Manulife Asset Management

Manage money, not commentaries

Investment commentaries are a challenge at every financial services firm. It’s a huge operational undertaking: getting accurate data, writing quality commentary, fact-checking, proofreading and designing these reports consumes a lot of time.

Ext. partnered with Manulife to help free up their portfolio managers’ time, so they can do what they do best – manage money.

On an ongoing basis, we support the portfolio management team by writing commentaries for the entire Manulife/John Hancock fund complex – covering Europe, Asia and North America – for both retail and institutional audiences. It’s a lot of work, but we have the expertise in financial commentary writing, down to a science.

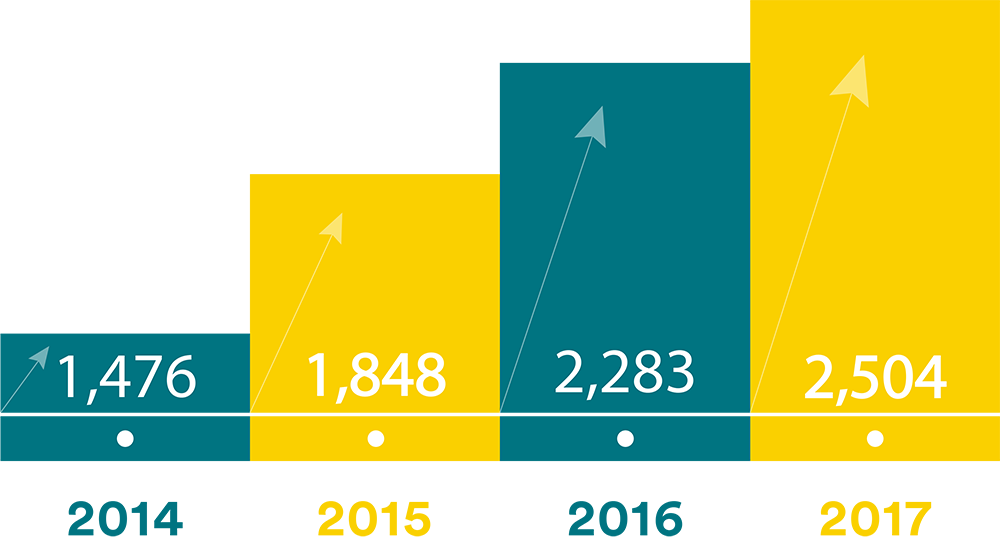

Number of portfolio manager commentaries by year

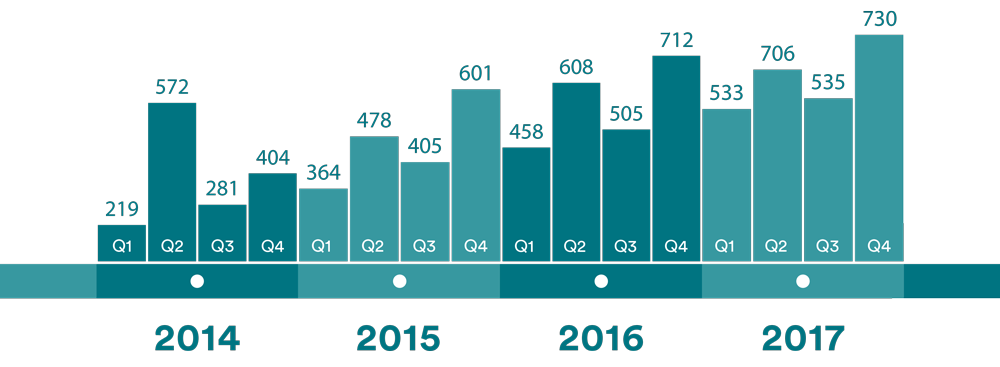

Number of portfolio manager commentaries by quarter

BMO

Learning to live with AI

We believe the future of financial services marketing will depend on human and artificial intelligence (“AI”) working together to provide value-added experiences.

