Monday morning briefing: China’s GDP

Due diligence key in offering PE to retail investors. Family offices’ top investments are private equity and hedge funds. SEC releases best practices for cybersecurity. And much more in this week’s briefing.

Economic/industry news

U.S. Federal Reserve Board held rates steady at 1.50%-1.75%: Fed holds rates steady, affirms commitment to higher inflation

USMCA signed into law in the U.S.: Trump signs new NAFTA into law, sealing political win

Negative debt still rising: World’s pile of negative debt surges by the most since 2016

Financial advisors should be proud of their role and impact: 17 reasons financial advisors should be proud of their profession

Why ETFs need fees: ETF issuers defend need for fees

Understanding the differences within ESG: Defining ESG investing and understanding its uses

Chart of the week

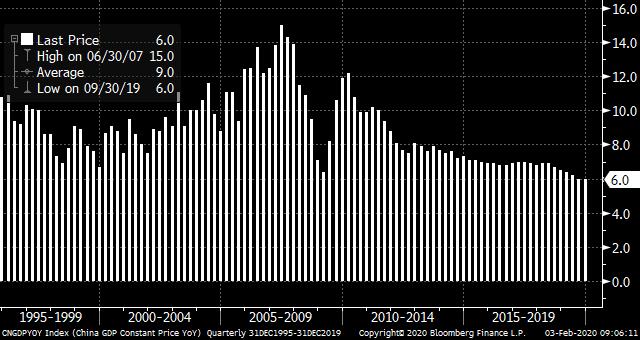

In recent years, trade tensions with the U.S., weaker manufacturing and high debt levels have weighed on China’s economic growth. Now, the spread of the coronavirus could put further pressure on economic conditions in 2020. Many global companies such as Apple Inc. and Starbucks Corp. have temporarily shut down manufacturing facilities and stores in China. Given that the Chinese economy is such an important linchpin to global economic growth, what will the impact be on the global economy over the first and second quarters of 2020? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Interest in hedge funds still high: Investors pulled nearly $100 billion from hedge funds in 2019, but UBS insists popularity isn’t waning

Understanding private equity returns: Red flags in alluring private equity track records

Due diligence key in offering PE to retail investors: Private equity needs due diligence help to go mainstream

Sovereign wealth funds and pensions may invest more heavily in PE in 2020: Pensions and sovereign wealth funds to become more sophisticated investors in 2020

VC interest in cannabis was strong in 2019: Even as overall deals declined, VC investments in cannabis nearly doubled over 2019

Fractional share trading offered by Fidelity: Fidelity now offers fractional share trading

News and notes (Canada)

CIBC launches the CIBC Flexible Yield ETF: CIBC launches fixed-income ETF

CI launches three liquid alternative ETFs: New liquid alt ETFs launched by CI

Wealthsimple to launch ETFs: Wealthsimple to enter the ETF market

Congratulations to the FundGrade A+ award winners: 2019 Awards

On the pulse – New frontiers in fintech

Why financial institutions need to innovate to thrive: Innovation lessons that respond to fintech challenges

A framework for digital currencies: The global consortium for digital currency governance

SEC releases best practices for cybersecurity: SEC releases cybersecurity, data loss best practices

Why AI standards are needed: Market contemplates AI standards amidst regulatory pressures

New digital onboarding helping Schwab advisors: Schwab says advisors are embracing its new digital onboarding tool

High-net-worth topics

Family offices’ top investments are private equity and hedge funds: Private equity, hedge funds top among family office investments

The high-net-worth expect the bull market to continue: Tax planning a top concern for ultra-high-net-worth investors during election year, according to Tiedemann Advisors survey

Polls & surveys – What financials are saying

Advisors bullish on Canadian equities (Horizons): Advisors and investors optimistic about equities in 2020

Generation Z in the U.S. more willing to use credit cards (TransUnion): Generation Z racking up more card debt than millennials are in U.S.

Many Canadians don’t have a good understanding of the differences between RRSPs and TFSAs (TD): Many Canadians clueless about how TFSAs, RRSPs work