019

Fractional share trading offered by Fidelity: Fidelity now offers fractional share trading

News and notes (Canada)

CIBC launches the CIBC Flexible Yield ETF: CIBC launches fixed-income ETF

CI launches three liquid alternative ETFs: New liquid alt ETFs launched by CI

Wealthsimple to launch ETFs: Wealthsimple to enter the ETF market

Congratulations to the FundGrade A+ award winners: 2019 Awards

On the pulse – New frontiers in fintech

Why financial institutions need to innovate to thrive: Innovation lessons that respond to fintech challenges

A framework for digital currencies: The global consortium for digital currency governance

SEC releases best practices for cybersecurity: SEC releases cybersecurity, data loss best practices

Why AI standards are needed: Market contemplates AI standards amidst regulatory pressures

New digital onboarding helping Schwab advisors: Schwab says advisors are embracing its new digital onboarding tool

High-net-worth topics

Family offices’ top investments are private equity and hedge funds: Private equity, hedge funds top among family office investments

The high-net-worth expect the bull market to continue: Tax planning a top concern for ultra-high-net-worth investors during election year, according to Tiedemann Advisors survey

Polls & surveys – What financials are saying

Advisors bullish on Canadian equities (Horizons): Advisors and investors optimistic about equities in 2020

Generation Z in the U.S. more willing to use credit cards (TransUnion): Generation Z racking up more card debt than millennials are in U.S.

Many Canadians don’t have a good understanding of the differences between RRSPs and TFSAs (TD): Many Canadians clueless about how TFSAs, RRSPs work

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Where’s oil going?

Activists are focusing on ESG. Is a digital currency on the way from central banks? Retirement plans are lagging the market. And much more in this week’s briefing.

Economic/industry news

The Canadian inflation rate was 2.2% in December: Inflation holds steady at 2.2% in December

The Bank of Canada held rates steady: Bank of Canada opens door to rate cut on persistent slowdown

Advisors need to understand human behaviour: When advisors don’t understand clients’ behaviours

Keep an eye out for these ESG trends in 2020: 5 ESG trends to watch for in 2020: MSCI

Are there potential opportunities in Japanese equities?: What’s driving Japanese equities

Why value investing could get a pick-up in a market downturn: How value investing helps investors weather volatility

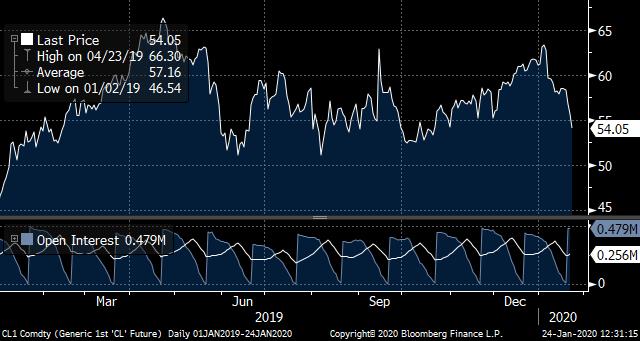

Chart of the week

Despite a volatile year, the price of oil rose in 2019. Production cuts and progress towards the phase-one trade deal between the U.S. and China contributed to the increase. However, oil prices dramatically fell in the new year, as global demand once again came into question in response to the outbreak of the coronavirus. Canadian energy companies are feeling the pinch from lower oil prices and additional headwinds, such as the uncertainty around the TransCanada pipeline. Will we see a broad-based improvement for Canada’s energy sector? Is government help on the way? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds returned 8.74% in 2019: Hedge funds up 8.74 per cent in 2019, says Eurekahedge

Activists focusing on ESG: Hedge fund activists pivot to ESG

Asian PE unit helping Morgan Stanley’s earnings: Morgan Stanley’s record results boosted by massive private equity coup in China

Seth Klarman finding opportunities in value stocks: Seth Klarman passionately defends value investing and said its time is coming again soon

