Monday Morning Briefing: How low can yields go?

The COVID-19 pandemic has accelerated some individual and business trends, including increased work from home and online shopping activity. The movie industry has also been significantly impacted by the pandemic. Production of many movies has been halted, while cinemas remain closed, resulting in the delay of feature presentations. Home video streaming services such as Netflix and Disney+ have benefitted as a result. Disney announced this week that Mulan, a major motion picture expected to pull in hundreds of millions of dollars in box office receipts from global theatres, will now be released through Disney’s streaming service. The cost to watch the movie will be approximately US$30. Theatre owners are worried that this could be the start of studios releasing big-budget movies via streaming services.

Economic/industry news

Canada’s unemployment rate falls to 10.9% in July: Canada adds 418,500 jobs, recouping 55% of losses in pandemic

U.S. economy adds 1.8 million jobs in July: U.S. added 1.8M jobs in July as recovery from COVID-19 continues, but slowly

The BoE held its central interest rate steady at 0.10%: Bank of England holds rates steady but warns of a slower economic recovery

Could the end of CERB reduce spending?: Spending trends positive, but risks remain: TD

The U.S. dollar could remain under pressure: U.S. dollar’s plunge could persist

Looking beyond standard diversification: Investors are clinging to an outdated strategy – at the worst possible time

Think globally and across multiple asset classes: A rational approach to expected returns

Reasons for hope

Positive results from a potential COVID-19 vaccine: Novavax says its coronavirus vaccine produced immune response in small study

Trying to help all parts of the world: Bill Gates lays out a possible timeline for a ‘stop-gap’ COVID vaccine

Small businesses prepared for the next crisis: Small businesses are optimistic about the future, even as they continue navigating COVID-19

Adapting your business

COVID-19 has brought on new challenges for CEOs: 4 major pandemic challenges facing leaders and how to solve them

Key take-aways from the pandemic: 4 lessons from the coronavirus

Changes that will impact the advisory business: Adapt or be left behind after COVID

Encourage your clients to have financial conversations with their children: Clients’ financial relationships with their kids

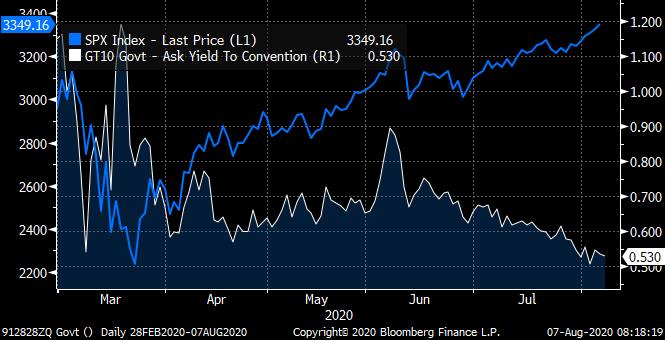

Chart of the week: How low can yields go?

Last week, the U.S. 10-year Treasury yield reached another record low, falling to 0.507% at close on August 4. A massive amount of government bond buying by the U.S. Federal Reserve Board (“Fed”), lower interest rates from the Fed and economic uncertainty have pushed the 10-year yield to these low levels. The low yield is signalling expectations of a weak economy and low interest rates for an extended period. On the other hand, U.S. equities, as represented by the S&P 500 Index, appear to be signalling an economic recovery, as the index has been approaching its record-high closing price of 3,386. With new cases of COVID-19 on the rise in parts of the U.S. and rising U.S.-China trade tensions, will there be more downward pressure on Treasury yields, or a downturn in stocks? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Interest in hedge funds could be on the rise: Outlook “bright” for hedge funds as industry seizes on surging volatility, JP Morgan Asset Management officials say

PE getting creative in its deal making: Private equity’s answer to a frozen deal market

Morgan Stanley increasing insurance offerings for the HNW: Morgan Stanley adds P&C insurance for wealth clients

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: August 5 edition

News and notes (Canada)

CI to purchase U.S. RIA: CI Financial to acquire BDF

Fixed income ETFs attracted strong flows in July: ETFs see their second strongest month of the year: National Bank

Many businesses have been forced to close amid the pandemic: Business closures doubled at height of pandemic: StatsCan

Canadian ESG funds had strong relative performance in the second quarter: Almost 60% of Canadian ESG funds outperformed in Q2