Monday morning briefing: Is Hertz back in the driver’s seat?

As economies begin to reopen, businesses are thinking about how to get their employees back to the office. For example, Citigroup plans to bring 5% of its Canadian and U.S. workforces to the office in early July.

Staggering start times, working from home either permanently or temporarily, and social distancing at the office are all on the table. Many businesses have adapted and found ways to continue operations in a more virtual world. This will all impact the financial services industry going forward.

Economic/industry news

The Fed holds key interest rate steady: Fed sees interest rates staying near zero through 2022, GDP bouncing to 5% next year

The U.S. inflation rate was 0.1% in May: Consumer prices drop again as pandemic cuts rate of inflation to near zero

The Fed doesn’t expect a quick recovery in the U.S. labour market: Jerome Powell sees long road ahead for jobs market

Belief is high that asset managers can navigate through the crisis: Institutional investor poll shows faith in asset managers still strong

The U.S. economic recovery could take two years: Expect extended recovery following U.S. recession

A look at the error in the jobs forecast and what this means for the future: Big error on jobs forecast could have policy ramifications

Advisors looking to increase use of ESG funds: More advisors turning to ESG funds

Reasons for hope

Canadians helping each other amid the pandemic: 45+ good news stories from across Canada amid coronavirus emergency

Zero COVID-19 cases in New Zealand: New Zealand declares itself ‘virus free’ as COVID-19 restrictions are lifted

Social distancing is working to lower respiratory-related illnesses: Social distancing sharply lowers respiratory illness in Thailand

Helping people with their commutes: Google Maps updated with COVID-19 info and related transit alerts

Adapting your business

Some keys to maintaining strong collaboration: How to maintain collaboration during lockdown

How to help recently unemployed clients: 3 steps for newly unemployed clients

Making businesses stronger through the pandemic: How one young advisor navigated his first downturn

The impact on the advisory business will be different this time: McKinsey report warns against applying 2008 lessons to coronavirus crisis

IPO roadshows are going online: Virtual IPO roadshows could become the new post-crisis standard

Preparing for the next pandemic: 8 ways financial institutions must prepare for the next pandemic

Chart of the week

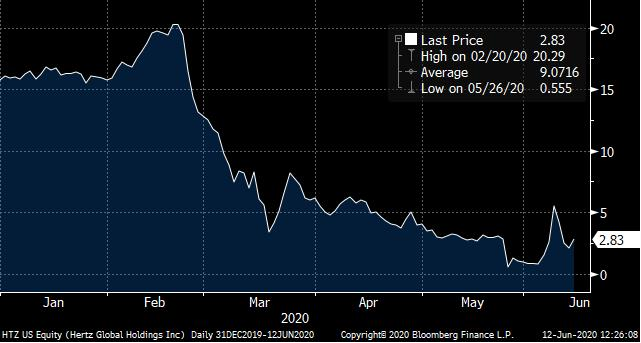

Is it back from the brink for Hertz? It has been an interesting period for the shares of Hertz Global Holdings Inc. Amid the COVID-19 pandemic, the rental car company faced immense financial pressure as global travel was brought to a standstill. In response, the company filed for bankruptcy protection on May 22. Shortly after, the company’s shares continued to plummet to a low of $0.55, falling 97% from their 2020 high. But as economies began to reopen and investor sentiment improved, particularly for companies expected to do better as economic conditions improved, Hertz’s share price increased substantially. Now Hertz is looking to sell US$1 billion in shares to raise working capital to get the company back on its feet. A global recovery and higher working capital may help the company, but will it be enough to outlast Hertz’s massive debt burden? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Activists seeking new leadership amid the pandemic: In the age of coronavirus, activist shareholders are going after company bosses

PE sees opportunity in distressed assets: Private equity managers eyeing distressed funds, private debt

BlackRock invests in Trustly: BlackRock invests in online payments firm Trustly

How IRS rule changes may affect business owners: IRS rules are changing (for the better) for business owners due to COVID-19

News and notes (Canada)

Many liquid alt funds performed well during market downturn: Liquid alternatives get their test

Mackenzie launches the Mackenzie Alternative Enhanced Yield Fund: Mackenzie launches alt fund

Fidelity launches new ETFs: Fidelity expands Fidelity Factor ETFs and launches new global fixed income ETF solution

A new platform for advisor training: New digital education tool for Aligned Capital advisors