4 Ways Marketing Can Enhance the Value of Your Private Equity Portfolio

Private equity (PE) firms are increasingly using a secret weapon to enhance the value of their portfolio companies and generate growth: marketing. PE firms excel at deal flow and restructuring, yet once they’ve acquired a company their toolkit should include strategies that improve brand identity and communications. Operational improvement, of which marketing plays an integral role, is a growing share of the value add provided by PE investors. Strong marketing strategies are proven to create value and attract higher exit premiums.

1. Increase market relevance.

Revisiting a company’s story and key messaging framework can help identify valuable attributes a portfolio company might have that align with current market demands. Identifying emerging or unmet needs in the industry and curating brand messaging that highlights these relevant attributes can be a game-changer in attracting investors, increasing value and capturing market share.

For example, a company may have inherent Environmental, Social and Governance (ESG) characteristics to bring to the forefront of their story in a way that bolsters that company’s overall value.

2. Improve competitive position in the current market.

Ensuring your portfolio companies’ brands and marketing strategies are as strong as possible will position them more favourably to investors. Uncertain markets are an essential time for stronger brands to vault over their more anemic competitors. Strong branding builds a sustainable competitive advantage that can withstand market fluctuations and make a company more resilient to external pressures.

3. Elevate digital presence.

Firms should not underestimate the power of a digital presence. With increased competition for consumer attention online, a harmonious brand presence across all relevant platforms is imperative. A well-designed website, up-to-date social media profiles and strategic content marketing all work to validate a company’s business model, enhance credibility and lead to a better consumer experience.

4. Improve internal and external communications.

Ensuring communications are aligned, both internally and externally, is vital to the strength of a brand. Internally, this can take the form of roadmaps, toolkits and dealer materials. Externally, this can involve communication with key stakeholders and customers, including whitepapers, thought leadership, educational materials and videos. Improved communication channels add value to your portfolio companies by streamlining operational practices and promoting transparency.

A marketing agency can give your portfolio companies the brand refresh they need to generate future value. A strong brand paired with a compelling digital presence, streamlined communications and other marketing materials will help position your companies advantageously, which can bode well for valuations and help promote successful exits.

Ext. Marketing recently won silver at the FCS Portfolio Awards 2023 for our Aqua Finance, Inc. rebrand campaign, and has worked with many other portfolio companies to successfully improve brand structuring and communications.

Discover how Ext. Marketing can add value to your firm. Book a call with us today at info@ext-marketing.com.

Four ways financial marketing will evolve over the next 10 years

The investment industry isn’t always easy to predict, but one thing is certain: the financial services marketing and communications landscape will constantly evolve. This was evident in our recent exploration of digital marketing trends. And there’s so much more to come! We foresee unprecedented evolution fueled by emerging technologies and shifting investor behaviours in the next five to 10 years. The future of digital content marketing presents exciting opportunities for the financial services industry.

What can we expect from financial marketing over the next five years?

1. Increased Personalization

Content will become even more personalized and tailored to individual customer needs and preferences. Advanced data analytics and AI technologies will enable financial marketers to deliver highly targeted content, personalized recommendations and customized experiences.

2. Gamification

Financial education and engagement may incorporate gamification elements to make learning and managing finances more interactive and enjoyable. Gamified experiences can help users understand complex financial concepts, track progress, and incentivize positive financial behaviours.

3. Voice-Activated Content

Voice-search optimization and voice-activated financial advice services will become increasingly prevalent components of marketing strategies.

4. Emphasis on Visual and Video Content

Visual and video content will continue to gain prominence in financial services marketing. Infographics, short videos and visual storytelling will be used to simplify complex financial information and captivate audiences with visually appealing content. Read more about ramping up your video marketing efforts here.

What about over the next 10 years?

1. Seamless Integration of Content and Transactions

Content marketing will become seamlessly integrated with transactional experiences. Financial brands may provide educational content and personalized offers at various touchpoints throughout the customer journey, ensuring a cohesive and value-driven experience.

2. Blockchain and Cryptocurrency Content

There is likely to be an increased focus on content aimed at educating audiences on the potential benefits, risks and investment opportunities in the blockchain and cryptocurrency spaces – including an emphasis on decentralized finance (DeFi) and digital assets.

3. Hyper-Personalization through Data Insights

By leveraging growth in data collection and analysis technologies, companies will gain access to improved insights into customer behaviours, preferences and needs. Content will be delivered in real time, enabling financial brands to provide timely and relevant information to their audiences.

4. Enhanced User Experience

The focus on the user experience will intensify, with financial brands aiming to provide seamless, intuitive and user-friendly experiences across multiple devices and platforms. User-centric design, intuitive interfaces, micro-interactions and enhanced accessibility will be key considerations in content marketing strategies.

Anticipating and adapting to industry changes will allow for strategic future planning. From increased demand for personalized content to a stronger focus on user-centric experiences, including immersive and interactive experiences, as well as digital advancements, will continue to redefine financial services marketing and communications.

If you’re interested in exploring these marketing trends further, or if you want to better align your messaging with these trends in mind, contact us today at info@ext-matketing.com.

How to engage hard-to-reach investor audiences

Investor audiences can be relatively difficult to reach for those raising capital or looking for new clients. By understanding the factors that make these audiences hard to reach, however, you can develop specialized marketing strategies to overcome the challenge of reaching investors and better engage this audience. Here are the main reasons investors can be tough to reach, along with some important strategic marketing solutions to attract investors.

Eight reasons why financial audiences can be particularly hard to reach:

1. Fragmented audience: Financial audiences can be diverse and comprise individuals with varying financial goals, knowledge levels and interests. This fragmentation makes it challenging to reach the entire target audience with a single approach or platform.

2. Information overload: The financial services industry is inundated with information from various sources, making it difficult to cut through the noise and capture investor attention. Strategic distribution and compelling content is required to stand out and engage the audience effectively.

3. Trust and credibility concerns: Financial decisions often involve a significant investment amount and a number of risks. As a result, investors tend to be cautious, and also tend to value trust and credibility. Companies looking to attract investors must establish themselves as reliable and trustworthy sources of information to gain investor attention and engagement.

4. Compliance and regulatory considerations: Financial content is subject to strict compliance and regulatory requirements. These regulations can impact the distribution channels and strategies available to companies looking to attract investors, while also requiring careful navigation to ensure compliance.

5. Financial jargon and complexity: The financial industry is notorious for its complex concepts and jargon. Communicating financial information in a clear and understandable manner is crucial to engaging your target audience.

6. Security and privacy concerns: Investor audiences are understandably concerned about their personal financial data and privacy. These concerns must be addressed to provide secure channels for content distribution.

7. Niche targeting: Investor audiences, including individual investors, retirees, small business owners or high-net-worth individuals, often have specific niches or segments. Effective distribution requires identifying and targeting these specific segments with tailored content that meets these audiences’ unique needs and preferences.

8. Relationship building and trust: Financial decisions are often based on trust and long-term relationships. Investing in building and nurturing relationships with your target investor audience requires consistent and targeted distribution strategies.

