Monday morning briefing: The people want to work

The Bank of Canada took a more positive tone this week, believing the worst of the economic downturn from COVID-19 might be over. Economists, however, disagree on how quickly the Canadian economy may rebound, with some believing it could be a choppy few years.

The U.K. and the European Union did not make much progress on trade talks last week. The end of June is the deadline to extend trade negotiations past 2020. Without an application to extend negotiations, we might see a no-deal Brexit at the end of 2020. This will be a hot topic leading up to the end of June.

Economic/industry news

U.S. unemployment rate fell to 13.3% in May: May sees biggest jobs increase ever of 2.5 million as economy starts to recover from coronavirus

Canada adds jobs in May: Canada unexpectedly adds 290,000 jobs on gradual reopening

The BoC holds its central interest rate steady: Bank of Canada keeps key interest rate at 0.25%

It could be a long road to a recovery for Canada: Despite optimistic signs, it will be 2022 before this is over says CIBC

How modern monetary theory may play out: Modern monetary theory meets moral hazard

The rise of small caps: Why some small companies are better positioned for a crisis

The changing business environment and what it means for investors: After the great lockdown: COVID-19’s lasting impact on business models

Reasons for hope

A look on the progress being made on a COVID-19 treatment and vaccine: Here’s exactly where we are with vaccines and treatments for COVID-19

A conversation with Dr. Fauci; where he is excited, cautious: Anthony Fauci on COVID-19 reopenings, vaccines, and moving at ‘warp speed’

Saying thanks through art: Banksy pays tribute to ‘superhero’ nurses in new piece donated to hospital

Raising billions to help vaccinate children in poor countries: Bill Gates-backed vaccine alliance raises $8.8 billion from world leaders and businesses

Adapting your business

Webinars have expanded the reach of advisory firms: Weekly webinars during pandemic have been a boon to this advisory firm

Keeping a strong culture amid remote work: Culture can’t be lost in shift to remote work

Unique ways Wall St. is meeting with clients and prospects: Wall Street sends wine, masks to clients with steakhouses closed

The pandemic will lead to a transformation of the workplace: How COVID-19 changes the future of work in banking

Most U.K. workers prefer to continue working from home, and are being more productive at home: One in four UK workers willing to return to the office full-time

Chart of the week

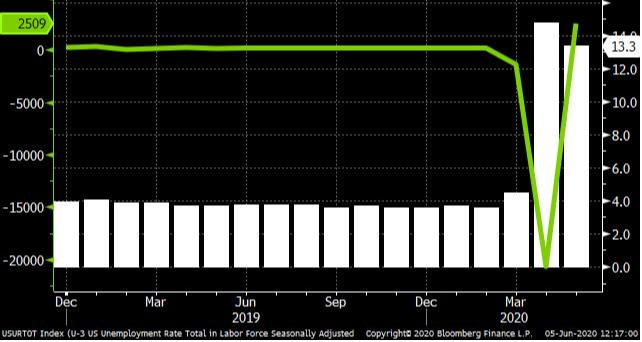

U.S. labour market numbers for May were released last week and stoked optimism that the U.S. economic recovery might be upon us. Non-farm payrolls rose by 2.5 million in May, the highest number of job additions ever. This is a substantial rebound from the record decline of 20.7 million jobs in April. The unemployment rate fell to 13.3% in May.

Reopening efforts across the country contributed to the job gains, and provided hope that economic activity will rise. This is a strong signal that the U.S. economy might be headed in the right direction. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Macro hedge funds were the strongest performers in May: Macro hedge funds lead the pack in May – but Lyxor urges caution on oil rally

Where GPs are turning to for liquidity: Creative capital: How cash-strapped funds bridge liquidity gaps

PE funds may make their way onto DC plans: DOL issues guidance allowing private equity in DC plans

Holdings not available: BlackRock moves ahead on plan for ETF that keeps holdings secret

News and notes (Canada)

TD launches new ETFs: TD launches 5 new actively managed ETFs

Hamilton ETFs launches the Hamilton Financials Innovation ETF: Hamilton sets sights on financial-services innovation

Equity ETFs had $1.9 billion of inflows in May: ETF flows rebound in May Canadians optimistic about their finances, despite pandemic: Despite everything, Canadians have sunny outlook for their money