Monday morning briefing: Bitfarms mining for success on the NASDAQ

The wait for a U.S.-based Bitcoin ETF continues. The SEC once again delayed a decision to approve a Bitcoin ETF, citing concerns over the lack of oversight in cryptocurrencies. The SEC will seek further public comments on the proposed VanEck ETF to be listed on the Cboe. The deadline to respond was extended into July. Many hoped the Bitcoin ETFs listed in Canada and their market activity would have a positive impact on the SEC’s views, but that doesn’t appear to be the case.

Economic/industry news

The Fed holds steady, but signals earlier-than-expected rate hikes: The Fed moves up its timeline for rate hikes as inflation rises

Canada’s inflation rate 3.6% in May: Inflation jumps to 3.6% in Canada, highest since 2011

The global labour market is still challenged: Millions of missing jobs should make inflation hawks think twice

Why vaccine distribution will be the most important economic policy: Vaccines will be the ‘most important’ economic policy this year, IMF chief says

Fund managers do not believe higher inflation will be sustained: Is higher inflation here to stay? Fund managers don’t think so

Janet Yellen wants financial services firms to prepare for a shift away from Libor: Treasury Secretary fears the attack of the bad interest rate benchmarks

Reasons for hope

Strong results for Novavax’s COVID-19 vaccine: Novavax COVID shot highly effective against variants in trial

The time is now to see your doctor: The COVID-19 pandemic may be easing: Why now is a good time to see your doctor

Regeneron’s COVID-19 treatment may help save lives: Regeneron antibody ‘cocktail’ can save lives in hospitalized COVID patients, study finds

Adapting your business

Projecting the right image: 3 ways entrepreneurs can project the right image to their clients

Closing the deal: 10 useful phrases for getting clients to commit

Using “Fintwit” creatively: Stimulus checks, Elon Musk and crypto memes: How Douglas Boneparth is using twitter like no other financial advisor

Handling the tough question about fees: Answering ‘How much do you charge?’

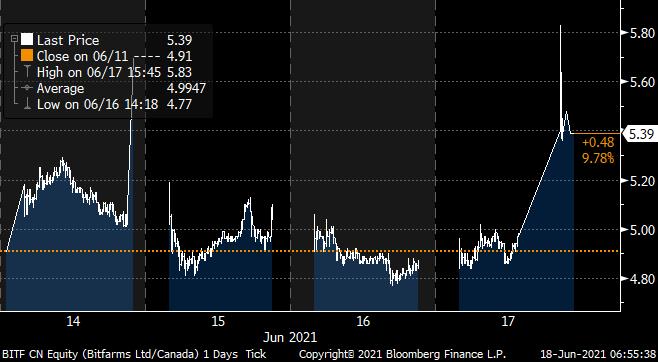

Chart of the week: Bitfarms mining for success on the NASDAQ

Bitfarms Ltd. received Depository Trust Company (“DTC”) eligibility on June 17, and its common shares will be listed on the NASDAQ Composite Index beginning on June 21. The Bitcoin mining company, headquartered in Quebec, will still maintain its listing on the TSX Venture Exchange. Bitfarms’ shares surged higher in response to its NASDAQ listing. The NASDAQ listing will bring more investor attention to the company. Despite concern over Bitcoin’s environmental impact, Bitfarms notes it uses green hydroelectricity to power 1% of the Bitcoin network. With more institutional adoption of cryptocurrencies and more visibility on the NASDAQ, what’s next for the stock price of Bitfarms? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Insurers may add to hedge fund positions: Hedge funds remain an option for some insurers, says new report

PE investors looking at secondaries: As interest in private equity expands, three quarters of LPs are now invested in secondaries

Reviewing the definition of an accredited investor: SEC plans more changes to accredited investor definition

Becoming one of the largest managers in the ETF space: Dimensional converts $29 billion of mutual funds into ETFs

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: June 15 edition

News and notes (Canada)

Dynamic Funds launches new ETFs: Dynamic launches two active ETFs

Canada’s IPO market is booming in 2021: IPO market surges in Canada as established firms find demand

With skyrocketing prices, many Canadians can’t afford to purchase a home: For most Canadians, home ownership is just a dream

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Inflation skyrockets, investors shrug

This is the end of the Keystone XL pipeline. Over the past 16 years, the Gulf Coast-to-Alberta pipeline experienced many regulatory challenges and raised concern among climate change activists in both Canada and the U.S. The project came under increased pressure earlier this year when U.S. President Joe Biden pulled its permit. Out of options, TC Energy Corp. has finally pulled the plug on the project. The Alberta Government, which has a $1.3 billion stake in the project, will now try to recoup some of that investment.

Economic/industry news

U.S. inflation rate 5.0% in May: Inflation is hotter than expected, but it looks temporary and likely won’t affect Fed policy yet

BoC holds its benchmark overnight interest rate at 0.25%: Bank of Canada holds steady ahead of possible July taper

ECB holds its key rate steady at 0.00%: ECB projects brighter outlook but keeps “steady hand” on stimulus

Study shows green bonds held up well during the pandemic-led stock market volatility: Green bonds were a better safe haven than gold during the pandemic

No, the 60/40 portfolio is not gone: Is news of the 60/40 portfolio’s death greatly exaggerated?

Consider climate in your portfolio: Carney warns of climate exposure at RIA conference

Reasons for hope

U.S. relaxes travel warnings for a number of countries: U.S. eases travel warning for many nations as pandemic eases

Quarantine rules for people coming into Canada will ease in July: Travel quarantine rules set to ease as millions of Moderna vaccine doses expected

U.S. to donate millions of Pfizer COVID-19 vaccine to other countries: US has bought and will donate 500 million doses of Pfizer’s vaccine worldwide

Adapting your business

Ext. Marketing Inc.’s Richard Heft and Andrew Broadhead provide helpful advisor communications tips to Advisor Analyst’s Joseph Lamanna on Insight is Capital Podcast: Ep. 65 Richard Heft and Andrew Broadhead: The Ascendant Advisor

Don’t eat lunch at your desk: Where do you eat lunch?

Delivering to e-commerce lockers, not homes: The future of internet shopping might not be home delivery

Need-to-know trends in the private wealth industry: High-net-worth trends in 2021

Time to prepare for a significant rise in employee turnover: Employers, don’t fear the ‘great resignation’-it’s already here

Americans demand sustainable investing practices: Investors expect financial firms to embrace sustainability

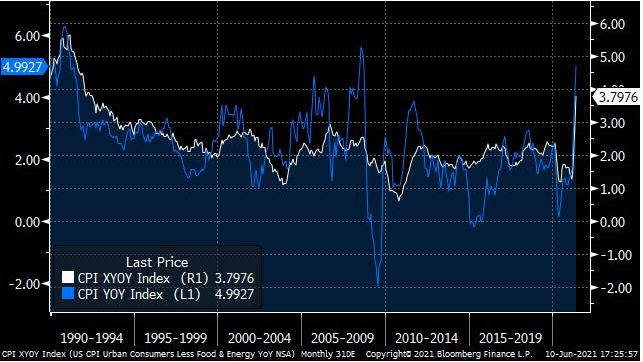

Chart of the week: Inflation skyrockets, investors shrug

U.S. inflation rose to 5.0% year-over-year in May, which was the highest year-over-year increase since 2008. The core inflation rate, which excludes more volatile food and energy prices, rose to 3.8% in May, its largest year-over-year increase since the early 90s. But investors didn’t blink an eye and pushed equity markets higher on June 10, focusing not on the overall inflation rate increase, but on its composition. Specifically, growth in consumer prices was highly concentrated in goods benefiting from easing lockdown restrictions. While consumer prices may have more growth ahead, this report eased concerns that inflation would stall the recovery. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds post strong returns in 2021: Hedge funds traverse volatility and inflation trends with biggest Jan-to-May returns in 25 years

Some parts of the U.S. real estate market are up, some are down: The risks and rewards in real estate investments

Forbes’ Fintech 50 for 2021: The most innovative fintech companies in 2021

News and notes (Canada)

BCI becoming more committed to its ESG intentions: BCI’s 2020 ESG report highlights sustainable bonds, investment guidelines

An investment to make transportation vehicles green: New investment in electric buses to create jobs and cut pollution

The MFDA to propose new standards to speed up account transfers: MFDA seeks to speed up account transfers

Many Canadian investors looking to change wealth providers: One in five Canadian investors plans to switch wealth providers: EY study

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: AMC shares wilder than anything on screen right now

Back in 2020, Bill Ackman launched Pershing Square Tontine Holdings SPAC and raised over US$4 billion. A couple of attempted deals fell through, but now it appears Pershing may be closing in on a deal to purchase 10% of Universal Music Group from Vivendi SE before it goes public. While the deal hasn’t been finalized, it could be massive if it does go through. It would value Universal Music, which is the world’s largest publisher of music, at US$40 billion.

