Monday morning briefing: Value (maybe) strikes back

What a week it was for the “big six” Canadian banks. Canada’s large banks all posted strong earnings results in their fiscal first quarter of 2021, beating expectations and showing little sign of weakness despite still-uncertain economic conditions.

One lingering concern since the start of the pandemic has been the potential for heightened personal and business debt defaults, and their impact on banks’ bottom lines. Luckily, defaults were mostly avoided and provisions for loan losses subsided, contributing much less to expenses in the first quarter.

Economic/industry news

Income and spending in the U.S. rise in January: Personal income leaps 10% in January thanks to stimulus, but inflation still in check

The Fed commits to continued support: Fed Chairman vows to keep supporting economic recovery

The shift to use model portfolios: Most firms now use model portfolios: survey

Interest in cryptocurrency debit cards gaining traction: Demand for crypto debt cards surges 194% in 12 months

Reasons for hope

We may be close to a single-shot vaccine: J&J single-shot vaccine found effective before FDA review

Production of vaccines ramping up: U.S. supply of COVID vaccine to substantially increase next month, manufacturers tell Congress

Canadian government extends recovery benefits period: Extra weeks to be added to COVID-19 benefits for workers and parents

Changing the pricing model for food delivery services: How this founder is helping restaurants reclaim their power

Adapting your business

How to ‘WOW’ your clients: 4 ways to give clients a ‘Wow’ experience

Expanding your business by encouraging innovation: Moderna cofounder Noubar Afeyan on innovating to drive real change

Americans are now paying closer attention to their finances: Pandemic makes Americans more financially focused, Allianz says

A plan to increase grant distributions: Five questions for clients growing their private foundations

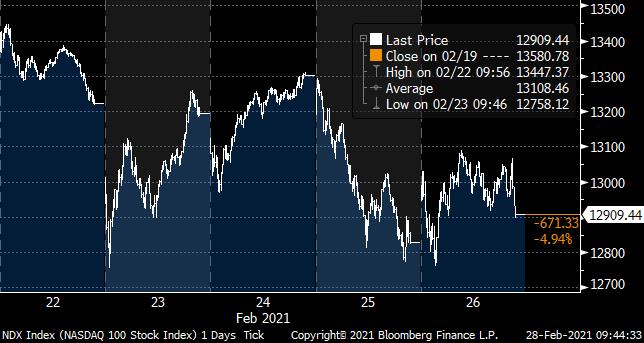

Chart of the week: Value (maybe) strikes back

Over the past year, tech stocks have led the equity market as people have been increasingly working from home. But the past week was a tough one for tech stocks. Rising bond yields and inflationary pressures put the spotlight on equity valuations, particularly those that surged higher in 2020.

The NASDAQ 100 Index dropped 4.94% over the week, which was its worst week since October 2020. This decline may be signaling a shift from high-flying growth stocks to value stocks that could benefit from an economic recovery. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds may experience massive inflows in 2021: Barclays investor poll predicts rush of new capital in “breakout year” for hedge funds

The top 25 hedge fund managers made 50% more in 2020 than 2019: 25 highest-paid hedge fund managers made $32 billion in 2020, a record

Private equity firms to purchase asset management arm of Wells Fargo: Wells Fargo to sell asset management unit for $2.1B

Why T+1 settlement could benefit industry participants: Shorter settlement cycle would reduce risk: Moody’s

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: February 23 edition

News and notes (Canada)

Canadians still making RRSP contributions despite pandemic: RRSP contributions remain steady despite COVID-19, advisors say

Small businesses taking on heavy debt burdens in response to the pandemic: Small businesses saddled with $135B in extra debt amid pandemic: CFIB

DBRS believes the big six banks may largely avoid cryptocurrency holdings: Canada’s big banks not likely to join Bitcoin bandwagon: DBRS

A look at Canadian investment fund sales in January: Canadian fund sales totalled $15.9B in January