Monday morning briefing: Is it Netflix’s turn to chill?

Central banks were in the spotlight last week, as the Bank of Canada, European Central Bank and the Bank of Japan all made their interest rate announcements. The message from all three was largely the same: wait and see.

The central banks left key interest rates unchanged and maintained their bond-buying programs, believing the current levels of stimulus should support an economic recovery from COVID-19. The group acknowledged the pandemic still poses considerable risks to their economies.

Economic/industry news

The BoC held its key rate steady at 0.25%: ‘A long climb back’: Tiff Macklem stresses recovery as BoC holds

The Chinese economy rebounds in Q2: China’s economy expands in second quarter

What’s in store for consumer spending?: How the pandemic has shifted consumer spending

Predictions for the second half of 2020: 10 midyear predictions for 2020

The HNW are concerned about fees: World’s rich question fees with wealth hitting $74 trillion

Reasons for hope

Positive early results for a potential vaccine: Moderna fires up COVID vaccine race with promising early results

Oxford scientists see breakthrough in an early trial: Hopes for a coronavirus vaccine this year have been boosted by a reported breakthrough in Oxford’s human trials

Keeping children entertained: Got bored kids? Here are 20 fun activities for a pandemic summer

Adapting your business

How your business can overcome COVID-19: 7 successful battle strategies to beat COVID-19

Creating a virtual office: Sidekick embraces remote working with always-on teleconferencing hardware

Many workers are now planning to retire later: The COVID-19 retirement reset stresses the need for income planning

The pandemic has changed how the wealthy think about money: Wealthy investors anticipate long-lasting lifestyle changes after COVID-19: UBS

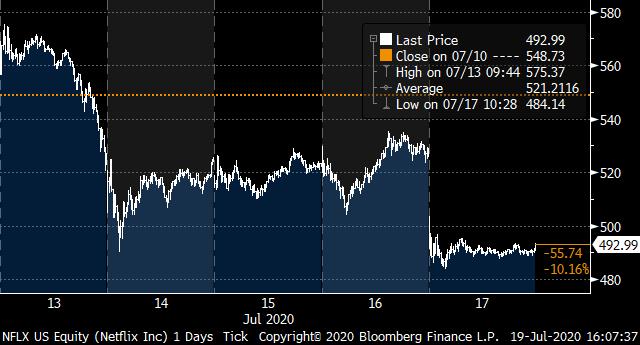

Chart of the week: Is it Netflix’s turn to chill?

As tech stocks came under pressure last week, one of the darlings of the “stay-at-home” stocks, Netflix Inc., posted a significant decline. It’s share price fell 11% over the week as a result of its announcement that new subscriber growth would drop markedly in the third quarter, to 2.5 million. This is well below market expectations of five million new subscribers. Netflix added more than 15 million subscribers and 10 million subscribers in the first and second quarters of 2020, respectively, as more people were forced to stay home. With lockdowns easing and competition in the space rising, it’ll be interesting to watch what happens next to Netflix. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds returned 2.04% in June: Hedge fund industry gains 2.04 per cent in June, says Backstop BarclayHedge

SEC considering changes to holdings disclosure rules for hedge funds: Lots of hedge funds could keep trade secrets under SEC plan

Fewer wealthy families expect private equity to outperform public investments: World’s wealthiest lower their private equity expectations

Fixed income ETFs attracting institutional investors’ money: Institutional demand is driving record growth in fixed income ETFs

What Bill Gross has to say about the current market environment: Bill Gross has some thoughts about the market

News and notes (Canada)

NEI launches impact bond fund: New bond fund rounds out NEI’s impact suite

A venture capital offering from National Bank: National Bank launches venture fund, looks to raise $200 million to support COVID-19 recovery

Wealthsimple to offer platform to trade Bitcoin and Ethereum: Wealthsimple to launch crypto trading platform

BDC Capital helping firms with intellectual property to accelerate growth: Canada starts fund to invest in firms with intellectual property