Economic/industry news

Canada’s economy grows 5.6%, annualized, in the first quarter: Economy grew at 5.6% annual rate in first quarter of year, Statistics Canada says

Canada’s unemployment rate rises to 8.2% in May: Canada suffers second labour market setback ahead of reopening

The U.S. economy adds jobs in May, unemployment rate falls: U.S. added 559,000 jobs in May, vs 671,000 estimate

According to BlackRock’s Fink, rising inflation could be a cause for concern: BlackRock CEO Larry Fink sees potential for ‘big shock’ from inflation

Reasons for hope

WHO authorizes use of Sinovac’s COVID-19 vaccine globally: China’s Sinovac shot cleared for wider global use by the WHO

Setting sail: 1st cruise ship sails through Venice since start of pandemic

New cases of COVID-19 in the U.S. plummeting: COVID cases in U.S. fall to levels not seen since March 2020

Adapting your business

Most leaders want to develop intelligent systems: Eight in ten leaders want intelligent systems success in five years but the time to start blueprinting is now

Strong collaboration with tax preparers can generate referrals: How advisors can impress tax preparers to get referrals

Pros and cons of crowdfunding vs. angel investors: Crowdfunding vs. angel investors for early stage startups

Clients are asking about cryptocurrencies: Advisors’ interest in crypto assets rising: FPA Survey

Pandemic caused many to change their estate plans: TD Wealth survey finds COVID-19 had major impact on estate planning

Remote work could have lasting impact on businesses: Working from home may revolutionize businesses

Chart of the week: AMC shares wilder than anything on screen right now

Shares of Redditt-darling AMC Entertainment Holdings Inc. had a wild ride last week. Attaining the “meme stock” moniker, shares of AMC surged as retail investors piled into the stock. And this action wasn’t isolated to North American investors, as people from all over the world joined in. But significant volatility hit the company’s share price on June 3, when AMC took advantage of its elevated share price to sell 11.6 million shares and raise about US$587 million. By the end of the week, the share price was up 84%. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds receive inflows of US$12.47 billion in April: Money continues to pour into hedge funds as investor interest remains strong

Bob Doll joins Crossmark Global Investments as CIO: Bob Doll joins faith-based investment firm

Will family offices be impacted by rising inflation?: Is inflation the biggest threat to family offices – scenarios to navigate

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: June 1 edition

News and notes (Canada)

Trying to replicate an annuity through a mutual fund: Purpose Investments tries wooing retirement savers with new annuity-like fund

Title protection in Ontario likely coming in the first half of 2022: Title protection in Ontario on track for 2022

Accepting deposits in real-time: Questrade introduces Instant Deposit to allow investors to fund trade accounts in seconds

Desjardins agrees to purchase Hexavest: Desjardins buys Montreal boutique firm Hexavest

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Litecoin, meet gravity

It appears that every company engaged in the streaming business is looking for ways to increase content, and spending billions to do so. Amazon agreed to purchase MGM Studios for US$8.45 billion. This will give Amazon access to MGM’s catalogue of films and TV shows. Amazon, which steams shows and movies through Amazon Prime, is hoping the deal will help the company compete against other streaming behemoths like Netflix and Disney, which both have massive pipelines of in-house content.

Economic/industry news

Core PCE prices rise 3.1% year-over-year: A key U.S. inflation gauge rose 3.1% year over year, higher than expected

Second estimate confirms sharp growth in first quarter GDP: U.S. GDP expanded at unrevised 6.4% rate in first quarter

How supply chain issues negatively impact consumers: Supply chain shortages are blocking multiple industries. Here’s what it means for you

The economic recovery in emerging markets could lag, stalling the global recovery: IMF head warns of ‘ricochet impact’ of uneven global recovery

The number of cryptocurrencies rises: The number of cryptocurrencies almost doubled since 2019 and hit over 5,300

Reasons for hope

The vaccine rollout in Canada is progressing: Half of all Canadians have had one COVID-19 shot; full reopening still months off

Mild symptoms of COVID-19 could produce antibodies, which may give long-term immunity: Good news: Mild COVID-19 induces lasting antibody protection

Vaccines, reopenings and social gatherings may make it a fun summer for backyard barbeques: Grill makers are ready for a busy summer of maskless backyard BBQs

Adapting your business

Statistics Canada predicts 25% remote work hours post pandemic: Remote work habits are likely to outlast the pandemic in Canada

The opportunities and challenges for investment professionals in a hybrid work model: How remote work is changing the industry and advisors

Bringing private markets to retail clients: This new fund structure helps retail clients access private markets

Maintaining high standards helped this hospitality business thrive during pandemic: How this hospitality business not only survived, but thrived during the pandemic

How different generations define wealth: What ‘wealth’ really means to 4 different generations

Chart of the week: Litecoin, meet gravity

Another cryptocurrency that has come under pressure in recent weeks has been Litecoin. Considered the silver to Bitcoin’s gold, Litecoin was launched in 2011 and is quite similar to Bitcoin, but with some key differences. For example, Litecoin can confirm transactions faster than Bitcoin and has lower fees. Litecoin is the official cryptocurrency of the Miami Dolphins NFL team. And, according to BeInCrypto, over 2,000 online vendors already accept Litecoin as payment. The price of Litecoin rose 183% from the end of 2020 to its high on May 7, 2021. But these gains have pared back in recent weeks along with other digital currencies. Given its age and ability to remain within the top ranks of cryptocurrencies, some believe Litecoin has staying power. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Strong performance pushes hedge fund assets to new record: Hedge funds surpass $4 trillion in assets

More hedge funds looking at cryptocurrencies: Hedge funds look to increase crypto exposure

Going green: Private equity has been slow to go green, but that may be changing

The ongoing interest in sports from PE firms: On the podcast: Private equity’s sports play

Canadian Bitcoin ETFs may prove useful for Bitcoin applications in the U.S.: Bitcoin ETF backers see Canada fund’s slump as reason to believe

News and notes (Canada)

Regulator focuses on unregulated crypto trading: OSC begins crypto crackdown

Labour productivity rising: Labour productivity leaped 3.8% in the last quarter of 2020

Younger investors looking to manage investments on their own: Survey finds 10% of Canadians plan to leave their advisor

SPAC to take Canadian steelmaker public: Steelmaker Algoma Steel to go public in SPAC deal

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Ford finds a new outlet

JPMorgan Chase & Co. is committed to improving the employer-sponsored healthcare market. After exiting a joint venture with Amazon.com Inc. and Berkshire Hathaway Inc., JPMorgan launched Morgan Health in another attempt to help improve employee benefits and health equity in the U.S. The company is focused on new innovations, and is testing this new offering within JPMorgan itself. If it works, the company will expand Morgan Health to other businesses. JPMorgan is hoping that its focus on testing new innovations based on its own employees’ needs will help drive further meaningful solutions.

Economic/industry news

Canada’s inflation rate higher than expected: Canadian consumer prices climb at fastest pace in a decade

Retail sales in Canada rise 3.6% in March, but April sales may fall: Retail sales in Canada reverse gains in April amid lockdowns

Fed appears to be thinking about tapering: Fed minutes: Economy remains far from FOMC goals

SPACs are set to become more popular in Europe: As the US SPAC boom cools, Europe’s is just heating up

Bitcoin may be close to a top, according to some fund managers: Fund managers say ‘long Bitcoin’ is the most crowded trade in the world

U.S. yields may continue to rise: An outlook for U.S. yields

Reasons for hope

Determining if mixing vaccines will be helpful: Preliminary results from Spanish study suggest mix and matching vaccine doses may increase antibodies

Kickstarting restaurants will help the economic recovery: Reviving food services sector key to economic recovery

Adapting your business

McKinsey looks at workplace issues as we come out of the pandemic: COVID-19: Implications for business

Asking employees to rest: Companies are battling burnout by giving employees more vacation days-but will they take them?

Bringing digital asset SMAs to advisors: Dynasty launches first crypto options for its advisors

Most Canadians want to go back to work with a hybrid model: Workers in Canada want to get back to the office, KPMG says

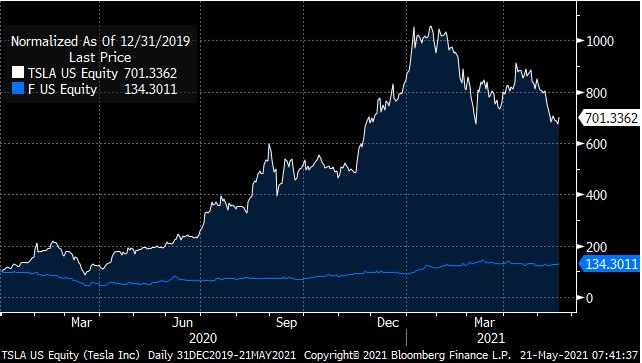

Chart of the week: Ford finds a new outlet

Ford Motor Co.’s Ford F-150, the best selling vehicle in Canada and the U.S., is going electric. Ford unveiled a prototype of the electric F-150, named Lightning, on May 20. The truck will have all the power of its gas-powered version and still tow up to 10,000 pounds. Ford also agreed to a joint venture with SK Innovation Co. Ltd. to produce battery cells and modules.

