Monday morning briefing: How low can yields go?

Who does the data belong to? Start young to generate wealth. How to serve women’s financial needs. And much more in this week’s briefing.

Economic/industry news

The Fed announces an emergency rate reduction: Federal Reserve announces first emergency rate cut since the financial crisis

The BoC cut its rate by 50 basis points: Bank of Canada follows Fed with rate cut as virus fears mount

COVID-19 to impact trade activity: Coronavirus to become bigger trade barrier than U.S.-China spat

Institutional investors prefer private markets for investment: Institutional investors planning to allocate more to private assets: survey

Is a comeback due for value ETFs?: When will value ETFs emerge from their prolonged slump?

Chart of the week

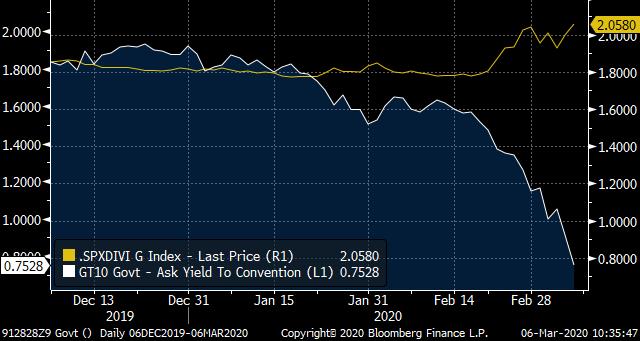

An emergency interest rate reduction by the U.S. Federal Reserve Board of 50 basis points, alongside an investor flight to safety, has pushed the 10-year U.S. Treasury yield to record-low levels. The S&P 500 Index was volatile again last week, as concern about COVID-19’s potential impact on the global economy was heightened. With equity prices falling, the dividend yield of the S&P 500 Index rose, and is now more than two times higher than the 10-year Treasury yield. How low can Treasury yields go? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Finding yield in private markets: Finding safe havens in private markets

Staying invested in the winners: PE firms are holding on to winners longer

Active fund managers’ returns relatively strong in February: Active fund managers outperformed as coronavirus shook stock market

Pershing adds two new fee options: Pershing announces subscription and zero-fee options for RIAs

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: March 3 edition

News and notes (Canada)

National Bank launches five new ETFs: National Bank introduces new ETFs

Invesco launches U.S. equity ESG ETF: Invesco ETF filters S&P 500 companies through ESG criteria

Banks reduce their prime rates: Several banks match Bank of Canada with 50-basis-point cut to prime interest rate

Understanding the RDSP: Common RDSP misconceptions

CWB expands presence in high-net-worth market: CWB buying T.E. Wealth and Leon Frazer from iA Financial

On the pulse – New frontiers in fintech

Who does the data belong to?: Fight over consumer data ownership pits banks against fintechs

Preparing to meet compliance standards: Transformative regulation finds its feet in 2020

The outlook for banking and capital markets, according to Deloitte: 2020 banking and capital markets outlook

Digital currency adoption could impact the U.S. dollar: ING economist: The US has most to lose in war of digital currencies

The challenges of succeeding in emerging markets: The unique challenges to scaling fintechs in emerging markets

Fintech sector being impacted by COVID-19: How coronavirus is disrupting the fintech sector

High-net-worth topics

Start young to generate wealth: It’s easier to become a millionaire if you’re a millennial – not in your 50s or 60s, says money expert

Improving your family office: 4 practical tips to transform your family office into a proactive organization

Polls & surveys – What financials are saying

How to serve women’s financial needs (CIBC): Tips for meeting women’s financial needs

Retirement savers not deviating from their plan (American College of Financial Services): Retirement investors staying the course despite coronavirus worries: survey