Monday morning briefing: GDP down … but is it out?

In the U.S., federal and state governments are planning to ease restrictions and allow some businesses to reopen. In Canada, various provinces have already started to reopen as well. These provinces have taken small steps and are demanding reopened businesses maintain proper health and safety measures.

Germany, Italy and France, among other European nations, are in midst of loosening restrictions and restarting parts of their economies. While it may take some time for economies to recover, this is an important first step to get commerce moving and people working.

Finally, all eyes were glued to jobs reports coming out of the U.S. and Canada on Friday, May 8th. These reports showed historical numbers of job losses in both countries.

Economic/industry news

Canadian unemployment rate rises to 13.0% in April: Canada lost about 2 million jobs in April, less than feared

U.S. economy loses 20.5 million jobs: Record 20.5 million American jobs lost in April. Unemployment rate soars to 14.7%

Tiff Macklem named the new governor of the BoC: New BoC governor named

A look at what happened to the oil market: Inside the biggest oil meltdown in history

What COVID-19 could mean for ESG strategies: Five ESG implications from COVID-19

Preparing the capital markets industry for post-crisis life: Charting a course for capital markets post-COVID-19

Canadian equities lagged other asset types in the first quarter: Canadian equities were worst hit asset type for fund managers in Q1, report says

Reasons for hope

A thank you to all of the nurses on the front lines: 14 meaningful ways people are saying thank you to nurses

Donor contribution to nonprofits exceed goal: Fidelity Charitable donors step up funding for COVID-19 relief

Stories of those making a difference: 7 good news stories from around the world to end your week

Remaining bullish on the U.S.: Warren Buffet just made one optimistic bet that you can make too

Adapting your business

Maximize your virtual meetings: Meetings aren’t what they used to be. Here’s how to make the most of it.

Helping your clients get through this crisis: Coaching clients in times of crisis

A shift to customers’ financial preferences poses a challenge to marketers: COVID-19 brings tectonic shifts in banking consumers’ life views

Going virtual to keep sales crown: How JPMorgan adapted to selling remotely

How to work with pre-retirees whose nest eggs have been impacted by COVID-19: The conversation you need to have with retiring clients … now

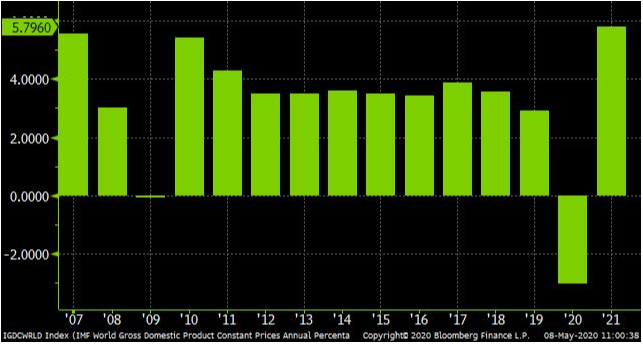

Chart of the week

COVID-19 has brought global economic activity to a near halt. In its World Economic Outlook in April, the International Monetary Fund (“IMF”) projected that global economic growth will decline by 3% in 2020. But the IMF expects growth to accelerate by 5.8% in 2021. As economies begin to reopen across the world, there are reasons for optimism that growth will return after a rocky 2020. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Private equity still has eyes on the wealth management industry: Despite COVID-19 disruption private equity firms are still acquiring wealth managers

Use of alternative data expected to increase: Hedge funds’ use of alternative data tipped to surge, new industry study finds

Larry Fink sounds warning for corporate America: BlackRock’s Fink delivers grim outlook with tax hikes for corporate America

Investment funds experienced substantial withdrawals in March: Mutual Fund, ETF assets ravaged by double-digit declines in March: Cerulli

News and notes (Canada)

Private Debt Partners launches closed-end fund: New private lender launches senior secured direct lending fund

Franklin Templeton introduces new bond fund that invests in popular ETF: Franklin Templeton launches global bond fund

Desjardins launches new ESG ETF: Desjardins adds to ESG ETF stable

Shopify surpasses RBC by market capitalization: Shopify displaces RBC to become Canada’s most valuable company