The company is not only battling old rivals in the race to electric, but relatively newer entrants such as Tesla Inc. Since the beginning of 2020, the stock price of Ford has significantly underperformed Tesla’s. As Ford makes significant inroads in the electric vehicle space, can its share price growth catch up? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Strong demand for hedge funds during the first quarter: Investor inflows hit USD9 billion as hedge funds see trade volumes surge in Q1

PE looking to capitalize on exits: How private equity plans to cash in on the COVID-19 recovery

Helping teens build strong financial habits: Fidelity rolls out no-fee investing accounts for teens

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: May 19 edition

News and notes (Canada)

Ninepoint launches new ETFs: Ninepoint launches three ETFs on NEO

Is space an issue for Canada’s real estate market?: The second-largest country in the world is running out of land

Canadians find opportunities in U.S. stocks: Canadian investors continue U.S. stock-buying binge: StatsCan

Those under 35 are more willing to bid above asking to purchase a home: Younger homebuyers more willing to fight bidding wars: survey

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Elon bails on Bitcoin

Athletes continued to rake in big bucks in 2020 despite the pandemic. The highest paid athlete in 2020 was Ultimate Fighting Championship star, Conor McGregor, who earned US$180 million, according to Forbes’ list of the Top 10 highest-paid athletes. Despite the pandemic hindering many sporting events, including the Olympics in Japan, sports returned to television. That said, most events had few to no in-person attendees. In earning much of their income through endorsements and other sources, athletes are understanding a key financial pillar: diversification.

Economic/industry news

U.S. inflation rate exceeds expectations: Inflation speeds up in April as consumer prices leap 4.2%, fastest since 2008

U.S. retail sales miss forecasts in April: U.S. retail sales unchanged in April

Diversify by industry, not country, according to a new study: Why investing by country is the wrong way to approach equity portfolios

Higher inflation may help value stocks: Why rising inflation may help sustain value’s recovery

Global IPO activity is surging in 2021: The IPO market is booming

Reasons for hope

Hopeful for more reopenings and social interactions by the fall: Trudeau’s ‘one-dose summer’ pitch raises hope for reopening plan

A look at reopenings around the world: When will international travel return? A country-by-country guide to coronavirus recovery

Celebrating our nurses: Former COVID-19 patients surprise their front-line heroes on National Nurses Day

Adapting your business

Better perception of asset managers who have a strong commitment to diversity and inclusion: The ‘hidden competitive advantage’ that sets apart consultants’ favorite asset managers

Tips to manage your start-up costs: 8 strategies for lowering your startup costs

Protecting privacy and anonymity in crypto transactions: Protecting your Bitcoin transactions

Understanding and preparing for client-focused reforms: What KYP reforms mean for advisors

Advisors need to know these important ESG trends: Three key ESG trends advisors need to be aware of

Chart of the week: Elon bails on Bitcoin

The price for Bitcoin came under pressure last week as the massive amount of electricity required to mine Bitcoin caught the public’s eye, as well as the attention of billionaires and policy makers. U.S. Treasury Secretary Janet Yellen voiced concern about the impact this mining is having on the environment. According to the Cambridge Bitcoin Electricity Consumption Index, mining for Bitcoin uses more energy than the energy required for some countries.

Now Elon Musk, previously a proponent of Bitcoin, has chimed in and expressed concern about the environmental impact of Bitcoin. Tesla has suspended the purchases of its vehicles using Bitcoin. The company will maintain its Bitcoin holdings and will not sell any until the environmental impact of Bitcoin is minimized. The news sent the price of Bitcoin spiraling down on May 13, hitting its lowest level since February, before paring back some of those losses. Can Bitcoin regain confidence and become more energy efficient? Let us know what you think..

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

It’s been a strong start to the year for hedge funds: Hedge funds are on a roll with strongest Jan-to-April returns in 20 years

Interest in SPACs may be waning: SPAC mania gives way to ‘meh’ as ETFs drop toward all-time lows

It’s not a Bitcoin ETF, but at least it says “crypto”: First ETF with ‘Crypto’ in name starts trading Wednesday on NYSE Arca

Cryptocurrency under custody keeps growing at Gemini: Gemini surpasses USD30bn in crypto under custody

News and notes (Canada)

CI acquires a San Diego-based RIA: CI acquires US$5.1B San Diego-based RIA

Sterling Mutuals adding ETFs to its lineup: Sterling Mutuals adds ETFs to product shelf

Canadians concerned about the housing market: Freaked-out Canadians open to rate hikes to cool hot housing market

FSRA wants a central database of title-users: FSRA updates title reg proposal

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: All Doges go to heaven … or, at least, the moon

A big congratulations to ext.’s very own President, Richard Heft, and Head of Content, Andrew Broadhead on their new book, The Ascendant Advisor. The book is now available on Amazon and uses content marketing and communications strategies to help financial advisors succeed in a post-pandemic world. This is an important subject for Richard and Andrew, who have dedicated their careers to helping advisors and financial services institutions’ convey their message and stories to clients. This is definitely a must-read for industry professionals.

Economic/industry news

Canada’s unemployment rate rises to 8.1% in April: Canadian economy lost 207,000 jobs in April, unemployment rate rises

The U.S. economy adds fewer jobs than expected: April’s expected hiring boom goes bust as nonfarm payroll gain falls well short of estimates

The Bank of England keeps its key rate steady at 0.10%: Bank of England slows bond-buying, sees economy bouncing back more quickly

Pension assets rebound strongly: The pandemic hit public pension funds hard – but now they’re better funded than they’ve been in years

Jim Grant’s thoughts on whether or not the Fed can contain inflation: Can the Fed contain inflation? Jim Grant says don’t count on it

Reasons for hope

Pfizer vaccine now deemed safe for teens: Children 12 and older now cleared to receive Pfizer vaccine: Health Canada

As India struggles, some companies stepping up to help: UPS donates $1 million in COVID aid to India, joining corporate giants including FedEx, Google and Amazon

Moderna to ramp up vaccine production later this year and next: Moderna will make up to 3 billion vaccine doses in 2022

Adapting your business

How to help employees who have suffered mental health issues in response to the pandemic: Employers brace for COVID’s mental health fallout as workers return

Don’t stop trying to achieve your goals: Stop stopping

Some tips to develop a strong cybersecurity network: The 6 things small businesses need to know about security

How to build employee loyalty: How to motivate staff (besides splashing money around)

The importance of understanding client personalities: Want your advice to stick? Consider your client’s personality

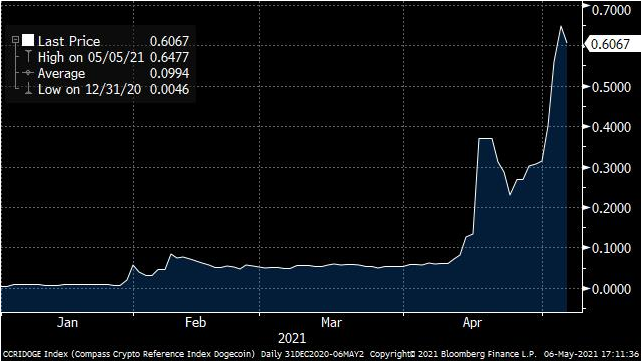

Chart of the week: All Doges go to heaven … or, at least, the moon

Add Dogecoin to the list of cryptocurrencies soaring higher in 2021. What is Dogecoin and how has it become so popular? Dogecoin was started as a bit of joke, and was named after a popular meme. A major difference between Dogecoin and some other digital coins is the ease in which miners can find Dogecoin, and there is not a finite supply. People such as Elon Musk and Mark Cuban have shown interest in the crypto, while Gemini, the crypto exchange founded by the Winklevoss twins, will soon allow trading of Dogecoin. Its price has risen more than 13,000% since the beginning of the year, now making it the fifth largest cryptocurrency by market capitalization. What’s next for this “memecoin?” Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Using technology to raise operational standards: Raising the bar for startup technology partners

Private equity makes a big splash in the digital media industry: Buyout of AOL, Yahoo signals PE’s biggest bet on digital media

Private equity firms don’t see SPACs as competitors: Private equity firms aren’t worried about SPACs anymore

Prepare to wait a bit longer for the first Bitcoin ETF in the U.S.: SEC delays Bitcoin ETF approval

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: May 5 edition

News and notes (Canada)

Investing in strong companies that are focused on climate change: Manulife launches climate-focused funds

Canadian ETFs post strong inflows in April, particularly crypto ETFs: Crypto ETFs hit $2.5B in AUM in April

Seeking growth through acquisitions: Wealthsimple eyes acquisitions after US$610M funding round

Some Canadian CEOs slow in acting on climate change: Canadian CEOs lag on climate change action

Demand for commercial properties in Canada is rising: ‘Stronger’ commercial leasing environment emerged amid COVID: RioCan REIT CEO

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Copper climbs

As vaccines are rolled out and a return to more normal conditions become a reality, the hard hit global travel industry received some positive news last week. A report noted that the European Union may soon begin allowing U.S. tourists who have been fully vaccinated to visit Europe this summer. The same situation is developing the U.K., which might also begin opening its borders to American travelers this summer. This, of course, is highly dependent on continued progress made to curb the spread of the pandemic.

