Monday morning briefing: Mining for profits in the 21st century

This is a wonderful few weeks for gamblers as March Madness, the NCAA’s biggest basketball tournament, has begun. According to the American Gaming Association, approximately US$8.5 billion has been wagered on the tournament this year. Not to mention the countless entrance fees as friends, family and co-workers fill out their brackets and put a few dollars on the line.

In a typical year, the NCAA holds its regional games in different locations around the U.S., which translates to millions of dollars for local economies. While the NCAA earns about US$1.5 billion from this tournament, there’s an indirect cost for companies that stems from the tournament. A major U.S. employment firm has estimated that employees taking the time to fill out their brackets costs businesses approximately US$13 billion every year.

Economic/industry news

Durable goods orders post first decline in 10 months: Weather slams U.S. business equipment spending, while supply disruptions weigh

The BoC will gradually scale back some liquidity programs: Bank of Canada to wind down crisis liquidity programs

Higher taxes may eventually be needed: Yellen sees room for U.S. to borrow, opens door to tax hike

Inflation may not be as harmful as many expect: Why fears of inflation are ‘overblown’

Consumers focused on saving for liquidity, rather than retirement: Consumers want liquidity: Survey

Reasons for hope

Continuing the fight against infectious diseases: What’s next for Moderna post-COVID-19: CEO Stephane Bancel details mRNA pipeline

WestJet restoring some service to Atlantic Canada: WestJet reinstating Atlantic Canada routes after COVID suspension

U.S. companies urging the government to establish paid family leave: Over 190 U.S. companies urge congress to pass paid family leave

Adapting your business

Getting your business off to a strong start: 4 basic business tools new entrepreneurs need to succeed

Many Americans are falling behind in their retirement planning: Saving for the future is more popular than Netflix, but many are still falling behind: Survey

Nuvei to incorporate Mastercard Send in its payment platforms: Mastercard expands partnership with Nuvei, facilitating accelerated payouts with Mastercard send

Social issues top of mind among Canadian CEOs: CEOs shift focus to the “S” in ESG

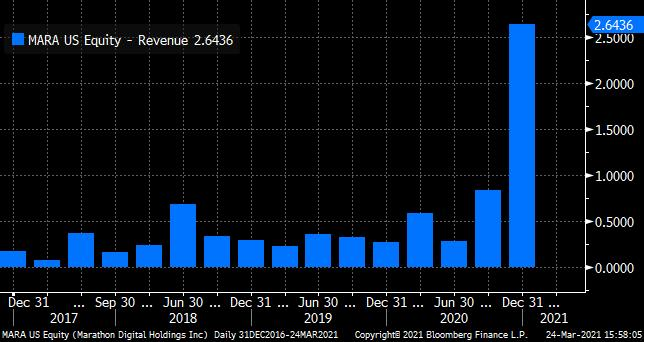

Chart of the week: Mining for profits in the 21st century

While investor attention is focused on Bitcoin, many companies are making inroads behind the scenes. One example is Marathon Digital Holdings Inc., which was one of the first digital coin miners listed on the NASDAQ Composite Index.

The company’s revenue rose in 2020, reaching US$4.4 million. The company has also been investing in additional miners, and plans to open another data centre. Bloomberg estimates that revenue could rise to US$286 million in 2021. So far in 2021, Marathon Digital’s share price has already increased 231%. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Why hedge funds are a natural fit with ESG: Hedge funds are the ESG bellwethers – do they know it?

Having a home country bias when choosing PE funds is not such a bad thing: The ‘home bias’ in private equity pays off

BlackRock making changes to its lineup of iShares Morningstar U.S. Equity Style Box ETFs: BlackRock cuts fees on $7.6 billion style ETFs to near zero

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: March 24 edition

News and notes (Canada)

Venture capital investments were $4.4 billion across 509 deals in 2020: Canadian venture capital investments totalled $4.4 billion in 2020

Credentialing bodies will be under the microscope to uphold standards: Title reg puts credentialing bodies to the test

Total assets for mutual funds and ETFs increased in February: Canadian fund sales exceeded $23B in February

Strong demand for Bitcoin ETF: Purpose Investments Bitcoin ETF crosses $1 billion in assets