Monday morning briefing: Oil prices rising

The impact of rising government bond yields has been far-reaching. One of the hottest sectors since the lockdowns that started in 2020 has been real estate. Real estate prices in both Canada and the U.S. have surged higher in response to historically low mortgage rates and households moving out of big cities.

Mortgage rates in the U.S. and Canada have begun to tick higher, however, largely in response to rising government bond yields. While mortgage rates remain at historically low levels, could rising rates negatively impact the red-hot real estate market in both countries? Let us know your thoughts.

Economic/industry news

Canada’s economy weakens 2020: Canadian economy contracted 5.4% in 2020, worst year on record

The U.S. unemployment drops to 6.2% in February: U.S. job growth blows past estimates; unemployment dips to 6.2%

European retail sales fall to 5.9% in January: Eurozone retail sales plunged in January

Caution warranted when investing in SPACs: Where SPACs pay off – and where they don’t

New stimulus package likely in the U.S.: Millions more will get stimulus check under U.S. rescue plan

Constructing a portfolio that may benefit from the recovery: How to prep portfolios for recovery as stimulus takes hold

Reasons for hope

J&J to partner with Merck to produce single-shot COVID-19 vaccine: Biden says Merck to help J&J boost production of new vaccine

A sense of control can boost happiness: Happiness expert: One technique for staying upbeat during the pandemic

Canadian government looking to boost vaccine research efforts: Vaccine efforts among 100-plus new projects to get $518M in federal research funding

Walmart goes on U.S. spending spree: Walmart says it will support U.S. manufacturers with $350 billion of added business

Adapting your business

The keys to launching a successful hedge fund: Successfully launching a hedge fund

Why your clients may need exposure to Bitcoin in their retirement portfolios: How Bitcoin fits in a retirement portfolio

Walmart hopes key hires will help propel its move into financial services: Walmart lures Goldman bankers in bid to fight Wall Street

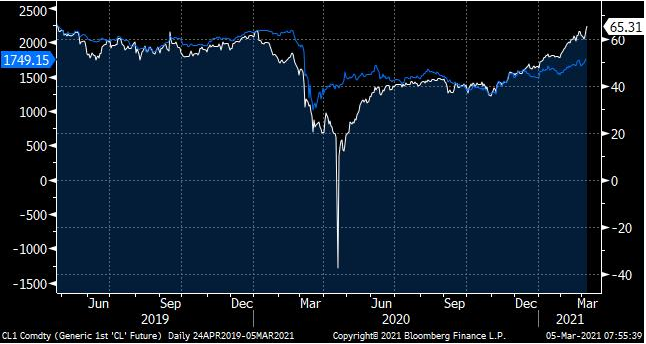

Chart of the week: Oil prices rising

The Canadian Energy sector (blue line in table above) has risen approximately 19% thus far in 2021, and has benefited from the rising price of oil (white line), which has risen 36%. As demand for oil dropped along with economic activity in 2020, a large inventory of oil amassed. Since then, however, demand has picked up while supply has remained muted.

Last week, the Organization of the Petroleum Exporting Countries and Russia announced they plan to maintain current levels of production for some time, which should cause global supply to decline even further. Canadian producers should benefit from rising oil prices. Higher oil prices could hit Canadians at the pump, however, which could, in turn, drive up inflation and reduce overall spending.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

U.S. large-capitalization mutual funds outperformed in February, and were helped by performance of value stocks: Active funds deliver alpha in ‘paradise’ for stock picking

Apollo Global Management makes two large acquisitions: Apollo doubles down on Las Vegas, retail with latest billion-dollar deals

Profits of asset managers were concentrated on a few firms: Asset managers ended 2020 with record revenues

From mutual fund to ETF: First mutual fund to ETF conversion is slated for late March

Confusion in reporting crypto holdings to the IRS: IRS rules on reporting Bitcoin and other crypto just got even more confusing

News and notes (Canada)

Attention has turned to an Ethereum ETF: Second Ethereum ETF filed in Canada

There were strong inflows into Canadian ETFs in February: February was a strong month for Canadian ETF flows and launches Why it might be the TSX’s turn to outperform: Why Canadian equities could (finally) outperform