Keep an eye on the operations: When it comes to hedge funds, don’t forget the operational side, says this industry veteran

News and notes (Canada)

Fidelity launches new ETFs: Fidelity Investments introduces new ETFs

Vanguard launches fixed income ETF: Vanguard launches new ETF

Purpose Advisor Solutions purchases advisor platform from Wealthsimple: Purpose Advisor Solutions to acquire Wealthsimple for Advisors

Wealthsimple launches cash account: Wealthsimple expands into everyday banking with new cash account

Net sales of ETFs were $4.6 billion in December: ETF sales surpass mutual fund sales in December

On the pulse – New frontiers in fintech

2020 may be a big year for fintech: Why 2020 is the year for fintech

Headwinds to the digital banking transformation: Why most digital banking transformation efforts have stalled

Still room for growth in adopting advanced analytics: Banks yet to fully adopt advanced analytics

Lots of potential for businesses with 5G technology: Open networks and the road to 5G

Is a digital currency on the way from central banks?: One in five people could have access to central bank digital currencies within three years

BMO to acquire Clearpool Group: BMO Financial to acquire fintech firm

High-net-worth topics

How the high-net-worth are invested to protect against a market downturn: Bloomberg radio interviews Tiger 21 founder on putting together an all-weather portfolio

The high-net-worth expect the bull market to continue: Wealthy investors see nothing that will stop this relentless bull market

Polls & surveys – What financials are saying

36% of investors expect global economic growth to improve in 2020 (BofA): Fund managers remain cautiously bullish: BofA survey

Retirement plans are lagging the market (University of Missouri): Even with an advisor, your retirement plan probably isn’t beating the market: survey

Canadians still prefer human advice (CIBC): Canadians prefer human advice for financial matters

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: The trillion dollar club

BlackRock will ask companies to disclose climate-related risks. The fintech industry could be squeezed by a market downturn. Private equities fundraising may decline in 2020. And much more in this week’s briefing.

Economic/industry news

The U.S. inflation rate was 2.3% in December: US consumer prices gain slightly; underlying inflation tame

China’s economy grew 6.0% (annualized) in the fourth quarter: China just reported its weakest annual growth in 29 years

JPMorgan’s outlook for alternative investments in 2020: What J.P. Morgan sees for hedge funds, real estate, other alt investments in 2020

ICE to enter ESG data business: ICE to launch ESG data service

Sustainable funds had flows of US$20.6 billion in 2019, setting a record: Sustainable fund flows smashed records in 2019: Morningstar

Chart of the week – The trillion dollar club

Alphabet (Google) surpassed a market capitalization of US$1 trillion last week, joining an exclusive club. So far, only tech firms have joined the club. Currently, three firms – Apple, Microsoft and Google – have trillion dollar valuations. Amazon hit the $1 trillion mark in 2019, but a subsequent decline in its share price pulled its market cap back to $929 billion. The next largest firms by market cap are Facebook and Berkshire Hathaway, but both have a long way to go in order to join the club.

Let us know who you think may be next?

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

A look at the hedge fund industry in December: State of the industry: December 2019

The keys to success of top-performing hedge fund managers: This is what sets top-performing hedge fund managers apart

PE fundraising may decline in 2020: After record-breaking 2019, US PE fundraising expected to dip in 2020

The evolving environment for traders: Bonus culture on Wall Street is coming to an end

BlackRock will ask companies to disclose climate-related risks: BlackRock makes climate change a top priority

News and notes (Canada)

Picton Mahoney completes acquisition of certain alternative fund assets from Vertex One: Picton Mahoney expands further into alternatives with acquisition

Canadian VC investment reached US$1.17 billion in 2019: Canadian VC investment had a record year in 2019

The TSX is set to release the S&P/TSX Cannabis Index: TSX sparks up new pot index

