Monday morning briefing: Markets rise while economies struggle

Potential COVID-19 drug showed positive results. The keys to running a successful remote meeting. Could M&A be banned during the pandemic? And much more in this week’s briefing.

Economic/industry news

U.S. economic expansion ends: US GDP shrank 4.8% in the first quarter amid biggest contraction since the financial crisis

Europe’s GDP contracts: Europe’s economy just had its worst quarter since records began

Canada’s GDP unchanged in February: Canada’s GDP growth was already flat in February, StatsCan data shows

Fed keeps its central interest rate steady: Fed holds near-zero rate, Powell sees severe impact from pandemic

Investments in real estate could decline in 2020: Institutional investors set to pull back on real estate investments in 2020: survey

A look at the benefits of a merger arbitrage strategy: Five reasons why merger arbitrage is a must-own strategy

Five tips for investing during this crisis: T. Rowe offers 5 rules for investing during time of pandemic

People are turning to financial advisors for help: How a surprise pandemic reinforced the need for financial advice

Reasons for hope

Potential COVID-19 drug showed positive results: Gilead says early results of coronavirus drug trial show improvement with shorter remdesivir treatment

Some stories of human compassion: 5 uplifting stories of people showing up for each other during the coronavirus pandemic

Looking for faster tests: Federal government launches $500 million ‘Shark Tank’ style challenge to speed development of better coronavirus tests

Assisting your clients

How companies should plan for the future: How to plan your company’s future during the pandemic

Taking a proactive approach with clients: Acting, not reacting, during the pandemic

The keys to running a successful remote meeting: How to host remote meetings without chaos

Keeping track of actions by federal regulators: Better Markets launches COVID-19 regulatory tracker

Chart of the week

The S&P 500 Index, NASDAQ Composite Index and Dow Jones Industrial Average posted their strongest monthly returns in 20 years, after reaching multi-year lows in March as a result of the spread of COVID-19. All 11 sectors on the S&P 500 Index advanced, with over 90% of stocks on the index finishing higher. This comes despite a significant drop in economic activity across the U.S. and around the world. In the U.S., initial jobless claims continue to be in the millions, while first-quarter gross domestic product fell by 4.8%. Lower valuations and hope that economies will soon begin reopening boosted the performance of equity markets. Will the expectations of getting past this crisis drive market performance in May, or will investors demonstrate concern over weak incoming economic data? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Could M&A be banned during the pandemic?: Elizabeth Warren, Alexandria Ocasio-Cortez want mergers halted due to COVID-19

VC funds under pressure from the COVID-19 pandemic: VC funds face bigger risk than in financial crisis

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 29 edition

News and notes (Canada)

Oak Trust purchased by Raymond James: Investment firm Raymond James Ltd. acquires Oak Trust Co.

Horizons Canada makes changes to oil ETFs: Horizons announces effort to save troubled oil ETFs

Canadian DB plans had a significant decline in the first quarter: Canadian DB plans return negative 7.1% in first quarter

Canada’s fund industry lagging behind other countries in tax and regulations: Canada’s fund regulation, taxation falling short for investors: Morningstar

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Will Shopify rise above them all?

Leading your business out of the COVID-19 crisis. Helping businesses calculate the wage subsidy. The environment has benefited from widespread business shutdowns. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate falls to 0.9%: Inflation in Canada slows to lowest since 2015 on oil glut

Could COVID-19 change capitalism?: Leon Cooperman says the coronavirus crisis will change capitalism forever and taxes have to go up

Fitch expects the global economy to contract by 3.9% this year: Global economy takes harder hit: Fitch

COVID-19 could force change in the wealth management industry: We are in the midst of a ‘total reboot’ of wealth management

Prices for WTI crude went negative last week: Covid-19 cripples demand for oil

ESG investments may gain even more interest: COVID-19 will boost interest in ESG investing: Nuveen

Reasons for hope

60 uplifting stories you need to know: 60 positive news stories you may have missed during the coronavirus outbreak

Helping the families of front-line workers who have lost their lives: Fund to help the survivors of workers who die fighting COVID-19

How to help support COVID-19 relief efforts: Giving in the time of COVID-19

The environment has benefited from widespread business shutdowns: The surprise emerging from the pandemic

Assisting your clients

The increased importance of video conferencing: Zooming in on the remote workplace

Leading your business out of the COVID-19 crisis: Five keys to the decisive action you need to accelerate out of COVID-19

A look at how financial advisors can grow their business amid COVID-19: 3 ways to maintain and grow your financial advisory practice during the coronavirus crisis

Setting up bank branches post COVID-19: Retail banking reboot: How COVID will force branch changes for safety

Handling clients while in self-isolation (video): How advisors can manage their business in self-isolation

Brands should adapt to a new reality: Want to save your brand? Adapt now

Chart of the week

Last week, Shopify surpassed The Toronto-Dominion Bank to become the second-largest company in Canada. The company’s market capitalization passed $100 billion. The share price for the e-commerce platform has already risen approximately 69% so far in 2020, and the company’s website has seen a strong uptick in traffic since people began to stay home. Can Shopify surpass Royal Bank of Canada as the largest company in Canada in 2020? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Secondary market trading for private equity has slowed: Trading of private equity stakes will plummet this year

Tax benefits from the CARES Act: How the CARES Act impacts your clients’ taxes

Fidelity launches eight new thematic funds: Fidelity launches thematic funds with time-based fee discounts

Morningstar to purchase remaining 60% of Sustainalytics: Morningstar to take full control of Sustainalytics

News and notes (Canada)

CI Financial takes a position in Cabana Group: CI Financial acquires strategic interest in Cabana Group

Helping businesses calculate the wage subsidy: CRA launches wage subsidy calculator for employers

It was a tough market environment for hedge funds in Canada: Hedge fund wipeout in Canada leaves only 5 gainers in Q1

Mutual fund assets under management fell 10% in March: Mutual funds, ETFs lose assets in March

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Tech stocks that shine during COVID-19 crisis

Thank you for reading Monday Morning Briefing. For this edition, and going forward, we have decided to change the format of the briefing to provide you with relevant information you will need to weather the new realities we face today – and the challenges that will likely continue over the coming months. As small business owners ourselves, we know that access to timely news, human stories and tools to help you operate better, can be invaluable at times like these. Please let us know if you have any feedback on our new format or want more information on our stories. We want to hear from you, our readers.

Jillian Bannister, CEO

Richard Heft, President

Economic/industry news

The BoC kept its central interest rate at 0.25%: BoC sees risk of ‘structural damage,’ ramps up bond-buying

Economic growth in Canada slumped in March: Data indicate economy plunged in March: StatsCan

China’s GDP contracted over the first quarter: China says its economy shrank by 6.8% in the first quarter as the country battled coronavirus

The value of alternatives through volatile markets: Alternatives can smooth market bumps

Cash levels among fund managers rising: Fund managers at highest cash levels since 9/11: BofA survey

COVID-19 has resulted in more cashless payments: Contactless payments skyrocket because no one wants to handle cash

Reasons for hope

A look at the potential cures for COVID-19: Handicapping the most promising of 267 potential coronavirus cures

Private equity firms stepping up to help first responders and portfolio company employees: Private equity firms promise millions for coronavirus relief

Restaurant changes operations to help community: Vaughan restaurant now making hand-sanitizer, keeps staff employed

Assisting your clients

Generation Z reconsidering how they view money: Why COVID-19 is rebooting how Gen Z feels about money and banking

Best practices to follow when RIAs are working from home: Key tech steps for RIAs working from home

Eight principles to keep in mind with your marketing efforts in the current market environment: PR and marketing: How to communicate during COVID-19

It is important to remain in constant contact with your clients: Communicate with clients clearly and often, consultant says

