Monday morning briefing: Coherent crypto or Ethereum delirium?

What a day for the BlackRock U.S. Carbon Transition Readiness ETF, which recorded a massive US$1.25 billion of inflows in its first day of trading last Thursday. The ETF invests in companies on the Russell 1000 Index that it expects to thrive in a low-carbon environment.

BlackRock CEO, Larry Fink, a big advocate of environmental, social and governance (“ESG”) investing for some time, has been demanding change from corporate CEOs. It is, therefore, not surprising that BlackRock’s new ESG product is so highly valued by investors. ESG ETFs attracted record inflows in 2020, and their popularity has continued thus far in 2021. According to Refinitiv, ESG funds should experience another year of strong inflows, with “social” becoming a key theme in ESG investing this year.

Economic/industry news

Canada’s unemployment rate falls to 7.5% in March: Canada adds 303,000 jobs in March, unemployment rate falls

The Fed is not moving on policy anytime soon: Fed officials say easy policy will stay in place until economic ‘outcomes’ are achieved

ESG funds have outperformed since the start of the pandemic: Here’s more evidence that ESG funds outperformed during the pandemic

A crypto ATM machine is coming soon to a location near you: At least one crypto ATM is installed hourly, total global machines to reach 20k in two months

Reasons for hope

Some vaccines found to be effective against the California variant: 2 vaccines in use will be effective against variant of COVID-19 identified in California, Duke finds

Opera singers helping those suffering from shortness of breath as a result of COVID-19: How opera singers are helping people with ‘long COVID’

IMF believes government spending to support economic growth during the pandemic will result in tax revenue: IMF says controlling virus can raise US$1 trillion in tax revenue

Adapting your business

Preparing to thrive after the pandemic: The secret to business survival in today’s tough market

Fidelity planning to boost hiring: Fidelity to hire 1,000 financial planners in 2021

How financial advisors can become a go-to resource: How to establish yourself as the alternative

Launching a membership program: Best Buy starts paid membership program to rival Amazon, Walmart

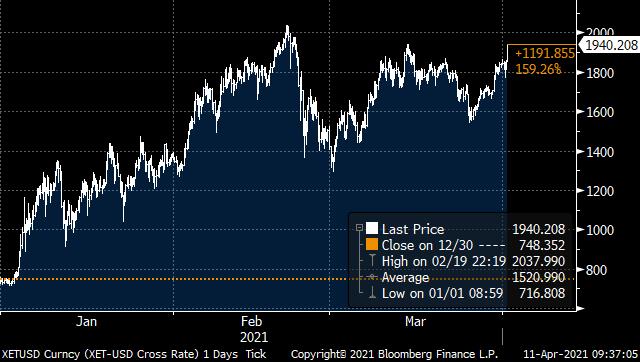

Chart of the week: Coherent crypto or Ethereum delirium?

While much attention has been paid to Bitcoin over the past few years, Ethereum has been gaining in popularity more recently in the cryptocurrency space. Ethereum is a blockchain network that carries Ether. This rise in popularity has prompted preliminary filings from Canadian ETF companies in an effort to launch Ethereum ETFs. The price of Ethereum has exploded thus far in 2021, and rose approximately 159% over the first quarter. Similar to Bitcoin, the rise in the price of Ethereum has been in response to increased interest from institutional investors.

Ethereum has benefited from other factors as well. Visa has begun settling its cryptocurrency transactions using the Ethereum network, while billionaire Mark Cuban has also stated his support of Ethereum. The largest difference between Bitcoin and Ethereum is the ability for developers to build applications on the Ethereum network, which they can’t do on the Bitcoin network. One question is which one will gain the most traction and be more widely adopted? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge fund investing in new technology is focused on alternative data: Amid the pandemic, hedge funds grapple with investments in new tech and alternative data

Financial firms join forces to create crypto trade group: Fidelity, other investment firms form crypto trading group

U.S. ETFs posted record inflows over the first quarter: U.S. ETF inflows set new record in first quarter

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: April 7 edition

News and notes (Canada)

CI launches the CI Bitcoin Fund: CI GAM launches Bitcoin mutual fund

There’s growing interest among investors in active ETFs: Canadian ETF investors get active

What the C.D. Howe Institute hopes for in the next federal budget: ‘Wrenching adjustment’ awaits feds if debt is unchecked: C.D. Howe

A national securities regulator appears unlikely: Shuttering of national securities regulator came as no surprise to industry