Meanwhile, the U.S. Centers for Disease Control and Prevention provided guidance to cruise operators that they can soon begin sailing with customers again. This is all welcome news for an industry that was particularly hard hit by the pandemic.

Economic/industry news

The Fed holds its policy rate steady: Fed holds interest rates near zero, sees faster growth and higher inflation

U.S. GDP expands 6.4%, annualized, in the first quarter: U.S. recovery gains steam as spending fuels 6.4% GDP growth

A look inside the American Families Plan: Here’s what’s in Biden’s $1.8 trillion American Families Plan

Retail sales in Canada rise 4.8% in February: Retail sales climbed in February ahead of third wave: StatsCan

Does bad weather impact investment decisions?: Even the most ‘sophisticated’ investors have rainy days

Reasons for hope

Americans can remove masks in some outdoor gatherings: Vaccinated Americans can go unmasked outdoors, gather indoors

Helping Canadians book their vaccine appointments: Having trouble booking your shot? These volunteer ‘vaccine hunters’ want to help

U.K. workers are beginning to return to the office: Almost half of U.K. office workers are back at their desks

Adapting your business

Understanding client vulnerability: How dealers can protect vulnerable clients

Embracing a flexible schedule: Manulife CEO embraces flex schedules, unhurried return to office

Building a portfolio for the very long term: How to build a portfolio that outperforms for a century

The financial planning industry is more important than ever: An inflection point for advice and planning

Helping people with their financial well-being: How well-being drives a future financial planner

The underlying motivation of investment managers: The best managers aren’t in it just for the money

Chart of the week: Copper climbs

The price of copper surged higher last week, reaching its highest level since 2011 and approaching the US$10,000/tonne mark. Strong global demand, along with supply concerns, have been pushing the metal’s price higher. Copper is often used as a barometer for global economic conditions, given its vast range of uses, particularly for industrial goods. Copper is used in things like electrical equipment, building construction, vehicles, etc.

And copper prices might have room to climb. Governments continue to announce plans to become more energy-efficient and environmentally friendly. Given copper is used in renewable energy systems, while also helping to reduce CO2 emissions and the amount of energy required to produce electricity, its value should continue to grow. Could prices advance to all-time highs? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds trail other investment firms in incorporating ESG factors: Hedge funds off the pace on ESG integration, new bfinance investor poll finds

Blackstone reaches record quarterly profits in Q1: Blackstone posts highest profit yet, powered by growth-equity and SPAC deals

Understanding the good and the bad of the new Ad Rule: The SECs ad rule: New strategies, new risks

JPMorgan to give its wealthy clients access to Bitcoin: JPMorgan preparing to offer Bitcoin Fund to wealthy clients: report

News and notes (Canada)

Serving business-owner clients: Canadian Western Bank sets sights on HNW entrepreneurs

A drop in labour force participation could stall the economic recovery: Fraser Institute: Canada’s aging population will reduce labour force participation, slow economic growth

No change in Canada’s AAA rating from S&P: S&P maintains AAA rating on Canada despite historic deficits

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Are NFTs the next Beanie Babies?

Could a higher capital gains tax be on the way in the U.S.? Bloomberg News reported U.S. President Joe Biden may propose an increase to the capital gains tax from 20.0% to 39.6% on the wealthy. Adding this to the 3.8% tax charged on investment income will take the total tax on investment income for the wealthy in the U.S. to 43.4%. This would make the total percentage of taxes paid by wealthier Americans on investment income greater than the highest tax rate they pay for both wages and salaries.

The proposed change is expected to be announced this week along with the release of further details about the American Families Plan (“AFP”). Higher taxes on investment income are expected to support some of the spending of the new AFP, while the impact the new capital gains tax rate might have on equity prices is still an unknown.

Economic/industry news

The BoC eases its bond purchase program: Bank of Canada keeps rate on hold, sees brighter economic outlook

Canada’s consumer prices rise 0.5% in March: Annual pace of inflation leaps higher in March to 2.2%, Statistics Canada says

According to Fidelity, traditional portfolios are changing: Advisors drift away from traditional portfolios, Fidelity says

The U.K. Treasury and BoE are exploring a digital currency: UK to explore issuing its own digital currency amid bitcoin boom

Could value outperform growth over the next 10 years?: Vanguard sees value trouncing growth by 5%-7% annually for next decade

Reasons for hope

Protecting UN peacekeepers: India donates 200,000 COVID vaccinations to protect UN peacekeepers around the world

On pace to reach President Biden’s 100-day goal: COVID cases, vaccinations remain elevated as U.S. nears Biden’s 200 million goal

Adapting your business

Study finds employees may be more productive working from home: Yes, working from home makes you more productive, study finds

Zoom fatigue is setting in, particularly among younger employees: 64% of younger employees suffer anxiety from excessive Zoom meetings, study finds

How to network in the current virtual environment: 4 ways to effectively network today

Planning a return to the office: How to plan a seamless transition back into the office

Canada’s fintech industry is thriving: A growth spurt for fintechs

Chart of the week: Are NFTs the next Beanie Babies?

Interest in non-fungible tokens (“NFT”) has exploded in recent months. An NFT is a digital piece of artwork, video, trading card or other digital good that can be bought and sold across the blockchain network. Many companies involved in the digital space are hoping to access this new market. Hall of Fame Resort & Entertainment Co., a sports, entertainment and media company focused on professional football, recently partnered with Dolphin Entertainment Inc. to create an NFT that will allow fans to buy and sell professional football content. The stock prices and trading volume of both companies initially surged higher before pulling back. The partnership, and continued investor interest, demonstrates heightened enthusiasm for anything and everything NFT. What does the future hold for NFTs? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Management and performance fees may rise this year: The biggest alternatives firms will make more money from fees in 2021

Hedge funds taking a larger position in the VC space: How hedge funds are leading the race to stake startups

M&A activity in the RIA space began to cool in the first quarter: RIA M&A activity pulling back from record highs, DeVoe says

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 21 edition

News and notes (Canada)

Asset managers purchasing ESG boutiques to access this burgeoning space: Canadian asset managers targeting ESG boutiques

Total assets in mutual funds and ETFs increased in March: Mutual fund sales outpace ETF sales in March

The OSC studied the experiences of self-directed retail investors: Many DIY investors shun advice as too expensive

A fee war is underway between the Ether ETFs: An Ether ETF isn’t even launched and already there is a fee war

A look at some of the highlights from the Canadian federal budget: Tax highlights from Budget 2021

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Coinbase arrives … to mixed reviews

Walmart Inc. has taken a major step in its plan to create a more efficient delivery network to challenge Amazon.com, Inc. Walmart now has a position in Cruise LLC, an autonomous-vehicle company. Cruise’s majority shareholder is General Motors Co. Walmart will be begin testing grocery deliveries in Scottsdale, Arizona, this year.

Large e-commerce companies are looking to control the entire sales ecosystem, meaning from warehouse to customers’ doorsteps. Walmart expects fewer customers will visit its physical locations in the future.