There are many opportunities to reach your target audience effectively. With the right marketing strategy and a focus on building trust, delivering valuable content and utilizing digital channels, you can easily overcome barriers to successfully engage investors.

Five ways to engage hard-to-reach investor audiences:

1. Leveraging digital channels and platforms: Utilize websites, blogs, social media, email marketing and industry-specific platforms to reach investors where they spend time.

2. Thought leadership and expertise: Establishing your thought leadership and expertise through content can help build trust and credibility, which, in turn, can make it easier to reach and engage investors.

3. Personalization and targeting: Leverage data and technology to personalize content and target specific audience segments to, deliver more relevant and tailored messages.

4. Strategic partnerships and collaborations: Partner with influencers, industry experts or complementary brands to expand your reach and credibility.

5. Educational and informative content: Provide valuable educational resources and informative content that positions you as a trusted source of information.

Reaching investor audiences can be challenging. By understanding their unique characteristics and tailoring distribution strategies accordingly, financial brands can effectively engage and connect with their target investors. Partnering with an agency like Ext. Marketing can help you create specialized marketing strategies and attract investors. Contact us today to reach your ideal investor audiences at info@ext-marketing.com.

How to use testimonials to boost your marketing strategy

If you’ve ever had to search for a new restaurant or book a hotel in a new city, you’ve likely read reviews (also known as testimonials) to make your decision. In the world of financial services marketing, testimonials can be just as powerful in creating a connection with your prospective customers. Studies have shown that 97% of business-to-business customers cited testimonials and peer recommendations as the most reliable type of content,1 while 72% of consumers say positive testimonials and reviews increase their trust in a business.2

Why testimonials work

When a person is faced with an uncertain decision, they naturally look to others for guidance. This “social proof” is rooted in our psychological need for validation from others who have experienced a company’s products and services.

There is a truism when it comes to marketing that says – “show, don’t tell”. You can have the best words to describe your value proposition and how you help your customers. However, there is nothing like having your own customers convey that message through their personal stories and experiences with your company.

If your purpose is to solve customers’ problems or challenges, testimonials show that you understand what they need and demonstrate how your company can help.

How to make sure your testimonials resonate

Be specific and focused

Stay away from generalities and draw on the details (metrics) that bring the reader into the story. Keep the testimonial focused on one problem or challenge and have your customer explain exactly how your company helped.

Use video

An effective testimonial is essentially a compelling narrative about how your company helped a customer. Videos are a great way to deliver that story, especially through social media.

Put a face to the name

Where possible, use a photo of the customer to create authenticity and a stronger connection to their story.

Case studies

Create a longer-form version of a testimonial with a case study, leveraging the context and complexity of the customer’s challenge to build a strong narrative.

Be credible

Avoid the perception of any conflict of interest or the notion that the customer is being compensated for their story. For U.S. investment advisors, be aware of the SEC disclosure requirements for testimonials and endorsements that came into effect in 2021 (the transition period for compliance ends on November 4, 2022).3

Need advice on how to incorporate testimonials into your marketing? Ext. Marketing can help you add this powerful tool to your digital platforms. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

1 Why B2B customer reviews matter as much as consumer reviews. Manya Chylinkski, Momentum, November 5, 2014.

2 How to Use Customer Testimonials to Generate 62% More Revenue From Every Customer, Every Visit, Emily Cullinan, Big Commerce, April 6, 2017.

3 SEC’s New Marketing Rule for Investment Advisers Goes into Effect, Arnold & Porter, May 14, 2021.

How solid are your marketing personas?

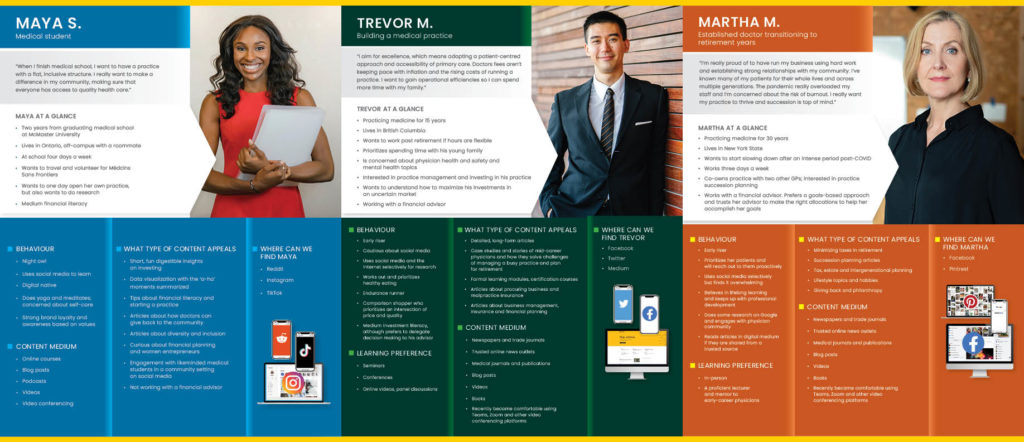

Who is this for? Why are we doing this? Are you sure we’re saying the right thing? Those are just three of the many questions you may ask yourself when working on a marketing project. Finding the answers is much easier when you have robust and relevant marketing personas.

What’s a marketing persona?

A marketing persona represents a group of clients with similar profiles, personal goals and client journeys.

Personas are a powerful way of embodying not only demographics (e.g., “our clients tend to be women in their 30s) but also user needs (e.g., “needs to prioritize risk management in their portfolio”). A persona can be viewed as a composite of attitudes, motivations, pain points and goals.

How customer personas add to your marketing strategy

The main benefit of developing personas is that they’ll help you adjust your brand messaging. Well-developed personas are powerful tools that can illuminate how a customer or prospect might interpret your offering. You can focus on marketing your messages and developing products based on those personas.

What to watch out for

Here are some pitfalls to avoid when creating your marketing personas:

- Making the personas too broad: You want them to address your clients’ specific likes, dislikes, goals, pain points, etc.

- Lack of research: You can build strong personas by interviewing a cross-section of your clients and prospects. Remember, it’s important to gather qualitative data to layer onto and complement quantitative data and insights.

- Making assumptions: If you’ve identified a blind spot in your personas, resist the urge to fill it up with something that may or may not be true. For example, if you’re not sure what your persona’s pain points are, don’t invent them, as you might be flavouring your content with incorrect assumptions. Do more research until your personas are truly useful.

The list could go on, but it’s a good start and reveals that building personas takes a bit of work.

Are your personas up to date? This is important. Over the years, your business may grow, expanding into new segments and regions and serving new clients. That’s why your marketing personas should also evolve.

Personas can help you tailor your messaging to optimize your clients’ experience and provide maximum value. As such, they should be essential tools in every marketer’s toolbox.

Need help creating or updating your user personas? Ext. Marketing can help. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

The golden rule of ESG investment marketing

As the landscape and regulatory environment around environmental, social and governance (ESG) continues to evolve, the question marketers of financial investments must answer is not if they need to factor ESG into their products and messaging, but how to do it. Whatever approach you take, it needs to be accurate and credible if you want to deliver a convincing story to your stakeholders to assure them you understand ESG and are taking it seriously. That was a key takeaway from the Gramercy Institute’s 2022 ESG Marketing & Communications Awards in New York this past June.