BMO engaged ext. because of our experience creating investment manager videos to produce a video for a national roadshow that would help advisors understand AI, how it has influenced other industries and how it will change the way advisors work – in a positive way.

The video we directed and produced successfully conveyed this new narrative about AI in a way that was engaging and memorable for advisors. Most importantly, it positioned BMO as a thought leader.

“I am very impressed with ext.’s creative process and ability to run a smooth project. Briefings are efficient, first drafts hit the mark and they deliver exceptional creative.”

Lynn Kahrkling, Senior Manager, Strategic Business Communications

BMO Global Asset Management

Timbercreek Asset Management

Making data come alive

How can an asset manager capture the attention of advisors? It’s an age-old question.

Here are some of the high-impact ideas we formulated for Timbercreek Asset Management to help capture more advisor mindshare.

We leveraged a “stat-heavy” outlook report for an immersive, fully interactive ivestment HTML infographic with responsive design that enabled it to go seamlessly from web browser to iPhone. We also produced a corporate video that told the Timbercreek story in under 60 seconds and was optimized for LinkedIn distribution. And, we helped develop an e-book with value-added information for Timbercreek advisors.

Eblast

A web presence with real presence

Timbercreek wanted a special place online for advisors to learn more about its impressive global portfolio of real estate investments. We decided a microsite was the best approach. With imagery and content that propelled Timbercreek’s brand forward, we delivered an advisor-facing website with a modern feel, clear navigation and fresh content to drive awareness of Timbercreek’s specialized investment expertise.