Mortgage borrowing slowed in November: Household credit growth slows in November

On the pulse – New frontiers in fintech

Learning from the new banking environment in China: The future of banking has arrived

Using technology to enhance the customer experience: Driving emotional transformation

Big firms are benefiting from fintech companies: How the largest firms depend on fintech startups

Reducing loan default risks using machine learning: How machine learning is reducing loan defaults and easing debt recovery

Understanding some of the limitations of personalization: How personalization strategies can backfire on financial marketers

Visa purchases Plaid: Visa buys financial technology company Plaid for $5.3B

The fintech industry could be squeezed by a market downturn: Bye-bye fintech

High-net-worth topics

Helping the high-net-worth access blockchain investments: Guiding HNW clients on blockchain investment options

Is now the time to sell a private, family-owned business?: Family-owned businesses urged to sell before the party ends

Polls & surveys – What financials are saying

Longer lifespan linked to education and income (StatsCan): Gains in lifespan, health not equal: StatsCan study

Less U.S. investors are worried about a recession (Allianz): U.S. investors’ concerns over market volatility eased in Q4: Allianz

Younger Canadians are spending more time worrying about money (Scotiabank): Millennials worry more about money than older Canadians: poll

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Spotlight on global manufacturing

What 2020 may look like for the retirement plan market. What customers consider when changing banks. Why growth in family offices may continue. And much more in this week’s briefing.

Economic/industry news

U.S. unemployment rate was unchanged in December: U.S. creates 145,000 jobs in December as hiring slows and wage growth softens

The Canadian unemployment rate was lower in December: December caps Canada’s second-best year for jobs since 2007

Possible investment themes to watch for in 2020: 10 hot investment themes for 2020

MSCI introduces 15 corporate bond indexes: MSCI introduces its first bond market indexes

The time is now for fiscal policy: Monetary policy no longer the best tool for supporting economic growth

How to position a portfolio for the upcoming year: Portfolio positioning in 2020

Chart of the week – Spotlight on global manufacturing

Global trade uncertainty has impacted many facets of the global economy, especially manufacturing. Manufacturing has seen a sharp slowdown around the world, which has negatively impacted economic growth. Major manufacturing nations, including the U.S., Canada, Japan, China and Germany, have all experienced weakness in this sector. Given the partial U.S.-China agreement announced near the end of 2019 manufacturing could experience a rebound and support stronger economic growth in 2020.

Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Agecroft’s predictions for the hedge fund industry in 2020: Top hedge fund industry trends for 2020

Hedge funds had strong performance in 2019: Hedge funds just saw strongest year since 2009, but lag stock market

Do poorer returns correlate with size?: Don’t blame bigger funds for disappointing private equity returns

Platinum Equity raises US$10 billion: Platinum Equity becomes latest PE heavyweight to raise $10B fund

What 2020 may look like for the retirement plan market: 2020 outlook for Plan Advisors

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: January 7 edition

News and notes (Canada)

Canadian underwriting grew in 2019: Canadian securities issuance rose in 2019

Risks to the Canadian economy: BoC governor says protectionism, housing market are risks

Looking at the delivery of investor disclosure documents: CSA launches consultation on investor disclosure

Canadian ETFs had $28 billion of inflows in 2019: ETFs outsell mutual funds for second straight year

On the pulse – New frontiers in fintech

What may be next for banks, credit unions and fintechs: Why fintech challengers may not conquer banking after all

What’s in store for the fintech industry: Ten years of fintech megatrends for the next decade

Technology forecast for 2020: 2020: A decade in technology

What customers consider when changing banks: The 4 things that matter most to consumers in selecting a new bank

Changes may be coming to the digital economy: Why the digital economy is set for a correction

YieldStreet partners with Citi to offer access to private credit markets: Citi partners with YieldStreet to offer investment opportunities to the masses

Many U.K. Millennials are using challenger banks: 1 in 3 millennials say their primary bank is a challenger