New risks and new opportunities

The shift to ESG has created fresh opportunities for investment marketers, but it has also introduced new risks. The lack of common ground between how different regulatory bodies measure ESG and set benchmarks are some of the biggest challenges marketers need to overcome. Despite the ambiguities around some of these core elements, misleading stakeholders by making an investment sound more environmentally friendly than it actually is could be construed as “greenwashing,” which will quickly attract the ire of regulators and erode the trust of key stakeholders.

At the Gramercy event, there was broad consensus that financial marketers need to take more time to understand what story they are trying to tell around ESG and why it matters, rather than using ESG as a marketing tactic.

Even amid the market uncertainty sparked by high inflation and rising geopolitical tensions, ESG isn’t about to fade from the conversation. Investors are concerned about returns, but, as many event panelists pointed out, ESG has become an important part of risk analysis and the due diligence process, even if it isn’t core to a strategy.

ESG is HTS (here to stay)

Institutional investors and other sophisticated allocators are increasingly asking ESG-related questions about non-ESG-labeled strategies. Measurement will be critical. Firms will be held accountable for measuring their progress to back up their messaging.

The best advice we can offer is to be authentic. Unlike the famous story of a large home improvement retailer that stocked its shelves with empty boxes in its early days to create the illusion they had lots of merchandise, fake-it-till-you-make-it won’t fly when it comes to marketing ESG.

Having supported a number of multinational financial firms with their ESG messaging, we can attest to this. How you message ESG can reveal a lot about how much an organization understands this issue. And never underestimate your audiences and stakeholders.

If you don’t have any ESG metrics you’re striving to achieve, don’t claim you do. It’s better to say you are developing your ESG strategy to set clear goals and benchmarks to track your progress than to get caught exaggerating your progress on the ESG front.

Don’t go it alone

As we noted in Five ESG trends every marketer should know, strong ESG reporting can offer an important competitive advantage in addition to being a powerful tool to mitigate reputational risk.

Just remember the golden rule of ESG marketing: If you want your messaging to be successful, it has to be authentic.

Looking for support in refining your ESG messaging? Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Auditing isn’t just for accountants. Marketers, we’re talking to you.

“Set it and forget it” is a thing of the past for financial marketers. Market volatility is spurring the need for more investor education, mounting investor demand is challenging marketers to create new and better environmental, social and governance (ESG) materials, and there’s a growing imperative for your messaging to be aligned with corporate diversity, equity and inclusion (DEI) efforts. The list goes on.

It’s no surprise that what once was considered an “evergreen” marketing mix is no longer as timeless as it once seemed. That’s why it’s important to audit your marketing content to ensure your messaging is aligned with your strategic marketing goals. If anything is off-kilter, it can compromise your brand story and put your hard-earned brand equity at risk.

Whether you are analyzing your marketing materials to identify stale messages, pinpointing gaps in your sales funnel, revising outdated figures or taking your marketing initiatives in a more digital direction, this five-step process will help you optimize your marketing and sales efforts.

Step 1: Analyze your marketing materials in relation to your priorities

Instead of a reactive approach to updating your materials, we recommend you be proactive to ensure your current marketing aligns with your firm’s strategic goals. Ask yourself what you want your marketing materials to achieve. Are there any risks or gaps? Have your goals evolved, and are your marketing materials keeping pace? The answers to such questions will likely be multi-faceted, so you will need an approach that takes a look at your key priorities and examines your marketing ecosystem through those diverse lenses. Here are examples of goals to guide your marketing audit:

- “We want our marketing materials to be on-message.”

- “We want to lower our marketing costs by amplifying our existing marketing materials.”

- “We want our language to reflect our ESG and DEI policies.”

- “We want our communications to be free of gender bias.”

- “We want to produce targeted materials that support our sales funnel.”

Step 2: Create a content map

Now that you’ve clearly defined your goals, it’s time to categorize, prioritize and map your marketing materials to identify opportunities, risks and gaps.

Start by using the goals you defined in Step 1 to determine how you prioritize your marketing efforts. You can group materials by client journey, theme, product or campaign. For example, if your goal is to target a specific demographic segment, such as Millennials or Gen Z, you could create a list of all the materials that apply to this segment and take stock of the touch points and assets you could use to communicate with them.

You might find that you have lots of content targeted at generating leads and awareness, but you need to fine-tune the messaging and value proposition on your website to drive conversions.

Step 3: Think digital first

While recent events have accelerated the transition away from print materials to digital assets, you may still have a library of strong materials that are only available in hard copy. And there’s an even better chance that your firm wants to take many of them in new digital directions. You can use a matrix or client journey map to help you identify where high-performing materials can be leveraged across all mediums. Digital is no longer an afterthought, because in many cases that’s how your audiences are accustomed to interreacting with your brand.

Over 50% of consumers believe that online experiences will be more important than in-person experiences.1 All the more reason to ensure your digital experience is on point. You likely have a wealth of marketing content that can be repurposed and optimized to create engaging and sharable infographics, videos, microsites and blogs.

Step 4: Line up your resources

Is your team big enough and scalable enough to handle the updates and fill in the gaps that you identified? Are there any talent or capacity gaps? If the thought of auditing or updating your marketing strategy and materials seems daunting, think about hiring a marketing and content partner who can help create a strategy and optimize your content. For best results, look for a partner that knows what resonates with key audiences in the financial services ecosystem. It’s important they understand how to produce desired outcomes that align with your business objectives – whether that’s reinforcing your brand, driving conversions, retaining clients or all of the above.

If you need additional resources, make sure that your content partner has the product and industry knowledge to complement and round out your team. Culture, collaboration and fit are key to a productive partner relationship.

Step 5: Execute, test and optimize

Now that you know what marketing materials you have and which ones you want to refresh, retire, optimize or create from the ground up, it’s time for your writers, designers and developers to get to work. Develop a strategic project plan that allows you to prioritize your marketing initiatives. That can help you think ahead, budget wisely and make large projects more manageable. It’s no longer a set-it-and-forget-it world. You’ll want to allow room in your budget for A/B testing so that you can course-correct and make micro-adjustments to ensure your content is performing at its best.

Next steps

Is your marketing strategy positioned to withstand the forces of change? Following the five steps above will help make sure your marketing plan is resilient and moves in lockstep as your markets, consumers, stakeholders and corporate guidelines evolve. The result? A marketing department with perennial value-add.

Ready to audit your marketing strategy? Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

What hedge funds can learn from luxury brand marketing

Brand matters. It sets you apart from the competition and helps entice a targeted audience to buy from you. This is one of the elements that sets a sports watch apart from an heirloom timepiece and, in many ways, one hedge fund apart from another hedge fund. Indeed, it could be argued that hedge funds and luxury brands have a lot in common.