Economic/industry news

U.S. inflation rate rises to 2.6% in March: Consumer prices rise more than expected, pushed by 9.1% jump in gasoline

U.S. retail sales jump 9.8% in March: Rebound in U.S. economy gathers steam with surge in retail sales

China posts strong year-over-year growth: China’s economy grows by a record 18.3% in the first quarter

ESG investing requires the human touch: Goldman Sachs says humans beat algorithms when it comes to ESG

Has the earnings boom arrived?: The earnings boom is here

Reasons for hope

Pfizer increases vaccine shipments to the European Union in Q2: Pfizer boosts second-quarter EU vaccine supply by 50 million

J&J vaccine pause not slowing down the U.S. vaccine rollout program: U.S. vaccination pace picks up as officials say Johnson & Johnson pause won’t slow rollout

People preparing for a better post-pandemic future: People are optimistic the end of the pandemic is near – and they’ve laid the groundwork for a better future

Adapting your business

Get your business ready for the coming rush of customers: How to scale your team for the impending customer surge

How to be “politely persistent”: 10 ways to be politely persistent

Crafting a great client e-newsletter (featuring Richard Heft): You’ve got mail

It may be time for a recharge: Pattie Lovett-Reid: WFH fatigue grows as pandemic enters year two

Protecting retirees’ portfolios from inflation: How financial advisors are protecting retirees from inflation

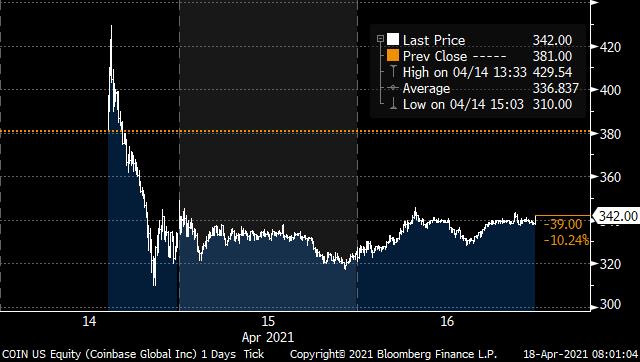

Chart of the week: Coinbase arrives … to mixed reviews

Coinbase Global Inc. went public on April 14, and it didn’t take long for the company’s market capitalization reach US$100 billion as investors rushed into the stock … before quickly pulling back. It was reported ARK Investment Management purchased almost US$250 million worth of the company’s stock on the first day for some of its funds.

Coinbase provides a platform for investors to buy, sell and store digital assets, and is an extremely popular cryptocurrency exchange in the U.S. Coinbase earned a revenue of US$1.3 billion in 2020, with Bloomberg estimating that its revenue will grow to US$4.7 billion in 2021. Could this listing give cryptocurrencies even more legitimacy in the investing universe? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Putting the SRI into macro hedge funds: How macro hedge funds can do more to embrace SRI

Ellie Rubenstein building her own PE firm focused on responsible food companies: Carlyle family dealmakers stake out new ground with food portfolio

The SEC is paying close attention to SPACs: Regulators ramp up scrutiny of SPACs

New applications for Bitcoin ETFs keep getting filed with SEC: Bitcoin ETF drumbeat gets louder as eight issuers file with SEC

News and notes (Canada)

Capitalizing on the clean energy investing trend: Canadian ETF providers look to capitalize on clean energy theme

Offsetting large companies’ carbon footprints: Proposed ETFs from Evolve will offset carbon footprints of large companies

Fundata Canada introduced its new Fundata ESG Ratings: New Fundata ESG Ratings can help build RI portfolios

The Canadian federal government provides a loan and an investment in Air Canada: ‘Holy cow’: Feds take stake in Air Canada as airline lands $5.9B in aid

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Coherent crypto or Ethereum delirium?

What a day for the BlackRock U.S. Carbon Transition Readiness ETF, which recorded a massive US$1.25 billion of inflows in its first day of trading last Thursday. The ETF invests in companies on the Russell 1000 Index that it expects to thrive in a low-carbon environment.

BlackRock CEO, Larry Fink, a big advocate of environmental, social and governance (“ESG”) investing for some time, has been demanding change from corporate CEOs. It is, therefore, not surprising that BlackRock’s new ESG product is so highly valued by investors. ESG ETFs attracted record inflows in 2020, and their popularity has continued thus far in 2021. According to Refinitiv, ESG funds should experience another year of strong inflows, with “social” becoming a key theme in ESG investing this year.

Economic/industry news

Canada’s unemployment rate falls to 7.5% in March: Canada adds 303,000 jobs in March, unemployment rate falls

The Fed is not moving on policy anytime soon: Fed officials say easy policy will stay in place until economic ‘outcomes’ are achieved

ESG funds have outperformed since the start of the pandemic: Here’s more evidence that ESG funds outperformed during the pandemic

A crypto ATM machine is coming soon to a location near you: At least one crypto ATM is installed hourly, total global machines to reach 20k in two months

Reasons for hope

Some vaccines found to be effective against the California variant: 2 vaccines in use will be effective against variant of COVID-19 identified in California, Duke finds

Opera singers helping those suffering from shortness of breath as a result of COVID-19: How opera singers are helping people with ‘long COVID’

IMF believes government spending to support economic growth during the pandemic will result in tax revenue: IMF says controlling virus can raise US$1 trillion in tax revenue

Adapting your business

Preparing to thrive after the pandemic: The secret to business survival in today’s tough market

Fidelity planning to boost hiring: Fidelity to hire 1,000 financial planners in 2021

How financial advisors can become a go-to resource: How to establish yourself as the alternative

Launching a membership program: Best Buy starts paid membership program to rival Amazon, Walmart

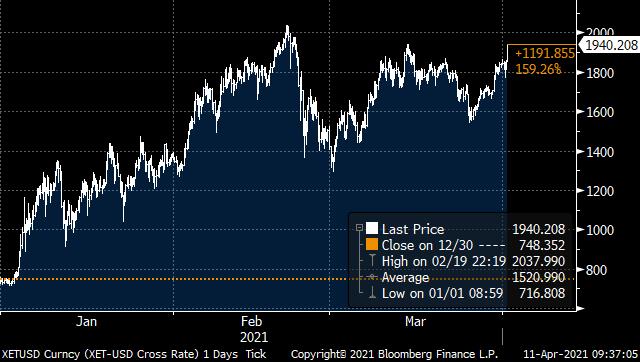

Chart of the week: Coherent crypto or Ethereum delirium?

While much attention has been paid to Bitcoin over the past few years, Ethereum has been gaining in popularity more recently in the cryptocurrency space. Ethereum is a blockchain network that carries Ether. This rise in popularity has prompted preliminary filings from Canadian ETF companies in an effort to launch Ethereum ETFs. The price of Ethereum has exploded thus far in 2021, and rose approximately 159% over the first quarter. Similar to Bitcoin, the rise in the price of Ethereum has been in response to increased interest from institutional investors.

Ethereum has benefited from other factors as well. Visa has begun settling its cryptocurrency transactions using the Ethereum network, while billionaire Mark Cuban has also stated his support of Ethereum. The largest difference between Bitcoin and Ethereum is the ability for developers to build applications on the Ethereum network, which they can’t do on the Bitcoin network. One question is which one will gain the most traction and be more widely adopted? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge fund investing in new technology is focused on alternative data: Amid the pandemic, hedge funds grapple with investments in new tech and alternative data

Financial firms join forces to create crypto trade group: Fidelity, other investment firms form crypto trading group

U.S. ETFs posted record inflows over the first quarter: U.S. ETF inflows set new record in first quarter

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 7 edition

News and notes (Canada)

CI launches the CI Bitcoin Fund: CI GAM launches Bitcoin mutual fund

There’s growing interest among investors in active ETFs: Canadian ETF investors get active

What the C.D. Howe Institute hopes for in the next federal budget: ‘Wrenching adjustment’ awaits feds if debt is unchecked: C.D. Howe

A national securities regulator appears unlikely: Shuttering of national securities regulator came as no surprise to industry

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: SPAC your bags, we’re hunting for acquisitions

There was big news for the cannabis industry as New York became the sixteenth state in the U.S. to legalize marijuana use for adults. Sales are expected to start next year. Early projections are that sales could reach US$4.2 billion per year in New York. Furthermore, the legalization may open up thousands of jobs in the state.

It’s unlikely that legalization in New York will have a material impact on Canadian cannabis companies. However, should cannabis use become legal at the federal level, it may provide an opening for Canadian companies to gain a significant footprint in the U.S. market.