Looking after yourself while working from home: Pandemic, stress and luxury

Chart of the week

Despite significant volatility in financial markets over the past two months, there have been a number of stocks that have performed well. Some stocks have benefited from higher expectations for sales given that more people are at home. Here are a few of these “stay-at-home” stocks, which have outperformed the broader market, even producing share price gains. Netflix Inc., Amazon.com Inc., Peloton Interactive Inc. and Zoom Video Communications Inc. are all seeing gains. As people eventually return to work, and social distancing measures are relaxed, what will be in store for the share prices of these companies? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The hedge fund industry experienced net outflows in February: Hedge funds see USD8.1bn in outflows in February

BlackRock raised US$5.1 billion for its latest alternative fund: BlackRock just closed its largest alternative fund yet

Allocators demonstrating cautious sentiment toward private market investments: Investors are cautious on private markets during shutdowns, Pitchbook survey shows

Investment funds experienced significant outflows in March: Funds saw largest ever exodus in March, Morningstar says

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 15 edition

News and notes (Canada)

Purpose Investments launches new fund: Purpose unveils new structured equity yield portfolio

A look at the federal government’s assistance programs: Understanding CERB, EI and the feds’ wage subsidy

CI Financial partnering with private-market investment company: CI Financial forges private-market investment partnership

IIROC is delaying fee collection: IIROC gives dealers a breather on fees

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: A look at the current equity run

What could be in store for the hedge fund industry in 2020? A look at the remarkable return of Bitcoin. A survey of some federal tax changes in 2020. And much more in this week’s briefing.

Economic/industry news

Canadian manufacturing pulls back in December: IHS Markit Canada Manufacturing PMI

China’s central bank reduces the reserve requirement ratio: China cuts banks’ reserve ratios again, frees up $115 billion to spur economy

Underwriting of global debt surged higher in 2019: A record year for global debt issuance

M&A activity across the world slowed last year: M&A activity declined in 2019

Millennials’ interest in ESG investing will impact markets: Millennials’ ESG investing will transform markets, DeVere Group says

Chart of the week – A look at the current equity run

What a decade it’s been for equities. The prolonged bull market has rewarded those investors who stayed the course with steady gains. Will the next decade bring more of the same, or are we due for a pullback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds’ performance fees fell in 2019: Hedge fund fees plummeted further in 2019

An overview of the mutual fund industry in 2019: Mutual funds scorecard: 2019 in review

What could be in store for the hedge fund industry in 2020?: 20/20 foresight for hedge funds in 2020?

Vanguard to offer free online trading for stocks and options: Vanguard joins the crowd, drops commissions on stocks and options trades

News and notes (Canada)

Will Ontario eliminate the DSC?: Investor advocate group expects Ontario to buckle on DSCs

A look at some federal tax changes in 2020: Lower taxes, new RRSP rules and digital news tax credit among 2020 changes

IIROC looking to support its dealer members: IIROC vows to support industry transformation

On the pulse – New frontiers in fintech

Some fintech predictions for the year ahead: Five fintech predictions for 2020, according to Kleiner Perkins

The path to becoming a digital institution: How to make your financial institution digital-first in 2020

Three trends in open source storage: Open source storage: driving intelligence in the small data sprawl era

A look at the remarkable return of Bitcoin: Bitcoin’s 9,000,000% rise this decade leaves the skeptics aghast

How fintech partnerships can help advisors: Taking a 2020 view of fintech in wealth management

High-net-worth topics

The number of high-net-worth individuals in Canada expected to grow: When it comes to wealth opportunity, Canada’s perfectly average

How the high-net-worth maintain their wealth across generations: 100 families’ secrets to staying wealthy for 100 years

Polls & surveys – What financials are saying

Canadians looking to eliminate debt in 2020 (CIBC): Getting out of debt remains Canadians’ top financial priority in 2020: poll

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Emerging markets equities poised for a comeback?

Why the 40 in 60/40 needs to change for investors. A look back at the decade in VC. The importance of data ethics. And is too much choice bad for advisors? These stories and much more in this week’s briefing.

Economic/industry news

Canadian inflation rate was 2.2% in November: Canadian inflation accelerates to 2.2%, core highest in a decade

The BoE holds Bank Rate steady at 0.75%: Bank of England keeps interest rates on hold

Why the 40 in 60/40 needs to change: Hey 60/40 investors: You need a new ‘40’

Three trends for investors and financial advisors: 3 trends investors and financial advisors should heed in 2020

Why corporate debt could be problematic for the global economy: China corporate debt flagged as ‘biggest threat’ to global economy

Chart of the week – Emerging markets poised for a comeback?

Let’s take a look at emerging markets stocks over the past five years. Emerging markets have underperformed developed markets over the past five years, particularly over the last couple of years as trade tensions intensified. As emerging markets countries are often export-heavy economies, the slowdown in the global economy has hurt performance. However, the partial trade agreement between the U.S. and China on December 13 has sparked a surge in performance among emerging markets equities. If trade tensions ease further and global economic growth ticks higher, will emerging markets equities gain traction and outperform developed markets? It may be time. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

A look at the hedge fund industry in November: State of the industry: November 2019

Risk-on sentiment among fund managers is back: Why fund managers are cranking up the risk

A look back at the decade that was in VC: VC’s decade in data: How the 2010s reshaped a market

Money market funds attracting a substantial amount of inflows: Investors favor money markets over stock and bond funds: Morningstar

Retail investors will gain more exposure to private markets: SEC votes to give retail investors more access to private markets

News and notes (Canada)

29 liquid alternative funds were launched in 2019: Fund managers have jumped into liquid alts, DBRS reports

Sun Life takes majority interest in InfraRed Capital Partners: Sun Life to expand infrastructure expertise with investment in InfraRed

What may be in store for Canadian alternative investments: A 2020 vision for Canadian alternative investments

A look at the changes to the Basic Personal Amount: New basic personal amount for 2020

On the pulse – New frontiers in fintech

Be prepared for a bigger adoption of mobile wallets: Why banks should care about mobile wallets (even if consumers don’t)

A look at some trends in cybersecurity for the year ahead: 10 cyber security trends to look out for in 2020

The importance of data ethics: Data ethics – what is it good for?

Why demand for regtech is expected to grow: Capital markets regtech in review

PayPal enters the Chinese payments market: PayPal completes GoPay acquisition, allowing payments platform to enter China

Why too much choice may be bad for advisors: Advisers are drowning in fintech choices

High-net-worth topics

UBS makes changes to its ultra-high-net-worth unit: UBS Group to revamp unit for ultra-high net worth clients

High-net-worth individuals are increasing their exposure to real estate, cash: Here’s where the wealthiest investors are finding opportunities

Polls & surveys – What financials are saying

Contributions to TFSA accounts grew in 2019 (BMO): Annual TFSA contributions up 10% on average: survey

74% of investors want financial advice from a human (IIROC): Investors prefer human advice: survey

The percentage of women directors on boards rose in 2019 (MSCI): Slow gains for female board membership: report

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday afternoon briefing: Small caps vs. large caps

A look at the top performing hedge fund strategies. The holdings of different generations. Europe is seeing a large increase in wearable payments. And much more in this week’s briefing.

Economic/industry news

The Bank of Canada held interest rates steady at 1.75%: Bank of Canada holds rates steady, citing ‘intact’ global recovery

Canada’s unemployment rate rose: Canada posts largest job loss since 2009 on full-time drop

U.S. labour markets were strong in November: Jobs growth surges in November, beating Wall Street expectations

Institutional investors’ looking to protect their portfolios: Global institutional investors sober as markets rally: survey

The challenges 2020 may bring: What headwinds do stocks face going into 2020?