High-net-worth topics

Why growth in family offices may continue: Opportunities abound within the family office space

How the wealthy can protect their portfolios during times of geopolitical tensions: Tiger 21 founder addresses on Fox Business how to protect your portfolio from geopolitical risks

Polls & surveys – What financials are saying

The personality of an ETF investor (IFIC): ETF investors: well-informed and independent

How advisors can differentiate themselves (Morningstar and Mercer): 5 ways advisors can stay ahead of the competition

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: A look at the current equity run

What could be in store for the hedge fund industry in 2020? A look at the remarkable return of Bitcoin. A survey of some federal tax changes in 2020. And much more in this week’s briefing.

Economic/industry news

Canadian manufacturing pulls back in December: IHS Markit Canada Manufacturing PMI

China’s central bank reduces the reserve requirement ratio: China cuts banks’ reserve ratios again, frees up $115 billion to spur economy

Underwriting of global debt surged higher in 2019: A record year for global debt issuance

M&A activity across the world slowed last year: M&A activity declined in 2019

Millennials’ interest in ESG investing will impact markets: Millennials’ ESG investing will transform markets, DeVere Group says

Chart of the week – A look at the current equity run

What a decade it’s been for equities. The prolonged bull market has rewarded those investors who stayed the course with steady gains. Will the next decade bring more of the same, or are we due for a pullback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds’ performance fees fell in 2019: Hedge fund fees plummeted further in 2019

An overview of the mutual fund industry in 2019: Mutual funds scorecard: 2019 in review

What could be in store for the hedge fund industry in 2020?: 20/20 foresight for hedge funds in 2020?

Vanguard to offer free online trading for stocks and options: Vanguard joins the crowd, drops commissions on stocks and options trades

News and notes (Canada)

Will Ontario eliminate the DSC?: Investor advocate group expects Ontario to buckle on DSCs

A look at some federal tax changes in 2020: Lower taxes, new RRSP rules and digital news tax credit among 2020 changes

IIROC looking to support its dealer members: IIROC vows to support industry transformation

On the pulse – New frontiers in fintech

Some fintech predictions for the year ahead: Five fintech predictions for 2020, according to Kleiner Perkins

The path to becoming a digital institution: How to make your financial institution digital-first in 2020

Three trends in open source storage: Open source storage: driving intelligence in the small data sprawl era

A look at the remarkable return of Bitcoin: Bitcoin’s 9,000,000% rise this decade leaves the skeptics aghast

How fintech partnerships can help advisors: Taking a 2020 view of fintech in wealth management

High-net-worth topics

The number of high-net-worth individuals in Canada expected to grow: When it comes to wealth opportunity, Canada’s perfectly average

How the high-net-worth maintain their wealth across generations: 100 families’ secrets to staying wealthy for 100 years

Polls & surveys – What financials are saying

Canadians looking to eliminate debt in 2020 (CIBC): Getting out of debt remains Canadians’ top financial priority in 2020: poll

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: The inverted yield curve

A new way to analyze equity investment funds. Why smaller could be better for private equity. Many aspiring investors don’t know how to get started. And much more in this week’s briefing.

Economic/industry news

The Fed held its federal funds rate steady: Fed holds rates steady and indicates no changes through at least 2020

Canadian and U.S. consumers in much different positions: U.S. consumers buoy global economy, while Canadians face debt

A new way to analyze equity investment funds: Morningstar launches a new framework to analyze equity funds

Why advisors need to frequently review their pricing structure: Advisors need to regularly reassess their fees, TD Exec says

The need to cross boundaries to drive growth: Investment managers must cross boundaries, says Deloitte