Economic/industry news

Canada’s GDP expands faster than expected in January: Canada’s recovery keeps up pace despite second-wave lockdowns

The Fed is not keeping rates low to help the government finance debt: Fed’s Waller says the central bank isn’t keeping rates low to finance government debt

Higher interest rates may not have a substantial impact on Canadian households: Households ready to weather higher interest rates: report

High correlation of returns make geographical diversification difficult: Geographical diversification is harder to come by, report says

Reasons for hope

Canada expecting a larger number of doses in June: Pfizer increases spring schedule, adds 5M doses to June shipments

Pfizer vaccine effective in children between 12 and 15 years old: Pfizer says COVID vaccine is 100% effective in kids ages 12 to 15

Adapting your business

A diverse team can help returns: What a ‘superior’ hedge fund team looks like

Finding solutions to work-from-home fatigue: Zoom CFO explains how the company’s employees avoid work-from-home fatigue

Exploring the future of financial planning: The future has never looked brighter

Social issues are top of mind among Canadian CEOs: 6 things your clients may not know about retirement planning

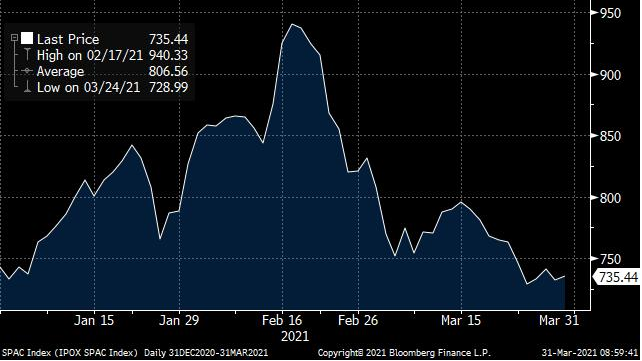

Chart of the week: SPAC your bags, we’re going hunting for acquisitions

Special Purpose Acquisition Companies (SPACs) have become more popular. These blank-cheque companies are formed for the sole purpose of acquiring an existing company. For investors, trust is put into the founder that a target company can be found and acquired. If an acquisition is not completed within two years, money is returned to investors. SPACs are also drawing the attention of the SEC regarding issues around how retail investors may be impacted.

In the first quarter of 2021, approximately 300 SPACs were launched, raising more than US$100 billion. Issuance has slowed recently as bankers and lawyers cannot keep pace with the number of SPACs looking to come to market. After strong performance in 2020, SPAC returns have since fallen partly as a result of an oversupply of issues. Let us know what you think about the future of SPACs.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Total assets in the hedge fund industry grew to US$3.4 trillion as of February: Hedge funds’ coffers swell further in February, as investors pile in

PE investment in tech firms sets new record in the first quarter: Private equity’s taste for tech spurs $80 billion deal spree

Selling NBA highlights using blockchain technology: NBA Top Shot mints a unicorn: How an Ethereum competitor cashed in on the NFT craze

BlackRock holds the strongest brand among asset managers: BlackRock, the world’s biggest asset manager, is also the world’s strongest asset management brand

Guinness Atkinson makes history with the first mutual fund to ETF conversion: History made with first U.S. mutual funds converted to ETFs

News and notes (Canada)

It was a busy week for ETF launches: Fund companies announce a bevy of new ETF launches

A look at the impact of social media on the lives of Canadians: Study: Canadians’ assessments of social media in their lives

Net new flows into Canadian ETFs had a record year in 2020: Pace of ETF growth to persist in 2021

Canadians concerned about having to owe taxes: 60% of Canadians procrastinating on tax filing over fears they may owe: Poll

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Mining for profits in the 21st century

This is a wonderful few weeks for gamblers as March Madness, the NCAA’s biggest basketball tournament, has begun. According to the American Gaming Association, approximately US$8.5 billion has been wagered on the tournament this year. Not to mention the countless entrance fees as friends, family and co-workers fill out their brackets and put a few dollars on the line.

In a typical year, the NCAA holds its regional games in different locations around the U.S., which translates to millions of dollars for local economies. While the NCAA earns about US$1.5 billion from this tournament, there’s an indirect cost for companies that stems from the tournament. A major U.S. employment firm has estimated that employees taking the time to fill out their brackets costs businesses approximately US$13 billion every year.

Economic/industry news

Durable goods orders post first decline in 10 months: Weather slams U.S. business equipment spending, while supply disruptions weigh

The BoC will gradually scale back some liquidity programs: Bank of Canada to wind down crisis liquidity programs

Higher taxes may eventually be needed: Yellen sees room for U.S. to borrow, opens door to tax hike

Inflation may not be as harmful as many expect: Why fears of inflation are ‘overblown’

Consumers focused on saving for liquidity, rather than retirement: Consumers want liquidity: Survey

Reasons for hope

Continuing the fight against infectious diseases: What’s next for Moderna post-COVID-19: CEO Stephane Bancel details mRNA pipeline

WestJet restoring some service to Atlantic Canada: WestJet reinstating Atlantic Canada routes after COVID suspension

U.S. companies urging the government to establish paid family leave: Over 190 U.S. companies urge congress to pass paid family leave

Adapting your business

Getting your business off to a strong start: 4 basic business tools new entrepreneurs need to succeed

Many Americans are falling behind in their retirement planning: Saving for the future is more popular than Netflix, but many are still falling behind: Survey

Nuvei to incorporate Mastercard Send in its payment platforms: Mastercard expands partnership with Nuvei, facilitating accelerated payouts with Mastercard send

Social issues top of mind among Canadian CEOs: CEOs shift focus to the “S” in ESG

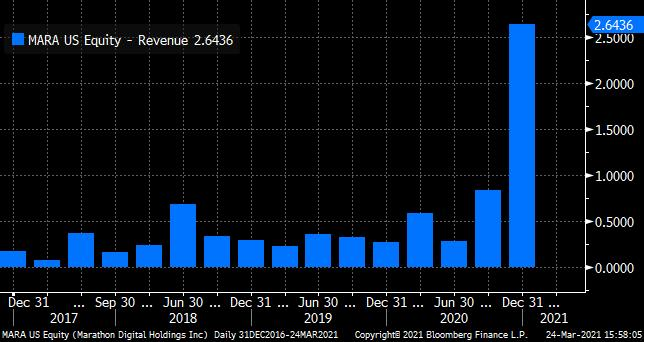

Chart of the week: Mining for profits in the 21st century

While investor attention is focused on Bitcoin, many companies are making inroads behind the scenes. One example is Marathon Digital Holdings Inc., which was one of the first digital coin miners listed on the NASDAQ Composite Index.

The company’s revenue rose in 2020, reaching US$4.4 million. The company has also been investing in additional miners, and plans to open another data centre. Bloomberg estimates that revenue could rise to US$286 million in 2021. So far in 2021, Marathon Digital’s share price has already increased 231%. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Why hedge funds are a natural fit with ESG: Hedge funds are the ESG bellwethers – do they know it?

Having a home country bias when choosing PE funds is not such a bad thing: The ‘home bias’ in private equity pays off

BlackRock making changes to its lineup of iShares Morningstar U.S. Equity Style Box ETFs: BlackRock cuts fees on $7.6 billion style ETFs to near zero

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: March 24 edition

News and notes (Canada)

Venture capital investments were $4.4 billion across 509 deals in 2020: Canadian venture capital investments totalled $4.4 billion in 2020

Credentialing bodies will be under the microscope to uphold standards: Title reg puts credentialing bodies to the test

Total assets for mutual funds and ETFs increased in February: Canadian fund sales exceeded $23B in February

Strong demand for Bitcoin ETF: Purpose Investments Bitcoin ETF crosses $1 billion in assets

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Spotlight on yields

No stone is being left unturned in the exchange-traded fund (“ETF”) industry. ETF manufacturers have launched unique mandates, capturing different parts of the old and new economies. From e-sports to Bitcoin, no sector or asset class is off limits. North of the border, three Bitcoin ETFs have already been launched. Next one up appears to be an Ethereum ETF.

In the U.S., four firms currently have applications with the Securities and Exchange Commission (“SEC”) to launch Bitcoin ETFs. For investors looking for some exposure to something a little larger than earth, Harvest Portfolios has filed a preliminary prospectus to launch the Harvest Space Innovation Index ETF in Canada. Finally, for anyone with a fear of missing out (i.e., “FOMO”), there might be an ETF for that. An application has been filed with the SEC to launch a FOMO ETF from the Collaborative Investment Series Trust.

Economic/industry news

The Fed holds its target range steady at 0.00% to 0.25%: Fed sees stronger economy and higher inflation, but no rate hikes

Canada’s inflation rate 1.1% in February: Canada inflation inches higher to 1.1% on rising gas prices

Canadian retail sales drop in January: Retail sales fall 1.1 per cent in January to $52.5B: Statistics Canada

CFA Institute launches new ESG program: CFA Institute launches certificate in ESG investing

Rising interest rates could negatively impact asset prices: This is the ‘biggest risk of all’ for investors, according to Howard Marks

Inflation now biggest concern among investors: COVID-19 no longer investors’ top tail risk: BofA

Reasons for hope

A return to the office may happen sooner rather than later: At long last, Wall Street sees path to return to the office

Many Canadians opened their own business: Surprise burst of entrepreneurship thrives year of grim economic fallout

Helping seniors book their vaccination appointments: Pennsylvania TSA officer praised for making COVID-19 vaccine appointments for local seniors

Adapting your business

Some tips on how advisors can reflect on their accomplishments: Look back on your accomplishments

The pandemic brought lasting change to the wealth management industry: Five ways COVID-19 has permanently changed wealth management

Wealthy are looking for consistency: The need for consistent consistency with UHNW investors

Stock options help employee retention and productivity: Stock options driving loyalty, hard work among employees: study

Raising compliance budgets address working from home: Institutional investors boost compliance budgets amid work-from-home trend

Chart of the week: Spotlight on yields

The yield on the 10-year U.S. Treasury bond recently surpassed the dividend yield on the S&P 500 Index. This is the first time this has happened since the start of the pandemic, as yields plummeted along with stocks, driving up the dividend yield of the broader index.