Understanding the screening process of responsible investments: Lifting the veil on RI screening

Chart of the week

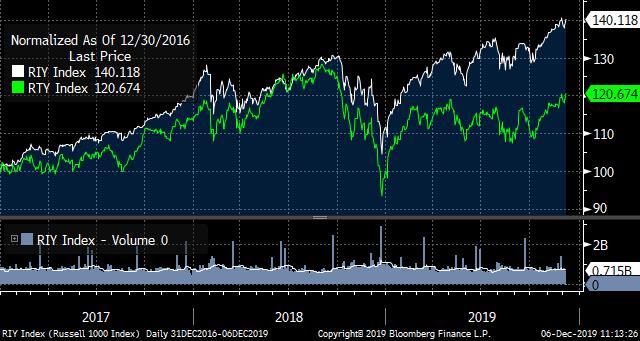

Since the end of 2016, small-caps have underperformed large-caps, as measured by the Russell 2000 Index and Russell 1000 Index, respectively. It’s not surprising given global trade tensions and their influence on equity market volatility. Investors have largely turned to larger-cap securities given their relative safety. If the U.S. and China reach a phase-one trade pact, will small-caps stocks take the lead? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Helping first-time managers raise money: These firms are helping managers beat their private capital fundraising goals

A look at the top performing hedge fund strategies: Equity long bias strategy tops hedge fund performance in 2019

Co-CEO of Bridgewater to leave firm: Murray to leave Bridgewater Associates

J.P. Morgan launches new ETF: J.P. Morgan Asset Management expands BetaBuilders suite

News and notes (Canada)

Horizons completes its corporate class reorganization: Horizons reorganizes 44 ETFs as corporate-class funds

Novacap launches Novacap Financial Services I: Private equity firm Novacap launches financial services fund

PE activity in Canada has slowed in 2019: Canadian PE industry on pace for investment slump

Onto the next step for a bitcoin fund: 3iQ files preliminary prospectus for Bitcoin fund

On the pulse – New frontiers in fintech

How changing technology will impact banking in 2020: The biggest technology trends that will disrupt banking in 2020

How tech and analytics are helping PE companies: Progressive VCs and private equity are using tech and analytics to revolutionize investing

Why regulators need to accept fintech in the banking industry: BankThink Charter or not, fintechs are already ‘banking’

Broadridge launches new AI tool: Broadridge launches new AI and machine learning platform for reconciliation, matching and exception management operations

A spotlight on emerging cities and fintech: Global fintech ranking shows importance of emerging cities

Europe is seeing a large increase in wearable payments: Wearable payments show sharp rise in uptake

High-net-worth topics

European private equity firms eyeing technology investments: Why Europe’s wealthy are betting on tech like never before

Younger U.S. high-net-worth investors showing interest in ESG: Wealthy, young investors driving shift to ESG, Cerulli reports

How the 2020 tax changes may impact the wealthy in the U.S.: What wealthy clients need to know about 2020 tax changes

Polls & surveys – What financials are saying

A look at the holdings of different generations (Charles Schwab): Self-directed millennials invested more in cash, ETFs than older investors

Business leaders uncertain about the outlook for the Canadian economy (CPA): Survey uncovers growing pessimism about Canada’s economy

A look at the struggles facing those who entered the labour market during the financial crisis (RBC): The struggle really is real for young investors

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: 25 years of value vs. growth

Value versus growth over the past 25 years. Private debt fundraising down in 2019. Working on an approach to DSC. And much more in this week’s briefing.

Economic/industry news

Canadian GDP grew 1.3% in third quarter: Canada’s economy slows in third quarter even as demand jumps

Europe continues to favour active management: McKinsey: Where active management survives

There’s still a place for value investing: Has value investing stopped working?

Why small-cap stocks may be set to soar: Small may turn mighty as strategists see Russell strength ahead

M&A deals in financial services was US$57 billion in the third quarter: Financial sector M&A jumps in Q3, GlobalData

Why private equity can help a portfolio during a market downturn: Worried about a downturn? Consider private equity

Investors concerned about interest rates: Global investors cite interest rates as key portfolio risk: survey

Current market conditions may require a unique approach to active management: Revisiting active management and asset allocation

Chart of the week

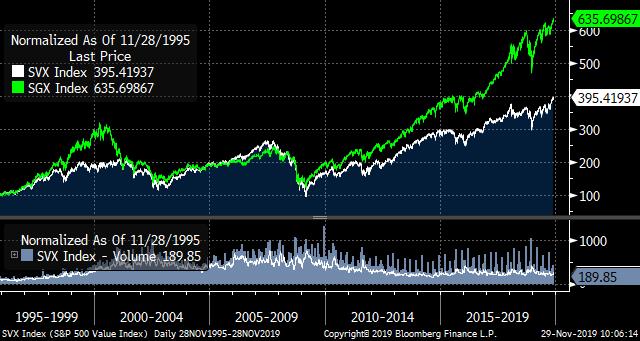

Let’s look at value versus growth stocks on the S&P 500 Index since 1995. Toward the end of the 1990s and early 2000s, growth stocks surged higher in response to the dot-com bubble. After moving in lockstep until the 2008 financial crisis, growth stocks began outpacing value stocks. Is value investing in trouble or is it primed for a comeback? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The Volcker Rule’s impact on hedge funds: The great hedge fund retreat

Private debt fundraising down in 2019: Against expectations, private debt fundraising saw a decline in 2019

The risks of unitranches: A booming corner of private credit has some investors on edge

Why it’s important to invest across vintages: In private equity, vintage diversification matters

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 26 edition

New rules proposed to make it easier for leveraged funds to come to market: SEC proposes new rule to ease the market entry of leveraged funds

Charles Schwab to purchase TD Ameritrade: Schwab to acquire TD Ameritrade in US$26-billion deal

Looking to allow private companies to raise money through a direct listing: NYSE proposes big change to direct listings

News and notes (Canada)

TD launches 10 new ETFs: TD Asset Management introduces new ETFs

CI takes stake in U.S. RIA firm: CI Financial buys US advisory firm

Canadian ETF assets rose to $192.3 billion in October: ETF sales rebound, mutual fund sales hold steady in October

Working on an approach to DSC: OSC decision on DSCs to come – eventually

Here are the winners from the Women in Wealth Management awards: Women in Wealth Management award winners revealed

IIROC provides updated guidance on AML requirements: IIROC steps up AML guidance

On the pulse – New frontiers in fintech

The importance of customer engagement: Reinventing retail banking customer experience in a digital world

How the entry of Big Techs into banking may impact fintech companies: Should ‘fintech’ fear big tech’s push into banking?

Customers are demanding a better digital experience: Banks losing customers who want seamless digital experiences

Why data science skills will be crucial for businesses to thrive: Analytics skills essential for business survival in ‘data decade’

The importance of IT infrastructure in developing AI capabilities: Big data LDN: Why you need to modernize your IT infrastructure for AI

Data analysis will be the focus in 2020: Why data will change the game again in 2020

Ant Financial looking to invest in the payments space: Ant Financial preps $1bn investment fund

New platform for independent advisors: Pascal Financial launches wealth management platform for advisors

High-net-worth topics

The wealthy want quality information from their advisor: What ultra high net worth clients want from wealth managers

The money habits of the rich: 5 things rich people do with their money

Polls & surveys – What financials are saying

During a recession, people want help from advisors (MDRT): Clients want you to help them through a recession: MDRT survey

Where are the female portfolio managers? (Goldman Sachs): Investment management is still a boys’ club: Goldman

Canadians are looking to eliminate debt (Manulife): Canadians agree they have too much debt

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 25, 2019

Could charities suffer from higher taxes for the wealthy? OSC introduces new recommendations to reduce regulatory burden. Some important points to know from Congress’ PE hearings. And much more in this week’s briefing.

Economic/industry news

The Canadian inflation rate was 1.9% in October: Canadian inflation holds steady at 1.9% in October, remains on target

Capturing your clients’ attention with a story: How storytelling bolsters financial plans & client relationships

Why alternative investments could benefit a portfolio in current market conditions: Fitting alternatives into a 60-40 portfolio

Global ETF assets continue to soar: Global ETF assets surpass $6T

A look at Morningstar’s sustainability ratings: Understanding Morningstar’s new sustainability ratings

Why private investments can help DC plans: DC plans need private investments, Neuberger Berman says

News and notes (U.S.)

