Monday morning briefing: Where’s oil going?

Activists are focusing on ESG. Is a digital currency on the way from central banks? Retirement plans are lagging the market. And much more in this week’s briefing.

Economic/industry news

The Canadian inflation rate was 2.2% in December: Inflation holds steady at 2.2% in December

The Bank of Canada held rates steady: Bank of Canada opens door to rate cut on persistent slowdown

Advisors need to understand human behaviour: When advisors don’t understand clients’ behaviours

Keep an eye out for these ESG trends in 2020: 5 ESG trends to watch for in 2020: MSCI

Are there potential opportunities in Japanese equities?: What’s driving Japanese equities

Why value investing could get a pick-up in a market downturn: How value investing helps investors weather volatility

Chart of the week

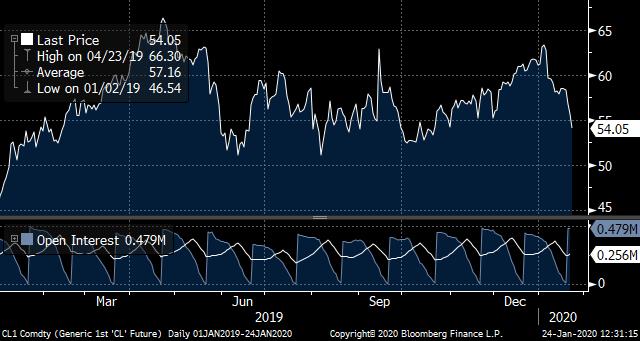

Despite a volatile year, the price of oil rose in 2019. Production cuts and progress towards the phase-one trade deal between the U.S. and China contributed to the increase. However, oil prices dramatically fell in the new year, as global demand once again came into question in response to the outbreak of the coronavirus. Canadian energy companies are feeling the pinch from lower oil prices and additional headwinds, such as the uncertainty around the TransCanada pipeline. Will we see a broad-based improvement for Canada’s energy sector? Is government help on the way? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds returned 8.74% in 2019: Hedge funds up 8.74 per cent in 2019, says Eurekahedge

Activists focusing on ESG: Hedge fund activists pivot to ESG

Asian PE unit helping Morgan Stanley’s earnings: Morgan Stanley’s record results boosted by massive private equity coup in China

Seth Klarman finding opportunities in value stocks: Seth Klarman passionately defends value investing and said its time is coming again soon

Keep an eye on the operations: When it comes to hedge funds, don’t forget the operational side, says this industry veteran

News and notes (Canada)

Fidelity launches new ETFs: Fidelity Investments introduces new ETFs

Vanguard launches fixed income ETF: Vanguard launches new ETF

Purpose Advisor Solutions purchases advisor platform from Wealthsimple: Purpose Advisor Solutions to acquire Wealthsimple for Advisors

Wealthsimple launches cash account: Wealthsimple expands into everyday banking with new cash account

Net sales of ETFs were $4.6 billion in December: ETF sales surpass mutual fund sales in December

On the pulse – New frontiers in fintech

2020 may be a big year for fintech: Why 2020 is the year for fintech

Headwinds to the digital banking transformation: Why most digital banking transformation efforts have stalled

Still room for growth in adopting advanced analytics: Banks yet to fully adopt advanced analytics

Lots of potential for businesses with 5G technology: Open networks and the road to 5G

Is a digital currency on the way from central banks?: One in five people could have access to central bank digital currencies within three years

BMO to acquire Clearpool Group: BMO Financial to acquire fintech firm

High-net-worth topics

How the high-net-worth are invested to protect against a market downturn: Bloomberg radio interviews Tiger 21 founder on putting together an all-weather portfolio

The high-net-worth expect the bull market to continue: Wealthy investors see nothing that will stop this relentless bull market

Polls & surveys – What financials are saying

36% of investors expect global economic growth to improve in 2020 (BofA): Fund managers remain cautiously bullish: BofA survey

Retirement plans are lagging the market (University of Missouri): Even with an advisor, your retirement plan probably isn’t beating the market: survey

Canadians still prefer human advice (CIBC): Canadians prefer human advice for financial matters