Monday morning briefing: Q2 GDP was down, way down

U.S. Federal Reserve Board (“Fed”) Chairman Jerome Powell gave his highly anticipated speech at the Jackson Hole Symposium last week. Powell announced the Fed will take a new strategy with monetary policy, looking to meet its 2% inflation target over time. In a material shift, the Fed will allow periods of above-target inflation to prevent prices from sliding lower following periods of economic downturn.

The new approach signals that the federal funds rate will likely stay near-zero for some time. This is welcome news for equities, which love an accommodative Fed. It may also contain borrowing costs, which could help individuals, organizations and the government, which is working under extremely high debt levels.

Economic/industry news

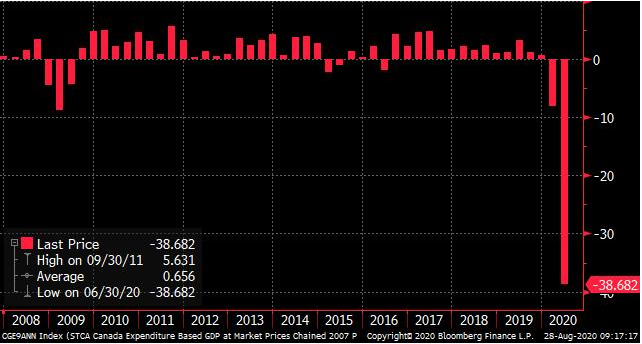

Canadian GDP falls an annualized 38.7% in Q2: Canada’s economy posts a record 38.7% annualized second-quarter contraction

U.S. GDP fell 31.7% in Q2, according to a second estimate: Second-quarter GDP plunged by worst-ever 31.7% as economy went into lockdown

New strategy to achieve inflation target: Powell’s Fed shifts to more relaxed approach to fight inflation

Changes in spending patterns may have BoC reconsidering inflation: Bank of Canada looks for broader input in updating inflation target framework

Some factors that are affecting equity markets: In an uneven recovery, advisors should mind these 3 key market factors

Consider the time horizon in the value vs. growth debate: The convergence of value and growth

Reasons for hope

FDA approves quick and inexpensive COVID-19 test: FDA-approved rapid US$5 coronavirus test doesn’t need specialty equipment

Helping those who need it: Brazilian high schooler hands out hygiene kits to poor neighbors who can’t afford hand sanitizer

What ambulances could look like in the future: The ambulance of the future will be flying and possibly hydrogen powered

Adapting your business

How to network online: Tips for virtual networking

How the top advisor firms remained strong during the 2008 Financial Crisis: What advisors can learn from the ‘standout’ firms of the Great Recession

Increased use of digital tools is here to stay: Advisors’ tech use: there’s no going back

Has there actually been a digital transformation?: The crucial role of digital in the UK’s economic recovery

Changes in business operations in response to COVID-19 have helped Asana: The anti-Facebook: 12 years in, Facebook Cofounder Dustin Moskovitz’s slow-burn second act Asana finally has its moment

Chart of the week: Q2 GDP was down, way down

Canada’s gross domestic product plummeted 38.7%, annualized, during the second quarter of 2020, which came as a surprise to no one. This is the steepest decline ever for Canada. Much of the country spent the quarter in lockdowns in response to the COVID-19 pandemic. Consumer spending, business investment and exports all fell sharply. After declining 8.2% in the first quarter, the Canadian economy is now in a recession.

How long will it take the Canadian economy to return to growth and fully recover? That growth may be well underway as Canada’s economy expanded 6.5% in June and Statistics Canada estimates a 3.0% growth rate in July.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds had positive inflows over July: Hedge funds see inflows after four consecutive months of redemptions

Who will end up getting the money?: Four lawsuits, 17 companies, and $900 million: The story behind Citi’s ‘mistaken’ loan repayment

Expanding who qualifies as an accredited investor: SEC expands accredited investor definition

Pandemic has weighed on bank profits: U.S. bank profits slump 70% as virus rakes businesses, households

News and notes (Canada)

Former central banker joins Brookfield: Mark Carney joins Brookfield Asset Management

Deloitte sees benefits from SRO merger: SRO merger could save industry up to half a billion dollars: Deloitte

Canadian insurers taking advantage of favourable bond market: Canadian insurers tap bond markets with record issuances: DBRS

The pandemic has put substantial pressure on Canadian media outlets: Media study says hundreds of Canadian radio stations, TV outlets risk closure