Hedge funds experienced outflows in September: Hedge fund redemption trend extends to four months in September

Helping hedge funds with their cold-calling efforts: Match.com for hedge funds or low-rent telemarketing service? Cold-calling firm Murano Connect has many fans, but just as many detractors.

Hedge funds preparing for a trade deal: Hedge funds are buying stocks exposed to US-China trade on hopes for a deal

Louis Bacon to close hedge funds: Billionaire Louis Bacon is closing legendary hedge fund to clients

Some important points to know from Congress’ PE hearings: 4 key takeaways from Congress’ private equity hearing

Two Sigma raises US$1.2 billion for first PE fund: Two sigma is getting into private equity

A brokerage powerhouse could be in the works: Charles Schwab in talks to buy TD Ameritrade, create brokerage giant: report

Still some concern from SEC on non-transparent ETFs: Fresh concerns raised on novel ETF structure

News and notes (Canada)

Evolve launches new ETF: Evolve launches high interest savings account ETF

iA Clarington launches new segregated funds: iA Financial expands seg fund lineup

The Financial Planning Association of Canada was launched: New association aims to elevate financial planning

OSC introduces new recommendations to reduce regulatory burden: OSC says firms will save millions in compliance costs

Capital growth being driven by real estate: Outside housing, Canadian capital growth is near a 60-year low

On the pulse – New frontiers in fintech

Fintech trends to watch for in 2020: Top fintech trends entrepreneurs must watch in 2020

Fintech needs principles-based regulation: Fintech regulation needs more principles, not more rules

The five trends you need to know for digital banking transformation: Top 5 digital banking transformation trends shaping 2020

A look at regtech’s impact on compliance: How regtech is transforming compliance

Making the most of customer analytics: How to maximise insight from your customer analytics

Teaching the ethics of AI: Scotiabank to train execs on AI ethics

PayPal purchases Honey Science Corporation: PayPal to acquire shopping and rewards platform Honey for $4B

Essential Portfolios lowers its minimum investment: TD Ameritrade lowers minimum for robo-advisor accounts

What’s in store for digital currencies: The high stakes of the coming digital currency war

Fidelity gets licence for its virtual currency business: Fidelity granted licence to operate virtual currency business in New York state

High-net-worth topics

A look at key-person insurance: How to protect your business from upheaval if the owner suddenly dies

Could charities suffer from higher taxes for the wealthy?: Tax the wealthy and their charities will suffer

The wealthy are looking for a secure location to store their precious metals: World’s rich are rattled and looking for old-fashioned security

Polls & surveys – What financials are saying

Millennials have a better understanding of fixed income’s role in a portfolio (BNY Mellon): Millennials understand fixed income better than do older investors: survey

Canadians’ concerned about the stock market, economy (IG Wealth Management): Canadians’ financial confidence dims: IG survey

Many Canadians are worried about outliving their retirement savings (Sun Life): 72% say retirement isn’t what they expected

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – November 11, 2019

U.S. PE funds’ capital raising reaches record high. Businesses looking to Canada for expansion. U.S. institutional investors are turning to liquid alternative ETFs. And much more in this week’s briefing.

Economic/industry news

Canada’s unemployment rate was 5.5% in October: Canadian economy lost 1,800 jobs in October, unemployment rate steady

The BoE held rates steady at 0.75%: Sterling falls after Bank of England split on interest rate cut

Expecting weaker growth in Europe: Eurozone forecast for long period of weak economic growth

How to access private markets: Smart ways to access private capital markets

U.S. institutional investors are turning to liquid alternative ETFs: Use of liquid alternative ETFs on the rise among institutional investors: study

Why defined contribution plans can benefit from alternative investments: Fundamental reasons for adding alternatives to DC pension portfolios

A look at Morningstar’s new rating system: Morningstar rolls out new ratings system

News and notes (U.S.)

Hedge funds returned 0.4% in October, according to HFR: Hedge funds in positive territory in October, says HFR

How technology can help hedge funds manage their operating expenses: Technology can act as a growth enabler to help hedge funds cope with increased margin pressures

U.S. PE funds’ capital raising reaches record high: Private equity fundraising in the US hits all-time high

Private equity investment model shifting: The shifting nature of private equity

Fidelity launches new funds: Fidelity rolls out four thematic funds

The SEC is looking to make changes to its advertising rule: SEC issues plan to modernize RIA ad rules

News and notes (Canada)

iA announces fund and ETF launches: iA Clarington launches new fund, adds ETF versions of existing funds

CI acquires asset management firm: CI Financial acquires WisdomTree’s Canadian business

Tracking cannabis stocks: Pot indexes to launch this month

ETFs in Canada saw inflows of $3.5 billion in October: Canadian equities ETFs had a ‘stellar’ October

On the pulse – New frontiers in fintech

Improving data security measures: 3 steps banks & credit unions should take as data privacy gets hotter

How active managers can benefit from machine learning: Can machine learning help active managers outperform passive peers?

How fintech will help the “underbanked”: The ‘underbanked’ is the next trillion-dollar opportunity in fintech

Looking at what’s in store for the fintech industry: The future of fintech

Employees must also accept digital transformation: Digital transformation will flop if you don’t also transform staff

Charles Schwab is looking to eliminate forms: Schwab’s plan to kill forms and expand integrations

Selling through messaging platforms: The convergence of messaging apps and payments

Canadian banks take interest in Mylo: Canadian banks invest in spare change app Mylo

What a single digital currency could mean for the finance industry: How worldwide digital currency adoption could change the finance sector

A look at Canadians’ awareness of bitcoin: Bitcoin awareness no guarantee of ownership, finds BOC

High-net-worth topics

The high-net-worth need to protect against debt too: Why ultra-high-net-worth clients need a financial cushion

The total wealth of billionaires fell in 2018: Billionaire wealth declines in 2018

Polls & surveys – What financials are saying

Expect weaker investment returns in the future (JP Morgan): Weak global growth ahead, J.P. Morgan says

Businesses looking to Canada for expansion (HSBC): Foreign businesses eyeing Canada for expansion: report

U.S. advisors are bullish on the industry (Schwab): Advisors are (mostly) upbeat about the future: Schwab

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 28, 2019

Will active managers become more activist? A look at volatility in the private markets. Interest in impact investing continues to rise. And much more in this week’s briefing.

Economic/industry news

The ECB held its central interest rate steady: ECB holds rates at historic lows as Mario Draghi waves farewell to Frankfurt

Canadian retail sales dropped in August: Retail sales fell slightly in August, Statistics Canada reports

Why growth has outperformed value: The real reason value has been lagging growth

A look at what will impact markets over the next few decades: Aging population top global investment trend, institutional investors say

Interest in factor investing on the rise: Factor investing strategies becoming more popular for fixed income: survey

Will active managers become more activist?: A Wall Street revolution: Why active fund managers have ‘stopped yawning and started flexing their muscles’

Gold’s comeback: The story behind gold’s resurgence

News and notes (U.S.)

A look at the hedge fund industry in September: State of the industry: September 2019

Hedge funds have experienced net redemptions in 2019: Hedge fund industry sees 6th consecutive quarter of outflows

Charles Schwab launches the Schwab Alternative Investment Marketplace: Schwab launches alts marketplace for advisors

Jeffrey Vinik closes hedge fund: Billionaire investor Jeffrey Vinik closes hedge fund less than a year after its relaunch

A look at volatility in the private markets: KKR: Private markets are much more volatile than they appear

U.S. executives believe M&A activity will be better next year: US M&A remains resilient despite market fears

A look at ETF flows in 2019: Where the ETF money flowed in 2019

News and notes (Canada)

Picton Mahoney to acquire funds from Vertex One: Picton Mahoney gains five funds from Vertex One

New ETF from Mackenzie: Mackenzie launches emerging markets bond ETF

Mutual funds were in favour in September: Mutual fund sales soared in September

A look at the possible financial impact from a Liberal minority government: How a Liberal minority government could help, or hit, Canadians’ wallets

Learn about the head of the Canada Infrastructure Bank: A profile of Janice Fukakusa, chair of the Canada Infrastructure Bank

On the pulse – New frontiers in fintech

How finance can benefit from AI: What can AI and big data do for finance?

