Wednesday morning briefing: Tech taking over the Dow

Kids across many states and provinces returned to school this week, although under much different conditions than last September. Social distancing, cohorting and masks will make this school year look and feel a lot different than, frankly, any other school year. Spending on backpacks, pencils and new clothes have boosted retail sales in years past. How much will spending be and what items will experience the biggest sales in 2020? A survey by the Retail Council of Canada found the average spending on back-to-school items will be approximately $727, down from $919 last year.

Economic/industry news

U.S. unemployment rate fell to 8.4% in August: Payrolls increase by nearly 1.4 million as the unemployment rate tumbles

Canada’s unemployment rate fell: Economy added 246,000 jobs in August, unemployment rate 10.2%

Why some sectors will perform better than others: Winners and losers of the pandemic economy

How much new stimulus will be enough?: Economy needs at least $1.3 trillion in new stimulus to sustain recovery, Bridgewater CIO says

New research on the endowments vs. 60/40 portfolio debate: All those studies showing endowments lost to 60/40? Cherry-picked data, Academic says

Stronger relative performance by female-led large-capitalization equity funds: Large-cap funds managed by women are outperforming in 2020: Goldman

Active equity funds outperformed in Q2: Investors in active funds outperformed in Q2

Reasons for hope

Will a vaccine be ready for distribution by November?: CDC tells states to get ready for Nov. 1 vaccine distribution

Canadian CEOs bullish on economic growth: Canadian CEOs more optimistic about growth than global peers

The success of Conquer COVID-19: $2 million in fundraising and 3 million PPE donations later, Conquer COVID-19 wraps up operations

Adapting your business

How to reboot your business: 5 steps to reboot business in the COVID-19 era

Staying creative while working remotely: How to stay creative when your team is working remotely

Using social media to maintain communication with clients and prospects: Advisors’ social media use surges during pandemic

Adapting to new opportunities: Why entrepreneurs need agility now more than ever

A look at the meaning of “distributed”: Why you should be thinking about distributed 4.0

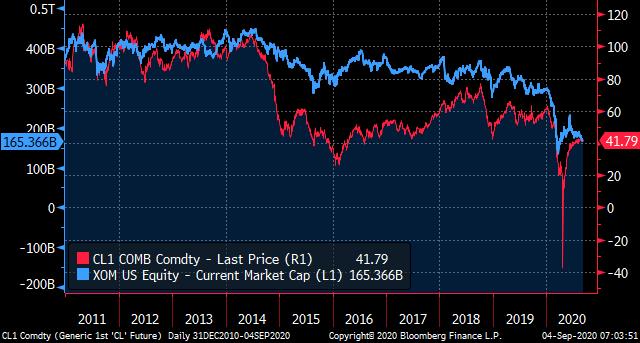

Chart of the week: Tech taking over the Dow

The Dow Jones Industrial Average made its biggest component changes since 2013, signalling strength in the information technology sector and weakness in energy. Exxon Mobil Corp., Pfizer Inc. and Raytheon Technologies Corp. were replaced by salesforce.com Inc., Amgen Inc. and Honeywell International Inc. Exxon Mobil, which once held the title of the largest company in the world, was a particularly notable change. Over the past decade, oil prices have fallen, as has the market capitalization of Exxon Mobil, which dropped 60%. The only remaining energy company still listed on the blue-chip stock index is Chevron Corp. Can more energy companies make their way back onto the Dow or is this more of a secular change? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Are stocks a little long in the tooth?: Billionaire Leon Cooperman warns investors of stock market ‘euphoria’ and shares three big risks to an economic recovery

A bitcoin fund for the wealthy: Fidelity launches inaugural Bitcoin Fund for wealthy investors

NYSE to offer share sales through direct listing: SEC expands direct listing options on NYSE as IPO alternatives abound

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: September 2 edition

News and notes (Canada)

Updating financial planning standards: FP Canada and IQPF update document of financial planning standards

Toronto fintech firm launches lending platform: New platform allows users to invest in consumer credit

Continued focus on integrating behavioural tools into wealth management: TD extends partnership with behavioural economics centre

Canadian ETFs experienced $2.8 billion of inflows during August: Canadian ETF inflows top $30B year-to-date