Monday morning briefing: The recovery begins in China

Is there cause for concern in Canada’s real estate market? Canada Mortgage and Housing Corporation (“CMHC”) CEO, Evan Siddall, thinks so. Siddall asked Canadian bank leaders, via a letter, to avoid providing “riskier” mortgages.

Despite a bit of a slowdown in 2019 and during the COVID-19 lockdowns, Canada’s housing market has grown at a rapid pace for the better part of a decade. Siddall now believes high unemployment and rising debt levels could put pressure on individuals when making their mortgage payments, particularly if they take on more risk with higher-valued mortgages. One of the “Big Five” bank CEOs responded that Siddall’s concern is valid, but may be a bit extreme, as Canada’s mortgage market has been managed in a relatively prudent fashion.

Economic/industry news

U.S. consumer prices rose in July: U.S. consumer prices rose 0.6% in July, matching June uptick

U.S. retail sales increased 1.2% in July: Americans keep buying stuff despite the pandemic – retail sales rise for a third straight month

U.K. economy plummeted in Q2: U.K.’s worst slump in Europe raises pressure to sustain rebound

Investor focus will be on jobs and growth: Recession? Over. Now it’s about jobs and growth in U.S. equities

Investors expecting strong returns over the next five years: Investors expecting big returns despite COVID-19 uncertainty

Invesco’s outlook on fixed income for the remainder of 2020: 8 fixed income predictions for the rest of 2020: Invesco

Total assets in ETFs and ETPs reached a record US$6.66 trillion in July: Assets invested in ETFs, ETPs hit new record

Reasons for hope

Finding success amid the pandemic: Business as (un)usual

Helping others prepare for school: Parents pay it forward with school supply drive

Some states partnering with Ageless Innovation to eliminate loneliness: Robotic pets are helping seniors avoid loneliness

Adapting your business

The pandemic has accelerated the growth in the outsourced chief investment officer industry: The pandemic is spurring OCIO growth. Transparency will follow.

Virtual models of providing advice are likely to persist beyond the pandemic: Vanguard: The pandemic proves the value of digitally driven advice

The importance of an estate plan for parents, and grandparents: Estate planning, COVID-19 and grandparents

The ins and outs of working from home, and what is means for you: Taxes, VPNS and office hours

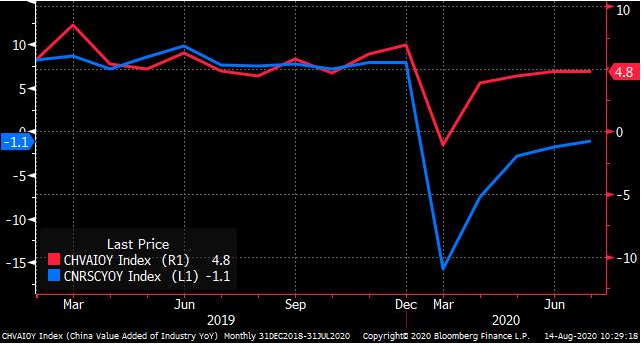

Chart of the week: The recovery begins in China

China’s economy began to recover in the second quarter of 2020, as gross domestic product rose 11.5%. After shrinking 10.0% in the first quarter, it now appears the country has avoided a recession. While China has worked to increase consumer demand over the past decade, it may be the manufacturing sector that leads the recovery as the country emerges from the pandemic. Industrial production rose 4.8% in July (over the same month in 2019). This was the fourth straight advance for the country’s industrial production.

Meanwhile, retail sales have fallen behind and declined 1.1% year-over-year in July, marking the seventh straight monthly fall for retail sales. While the pace of the slowdown in retail sales has been easing, the effects from the pandemic are still weighing on consumers, who are not returning to stores as expected. Although the economy appears to be recovering, will a slowdown in retail sales activity hinder the accelerated growth figures China has been used to? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds posted strong returns in July: Hedge funds turn up the heat with strong gains across equities, macro and activist strategies

Forget about math when it comes to investing: Meet the hedge fund manager who thinks math is overrated (when it comes to investing)

T. Rowe Price enters ETF market with actively managed offerings: T. Rowe Price debuts four active equity ETFs

Will capital gains tax be reduced?: Trump looking ‘seriously’ at capital gains tax cut

News and notes (Canada)

CI makes fund available to retail investors: CI opens institutional fund to retail investors

Mark Carney returns to Canada: Mark Carney’s quiet return to Ottawa

BoC reduces five-year mortgage rate to 4.79%: BoC cuts benchmark mortgage rate to lowest level in three years

Canadian pension funds are producing robust returns versus their peers: The world’s best pension funds are Canadian. Sorry.