Four principles to launch unique products: 4 crucial steps to transform banking products for a fintech world

Partnership formed to launch fintech research unit: Fintech research unit founded by AMF, Finance Montreal

Why improving the onboarding process is crucial: Research shows banks could lose $22.75bn to slow onboarding

Alberta Investment Management Corp. using AI to predict stock price movements: Institutional investors turning to AI, data science to improve processes, yield alpha

Using API to better your business: How can organizations take advantage of the API economy?

Cyberattack discovered, focused on institutional investors: Cyber attack hits prominent hedge fund, endowment, and foundation

Wealthscope launched to help investors look at total portfolio diversification: New tool to help those accumulating and decumulating retirement assets

WealthBar acquires Snap Projections: WealthBar deepens financial-planning commitment with acquisition

Is there a place for blockchain in fintech?: Blockchain: Is it the future of fintech?

High-net-worth topics

The high-net-worth in the U.K. are concerned about the political landscape: Politics is more worrying than Brexit for Britain’s wealthy

Wealthy executives have specific needs from a financial advisor: What high-earning executives need, and aren’t getting, from advisors

A look at the world’s ultrawealthy: Who are the ultrawealthy? These charts will give you an idea

Polls & surveys – What financials are saying

Interest in impact investing continues to rise (American Century): US, UK millennials embrace impact, ESG investing: Survey

Lacking knowledge of fixed income securities (BNY Mellon): Survey reveals severe lack of awareness on fixed income

Canada falling behind in dealing with climate risk (FTSE Russell): Canada’s climate readiness gets a thumb-down

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – October 21, 2019

Digital-only banks succeeding through a robust customer experience. ESG adoption by institutional investors may be slowing. Venture capital mega-deals continue to grow. And much more in this week’s briefing.

Economic/industry news

Canada’s inflation rate was 1.9% in September: Canadian inflation holds steady at 1.9%, core measures inch up

China’s economic growth slowed in the third quarter: China says its economy grew 6% in the third quarter, slower than expected

Retail sales in the U.S. declined: U.S. retail sales dip 0.3% in September

The end of the 60/40 portfolio?: Bank of America says 60-40 portfolios are dead. They’re right

Show a bit of pessimism towards a trade deal: Morgan Stanley tells stock bulls not to kid themselves on trade

The IMF predicts weaker economic growth in 2019: Global conflicts could lead to weakest growth since 2008: IMF

News and notes (U.S.)

The Eurekahedge Hedge Fund Index declined 0.30% in September: Hedge funds down 0.30 per cent in September

A look at hedge funds’ favourite research firms: The research hedge funds want to pay for

Why private markets will continue to flourish: The company of the future is private

How debt financing companies are attracting businesses: How debt financing is adapting to compete with equity financing

VC mega-deals continue to grow: 2019 on pace for another $100B invested as VC exit value tops $200B for the first time [datagraphic]

A look at how much the U.S. green economy is worth: America’s ‘green economy’ is now worth $1.3 trillion

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: October 15 edition

News and notes (Canada)

Waypoint launches liquid alternatives fund: Liquid alternatives: The Waypoint All Weather Liquid Alternative Mutual Fund

Desjardins launches ETF portfolios: Desjardins adds ETF portfolios to its roster

National Bank launches the NBI Unconstrained Fixed Income ETF: National Bank launches fixed-income ETF

Canaccord Genuity expands into Australia: Canaccord Genuity to acquire Australian firm for $23.3 million

Canadian M&A activity down in the third quarter: Mergers and acquisitions slow in third quarter: report

Michael Lee-Chin discusses the challenges impacting advisors: Adapt or become irrelevant, Lee-Chin warns advisors

On the pulse – New frontiers in fintech

Using technology to focus on consumer engagement: Digitizing banking is all about engagement and CX, not ‘tech’

Digital-only banks succeeding through a robust customer experience: Look to your customers for the key to banking success

Searching for innovative new technology: Where do incumbents look for game-changing innovation?

Canadians’ use of fintech on the rise: More Canadians using fintech, in spite of privacy concerns

The majority of U.K. financial institutions are using machine learning technology: Machine learning advancing in financial sector – Bank of England

Emerging challenger banks can be found all around the globe: Some challengers really are challenging … but not where you’re looking

Appealing to wealthier millennials: How upscale millennials’ money views impact their banking habits

How to keep up with regulatory change: How to approach modern regulatory change management in financial services

NatWest piloting a fingerprint credit card: Technology-based banking products launched

A look at what technologies are impacting advisors most: 10 female leaders share top tech trends that’ll change your practice

High-net-worth topics

Millennials’ wealth is expected to grow: There are more than 600,000 millennial millionaires in the US, according to report

What a wealth tax could mean for the high-net-worth: Explaining a wealth tax to clients

Polls & surveys – What financials are saying

Preparing portfolios for an economic slowdown (Aviva): Proceed with caution on asset allocation: report

ESG adoption by institutional investors may be slowing (RBC): Survey finds ESG adoption tapering off among institutional investors

There may not be a global recession until 2021 (HSBC): Global recession unlikely until 2021: HSBC

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – September 23, 2019

A bitcoin yield fund for the high-net-worth. Private equity and venture capital outperforming public equities. Why international co-operation is needed to combat cybercrime. And much more in this week’s briefing.

Economic/industry news

The Fed reduced its central interest rate: Fed lowers interest rate by a quarter-point, and is open to the idea of more easing

Canadian inflation rate was 1.9% in August: Canadian inflation slows to 1.9% on lower gas, vegetable prices

The BoE held its Bank Rate steady at 0.75%: Bank of England holds rates, warns another Brexit delay could hurt economic growth

The BoJ kept its key interest rate at -0.10%: BOJ keeps policy steady, signals chance of easing in October

A look at how liquidity affects an ETF’s trading costs: Why liquidity matters in ETF cost minimization

Does the value of benchmark data justify the cost?: Fund managers seek more insight from benchmark data

News and notes (U.S.)

Hedge fund net exposure at highest level since 2018: Goldman: Hedge fund exposure to stock market at 15-month high

A conversation with Josh Harris on private markets: Apollo’s Josh Harris talks private markets at delivering alpha

PE and VC outperforming public equities: Private equity outperforms and captures institutional flows

Private equity net cash flow was over US$150 billion in 2018: Eight years in the black for private equity cash flows

Vanguard to launch Digital Advisor: Vanguard preparing to offer digital-only robo-advisor

Rockefeller Capital eyes Silicon Valley: Rockefeller Capital buys wealth firm for Silicon Valley rich

The Fed took action in money markets for first time in a decade: Fed intervenes in money markets for first time in 10 years

Looking for more customized target-date funds: Interest rising in active/passive hybrid strategies for TDFs

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: September 17 edition

News and notes (Canada)

Horizons launches the Horizons Growth TRI ETF Portfolio: Horizons ETFs expands lineup of portfolio ETFs

CI Investments launches ESG funds: CI introduces debut ESG funds

Combining mutual funds and ETFs could be beneficial: Mutual funds and ETFs in harmony

Canada ranks “below average” in fund costs, according to Morningstar: Canada rates poorly in Morningstar survey of mutual fund costs

Foreign investors moving out of Canadian securities: Foreign investors continue to divest Canadian securities

On the pulse – New frontiers in fintech

Five fintech trends to watch in 2020: Five trends shaping fintech into 2020

How to navigate through customers’ fear of open banking: Open banking scares customers, but they want what APIs can deliver

A look at Canadians’ comfort with AI: How Canadians feel about AI in financial services

We’re in the early innings of AI’s impact on the financial services industry: The beginning of the road for AI in finance, the best is yet to come

Building a branch as an advice centre: Transforming branches into advice centers: The long road ahead

How technology is impacting capital markets: Buyers’ brief: Fintech drives capital markets

Why international co-operation is needed to combat cybercrime: Cyber-crime best tackled by international co-operation

Arab Bank launches custody and brokerage services for digital assets: Leading Swiss private bank launches full suite of digital asset services

High-net-worth topics

Family offices incorporating ESG principles: Wealthy families pour fortunes into $31 trillion ESG opportunity

A bitcoin yield fund for the high-net-worth: Wealth manager launches world-first bitcoin yield fund

Polls & surveys – What financials are saying

38% of fund managers expect a recession over the next year (Bank of America Merrill Lynch): Recession fears among fund managers rise to highest level in a decade

Immigration wage gap impacting Canada’s economy (RBC): Immigrant wage gap costing Canada $50 billion a year in GDP: RBC study

Millennials are starting to save early (E*Trade): Young investors are doin’ it for the ‘Gram

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – August 26, 2019

What’s impacting value investing? Why is 5G important to businesses? Why are CRM2 disclosures still confusing investors? Which cities have the most ultra-high-net-worth individuals? These and many more questions are answered in this week’s briefing.