Ad spots

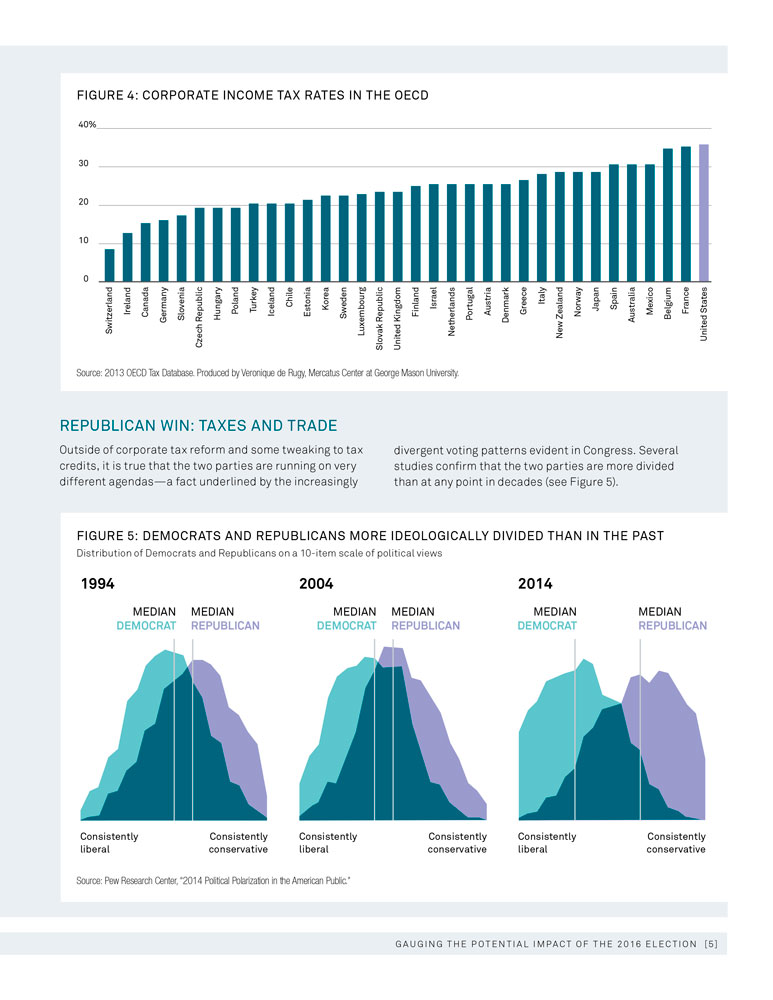

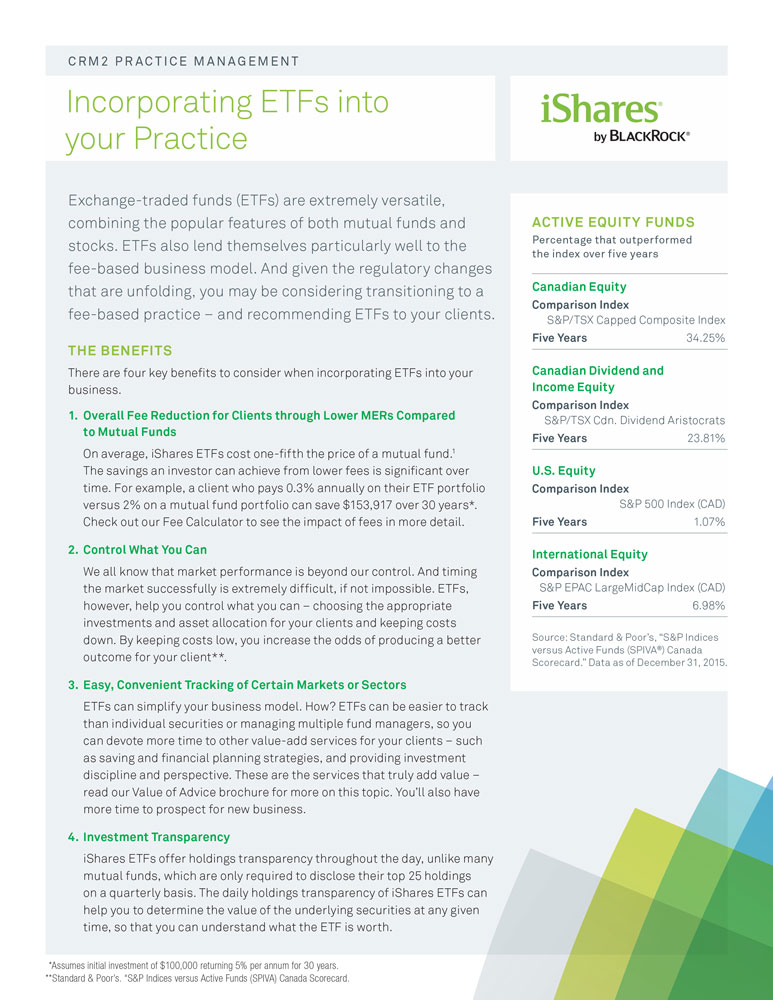

Blackrock Inc.

WHITEPAPERS & PUBLICATIONS

Even the largest investment managers in the world need to speak directly with their audience – whether that audience is advisors, investors and/or institutional clients. We produced a suite of advisor and investor communication tools focused on regulatory and relationship changes coming from Client Relationship Model – Phase 2 (“CRM2”). That meant helping advisors articulate the value of their advice, and helping clients understand that value. Needless to say, we helped make advisors’ CRM2 conversations a lot easier.