Here are five ways hedge funds can be marketed like luxury brands:

1. Targeting the right persona

Hedge funds and luxury brands have similar buyer personas. That persona is affluent, accredited, cultured, well-educated and well-travelled. Specifically targeting these individuals – versus other retail investors – with your marketing efforts can be the difference between success and failure.

2. Being relevant

While luxury brands often have a “classic” feel to them, they’re never out of date or stale. Their websites, brochures and social media presence are relevant to today’s consumer and always focus on living the good life. Your hedge fund needs to convey a similar timeliness and relevancy.

3. Telling their story

Luxury brands are couched in stories of quality and exclusivity and hedge funds need to tell their story in the same way. Providing background information through adept storytelling weaves a compelling narrative, while helping investors make an informed decision about your fund.

4. Positioning matters

Hedge funds are the tools that build and protect the wealth of the same people who buy luxury brands. As such, they can be positioned as a part of your clients’ overall perception of success.

5. Having a robust digital marketing strategy

McKinsey & Company reports that nearly 80 percent of luxury sales today are “digitally influenced,” meaning people research online before making a purchase.* Hedge funds can reach that same key target audience by having a robust digital marketing strategy.

While hedge funds aren’t watches, cars or clothes, this type of thinking sheds some light on what’s possible. Investors in hedge funds and luxury brands share many of the same buyer persona traits. Understanding that demographic can help you better tailor your message to their specific needs and goals. That, in turn, can help you to better attract and retain customers.

Whether you’re an emerging or established hedge fund manager, Ext. can help you to create an effective marketing strategy for your brand. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Learn more about how Ext. can help you: Raise capital in a competitive environment.

Five ESG trends every marketer should know

In conversation with Daniella Woolf, Danesmead ESG

Over the past decade, Environmental, Social and Governance (ESG) has become a new reality for asset managers and asset owners across the capital spectrum – from large investment funds to alternative asset managers and hedge funds.

As more firms look to develop ESG policies, marketers must keep up with the trends to ensure their firms stay compliant in an evolving regulatory environment. To better understand these trends, we spoke to London-based Daniella Woolf, the founder of Danesmead ESG, which offers bespoke ESG services for investment managers and allocators.

It’s time to shift the narrative, says Woolf. “ESG shouldn’t be seen as an issue; it’s an opportunity for the investment industry,” she says. “Investment managers are in the midst of a new reality and those that adapt are poised to thrive. On the flipside, there is a significant opportunity cost and risk for those that fail to approach ESG proactively.”

Here are five ESG trends that every marketer needs need be prepared for:

1. Get ready to up your disclosure game

What you say and how you say it are becoming more important for marketers when addressing ESG. Increasing disclosures, particularly climate-related disclosures, is already a significant theme in 2022. Global regulators are all moving towards harmonizing the disclosure rules for carbon calculations, reductions or carbon offsets. Their near-term focus is at the corporate level for larger publicly listed, carbon-emitting companies and asset managers who engage in public financial reporting. Still, Woolf expects the attention will increasingly shift to investment managers in a tiered approach over the next few years – a trend she has already observed in jurisdictions such as the UK.

The takeaway: Overall, regulators and the industry are attempting to develop a common language around what it means to be sustainable. We are seeing a global move to harmonize a classification system for companies and asset managers, leading to easier comparisons and more accountability. With better disclosures, it’ll be easier to spot laggards and overachievers, which is a very positive development. For marketers, it’ll be easier to communicate the value of ESG with a common framework that allows participants to compare apples to apples.

2. Greenwashing will be an important lens when scrutinizing marketing

As marketers, you know how important it is to be authentic in all communications. With ESG, adhering to that approach is now more critical than ever. With increased regulation comes increased regulatory scrutiny targeting greenwashing. Avoiding hyperbole will be paramount. This will present new challenges for asset managers since there is still a grey area when it comes how ESG investments are classified. For example, the Sustainable Finance Disclosure Regulation (SFDR) provides a framework for investors to articulate the degree of sustainability risk for funds that are marketed in Europe. However, there is still room for interpretation within each degree of the framework. It may surprise some investors to see fossil fuel companies in impact funds. These managers may argue that there is a case for investing in fossil fuel companies that are “transitioning” or moving away from carbon-intensive activities or are participating in net-zero initiatives to offset their emissions.

The takeaway: According to Woolf, transparency is critical. Don’t overstate your efforts or link your investment objectives to ESG unless you can back up those claims. It pays to be really clear about what you do and what you don’t do up front. Marketers are well served to work with their legal counsel, compliance departments and investment managers to develop clear, holistic guidelines for promoting and communicating ESG funds to investors as marketing initiatives come under more intense scrutiny. On the client side, there is also a significant opportunity for investor education and literacy to reduce the risk of misunderstanding, especially for retail investors. For example, delineating the difference between ESG as a due diligence or risk factor versus focusing the conversation on whether a fund is impact- or sustainability-focused.

3. Expect to field more sophisticated ESG demands

As ESG discourse becomes more sophisticated, the bar will be raised for investment managers and marketers. Woolf says that over the last two or three years she’s increasingly seen established hedge funds and private equity firms that don’t have ESG products fielding specific ESG-related questions. Those questions can range from the type of climate-related or scenario analysis they’re performing to questions about stewardship and how they monitor and measure ESG in their portfolios. As standards are getting raised, it’s also a source of opportunity: Woolf has witnessed examples of hedge funds attracting significant inflows in direct response to implementing an ESG policy that they wouldn’t have landed otherwise.

The takeaway: Asset allocators are asking sharper questions and are better able to identify good versus poor ESG processes – even for non-ESG labelled products. Expect to see minimum standards for eligibility where asset managers can stand to lose out on capital if their ESG game is not up to par. In this environment, marketers should make sure client-facing teams are armed to articulate their ESG proposition and manage more sophisticated ESG conversations.

4. More ways to tell the ESG story

Historically ESG reporting has been very “ad hoc” and “on request.” We are starting to see managers looking into more structured and consistent reporting, says Woolf. Increasingly she’s seeing robust sustainability reports with differentiated content, including case studies and concrete KPIs. In addition, many asset managers are amalgamating and reporting ESG data in the form of consolidated risk reports.

The takeaway: Strong ESG reporting can confer an important competitive advantage in addition to being a powerful tool to mitigate reputational risk.

Marketers and communicators can expect to engage in sustainability reporting using an integrated approach, including web, prospectuses, newsletters, databases, and investment communications. While marketers will have more opportunities to tell their ESG story, any marketing and communication efforts need to be done holistically as they will also have regulatory and compliance implications. Woolf advises firms to be mindful about the data they’re collecting and what their end game is, by not looking at data in silos and being thoughtful when collecting data to think ahead to its future utility.

5. A richer, more diversified ESG dialogue ahead

Today, much of the ESG discourse is on climate change, and rightly so, but marketers need to think beyond the “E” in ESG. In the future, Woolf expects the conversation to diversify, including deepening the environmental conversation beyond climate change to issues such as biodiversity. Diversity, equity and inclusion (DEI) issues are also coming to the fore. Recent geopolitical events have highlighted defence questions, which has seen asset owners and managers revisiting their stance on certain exclusions and closely monitoring their portfolios’ potential impact on reputational risk. Overall, due to the higher profile, ESG issues are receiving in the media, there is greater potential for bigger headlines and there is more reputational risk at stake for any issue.