Economic/industry news

Canadian inflation rate at 2.0% in July: Inflation holds steady at 2%, tempering case for rate cut

U.S. manufacturing contracts in August: Manufacturing sector contracts for the first time in nearly a decade

The Fed wasn’t unanimous in its decision to cut rates: Fed officials divided over July rate cut, minutes reveal

A look at what may be impacting value investing: Grantham Mayo: What’s gone wrong with value investing?

Interest in asset management jobs high: More people than ever want to be in asset management, CFA data shows

It’s not only about the shareholders: Top U.S. CEOs rethink the meaning of shareholder value

News and notes (U.S.)

Hedge fund assets growing, despite redemptions: Hedge funds still seeing outflows, but performance boosts AUM

Hedge funds don’t believe that the U.S. economy is headed for a recession: Hedge funds aren’t betting on a recession, Goldman data show

The stronger the conviction, the stronger the return: For short bets, higher conviction = higher returns

Using social media to research alternative firms: PE and hedge funds are targets of social media sleuthing, suggest survey

The orthopedic space garnering a lot of attention from PE: This joint is jumping: PE firms knee-deep in orthopedic space

Unicorn exits in the U.S. may set a record in 2019: Unicorn exits are booming in 2019. Will it last?

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: August 20 edition

News and notes (Canada)

Investors still don’t fully understand what they are paying for: Report finds investors still confused by CRM2 disclosures

Goldman Sachs invests in Canadian alternatives firm: Goldman Sachs unit invests in Toronto-based Slate Asset Management

The Ontario Teachers’ Pension Plan surpassed $200 billion in assets: Ontario Teachers’ Pension Plan returns 6.3% in H1

IIROC plain language rulebook to be instituted next year: New IIROC rulebook approved for June 2020

On the pulse – New frontiers in fintech

A look at how banks can benefit from adopting AI: AI advantages in banking grow, adding pressure for broad adoption

A culture change is needed to fully leverage new technology: AI is not a technology change but a cultural one

How retailers are benefitting from fintech: 5 ways retailers are adapting to fintech revolution

Helping baby boomers retire: Fintechs need to help baby boomers boom

How fintechs can stay relevant: The longevity of challenger banks

How banks may evolve to help clients in their daily lives: The bank of the future will have data vaults and money vaults

A look at why 5G will be so important: What 5G really means for your business

Visa launches new security services to protect banks and merchants: Visa launches security suite

Revolut to focus on the business banking sector with expense management tool: Revolut targets business banking market

JPMorgan Chase to discontinue Chase Pay: Chase Pay app shut down

High-net-worth topics

The next generation may move their assets to other firms: Trillions in HNW assets up for grabs in years ahead

These are the cities with the most ultra-high-net-worth individuals: Where the ultra-wealthy live in the United States

The high-net-worth are using 529 plans to reduce income and estate taxes: How high earners are maximizing this unique tax loophole for education funding

401(k) millionaires rose in the second quarter: The number of 401(k) millionaires hits an all-time high

Polls & surveys – What financials are saying

Canadians need assistance on how to use the TFSA (RBC): Many Canadians unsure how to use TFSAs to build wealth: RBC poll

Majority of U.S. economists expect a recession (National Association for Business Economics): Almost three-quarters of American economists expect a recession by end of 2021

Advisors benefit from outsourcing investment management (AssetMark): How outsourcing investment management can benefit advisors: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Upcoming macroeconomic events – August/September

Do you write or edit portfolio manager commentaries? Do you want to stay on top of the macroeconomic events that shape your day-to-day life as a financial services marketer?

If so, here are the big macro events that the ext. team is keeping an eye on over the coming weeks.

- Canada will announce its inflation rate for July on August 21. In June, Canada’s inflation rate fell to 2%, partly as a result of a decline in gasoline prices and a slowdown in shelter as well as clothing and footwear. Despite the slowdown in June, the inflation rate has crept higher in 2019, largely in response to higher food prices

- Canada’s gross domestic product (“GDP”) growth rate for the second quarter will be announced on August 30. In the first quarter, Canadian GDP grew 0.4% annualized, a slight improvement from 0.3% in the last quarter of 2018. GDP growth was led by consumer spending in the first quarter. However, real estate investment fell for a fifth consecutive quarter. Markets are hopeful that the Canadian consumer remained strong in the second quarter, while recent positive real estate news contributes, rather than impedes, economic growth

- The Bank of Canada (“BoC”) will announce its interest rate decision on September 4. The BoC’s benchmark overnight interest rate currently stands at 1.75%. At its most recent meeting in July, the BoC stated that the current level of its central interest rate is “appropriate.” However, the BoC does see some weakness in the Canadian and global economies as a result of continued trade tensions. The BoC will closely monitor how trade disputes are impacting the Canadian economy before any future interest rate decisions

- Also on September 4, the U.S. balance of trade for July will be announced. The U.S. trade deficit narrowed slightly from US$55.5 billion to US$55.2 billion in June, partly as a result of a reduction in imports. The trade deficit with China also narrowed. Given persistent trade tensions with China, markets will carefully monitor the results from this announcement

- On September 12, the European Central Bank (“ECB”) will announce its interest rate decision. At is last meeting on July 25, the ECB held its central interest rate steady at 0.00%. The ECB gave a more cautious tone, citing concerns about the slowing global economy. Furthermore, the ECB expects its rates to remain steady or even lower until at least the first half of 2020, hoping to push inflation up towards its target. The ECB is prepared to take measures to provide the European economy with more monetary stimulus, if needed

For investment commentary support (including monthly and quarterly commentaries, as well as MRFPs), contact us today at 1.844.243.1830 or info@ext-marketing.com.

Top ESG trends in 2019, and beyond

The popularity of investment products managed through an environmental, social and governance (ESG) lens continues to grow. And the ESG space is evolving to fit the needs of increasingly diverse investors – both retail and institutional.

The biggest change we’ve seen in the past few years is the growing recognition that the ESG investment approach isn’t going away and that the old tropes about weaker performance have been proven incorrect.

Although predictions about the direction of ESG abound, there are a few core themes about the future of this space that we’ve identified during our work with investment professionals across North America.

Brand and governance beats financials

According to an Ocean Tomo study, approximately 83% of a company’s share price on the S&P 500 Index in 1975 was based on tangible assets, meaning things like past earnings results, real estate and equipment. This meant that a company’s reputation didn’t matter nearly as much to its stock price as its last quarter’s earnings results.

In 2015, a full 84% of a company’s valuation was based on intangible assets, meaning things like brand, intellectual property, goodwill and reputation. And this number has continued to rise since 2015. What this tells us is that, today, it’s more important to maintain a strong reputation and brand, and to be viewed in a positive light, than to simply have a solid quarter.