Chart of the week

In late August, the two- and 10-year yield curve inverted, seeing its spread dip into negative territory. This inversion was brought on by concerns about the global economy in response to escalating U.S.-China trade tensions. This sparked fears that a recession was imminent as was the case with previous inversions. While the global economy has been sluggish, the U.S. and China appear to be closing in on a phase-one trade deal that might help reignite global growth. According to a recent report by Goldman Sachs, the possibility of a recession in 2020 is low. Will we see a recession in the next year or two? Or, will a recession be avoided and slow growth continue? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds rose 0.84% in November: Eurekahedge Hedge Fund Index up 0.84 per cent in November

Conversation with Stephen Schwarzman: Stephen Schwarzman doesn’t stop: An exclusive Q&A with Blackstone’s chief

Why smaller could be better for private equity: The truth about private equity fund size

A look at some year-end financial planning tips: Sixteen year-end financial planning tips

Remembering Paul Volcker: There’s the legend of Paul Volcker and the man I got to know

News and notes (Canada)

How Canada may benefit from the new USMCA: ‘A really good deal for Canada’: Former ambassadors on new NAFTA

Looking to eliminate redundancies in investor disclosure documents: IFIC asks CSA to reconsider fund disclosure rules

BoC Governor will not seek a second-term: Bank of Canada says Poloz will not seek a second term as governor

The potential impact from a higher tax-exempt basic personal amount: How the federal tax cut will impact clients

On the pulse – New frontiers in fintech

Banks should disrupt themselves before others do: How banking can avoid being disrupted in 2020 … disrupt themselves

Why partnerships are key for traditional and challenger banks: The growing trend of ecosystems within financial services

Preparing for augmented analytics: Augmented analytics: Are you ready?

Driving growth through new technology: Wealth manager using technology to drive next phase of growth

A look at the possible risks posed by BigTech firms entering the financial services industry: Rise of the machines: BigTech poses risks to financial system, FSB says

Helping businesses manage receipts: Metro Bank trials digital business receipts

High-net-worth topics

Why family offices should take a deeper look at sustainable investments: As high-net-worth families shift wealth to the next generation, family offices should lean in on sustainable investments

A look at the blockchain-related investments available to high-net-worth investors: Blockchain investment opportunities for HNW clients

Polls & surveys – What financials are saying

Many aspiring investors don’t know how to get started (IIROC): Aspiring investors don’t know where to find advice: survey

A look at Americans’ top financial priorities next year (Fidelity): Here are Americans’ financial goals for 2020: Fidelity

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday afternoon briefing: Small caps vs. large caps

A look at the top performing hedge fund strategies. The holdings of different generations. Europe is seeing a large increase in wearable payments. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held interest rates steady at 1.75%: Bank of Canada holds rates steady, citing ‘intact’ global recovery

Canada’s unemployment rate rose: Canada posts largest job loss since 2009 on full-time drop

U.S. labour markets were strong in November: Jobs growth surges in November, beating Wall Street expectations

Institutional investors’ looking to protect their portfolios: Global institutional investors sober as markets rally: survey

The challenges 2020 may bring: What headwinds do stocks face going into 2020?

Understanding the screening process of responsible investments: Lifting the veil on RI screening

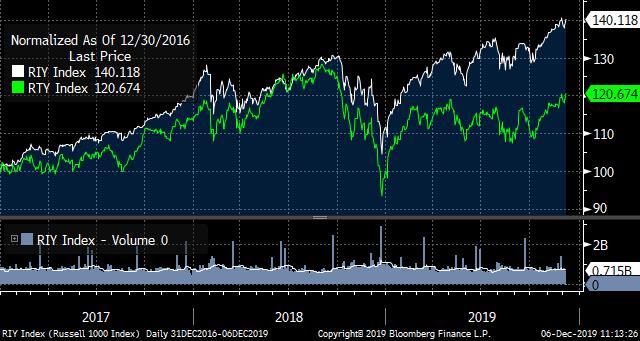

Chart of the week

Since the end of 2016, small-caps have underperformed large-caps, as measured by the Russell 2000 Index and Russell 1000 Index, respectively. It’s not surprising given global trade tensions and their influence on equity market volatility. Investors have largely turned to larger-cap securities given their relative safety. If the U.S. and China reach a phase-one trade pact, will small-caps stocks take the lead? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Helping first-time managers raise money: These firms are helping managers beat their private capital fundraising goals