The takeaway: In a fast-evolving ESG field, we must constantly learn and be open to change. Those who are best positioned to educate clients and communicate with stakeholders will not only win additional clients, but effectively manage risk.

Is your ESG messaging and strategy future-proof? Ext. and our network of partners have the expertise you need to optimize your ESG story and help you mitigate risk. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Don’t let your marketing take a summer vacation

Have you started planning your summer marketing campaign? If not, time is running out.

Banking and investing used to slow down in the summer, but times have changed. Savers, investors and borrowers don’t just stop dealing with financial issues for two months. Their phones are always within reach, and they check on how their finances are doing. We know because we all do too.

In our digitally connected world, it’s dangerous to disappear over the summer. Your clients and prospects keep living and experiencing challenges; you have to move with them, so they don’t move away from you.

Here are a few ideas on why (and how) you should run a summer campaign.

1. Our digitally connected world never sleeps

The traditional seasons of investing, such as retirement savings season, are fading as we move into a 24/7/365 world in financial services. Contribution deadlines are still important, but investors are becoming more sophisticated and understand the value of investing year-round. Summer months, which were once thought of as times to disengage, have grown into a time when people now actively check their social media platforms for updates, meaning they are now great times to market to clients and prospects.

But engaging investors in the summer requires a different approach. Investors may be more likely to be away from their desks, but they’re always online. As such, consider mobile-first campaigns. Catch them when they’re out and about and taking a quick look at their phones.

2. Planning conversations happen during the summer

When people are enjoying the late evening on their deck or dock, they tend to slip into conversations about the future. And financial issues are definitely top of mind.

At the risk of repeating ourselves: people do not take two-month vacations from their finances. They may go away for a week or two. That’s why we think you should plan to run a marketing campaign for most of the summer. This will help you grab the attention of as many people as possible.

3. Keep it light, like a sunny day

People might have more headspace to talk about their plans during the summer, but you have to read the room. Don’t hit people with messages that are overly challenging. You want to make them feel easy, even fun.

The good news here: creating an engaging campaign will be more fun for you too! Choose a topic that lends itself well to positive, life-focused messages, and could spur many other wealth planning conversations.

While we hope you enjoy some downtime this summer, make sure that your marketing efforts don’t!

Start planning your summer campaign today! Contact us at 1.844.243.1830 or info@ext-marketing.com.

Inflation: a marketing opportunity or obstacle for asset managers?

Inflation is rising and the current surge may not abate anytime soon, which is something we haven’t seen much of since the 1970s. Asset managers have an opportunity to recalibrate their marketing strategies to this shifting economic landscape to help their firms not just survive, but thrive.

According to a recent Morgan Stanley survey, wealthy investors are starting to worry about their stock market holdings and finances at a level not seen since the second quarter of 2020, right after the COVID-19-related shutdown of the economy. This reduced optimism, paired with heightened price sensitivity among your clients, makes having a standout marketing strategy more important than ever. What does that look like today?

Foster trust through education

There’s a real opportunity in the asset management space to be up front about inflation in your messaging. Lead with education and put it into a context that makes sense for your clients. As you coach them on the impact of inflation, highlight the importance of putting cash to work to protect against savings erosion. Reiterate the power of diversification and the role of stocks and other asset classes as an inflation hedge. Also, educate and be transparent about the fees and costs associated with your products and services. Honesty and authenticity can go a long way in winning and retaining market share.

Amp up your brand

Periods of uncertainty are the perfect time to focus on brand building. Maintain the strength of your firm’s position by nurturing the emotional and rational story of your brand. Stay actively visible in your key markets and remember that your audience goes beyond your end clients. Consider how marketing connects with partners, suppliers, employees, colleagues and other engaged parties. Keep in mind that no previous period of prolonged inflation has had a digital ecosystem as widely accessible or advanced. You have countless opportunities to connect with your audiences and reinforce your value proposition.

Revisit your client segments

Given the psychology of inflation, your clients may feel different about their economic well-being. Even higher-income earners can be anxious that their health or employment circumstances will take a turn for the worse. Re-evaluating your existing client segments and conducting market research more regularly can help you identify new segments and their pain points. Having a keen understanding of your audiences and their motivations and preferences will help you develop products, fee structures and marketing strategies that effectively respond to their changing needs. Communicating to overcome client fears about inflation can be a way to combat their pessimism and compel them to keep investing. A/B testing (comparing two versions to determine which performs best) can be your friend in getting a closer read on what messages resonate best with them.

Spend smarter

While containing costs is always good practice, avoid making indiscriminate cuts from your marketing budget. Fine-tune your spending, focusing on creating efficiencies and accelerating activities that can generate future sales or build your brand. Digital tools can also help you defend against inflation by helping you manage costs, logistics and other overhead expenses associated with your marketing efforts. Arming your salesforce with clear scripts that address client concerns and are consistent with your revised marketing strategy can help them feel supported and motivated.

Seizing this time as an opportunity to win your clients’ appreciation will have a positive impact that can last long after inflation has receded.

Looking to ramp up your inflation marketing strategy? Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Pandemic marketing lessons that are here to stay

We have learned many marketing lessons during the COVID-19 pandemic. Here are four key strategies that are likely to remain.

1. Social distancing … is the new norm

Work from home, shop from home, do pretty much everything from home. It is a pre-pandemic trend that accelerated dramatically during lockdowns. Are we all more introverted than we thought? Whatever the case, we’ve become more comfortable with digital life. Not only digital shopping but attending virtual meetings and online conferences, taking continuing education courses, working from home – you name it. Doing it online has become the new norm.

Clients have become accustomed to the time and location freedom provided by online transactions. So, keep developing tools that ease digital communication. Also, leverage customer relationship management (CRM) technology to obtain good digital intel on your contacts, as you may have fewer opportunities for in-person face time in the future.

2. Temperature checks … for your clients

We’re not talking about taking the temperature of your clients’ foreheads. We’re suggesting you take the “temperature” of your clients with surveys and conversations.

As business moves online, what you lose in face time you can more than make up for with “digital” time. By leveraging email, social media, webinars and virtual meetings, you can more efficiently manage your day.

You can survey clients formally via digital survey tools or informally during meetings by simply asking them what they want.

Surveys can address broad issues such as client satisfaction or target more specific areas of your business. It’s also valuable to capture information shared in informal conversations. These talks can sometimes bring nuance or a different answer than surveys alone. The insights you glean can help you develop an updated, or more highly refined, marketing strategy.

3. Clean and disinfect … your marketing strategy

To remain successful, marketing teams had to re-examine their marketing strategies in 2020 and 2021. While stressful and time consuming, most firms benefited from the changes. Some even reimagined or refined who they are.