As yields keep rising on expectations of higher inflation and a swift recovery, the gap between the two are widening. Given the relative safety of U.S. government bonds, this could make equities a little less attractive, potentially resulting in even more volatile conditions. On the other hand, business activity is picking up, which may be constructive for profitability and dividend payments, which could be a key theme to watch in the months to come. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds post positive performance in February: Hedge funds return 2.68 per cent in February

Health care industry looking to private equity for capital: Private equity’s presence in health care is growing

Many companies trying to launch the first Bitcoin ETF in the U.S.: Wall Street steps up Bitcoin ETF push with SEC verdict unknown

Is this the springboard for more PE firms in professional sports?: LeBron James’ Red Sox deal points to private equity’s future as a pro sports owner

News and notes (Canada)

CI purchases another RIA firm: CI acquires Atlanta-based RIA Brightworth

Canada’s population growth slowed in 2020 in response to the pandemic: Population growth slowed to World War I levels in 2020: StatsCan

Canada and Germany partnering to achieve shared energy goals: Canada strengthens energy partnership with Germany

IMF praises the federal government’s response to the pandemic, but there are gaps that must be tightened: Ottawa should review employment insurance as economy recovers: IMF

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: All eyes on inflation

One of Joe Biden’s first priorities as President was to pass a new, US$1.9 trillion stimulus package. After a few changes from the Senate and approval from the House of Representatives, the American Rescue Plan Act was signed into law on March 11. The plan includes an extension to unemployment benefits, making student loan-forgiveness tax free, maintaining the moratorium on evictions and foreclosures, as well as an expanded Child Tax Credit.

Economic/industry news

The BoC holds its key interest rate steady at 0.25%: Bank of Canada stands pat on stimulus, keeps up bond-buying

Canada’s unemployment rate declines to 8.2% in February: Economy blows past expectations, adds 259,000 jobs in February

The U.S. inflation rate was 1.7% year-over-year in February: U.S. consumer prices rise 0.4% in February, as expected

The ECB temporarily boosts its bond-buying efforts: ECB to boost emergency bond buys to stem yield rise

Monetary policy could tighten next year in response to inflationary pressure: RBC CEO sees inflationary pressure building as economy bounces back

The rotation from momentum to value stocks has been swift: The stocks rotation ride is real, and violent

Reasons for hope

The Pfizer vaccine is proving highly successful in Israeli study: Pfizer COVID vaccine blocks 94% of asymptomatic infections and 97% of symptomatic cases in Israeli study

U.S. looking to double its order of the J&J single-shot vaccine: Biden to order 100 million more J&J doses, boosting stockpile

Possible opportunities ahead for the restaurant industry: Restaurants face a great reset, thanks to COVID-19

Adapting your business

Tips to help you build your business: 11 useful tips for growing your business

Look no further than the landscaping business for guidance on proving your worth to HNW clients: An easy analogy to show your value to HNW prospects

Metric for proving the quality of a fund’s ESG investing required: How ESG are you, really?

Chart of the week: All eyes on inflation

The U.S. core inflation rate, which excludes food and energy prices, eased to 1.3% year-over-year in February (from 1.4% the previous month). This reduced some concerns about rising inflationary pressure. But is this also a signal of consumer prices rising at a slower pace in the months to come?

Recent manufacturing and services sector reports have shown significant gains in input costs, which will eventually make their way to consumers. Demand is expected to increase further in the U.S. as the majority of Americans receive direct payments as part of the new stimulus plan. Core inflation may have subsided in February, but it could pick up in the upcoming months. How fast inflation rises will impact the U.S. Federal Reserve Board’s decisions. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

The strategies hedge fund allocators are looking at: Demand for hedge funds is rising. These are the strategies investors like most.

SPACs are looking at tech firms, and it is concerning PE firms: Why PE firms targeting tech buyouts could face competition from SPACs

Understanding the impact of taxes on Social Security: 3 things advisors should know about Social Security and taxes

Fidelity launches new SMA offerings: Fidelity expands SMA lineup

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: March 9 edition

News and notes (Canada)

Mackenzie partners with Northleaf Capital Partners on new private credit fund: Mackenzie launches private credit fund

BMO launches new service for HNW clients: BMO’s adviceDirect launches premium service

Another Bitcoin ETF has come to market, this time from CI: Third Bitcoin ETF begins trading on TSX

Women are making up a greater proportion of board seats in Canada: Progress made in appointing women to boards: CSA

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Oil prices rising

The impact of rising government bond yields has been far-reaching. One of the hottest sectors since the lockdowns that started in 2020 has been real estate. Real estate prices in both Canada and the U.S. have surged higher in response to historically low mortgage rates and households moving out of big cities.

Mortgage rates in the U.S. and Canada have begun to tick higher, however, largely in response to rising government bond yields. While mortgage rates remain at historically low levels, could rising rates negatively impact the red-hot real estate market in both countries? Let us know your thoughts.

Economic/industry news

Canada’s economy weakens 2020: Canadian economy contracted 5.4% in 2020, worst year on record

The U.S. unemployment drops to 6.2% in February: U.S. job growth blows past estimates; unemployment dips to 6.2%

European retail sales fall to 5.9% in January: Eurozone retail sales plunged in January

Caution warranted when investing in SPACs: Where SPACs pay off – and where they don’t

New stimulus package likely in the U.S.: Millions more will get stimulus check under U.S. rescue plan

Constructing a portfolio that may benefit from the recovery: How to prep portfolios for recovery as stimulus takes hold

Reasons for hope

J&J to partner with Merck to produce single-shot COVID-19 vaccine: Biden says Merck to help J&J boost production of new vaccine

A sense of control can boost happiness: Happiness expert: One technique for staying upbeat during the pandemic

Canadian government looking to boost vaccine research efforts: Vaccine efforts among 100-plus new projects to get $518M in federal research funding

Walmart goes on U.S. spending spree: Walmart says it will support U.S. manufacturers with $350 billion of added business

Adapting your business

The keys to launching a successful hedge fund: Successfully launching a hedge fund

Why your clients may need exposure to Bitcoin in their retirement portfolios: How Bitcoin fits in a retirement portfolio

Walmart hopes key hires will help propel its move into financial services: Walmart lures Goldman bankers in bid to fight Wall Street

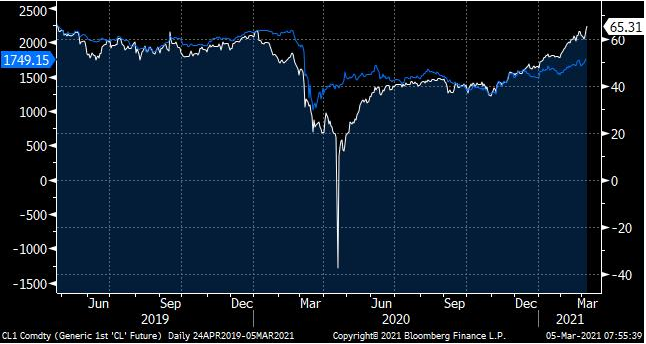

Chart of the week: Oil prices rising

The Canadian Energy sector (blue line in table above) has risen approximately 19% thus far in 2021, and has benefited from the rising price of oil (white line), which has risen 36%. As demand for oil dropped along with economic activity in 2020, a large inventory of oil amassed. Since then, however, demand has picked up while supply has remained muted.

Last week, the Organization of the Petroleum Exporting Countries and Russia announced they plan to maintain current levels of production for some time, which should cause global supply to decline even further. Canadian producers should benefit from rising oil prices. Higher oil prices could hit Canadians at the pump, however, which could, in turn, drive up inflation and reduce overall spending.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

U.S. large-capitalization mutual funds outperformed in February, and were helped by performance of value stocks: Active funds deliver alpha in ‘paradise’ for stock picking

Apollo Global Management makes two large acquisitions: Apollo doubles down on Las Vegas, retail with latest billion-dollar deals

Profits of asset managers were concentrated on a few firms: Asset managers ended 2020 with record revenues

From mutual fund to ETF: First mutual fund to ETF conversion is slated for late March

Confusion in reporting crypto holdings to the IRS: IRS rules on reporting Bitcoin and other crypto just got even more confusing

News and notes (Canada)

Attention has turned to an Ethereum ETF: Second Ethereum ETF filed in Canada

There were strong inflows into Canadian ETFs in February: February was a strong month for Canadian ETF flows and launches Why it might be the TSX’s turn to outperform: Why Canadian equities could (finally) outperform

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Monday morning briefing: Value (maybe) strikes back

What a week it was for the “big six” Canadian banks. Canada’s large banks all posted strong earnings results in their fiscal first quarter of 2021, beating expectations and showing little sign of weakness despite still-uncertain economic conditions.