A look at the top performing hedge fund strategies: Equity long bias strategy tops hedge fund performance in 2019

Co-CEO of Bridgewater to leave firm: Murray to leave Bridgewater Associates

J.P. Morgan launches new ETF: J.P. Morgan Asset Management expands BetaBuilders suite

News and notes (Canada)

Horizons completes its corporate class reorganization: Horizons reorganizes 44 ETFs as corporate-class funds

Novacap launches Novacap Financial Services I: Private equity firm Novacap launches financial services fund

PE activity in Canada has slowed in 2019: Canadian PE industry on pace for investment slump

Onto the next step for a bitcoin fund: 3iQ files preliminary prospectus for Bitcoin fund

On the pulse – New frontiers in fintech

How changing technology will impact banking in 2020: The biggest technology trends that will disrupt banking in 2020

How tech and analytics are helping PE companies: Progressive VCs and private equity are using tech and analytics to revolutionize investing

Why regulators need to accept fintech in the banking industry: BankThink Charter or not, fintechs are already ‘banking’

Broadridge launches new AI tool: Broadridge launches new AI and machine learning platform for reconciliation, matching and exception management operations

A spotlight on emerging cities and fintech: Global fintech ranking shows importance of emerging cities

Europe is seeing a large increase in wearable payments: Wearable payments show sharp rise in uptake

High-net-worth topics

European private equity firms eyeing technology investments: Why Europe’s wealthy are betting on tech like never before

Younger U.S. high-net-worth investors showing interest in ESG: Wealthy, young investors driving shift to ESG, Cerulli reports

How the 2020 tax changes may impact the wealthy in the U.S.: What wealthy clients need to know about 2020 tax changes

Polls & surveys – What financials are saying

A look at the holdings of different generations (Charles Schwab): Self-directed millennials invested more in cash, ETFs than older investors

Business leaders uncertain about the outlook for the Canadian economy (CPA): Survey uncovers growing pessimism about Canada’s economy

A look at the struggles facing those who entered the labour market during the financial crisis (RBC): The struggle really is real for young investors

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: 25 years of value vs. growth

Value versus growth over the past 25 years. Private debt fundraising down in 2019. Working on an approach to DSC. And much more in this week’s briefing.

Economic/industry news

Canadian GDP grew 1.3% in third quarter: Canada’s economy slows in third quarter even as demand jumps

Europe continues to favour active management: McKinsey: Where active management survives

There’s still a place for value investing: Has value investing stopped working?

Why small-cap stocks may be set to soar: Small may turn mighty as strategists see Russell strength ahead

M&A deals in financial services was US$57 billion in the third quarter: Financial sector M&A jumps in Q3, GlobalData

Why private equity can help a portfolio during a market downturn: Worried about a downturn? Consider private equity

Investors concerned about interest rates: Global investors cite interest rates as key portfolio risk: survey

Current market conditions may require a unique approach to active management: Revisiting active management and asset allocation

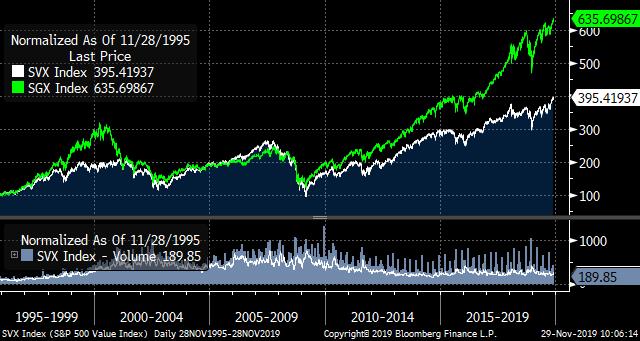

Chart of the week

Let’s look at value versus growth stocks on the S&P 500 Index since 1995. Toward the end of the 1990s and early 2000s, growth stocks surged higher in response to the dot-com bubble. After moving in lockstep until the 2008 financial crisis, growth stocks began outpacing value stocks. Is value investing in trouble or is it primed for a comeback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The Volcker Rule’s impact on hedge funds: The great hedge fund retreat