Why does this matter in the context of ESG trends? Because ESG screens – particularly those that focus on governance – are specifically designed to improve performance by screening out companies that are at higher levels of reputational risk for any number of reasons.

Increasing access to information

The top trend in the ESG space is access to – and reliance on – different data sources for ESG research and investment direction.

In the past, investment managers usually had access to one or two sources of ESG research/information that they would base their investment decisions on. Today, many investment managers pull information from multiple leading sources including Bloomberg, Dow Jones, Morningstar and MSCI, which all offer different, but meaningful, ESG insights based on largely unique methodologies.

This additional information is being leveraged by many of the largest asset managers around the world as they build out their ESG-related product shelf and service offering.

With more information comes more regulations

Although there’s an increasing amount of information available in the ESG space, not all of it is created equal.

Given the amount of money flowing into this space, guidelines as to how information is gathered and distributed have been driving providers of this information to follow stricter parameters. Regulators want to ensure the information being provided comes as advertised based on an agreed-upon framework.

Transparency isn’t just a good idea

Investors no longer blindly assume company management will always make the right decisions to drive their company’s valuation higher. Weak governance has repeatedly been shown to detract from share prices.

As stock prices continue to be driven less by financials and more by intangibles like brand and governance, investors are demanding corporate leadership avoid decisions that negatively impact their investments’ longer-term performance.

Company leadership is taking notice of this demand, with c-suite executives and board members being replaced faster when missteps occur. Diversity is also continuing to grow in company management, as this is what is widely expected by investors today.

These are just a few changes unfolding in the ESG space. We’re seeing many other trends as well, including better marketing and evolving sales opportunities, and we’d be happy to discuss them with you.

If you’d like to learn more about the trends driving ESG growth (and how you can benefit from those trends), contact us today at 1.844.243.1830 or info@ext-marketing.com.

Upcoming macroeconomic events – July/August 2019

Do you write or edit portfolio manager commentaries? Do you want to stay on top of the macroeconomic events that shape your day-to-day life as a financial services marketer?

If so, here are the big macro events that the ext. team is keeping an eye on over the coming weeks.

- The European Central Bank (“ECB”) will announce its interest rate decision on July 25. The ECB held its benchmark refinancing rate at 0.00% at its most recent meeting in June, citing concerns about weak inflation and slower global economic growth. At that meeting, the ECB indicated it would not be raising its central interest rate until the second half of 2020 at the earliest. Since then, trade uncertainty, Brexit risks and weakness in the European economy has the ECB considering further stimulus to the European economy, if warranted

- On July 26, the U.S. will announce its advanced estimate of second quarter gross domestic product (“GDP”) growth. In the second quarter, GDP growth was 3.1%, an improvement over the 2.2% in the fourth quarter of 2018. U.S. GDP may remain relatively strong as personal spending and exports appear robust, which may offset some weakness in business investment

- The U.S. Federal Reserve Board (“Fed”) will announce its interest rate decision on July 31. On June 19, the Fed kept the target range for its federal funds rate steady at 2.25% to 2.50%. The Fed took a more cautious tone and hinted at a possible rate cut as a result of trade tensions with China and a slowdown in global economic growth. Investors are expecting an interest rate reduction at this meeting

- Canada’s balance of trade for June will be announced on August 2. Surprisingly, Canada’s trade balance turned positive in May, seeing a surplus of $760 million. This came despite slowing global economic growth and continued trade uncertainty. How trade restrictions from China and slowing demand for some commodities affected Canada’s trade balance will be closely watched by investors

- On August 9, Canada’s unemployment rate for June will be announced. The unemployment rate rose to 5.5% in June, slightly above the 40-year low of 5.4% reached in May. The unemployment rate rose as employment decreased by 2,000. The Canadian economy has seen a large increase in jobs being added throughout 2019, and is looking for a rebound from the decline in June

For investment commentary support (including monthly and quarterly commentaries, as well as MRFPs), contact us today at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – July 15, 2019

Hedge funds are changing their fee structures. A new climate change index from FTSE Russell. Turning the branch into an advice center. And much more in this week’s briefing.

Economic/industry news

The BoC held its rate steady at 1.75%: Poloz flags growing trade risks but keeps rates firmly on hold

The U.S. inflation rate fell to 1.6% in June: Consumer prices edge up in June, CPI shows, but inflation is still quite tame

Canadian housing starts rose to 246,000 in June: Canadian housing starts rise in June: CMHC

The debt ceiling may need to be raised by September: U.S. debt ceiling fears surface in “kink” in Treasury bill yield curve as drop-dead date approaches

A new climate change index from FTSE Russell: FTSE Russell launching climate change index for sovereign bonds

MSCI to provide ESG ratings on funds and ETFs: MSCI adds ESG ratings to 32,000 funds and ETFs

New guidelines on performance reporting from the CFA Institute: CFA Institute unveils new global investment standards

A look at the benefits of using multifactor ETFs: Why use multifactor ETFs?

News and notes (U.S.)

A look at the hedge fund industry in June: State of the industry – June, 2019

Hedge funds soared higher in the first half of 2019: Hedge funds post best first half in decade

Will there be a rebound in PE-backed exits?: Will US PE exits make up for lost time in the second half of 2019?

PE funds selling at a premium: The private equity funds selling for more than they’re worth

Charles Schwab adds more funds to its commission-free ETF platform: Schwab adds 25 ETFs to commission-free platform

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: July 9 edition

News and notes (Canada)

CIBC purchases U.S. investment banking firm: CIBC signs deal to buy Milwaukee-based boutique investment bank Cleary Gull

RBC purchases WayPay: RBC buys accounts payable specialist WayPay

Mercer and Wealthsimple partner to create a savings and advice solution: Mercer partners with Wealthsimple for digital investing solution

Canadians finding it difficult to move into higher income brackets: Canadian families are increasingly stuck in their income niche, StatsCan finds

Canadian ETFs experienced outflows in June: ETF flows flat in June as investors get defensive

On the pulse – New frontiers in fintech

A look at five fintech trends: Here is a look at where fintech is leading us and why

Understanding the bank-fintech partnership: Banks and fintech partnerships: A clash of extremes

Banking customers still demand human contact: Financial services customers set to embrace AI but human contact still vital

Turning the branch into an advice center: Branches should be advice centers, but are banks ready?

Creating highly personalized products and services: The market of one

Keeping AI ethical in corporate finance: Preventing unethical use of AI in corporate finance transactions

Advisors should be adopting new technologies: Why more advisors are embracing financial planning technology

JPMorgan enters robo-advice arena: JPMorgan rolls out robo-advisor

High-net-worth topics

The way the wealthy spend their money may be surprising: How do the wealthy spend their money?

The net worth of high-net-worth individuals fell: Wealth declines among the global rich after seven years of growth

A look at some traits of billionaires: The secrets of self-made billionaires

Polls & surveys – What financials are saying

Hedge funds are changing their fee structures (AIMA): Hedge funds replacing ‘2 and 20’ with more flexible fees: study

U.S., Canadian and Japanese investors typically hold their investments for over four years (Schroders): U.S. investors most patient, and demanding, in world, study says

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – July 8, 2019

Bitcoin’s volatile June may impede the possibility of an ETF. Funds-of-hedge funds are making a comeback. Ontario to get 50 more cannabis retail stores. 5G technology will enhance digital banking capabilities. And much more in this week’s briefing.

Economic/industry news

The Canadian unemployment rate rose to 5.5% in June: Canada’s jobs market pauses in June after monster start to year

The unemployment rate in the U.S. rose to 3.7% in June: Hiring rebounds as U.S. economy adds 224,000 jobs in June, unemployment rate inched up to 3.7 percent

Global equity issuance slow in the first half of 2019: Global equity issuance dives in the first half, Refinitiv reports

State Street launches ESG money market fund: State Street Global Advisors launches its first ESG money market fund

Christine Lagarde will become president of the ECB: Christine Lagarde: Key issues she must address at the ECB

Will more tariffs come to the EU?: U.S. proposes more tariffs on EU goods in Airbus-Boeing dispute

MSCI plans to add Kuwait to its emerging markets index: MSCI set to classify Kuwait as emerging market, subject to certain conditions

News and notes (U.S.)