Whitepaper

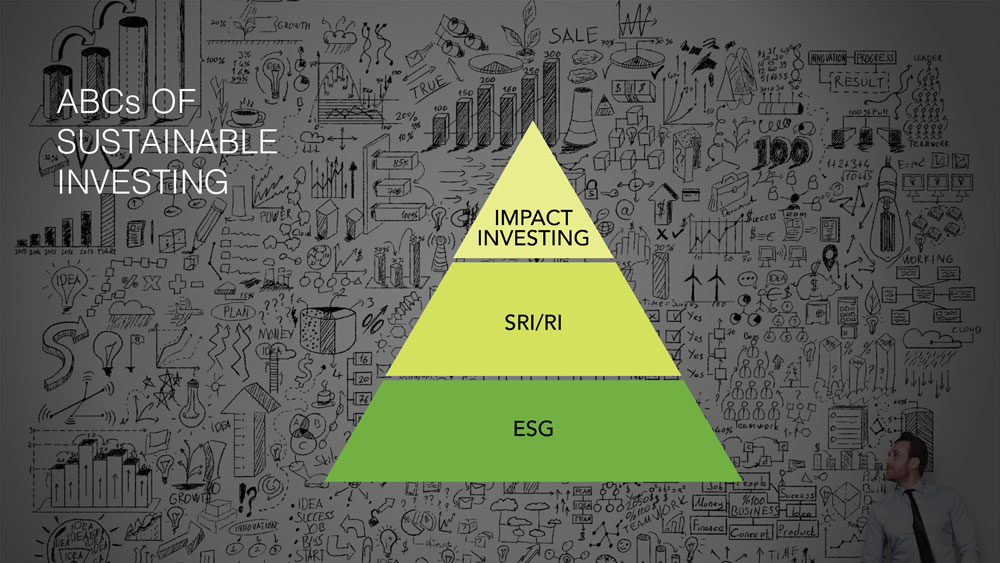

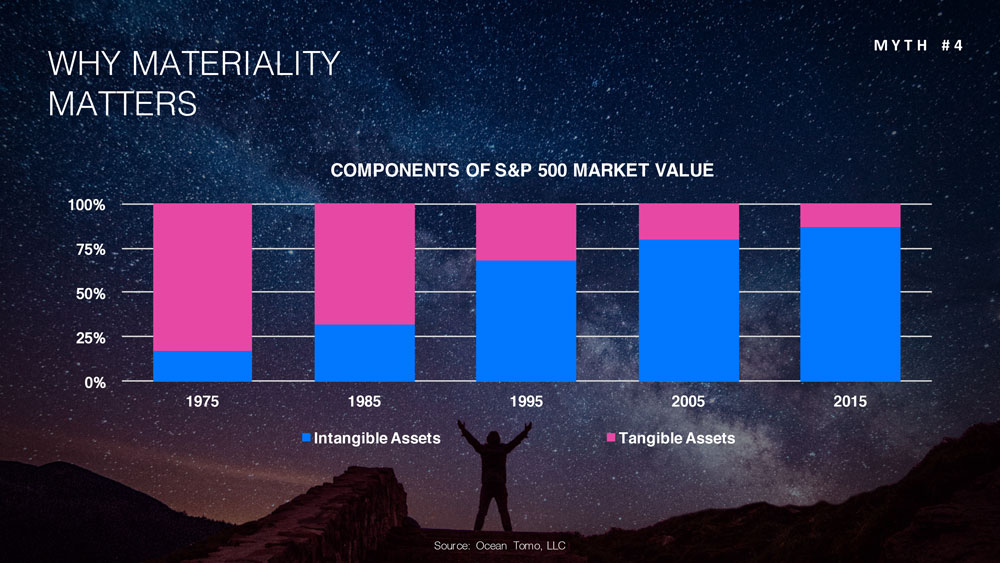

NEI Investments

Take presentations to the next level

NEI Investments is a leading Socially Responsible Investing (“SRI”) shop with a strong legacy of environmental, social and governance (“ESG”) investing in Canada. The company engaged ext. because they needed to change the way they were telling their story to advisors.

With our vast knowledge in financial service branding, we knew we could get the job done. When our sharply crafted key messages and visually compelling roadshow presentation garnered rave reviews, we knew we hit the mark.

“Ext. provides great strategic plans that my team is able to leverage to deliver outstanding results and return on investment.”