Private debt fundraising down in 2019: Against expectations, private debt fundraising saw a decline in 2019

The risks of unitranches: A booming corner of private credit has some investors on edge

Why it’s important to invest across vintages: In private equity, vintage diversification matters

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 26 edition

New rules proposed to make it easier for leveraged funds to come to market: SEC proposes new rule to ease the market entry of leveraged funds

Charles Schwab to purchase TD Ameritrade: Schwab to acquire TD Ameritrade in US$26-billion deal

Looking to allow private companies to raise money through a direct listing: NYSE proposes big change to direct listings

News and notes (Canada)

TD launches 10 new ETFs: TD Asset Management introduces new ETFs

CI takes stake in U.S. RIA firm: CI Financial buys US advisory firm

Canadian ETF assets rose to $192.3 billion in October: ETF sales rebound, mutual fund sales hold steady in October

Working on an approach to DSC: OSC decision on DSCs to come – eventually

Here are the winners from the Women in Wealth Management awards: Women in Wealth Management award winners revealed

IIROC provides updated guidance on AML requirements: IIROC steps up AML guidance

On the pulse – New frontiers in fintech

The importance of customer engagement: Reinventing retail banking customer experience in a digital world

How the entry of Big Techs into banking may impact fintech companies: Should ‘fintech’ fear big tech’s push into banking?

Customers are demanding a better digital experience: Banks losing customers who want seamless digital experiences

Why data science skills will be crucial for businesses to thrive: Analytics skills essential for business survival in ‘data decade’

The importance of IT infrastructure in developing AI capabilities: Big data LDN: Why you need to modernize your IT infrastructure for AI

Data analysis will be the focus in 2020: Why data will change the game again in 2020

Ant Financial looking to invest in the payments space: Ant Financial preps $1bn investment fund

New platform for independent advisors: Pascal Financial launches wealth management platform for advisors

High-net-worth topics

The wealthy want quality information from their advisor: What ultra high net worth clients want from wealth managers

The money habits of the rich: 5 things rich people do with their money

Polls & surveys – What financials are saying

During a recession, people want help from advisors (MDRT): Clients want you to help them through a recession: MDRT survey

Where are the female portfolio managers? (Goldman Sachs): Investment management is still a boys’ club: Goldman

Canadians are looking to eliminate debt (Manulife): Canadians agree they have too much debt

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 25, 2019

Could charities suffer from higher taxes for the wealthy? OSC introduces new recommendations to reduce regulatory burden. Some important points to know from Congress’ PE hearings. And much more in this week’s briefing.

Economic/industry news

The Canadian inflation rate was 1.9% in October: Canadian inflation holds steady at 1.9% in October, remains on target

Capturing your clients’ attention with a story: How storytelling bolsters financial plans & client relationships

Why alternative investments could benefit a portfolio in current market conditions: Fitting alternatives into a 60-40 portfolio

Global ETF assets continue to soar: Global ETF assets surpass $6T

A look at Morningstar’s sustainability ratings: Understanding Morningstar’s new sustainability ratings

Why private investments can help DC plans: DC plans need private investments, Neuberger Berman says

News and notes (U.S.)

Hedge funds experienced outflows in September: Hedge fund redemption trend extends to four months in September

Helping hedge funds with their cold-calling efforts: Match.com for hedge funds or low-rent telemarketing service? Cold-calling firm Murano Connect has many fans, but just as many detractors.