One lingering concern since the start of the pandemic has been the potential for heightened personal and business debt defaults, and their impact on banks’ bottom lines. Luckily, defaults were mostly avoided and provisions for loan losses subsided, contributing much less to expenses in the first quarter.

Economic/industry news

Income and spending in the U.S. rise in January: Personal income leaps 10% in January thanks to stimulus, but inflation still in check

The Fed commits to continued support: Fed Chairman vows to keep supporting economic recovery

The shift to use model portfolios: Most firms now use model portfolios: survey

Interest in cryptocurrency debit cards gaining traction: Demand for crypto debt cards surges 194% in 12 months

Reasons for hope

We may be close to a single-shot vaccine: J&J single-shot vaccine found effective before FDA review

Production of vaccines ramping up: U.S. supply of COVID vaccine to substantially increase next month, manufacturers tell Congress

Canadian government extends recovery benefits period: Extra weeks to be added to COVID-19 benefits for workers and parents

Changing the pricing model for food delivery services: How this founder is helping restaurants reclaim their power

Adapting your business

How to ‘WOW’ your clients: 4 ways to give clients a ‘Wow’ experience

Expanding your business by encouraging innovation: Moderna cofounder Noubar Afeyan on innovating to drive real change

Americans are now paying closer attention to their finances: Pandemic makes Americans more financially focused, Allianz says

A plan to increase grant distributions: Five questions for clients growing their private foundations

Chart of the week: Value (maybe) strikes back

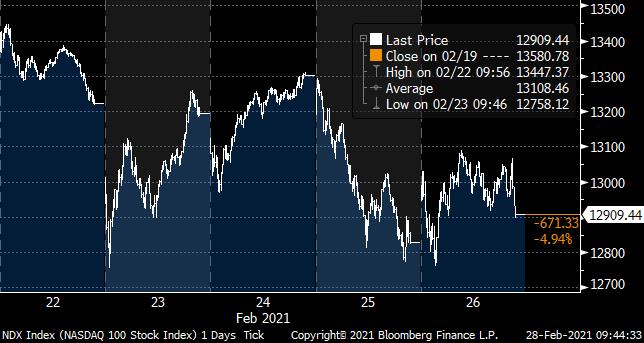

Over the past year, tech stocks have led the equity market as people have been increasingly working from home. But the past week was a tough one for tech stocks. Rising bond yields and inflationary pressures put the spotlight on equity valuations, particularly those that surged higher in 2020.

The NASDAQ 100 Index dropped 4.94% over the week, which was its worst week since October 2020. This decline may be signaling a shift from high-flying growth stocks to value stocks that could benefit from an economic recovery. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds may experience massive inflows in 2021: Barclays investor poll predicts rush of new capital in “breakout year” for hedge funds

The top 25 hedge fund managers made 50% more in 2020 than 2019: 25 highest-paid hedge fund managers made $32 billion in 2020, a record

Private equity firms to purchase asset management arm of Wells Fargo: Wells Fargo to sell asset management unit for $2.1B

Why T+1 settlement could benefit industry participants: Shorter settlement cycle would reduce risk: Moody’s

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: February 23 edition

News and notes (Canada)

Canadians still making RRSP contributions despite pandemic: RRSP contributions remain steady despite COVID-19, advisors say

Small businesses taking on heavy debt burdens in response to the pandemic: Small businesses saddled with $135B in extra debt amid pandemic: CFIB

DBRS believes the big six banks may largely avoid cryptocurrency holdings: Canada’s big banks not likely to join Bitcoin bandwagon: DBRS

A look at Canadian investment fund sales in January: Canadian fund sales totalled $15.9B in January

For financial marketing and investment commentary help, contact us at 1.844.243.1830 or info@ext-marketing.com.

Winning in a New Marketing Normal

| What financial professionals need to know to achieve the biggest impact from their marketing spend. The vaccine roll-out now underway offers hope that we will soon return to some sense of normal. Just don’t count on the vaccine to save you from another Zoom meeting once the pandemic is behind us. The way we communicate with clients and partners might never be the same. Developing creative ways to tell stories with digital tools is a great way for financial service providers to engage clients and create tighter partnerships, but many firms are just beginning to understand their full potential. Companies that use these tools most effectively will be clear winners. Here are four areas of focus that will set you up for success. |

| 1. Go all in – and get creative – with your thought leadership As our clients reduce spending on travel and entertainment, they are investing in their digital channels. One of the big opportunities? Thought leadership. The return on investment is more than worth the effort. The research bears this out. A study by Edelman and LinkedIn found that almost half of decision-makers say thought leadership is influencing their purchasing decisions. Overall: – 48% of decision-makers spend an hour or more per week engaged with thought leadership – 89% say thought leadership has enhanced their perceptions of an organization – 15% of decision-makers rate the quality of the thought leadership they see as excellent – 29% say they gain valuable insights more than half the time |

| ext. Takeaway: The most effective approach integrates the central themes from your thought leadership pieces into client emails and microsites, as well as conferences and client meetings. If you are already engaged in thought leadership, take the opportunity to analyze your approach to make sure your strategy will help you achieve your objectives. |

| 2. Prioritize marketing efficiency How you distribute your thought leadership can be just as important as the content itself. Your plan should outline how you are going to get your thought leadership in front of the right people. This is a critical step, especially now that we are all working in a world of fragmented engagement and tighter time pressures. While these challenges are making marketing more complex, your customer relationship management tool (“CRM”), if you have one, could provide a valuable solution. With the proper setup, you can get a deeper understanding of your clients to learn how best to engage them. Yet, this is an area where many companies still struggle. Many Salesforce users believe data quality is low. In fact: – 43% are not satisfied or are neutral with their Salesforce data quality – 58% believe up to 80% of data is not useful/reliable – 38% report duplicate/outdated/incorrect data * |

| Weak data quality can stem from a variety of issues. Firms tend to attribute it to a data-entry issue, but many major deficiencies can be traced back to poorly executed integrations. To make sure you get key insights into client profiles (i.e., you have high-quality data), ensure your integration is done right. CRM is a mindset and it needs to be integrated the right way. ext. Takeaway: The shifting structure of financial services firms and the sales and marketing teams within them is happening fast. While change can feel chaotic at times, financial services firms will benefit from strategic investments in their CRM. |

| 3. Story-tell your way out of the crisis Everyone loves a good story, but far too often, companies forget the importance of a strong narrative to help clients and prospects understand why a product, solution or platform should matter to them. Starting with key messages and building a compelling narrative will go a long way to helping you tell a memorable story. Having a strong message is key to grabbing people’s attention. Doing so will help you emerge stronger and deepen your client loyalty. ext. Takeaway: Take extra time at the front end to get your key messaging right. A compelling and consistent story will help to amplify your message across all channels. |

| 4. Diversity and inclusion matter more than ever The financial services industry has always been at the forefront of important cultural changes, and diversity and inclusivity have certainly become top priorities for companies within our sector. There is an increasing amount of evidence pointing to gender and racial diversity as being important components of a company’s brand and reputation. A recent Edelman-study reinforces why this matters so much: – 92% believe business must lead on positive societal change – 69% say diversity on boards will build trust in companies (an increase of 14% over last year) – 89% of institutional investors say shareholder activism will increase when the economy rebounds ext. Takeaway: Diversity and inclusion need to be approached with sensitivity and authenticity. They will strengthen your brand, increase engagement, and even enhance your performance. |

| Contact us today at info@ext-marketing.com or 1.844.243.1830 to see how we can maximize your marketing efforts in 2021. * Source: https://www.symphonicsource.com/blog/5-data-quality-stats-caught-eye/ |

Monday morning briefing: Steepening yield curve means steepening profits for banks

The first Bitcoin exchange traded fund (“ETF”) in North America, Purpose Bitcoin ETF, was launched last week. The ETF invests directly into Bitcoin and is available in Canadian, non-hedged units and U.S. dollar units. Needless to say, interest was extremely high, with US$145 million in shares of the ETF being exchanged in the first day.

Bitcoin has soared higher in 2021, largely in response to wider adoption, particularly among institutional investors. This will be a closely watched ETF, and it appears more offerings will be making their way to market in the near future. The U.S. Securities and Exchange Commission is likely monitoring this launch and considering its own approval of a Bitcoin ETF in the U.S.