Monday morning briefing: All Doges go to heaven … or, at least, the moon

A big congratulations to ext.’s very own President, Richard Heft, and Head of Content, Andrew Broadhead on their new book, The Ascendant Advisor. The book is now available on Amazon and uses content marketing and communications strategies to help financial advisors succeed in a post-pandemic world. This is an important subject for Richard and Andrew, who have dedicated their careers to helping advisors and financial services institutions’ convey their message and stories to clients. This is definitely a must-read for industry professionals.

Economic/industry news

Canada’s unemployment rate rises to 8.1% in April: Canadian economy lost 207,000 jobs in April, unemployment rate rises

The U.S. economy adds fewer jobs than expected: April’s expected hiring boom goes bust as nonfarm payroll gain falls well short of estimates

The Bank of England keeps its key rate steady at 0.10%: Bank of England slows bond-buying, sees economy bouncing back more quickly

Pension assets rebound strongly: The pandemic hit public pension funds hard – but now they’re better funded than they’ve been in years

Jim Grant’s thoughts on whether or not the Fed can contain inflation: Can the Fed contain inflation? Jim Grant says don’t count on it

Reasons for hope

Pfizer vaccine now deemed safe for teens: Children 12 and older now cleared to receive Pfizer vaccine: Health Canada

As India struggles, some companies stepping up to help: UPS donates $1 million in COVID aid to India, joining corporate giants including FedEx, Google and Amazon

Moderna to ramp up vaccine production later this year and next: Moderna will make up to 3 billion vaccine doses in 2022

Adapting your business

How to help employees who have suffered mental health issues in response to the pandemic: Employers brace for COVID’s mental health fallout as workers return

Don’t stop trying to achieve your goals: Stop stopping

Some tips to develop a strong cybersecurity network: The 6 things small businesses need to know about security

How to build employee loyalty: How to motivate staff (besides splashing money around)

The importance of understanding client personalities: Want your advice to stick? Consider your client’s personality

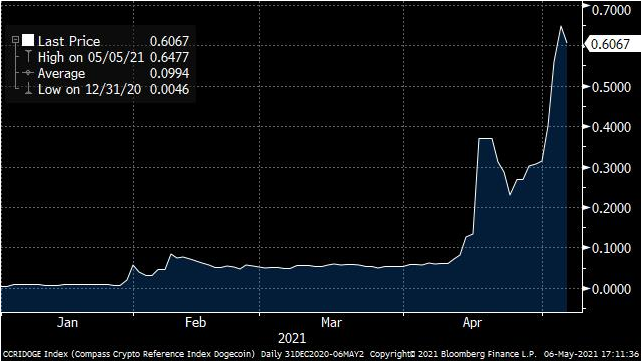

Chart of the week: All Doges go to heaven … or, at least, the moon

Add Dogecoin to the list of cryptocurrencies soaring higher in 2021. What is Dogecoin and how has it become so popular? Dogecoin was started as a bit of joke, and was named after a popular meme. A major difference between Dogecoin and some other digital coins is the ease in which miners can find Dogecoin, and there is not a finite supply. People such as Elon Musk and Mark Cuban have shown interest in the crypto, while Gemini, the crypto exchange founded by the Winklevoss twins, will soon allow trading of Dogecoin. Its price has risen more than 13,000% since the beginning of the year, now making it the fifth largest cryptocurrency by market capitalization. What’s next for this “memecoin?” Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Using technology to raise operational standards: Raising the bar for startup technology partners

Private equity makes a big splash in the digital media industry: Buyout of AOL, Yahoo signals PE’s biggest bet on digital media

Private equity firms don’t see SPACs as competitors: Private equity firms aren’t worried about SPACs anymore

Prepare to wait a bit longer for the first Bitcoin ETF in the U.S.: SEC delays Bitcoin ETF approval

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: May 5 edition

News and notes (Canada)

Investing in strong companies that are focused on climate change: Manulife launches climate-focused funds

Canadian ETFs post strong inflows in April, particularly crypto ETFs: Crypto ETFs hit $2.5B in AUM in April

Seeking growth through acquisitions: Wealthsimple eyes acquisitions after US$610M funding round

Some Canadian CEOs slow in acting on climate change: Canadian CEOs lag on climate change action

Demand for commercial properties in Canada is rising: ‘Stronger’ commercial leasing environment emerged amid COVID: RioCan REIT CEO