Events weren’t cancelled, they went online. Print materials went digital. Digital became more interactive. Marketing teams became more selective about where, when and how they advertised.

Read more on B2B marketing trends.

4. Monitor your health … your marketing health that is

Going digital makes everything trackable. That’s not news. But it’s vital to embrace it like you will embrace your friends when lockdowns end.

Track data and use Google analytics to measure interest and key performance indicators. And then measure your success.

Having data at your fingertips will help you identify what’s working and what’s not, and adjust your plans accordingly. Most importantly, you can see when something is going right and lean into that success going forward.

Looking to take your marketing out of a creative lockdown? Ext. Marketing has the expertise you need. Contact us today at info@ext-marketing.com or 1.844.243.1830.

Five New Year’s marketing resolutions you’ll want to keep

There are few times when we are as eager to set goals for ourselves as we are the start of a new year. Psychology Today suggests the key to sticking with your resolutions requires a shift in mindset. It’s not enough to set a goal; you also need to develop a thoughtful plan that considers how you might respond to potential pitfalls.

Resolutions that stretch your abilities are great, but they must be realistic. Having someone in your corner is vital. This support can help keep you motivated and offer fresh perspectives on how you can achieve your goal.

Here are five New Year’s marketing resolutions that’ll help you get better results:

1. Understand the why before diving in

When work is piling up, take a moment to reflect and wrap your head around the purpose and outcome you are hoping to achieve. It’s natural to develop new and exciting marketing ideas as you work through a project. As tempting as it may be to integrate those ideas into the work that’s already underway, consider saving those ideas for later. Not only will this help keep your current project on track and on budget, but it gives you an opportunity to build off the momentum of getting a successful project into market.

2. Adopt a storytelling mindset

Always keep in mind who your audience is and look for opportunities to incorporate storytelling into your marketing. It’s always better to “show” the value of your brand rather than “tell” people why it is so great. Marketing professor and bestselling author, Jonah Berger, puts it this way: “When people put their kids to sleep, nobody tells bedtime facts.”

3. Make white space your friend

You have so much thoughtful information to share with your audience that you feel compelled to put it all on the page. Resist this urge. Your audience will skip over copy-dense pages. Keep what’s most important. Lighter pages are easier to process, making it more likely they will retain your message.

4. The five-second rule

By some estimates, the average user spends no more than 5.59 seconds on a site’s written content and about 5.94 seconds on a site’s main image.1 The key to developing great website content is to say more with less. Make sure your readers can skim the page to find what they want quickly and easily – whether they are on desktop or mobile.

5. Test and learn

No matter how confident you may be that you have created an engaging marketing campaign, the only way to know for sure is to track results. Continuous testing and refining of your messaging can drive more leads. In the case of online content, consider A/B testing by splitting your audience into two (or more) groups and serve a different version of your campaign to each group. Once you determine which version is performing best, you focus on that one and pull the others down.

Just as the key to enjoying life is moderation, successful marketing requires a thoughtful and measured approach. Following these five resolutions can help create a better marketing experience and deliver incredible results.

Cheers to a healthy and prosperous 2022!

Looking for support in getting your message out in 2022? Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

1Laja, Peep, “10 useful findings about how people view websites,” CXL (Viewed on Dec. 30, 2021) https://cxl.com/blog/10-useful-findings-about-how-people-view-websites

Giving the gift of education with a 529 plan

What better gift can you give a young person than a contribution to their future education? It’s a simple message – but a powerful one. It was also one of the core themes of last month’s 529 Conference, attended by Ext.’s CEO, Jillian Bannister and Ira Berg, Ext.’s Managing Director, U.S.

The annual conference focuses on the ever-evolving 529 education savings plan market. The conference was a rich source of updates on recent U.S. federal legislative developments, along with insights and ideas on how to support the successful marketing of 529 and ABLE accounts (tax advantaged savings accounts for individuals with disabilities).

The discourse was of great interest to the Ext. team due to the marketing strategy and campaign work we help asset managers and advisors undertake with their 529s in the United States and RESPs in Canada. We came away with the following key insights.

Lingering misconceptions: an opportunity to educate

There are many misconceptions about 529 plans that marketers need to address. Many forget that 529s are not just for college – they’ve been adjusted to accommodate apprenticeship expenses and, since 2019 SECURE Act, was passed they can even be used to pay down student loans. The Tax Cuts for Jobs Act (TCJA) also paved the way for 529s to cover grades K through 12 tuition (in eligible states). Given the volume of change in recent years, we often advise our clients to consolidate a list of myths and dispel them. It’s an opportunity for investment professionals to showcase the flexibility of this education savings vehicle and how it can help meet diverse financial goals.

What’s new: 529s will no longer impact financial aid

In the past, one of the major concerns about 529 plans was the impact they had on whether a student could qualify for federal financial aid. But planned revisions to the Free Application for Federal Student Aid (FAFSA) are about to change that. SavingForCollege.com reports that as of the 2024-25 school year, applicants will no longer be required to disclose cash support (which is currently counted as untaxed student income). This is great news for contributors and a key issue that can be included when educating investors. Grandparents and others can now feel confident knowing the additional support they’re providing won’t detract from a student’s need-based financial aid package. This is another great educational opportunity as clients may wish to revise their strategy based on this important development.

Expanding market: 529 plan and ABLE account assets continue to rise

The 529 and ABLE plan markets represent a huge opportunity for the industry in terms of tax, financial and estate planning. Stats shared at the conference, as part of its 3Q 2021 529 and ABLE Market Sizing Highlights report, confirmed the ever-growing amount of money being drawn out of these plans to help fund education. The report says: “Estimated 529 savings plan net outflows were $3.9 billion in 3Q 2021 compared to net outflows of $3.6 billion in 3Q 2020 and $3.9 billion in 3Q 2019.” It also points out that there is a missed opportunity when it comes to ABLE accounts. Only $937 million was invested in ABLE accounts in 3Q 2021, yet the Centers for Disease Control reports that 61 million adults in the U.S. live with a disability. Learn more about the value of ABLE accounts.

Growing your business: 529s can be just the beginning

It may not seem like much but offering to manage a 529 plan on behalf of a parent or grandparent can be a great first step towards providing them with more holistic wealth management, including estate planning. Helping a young couple save for their new baby can be an opportunity to grow relationships and achieve stickier assets.

With the holiday season upon us and the new year fast approaching, now is a perfect time to promote the advantages of both these plans. Plus, explaining their tax advantages may open the door to a wider discussion on investing and life goals.

We can help you get an A+ on your 529 marketing

Looking for support in refining your 529 plan or RESP marketing? We have education savings strategies that can sustain your client conversations throughout the year. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Five things B2B content marketers are focusing on in 2022

The pandemic’s impact has reinforced the effectiveness of content marketing in helping to build brand awareness, generate trust and drive leads. In the last 12 months, 90% of respondents to the 12th Annual B2B Content Marketing Survey by Marketing Profs/Content Marketing Institute said they used short articles/posts for content marketing.

Two-thirds of the marketers surveyed said they expect their budgets to increase in 2022. So, where are their investment dollars going?