David Rutherford, Vice President of Marketing

NEI Investments

Sun Life Global Investments

Perspective in print

We took the old-school fund book and turned it into Sun Life Global Investments’ (“SLGI’s”) Viewpoint. We think this is one of the most beautiful (and impactful) publications of its kind in the industry, and it has helped propel SLGI’s brand forward.

The publication combines magazine-style interviews with enhanced fund sheets to arm SLGI’s wholesalers with high-quality editorial and topical information. It’s a prime example of how to use marketing to propel your financial services branding forward.

Viewpoint Q3 – 2016

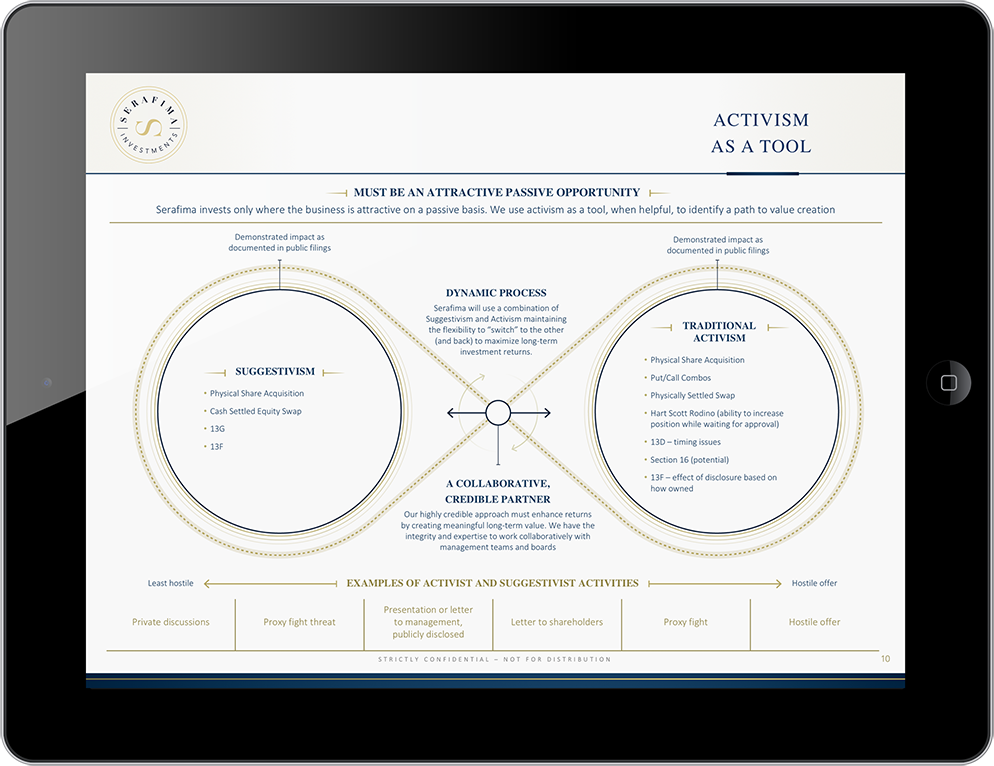

Serafima Investments

It all starts with a name

Serafima was a new hedge fund with a name, but no brand identity. Its renowned CIO needed a brand that represented his values, experience, credibility and vision.

Our hedge fund branding team got to work. We built Serafima’s brand from the ground up, including messaging, logo, stationery, landing page pitch book design and content.

“Ext. was instrumental in Serafima’s brand discovery process. They helped us articulate our brand and define our brand standards in a way that resonated with our clients. The team has strong knowledge of the hedge fund space, and we are thrilled with our new brand.”

Emma Sugarman, Head of Business Development

Serafima Investments LP

Stationery

Pitchbook

Pitchbook

Pitchbooks are essential for managers to raise capital. A pitchbook with an elegant design and clear information helps these respected managers tell their story and be remembered. We ensured Serafima’s pitchbook checked off all the right boxes for their launch.

Brand Guideline