Tuesday morning briefing: McDonald’s not lovin’ it

U.S. economic growth plummeted in the second quarter of 2020 in response to lockdown measures. Gross domestic product shrank 32.9%, annualized, but was slightly better than the 34.5% decline economists had expected. Now the recovery is expected to begin, but how quick will it be? Rising COVID-19 infections in some states are forcing reopening efforts to be scaled back. Meanwhile, initial jobless claims rose for a second straight week. It’s likely to be a choppy recovery, but the U.S. Federal Reserve Board (“Fed”) appears ready to serve as a partial safety net. At its meeting last week, the Fed reiterated its commitment to do whatever is necessary, using all available tools, to help support the U.S. economy through this challenging period.

Economic/industry news

U.S. GDP shrank 32.9% in the second quarter: Economy shrank at historic 33% annual rate in second quarter – but that’s not the whole story

The Fed keeps its target range unchanged, committed to supporting recovery: Fed sticks to whatever it takes with no signs of virus easing

Canada’s economic growth rebounded in May: May’s GDP growth beat economists’ expectations

It may not be a smooth recovery for the global economy: Outlook looks stormy for rest of 2020

An opportunity in emerging markets equities: Investing in emerging market equities during the COVID-19 crisis

The ins and outs of factor investing: Back to basics on factor investing

The price of gold continues to surge higher: Gold’s lustre grows as investors hedge in uncertain times

Reasons for hope

Potential Johnson & Johnson vaccine began human trials: J&J’s COVID vaccine protected primates with single shot

How to help amid the pandemic: Can I afford to be generous during a pandemic?

Sustainability becoming top-of-mind: Despite coronavirus, 85% of Americans are thinking about sustainability as much as or more than ever

Adapting your business

Conferences may go virtual in the future: The new normal for conferences (#Money2020)

Clients now want frequent contact: Personalized and frequent contact is what clients want now

It’s important to help clients feel confident: Tips to instill client loyalty

Digital marketing tools can help with client retention: Pandemic leaves advisors worried about client retention: survey

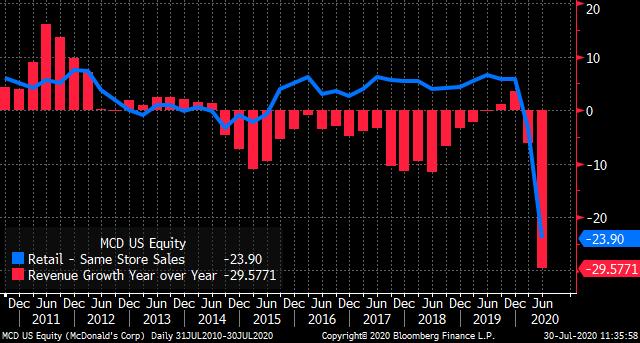

Chart of the week: McDonald’s not lovin’ it

It was a tough second quarter for McDonald’s Corp. Physical distancing measures and lockdowns shut down in-store dining for the fast food behemoth. While drive-thru and delivery were still available, these were not enough to stop a massive decline in sales. Same-store sales fell 23.9% in the second quarter, while year-over-year revenue growth dropped 29.6%. However, there appears to be some light at the end of the tunnel. Sales have picked up recently as reopening efforts continue, while the company pledged to increase marketing efforts to help its recovery. Furthermore, notable analysts maintained or raised their outlook for the share price of McDonald’s. Will people return to the golden arches or has the pandemic brought about changes in eating habits that could slow the company’s recovery? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Almost half of investors are satisfied with hedge fund performance this year: Hedge fund investors split down the middle on 2020 performance, says new investor poll

Contributions to hedge funds muted: Hedge funds still struggling to win back investors

PE giants return to profitability in the second quarter: Carlyle, Apollo both back in the black after grim Q1

Homeownership in the U.S. at an all-time high: U.S. homeownership rate soars to highest level since 2008

Wells Fargo to enter ETF market: Wells Fargo plans to offer its first ETF

News and notes (Canada)

CIBC launches two actively managed ETFs: CIBC adds to ETF shelf

Increasing access to capital for small businesses: OSC issues interim order on startup crowdfunding exemptions

Canada’s Big Five banks onboard with the launch of the Financial Data Exchange: Big banks back Canadian launch of Financial Data Exchange

Canadian DB plans experienced strong performance in the second quarter: Canadian DB plans see upsurge in second quarter: report