Here are the top five areas B2B content marketers are planning to focus on in 2022.

VIDEO CONTENT

69% of marketers

Videos can tell powerful stories to engage audiences. According to Wyzowl, 68% of consumers would rather watch a video than read something to learn about products or services. Quick tips: Include captions and shorter is better. Verizon Media reports 92% of consumers view videos in silent mode. And WeVideo Inc. says videos of 15 seconds or less have a 37% higher chance of being shared.

Events

61% of marketers

Digital, in-person and hybrid events can provide unique ways to connect. Digital events can increase your reach and provide on-demand viewing options. However, in-person events can generate anticipation and provide an exclusivity not easily duplicated on screen. In 2022, marketers are planning an increased mix of both. Of those surveyed, 52% expect their investment in in-person events to increase, while 39% say their spending for hybrid events will grow.

OWNED MEDIA ASSETS

57% of marketers

Posting content on your website and social media channels can help you engage with target audiences. Consumers are likely to react positively to objective, meaningful and educational content that is both informative and compelling. If you’re writing a guest blog for another platform, be sure to request a link back to your website to help boost traffic.

PAID MEDIA

55% of marketers

In 2022, mobile is expected to replace direct mail for the first time in the local marketplace. Mobile will become the top local paid media advertising platform, reports Forbes. Much of that paid advertising will promote posts on social media. Not surprising, as Hootsuite says marketers can reach more than 60% of all adults aged 13 and above outside of China using Facebook’s portfolio of platforms.

Looking for content marketing support? Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Source: Stats from the 2022 B2B Content Marketing Report: Benchmarks, Budgets, and Trends and the Content Marketing Institute: B2B Content Marketing Insights for 2022

Get noticed on a budget: Key marketing strategies for fintech start-ups

The financial technology (“fintech”) industry has been growing at a breakneck pace. In such a competitive space, getting noticed as a start-up can be tricky. Here are three key ways to help you stand out from the crowd.

1. Define your value proposition

Think about it, write it down, revise it. Repeat. You understand what your company does and how it makes your clients’ lives easier, but can you distill all that down into a single, easy-to-understand sentence?

Putting the value proposition right into your tagline can help potential clients understand what you do immediately. For example, Wealthsimple uses, “Do money right: Powerful financial tools to help you grow and manage your money.” Shopify uses, “The platform commerce is built on.”

A strong pitch serves as the entrée for a longer, more detailed conversation about the benefits of your products and services. It ensures that when potential customers think of your company, they will have a clear idea of the often-complex nature of your work.

Another benefit? Your employees will better understand the vision and focus of the company, which will help them conduct business activities from sales to recruitment to investor relations.

2. Identify your key audiences

Fintech is not a one-size-fits-all proposition. Customers will have different goals and present distinct challenges to achieving those goals. This can be a benefit to you as a marketer. It allows you to zero in on those individuals or companies with problems that your products are well positioned to solve.

Identifying your key audiences should be an ongoing process. You can take advantage of digital tools to find out who has been visiting your website, reading your LinkedIn posts and leaving comments.

Once those key audiences are identified, you need to determine the best ways to reach them, be it through owned media (your website, blog, social media posts), earned media (where you inspire others to share your posts) or bought media (purchased ad space or advertorial content). Each channel has unique benefits and costs, but all can be useful in getting your message out to the right people.

3. Leverage social media

Maintain a strong website and social media presence, and create blog posts to share your current thinking or research. Leverage your technology advantage. Industry-specific and tech-savvy mainstream media are hungry for stories about technology. By making them aware of what you’re doing, your offering may become a future headline.

With the growing importance of social media (such as LinkedIn) and community-specific forums (such as Reddit), the concept of engagement has evolved. While generating sales is still your goal, it’s also important to engage customers by building a community around your industry, your products and the people who use them.

Sharing great ideas or expertise via social media is a cost-effective way to introduce your company to new customers and maintain relationships with existing customers. Your posts will more likely be shared if they are thoughtful, timely and relevant to issues your potential clients are facing.

Also, the more you engage with prospects and customers, the more you will learn about them and the better you will be positioned to serve their fintech needs. Looking for marketing support in launching your fintech company?

Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Marketing ETFs to investors goes beyond a battle of low fees

With thousands of ETFs to choose from, marketers need innovative strategies to stand out from the crowd.

The popularity of low-cost exchange-traded funds (ETFs) among both seasoned and novice investors continues to snowball.

BlackRock’s iShares, Vanguard ETFs and State Street’s SPDR (SPY) dominate the global ETF marketplace in terms of assets under management (AUM). iShares AUM was US$2,360.25 billion as of October 15, 2021.

Low fees have been one of the defining facets of ETFs, and it continues to be an important selling point. None of the top ETF fund providers shy away from promoting cost-effectiveness. And why should they? After all, investors love the low fees. Vanguard describes ETFs as “highly effective, affordable investments.” BlackRock says iShares are “easy and cost-effective.” State Street highlights “lower expense ratios.”

Even the newly launched bitcoin ETFs are trying to follow this model to carve out their own market share with lower and lower fee offerings, reports Bloomberg.

But in an increasingly competitive marketplace how can marketers help ETF entrants stand out from the crowd beyond their low fees? We looked to the “big three” for some clues.

Investment philosophy

For novice investors, making investment decisions can be daunting and complex. A recurring theme within the big three’s marketing materials is investor education. On its website, Vanguard presents the following four guiding principles to promote investment success:

- Think about goals

- Stay balanced

- Keep costs low

- Be disciplined

These four nuggets of advice reinforce the importance of crafting a crystal-clear message that invites investors to harness the power of the fund’s investment philosophy.

Resources

Sharing information based on feedback from investors is a great way to promote transparency. In a recent article Marketing ETFs in uncertain and volatile times, Alex Craddock, Global CMO of iShares, recommends posting informative content to reassure investors. Providing insight into a trending investment theme also helps engage your target audience and encourages them to follow you. iShares’ paper A sea change in global investing, for example, addresses investors’ concerns about climate risk and sustainable investing.

Font in focus

With mobile devices accounting for approximately half of digital traffic today, optimizing digital marketing for smartphones is vital. On its website, the iShares paper is posted with a large black font against a bright green background to evoke an energetic sense of confidence. The strong colour palette is instantly memorable.

The bold title fonts used on iShares’ website and in State Street’s ETF Education section are particularly effective for a smaller smartphone screen. Eye-catching statistics, like State Street launching the first U.S.-listed ETF in 1993, pop off the page.

Celebrity power

In a very different bid to get people to sit up and notice, State Street enlisted Hollywood actress Elizabeth Banks to create a video raising awareness about its ETF mid-cap assets. During an interview with Bloomberg, Matt Bartolini, Head of State Street’s SPDR Americas Research, said he wanted to get the message out to investors and clients in a “fun, digestible way.”

The right support

While all ETFs provide the promise of lower fees, offering the right support to help guide investors can be the most effective marketing tool. Marketers face the challenge of curating these resources into manageable bite-size pieces that can give scrolling investors pause for thought. In a hyper competitive marketplace, small tactics like ease of viewing on mobile, timely and transparent resources, and a clearly articulated investment philosophy can make a difference.