Funds-of-hedge funds are making a comeback: They’re baaaaack: The investment that’s making an unlikely comeback

Europe’s interest in alternative investments growing: Interest in alternative investments on the rise in Europe

PE firms looking to raise US$1 trillion in fundraising efforts: Private equity seeks almost $1 trillion globally

Venture capitalists keeping a keen eye on companies that move people and things: Wheeling & dealing: In 2019, VCs can’t stop funding mobility startups

Fixed income ETFs see record inflows in June: Fixed income ETF inflows surpassed $25B during June

Understanding the rules of Reg BI: SEC’s Reg BI adds unexpected fiduciary hurdle for retirement advisors

News and notes (Canada)

Canadian banks meeting global regulatory standards on net stable fund ratio: Reports find Canadian banks meet global standards

Ontario to get 50 more cannabis retail stores: Ontario to issue 50 new cannabis store licences, eight to go to First Nations

Value of Canadian defined benefit pension plans stable in the second quarter: Strong equity market performance helped DB plans in Q2

Project Reconciliation preparing bid for the Trans Mountain pipeline: Indigenous group says Trans Mountain bid could be ready next week

On the pulse – New frontiers in fintech

Using data to drive the personalized customer experience: Digital changes customer engagement playbook for financial institutions

New associations will be important to drive fintech forward: We’re all in this together – The Value of associations in fintech

5G technology will enhance digital banking capabilities: Banking in 5G: Why financial marketers should care (now)

A look at the challenges and opportunities of AI in banking: AI in banking: The pitfalls and opportunities (research paper)

Understanding Intelligent Spend Management: Intelligent Spend Management and the evolution of procurement

Here are 10 payment start-up companies that you need to know about: 10 payments start-ups to watch

NatWest experiments with live chats on mobile, tablet and PC: NatWest trials video banking service for business customers

Online payment startups are focusing on these sectors: What sectors do online payment startups try to target?

Giving businesses unlimited access to their PayPal account: PayPal launches its first UK debit card with unlimited cash back for businesses

Bitcoin’s volatile June may impede the possibility of an ETF: Bitcoin’s wild June is ‘slam dunk’ against crypto ETF approval

High-net-worth topics

Ways business owners can save for retirement: Eight things business owners can do to build up funds for after retirement

Financial planning for families with assets in multiple countries: Cultivating foreign clients

How insurance can mitigate some of the risk for high-net-worth investors: The secret key to protecting your client’s wealth

Polls & surveys – What financials are saying

Professional accountants are bullish on the Canadian economy (CPA): Business leaders feel better about the economy: survey

Canada’s economic growth is dependent on global economic conditions (Russell Investments): Canadian economy not immune to outside forces: report

Why India might be a good source of investment returns (Manulife): Investors chasing higher returns can’t skip India, Manulife says

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Tuesday morning briefing – July 2, 2019

Spotting a financial bubble. The rising stars of the hedge fund industry. The benefits of advisors adopting technology. The affluent market is expected to grow. And much more in this week’s post.

Economic/industry news

U.S. GDP growth confirmed at 3.1% in the first quarter: US economy grew at a solid 3.1% rate in the first quarter

Optimism regarding small– and medium–sized businesses in the U.S. waning: Optimism hits nine-year low at U.S. small, midsize companies

Spotting a financial bubble: Can you spot a bubble before it bursts?

What’s hurting value investing: Two suspects behind value’s apparent death

New climate change indices announced: MSCI launches climate change indexes: Portfolio products

The number of global IPOs declined in the first half of the year: A weak first half for global IPOs, EY reports

News and notes (U.S.)

Forward Redemption Indicator was 3.81% in June 2019, lower than June 2018: SS&C GlobeOp Forward Redemption Indicator at 3.81 per cent for June

Equity leverage rising fast for hedge funds: Hedge funds boost equity leverage at fastest rate in three years

Alternative investment managers expect moderate economic growth for 2019: Alternative investment professionals bullish on prospects for remainder of 2019

A look at the most powerful hedge fund managers: The 10 most powerful hedge fund managers this year

The rising stars of the hedge fund industry: Hedge funds might be under scrutiny – but these rising stars are their future

Will Vanguard enter private equity space?: Vanguard mulling move into private equity: report

Another strong year for PE cashflows: Global PE cashflows eye eighth consecutive year in the black

U.S. tech firms reduced hiring in China amid trade dispute: Silicon Valley cools Chinese growth plans during trade war

Average wage earners having difficulty purchasing a home in many U.S. markets: Homebuying difficult for Americans in three-fourths of markets

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: June 25 edition

News and notes (Canada)

Mutual funds experienced $719 million of net sales in May: Mutual fund sales rebound, despite retreat in AUM, IFIC reports

Steve Hawkins takes over as board chair for the Canadian ETF Association: CETFA welcomes new board chair

Advisor title reform to be reviewed by new provincial regulator: FSRA to lead advisor title reform, while OSC works on other reforms

Tax proposal could hurt Canadian ETFs: Tax proposals get pushback from ETF industry

On the pulse – New frontiers in fintech

Wall Street is learning from Silicon Valley: Wall Street is taking cues from Silicon Valley to innovate fintech

The top trends in retail banking: The Top 5 retail banking technology trends of 2019 (so far)

Why it’s imperative that traditional banks adopt AI usage: Banking brands can’t keep pace with digital giants without AI

What is Facebook’s future in fintech?: Facebook’s Libra cryptocurrency is the future of fintech

Consumer use of fintech growing: More than half of global consumers use fintech

The benefits of advisors adopting technology: Five ways advisors can leverage technology

Welcome to the new Chase retail branch: Chase makes bold statement with stunning new flagship branch

Helping VCs make investment decisions: VCs double down on data-driven investment models

A look at how the investment banking industry can benefit from AI: How AI could shape the future of investment banking

High-net-worth topics

The affluent market is expected to grow: The growing promise from affluent individuals

How to respond to the traits of wealthy investors: 12 surprising traits of the wealthy

Sotheby’s to merge with BidFair USA: Sotheby’s goes private: What it means for the art market

Polls & surveys – What financials are saying

U.S. investor confidence falling (Wells Fargo/Gallup): Investors are battening down the hatches for a recession: Wells Fargo

Geopolitical and market risks affecting the outlook for institutional investors (Manulife): Uncertainty clouding institutional investor outlook: report

Canadians trust financial advisors for their retirement planning (Fidelity): Advisors top list of retirement planning resources: survey

A look at the contributors to growth in robo-advice (BMO): ETFs played a role in robo growth, fee-based shift: report

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing – June 24, 2019

Can the Fed Chairman be replaced? How geopolitical risks impact emerging markets. Facebook is planning a new cryptocurrency. Advisors are preparing for a possible recession. Plus much more news in this week’s briefing.

Economic/industry news

The Fed holds steady, raises expectations of rate cut: Fed holds rates steady, but opens the door for a rate cut in the future

The Bank of England kept its Bank Rate steady at 0.75%: BOE warns on global economic outlook as it holds rates steady

The inflation rate in Canada rises to 2.4% in May: Canadian ‘inflation is back’ as rate rises most since October

Can Fed Chairman Powell be replaced?: Trump believes he has the authority to replace Powell at Fed

The impact of geopolitical risk on emerging markets investments: Geopolitical tensions high on investors’ list when examining emerging markets

News and notes (U.S.)

Hedge funds fell 0.71% in May: Eurekahedge Hedge Fund Index down 0.71 per cent in May

Hedge fund redemptions were US$9.4 billion in April: Hedge fund redemptions slow in April

Paulson & Co. to exit London: John Paulson’s hedge fund scales back operations

Goldman Sachs increasing its PE presence: Goldman Sachs looks to become the next private equity giant