Monday morning briefing: SPAC your bags, we’re hunting for acquisitions

There was big news for the cannabis industry as New York became the sixteenth state in the U.S. to legalize marijuana use for adults. Sales are expected to start next year. Early projections are that sales could reach US$4.2 billion per year in New York. Furthermore, the legalization may open up thousands of jobs in the state.

It’s unlikely that legalization in New York will have a material impact on Canadian cannabis companies. However, should cannabis use become legal at the federal level, it may provide an opening for Canadian companies to gain a significant footprint in the U.S. market.

Economic/industry news

Canada’s GDP expands faster than expected in January: Canada’s recovery keeps up pace despite second-wave lockdowns

The Fed is not keeping rates low to help the government finance debt: Fed’s Waller says the central bank isn’t keeping rates low to finance government debt

Higher interest rates may not have a substantial impact on Canadian households: Households ready to weather higher interest rates: report

High correlation of returns make geographical diversification difficult: Geographical diversification is harder to come by, report says

Reasons for hope

Canada expecting a larger number of doses in June: Pfizer increases spring schedule, adds 5M doses to June shipments

Pfizer vaccine effective in children between 12 and 15 years old: Pfizer says COVID vaccine is 100% effective in kids ages 12 to 15

Adapting your business

A diverse team can help returns: What a ‘superior’ hedge fund team looks like

Finding solutions to work-from-home fatigue: Zoom CFO explains how the company’s employees avoid work-from-home fatigue

Exploring the future of financial planning: The future has never looked brighter

Social issues are top of mind among Canadian CEOs: 6 things your clients may not know about retirement planning

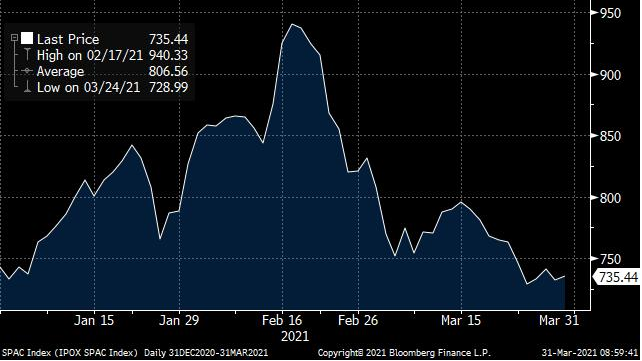

Chart of the week: SPAC your bags, we’re going hunting for acquisitions

Special Purpose Acquisition Companies (SPACs) have become more popular. These blank-cheque companies are formed for the sole purpose of acquiring an existing company. For investors, trust is put into the founder that a target company can be found and acquired. If an acquisition is not completed within two years, money is returned to investors. SPACs are also drawing the attention of the SEC regarding issues around how retail investors may be impacted.

In the first quarter of 2021, approximately 300 SPACs were launched, raising more than US$100 billion. Issuance has slowed recently as bankers and lawyers cannot keep pace with the number of SPACs looking to come to market. After strong performance in 2020, SPAC returns have since fallen partly as a result of an oversupply of issues. Let us know what you think about the future of SPACs.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Total assets in the hedge fund industry grew to US$3.4 trillion as of February: Hedge funds’ coffers swell further in February, as investors pile in

PE investment in tech firms sets new record in the first quarter: Private equity’s taste for tech spurs $80 billion deal spree

Selling NBA highlights using blockchain technology: NBA Top Shot mints a unicorn: How an Ethereum competitor cashed in on the NFT craze

BlackRock holds the strongest brand among asset managers: BlackRock, the world’s biggest asset manager, is also the world’s strongest asset management brand

Guinness Atkinson makes history with the first mutual fund to ETF conversion: History made with first U.S. mutual funds converted to ETFs

News and notes (Canada)

It was a busy week for ETF launches: Fund companies announce a bevy of new ETF launches

A look at the impact of social media on the lives of Canadians: Study: Canadians’ assessments of social media in their lives

Net new flows into Canadian ETFs had a record year in 2020: Pace of ETF growth to persist in 2021

Canadians concerned about having to owe taxes: 60% of Canadians procrastinating on tax filing over fears they may owe: Poll