Looking for support in refining your ETF messaging? Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

ESG marketing about to face new scrutiny as SEC cracks down on greenwashing

Marketers love talking about ESG, but with regulators starting to examine investment managers’ policies, it’s more crucial than ever that claims align with reality.

ESG (an acronym for environmental, social and governance) investing is reshaping the investment industry, if not the entire world. And now, the U.S. Securities and Exchange Commission (SEC) is looking to reshape ESG.

Marketers are often called on to shape the messages that articulate ESG. What does it mean? Why does it matter? What do we do differently? Given the scope of the SEC’s approach, marketers’ work will be affected.

What’s happening – All eyes on ESG marketing messages

ESG issues such as climate change and diversity are driving everything from political agendas to corporate policies to your neighbours’ investment decisions. As such, many ESG investment products are coming to market.

Following in the footsteps of European regulators, the SEC is scrutinizing investment managers’ ESG claims. The SEC wants to know the standards that managers use to classify their ESG funds. The SEC is focused on the hype – and it wants to know if what marketers are saying is accurate.

Third parties are also reviewing managers’ claims. One recent study found that a number of climate-themed solutions are not living up to Paris Agreement goals for reducing greenhouse gas emissions. While this study was limited and may have had gaps in its analysis, for marketers the point is clear: the messages you take to market will be viewed by many different parties.

What this means for you – Accuracy and authenticity rule

Marketers should be aware of the potential perils when their messages do not align with the investment policy and process. ESG is a broad label. It’s important that regulators do not think marketers are using vagueness to mislead investors.

Disclosures: Must reflect what’s actually occurring within the strategy. If not, financial and reputational risks may develop.

ESG issues: Make them crystal clear. If your fund is aligned with the Paris Agreement, explain how. If it focuses on governance issues such as diversity on boards, provide details.

The good news is that marketers, and the firms they work for, are staying ahead of change. In fact, they are taking leadership roles. In Canada, a recent Canadian Securities Administrators (CSA) ESG-related roundtable discussed emerging issues in the ESG space. Enhancing ESG-related disclosure was at the top of the panel’s priorities.

In Europe, the Sustainable Finance Disclosure Regulation requires ESG funds to classify themselves according to a specific framework. While this type of requirement may be further down the road for North American funds, it’s time for marketers here to prepare for the future.

Marketers need to work closely with product specialists to build a deep familiarity with ESG investment processes. This collaboration will help identify the data needed to back up their marketing messages.

With those relationships in place and the data in hand, marketers can ensure their messages are accurate and authentic, which will further help their messages resonate in the market.

Learn more

- SEC Response to Climate and ESG Risks and Opportunities (U.S. SEC)

- Intro to Responsible Investing (RIA Canada)

- New ESG Regulation Out of Europe Redefines Investment Risk (TriplePundit)

Looking for support in refining your ESG messaging? Ext. has the expertise you need. Contact us today at 1.844.243.1830 or info@ext-marketing.com.

Get mindful about your hedge fund marketing

Launching and managing a hedge fund pulls you in many different directions. You’re juggling countless priorities, such as performance goals, research and analysis, meetings and conference calls, just to name a few. It’s hard to take a step back to gain perspective while all of this is going on.

Here’s the challenge: if you’re looking to create great marketing materials for your hedge fund – which you’ll need to do to succeed in this challenging environment – you need a deeper perspective. That’s where mindfulness comes in.

Mindfulness is about connecting with the present moment and making sense of the ongoing stress in our personal and professional lives.

Practicing mindfulness helps you redirect your focus, allowing you to regain awareness of your body, mind and environment. “Mindfulness means being awake. It means knowing what you are doing,” said Jon Kobat-Zinn, better known as the founder of modern mindfulness.1

Mindfulness and hedge fund marketing go hand in hand. Here’s how:

Helps view your fund from investors’ eyes

Great marketing speaks directly to your audience, typically investors and allocators. You need to see the features and benefits of your hedge fund from their eyes, not just your own.

Because mindfulness helps you slow down and be present, it helps you detach from conflicting points of view and lets you see your fund through a different lens.

“Learn to train your mind like you train you body, and begin to re-wire your brain to be more calm, more productive, more creative.” –Kirstin Broderick, Founder, North Scale, Leadership Development and Performance Management Training

Sharpens your focus on key messages

Marketing focuses your message on the most compelling aspects of your offering, better known as your unique value proposition or “edge.” This can be tough if you’re too deeply involved in the nitty-gritty of managing your fund.

Mindfulness, however, redirects your point of view and, in turn, helps you isolate the key messages that you want to your audience to understand.

Nurtures your creative marketing side

Given that mindfulness makes you more aware, you may be compelled to eat better and take more breaks. It also slows down your thoughts and nervous system, helping you avoid excessive stress.

Ultimately, it strengthens your body and mind, and re-energizes your creative efforts, which are key to effective hedge fund marketing.2

Contact us at 1.844.243.1830 or info@ext-marketing.com for a deeper perspective on your hedge fund marketing efforts.

1 Jon Kabat-Zinn, Wherever You Go, There You Are: Mindfulness Meditation in Everyday Life, 2005.

2 Thrive Global, How Mindfulness Can Change Your Marketing Activities as An Entrepreneur Forever, 2017.

How to create a great workback schedule

A clear workback schedule is essential for a smooth running project. It will help map out all the tasks that are required to finish a project, as well as assign a person and due date to each task.

Why is this so important? Because it helps everyone involved know what they need to do and when they need to do it.

Don’t know what a workback schedule looks like? Here’s a sample we found after a quick search online.

Here are some tips for creating the best-possible workback schedule for your next project.

Organize by date

- Review all deliverables and talk to (or email or phone) your team to estimate how long each deliverable will take to complete

- Communicate with your client (internal or external) to find out their review process (e.g., compliance, sales, etc.)

- Try to coordinate deliverables that can be delivered on the same date if they can be completed at the same time

- Schedule delivery dates on the same days each week to maintain a regular work flow

Colour code

- Colour code each deliverable due by a specific team/member

- Choose a universal colour that will be used to highlight due dates so that they stand out

- Create a legend with the colours used in the workback

Global statutory holidays and employee holidays

- Review and take into account statutory holidays in the countries that will be involved with/impacted by the project

- Factor in employee holidays to ensure deliverables won’t be impacted by these holidays

- If employees are going to take holidays while the project is occurring, get a list of individuals who will be responsible for moving their part of the project forward during those dates

Key columns

The columns you choose to include in a workback schedule are at your own discretion, but remember to always include these three columns:

- Milestones

- Delivery dates

- Responsibilities

Final signoff

- After putting in the hard work to complete your workback schedule, it’s important that you have all relevant parties review it and modify as needed to ensure their buy-in

- Once everyone has settled on deliverables and dates, it’s very important you receive final signoff on the workback schedule

There you have it – all the important factors to consider when creating a clear and effective workback schedule.