Monday morning briefing: Business activity pulls back

On January 20, Joe Biden was sworn in as President of the United States. The new President is focused on getting a US$1.9 trillion stimulus proposal passed, and also put a full stop to the XL Keystone Pipeline. A familiar face in Washington, Janet Yellen, the former Chair of the U.S. Federal Reserve Board, gave her testimony in front of the Senate Finance Committee, looking to secure her spot as the next U.S. Treasury Secretary.

In Canada, the continued spread of COVID-19 lead to a new round of lockdowns and economic uncertainty, while the aforementioned stop to the XL Keystone Pipeline resulted in the immediate loss of approximately 1,000 jobs in Alberta.

Economic/industry news

The BoC holds its central interest rate steady at 0.25%: Bank of Canada holds rates amid optimism for vaccine rebound

The ECB maintains its key rate at 0.00%: Lagarde says pandemic still ‘poses serious risks’ and the ECB stands ready to act

Many opportunities for distressed debt investing: A twist in style: How distressed and bankruptcy investing is different this time

Which sectors could benefit from the new President?: These are the sectors to watch with Biden as President

Five factors to consider for your 2021 investment plan: 5 considerations for 2021 investment strategy

Reasons for hope

Protecting against the new COVID-19 variant: Pfizer-BioNTech shot likely to foil mutant, new study shows

Washington State teams with industry heavyweights: Washington state announces partnership with companies including Starbucks and Microsoft to boost vaccinations

Tips to make it through a potentially difficult winter: 10 winter wellness tips from Parsley Health founder Dr. Robin Berzin: How to beat burnout and boost immunity

Adapting your business

How small businesses can access funding and thrive through the pandemic: Steve Case’s pandemic playbook for 2021

Some tips to help your business meet its ESG goals: How to keep sustainability at the forefront of decision-making

Helping companies with their climate-related disclosures: New software aims to enhance TCFD disclosure

Don’t count out your friends: Why friends want to do business with you

Using technology to meet customer expectations: Why digital disruption matters for your practice

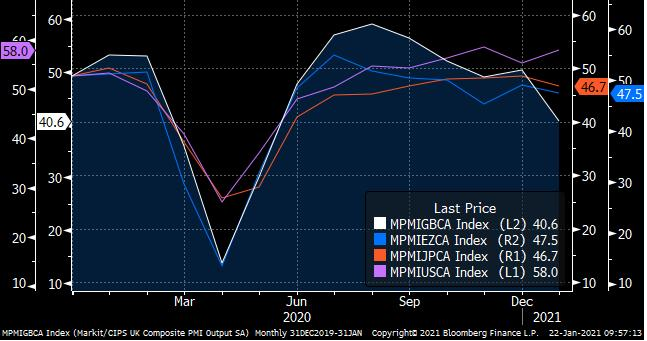

Chart of the week: Business activity pulls back

Preliminary data for the month of January is showing a pullback in business activity across major economies around the world. U.K. business activity dropped into contraction territory in response to a sharp fall in that country’s services sector. While business activity in Europe and Japan fell further into contraction, U.S. business activity improved over the month.

Globally, business activity, however, appears to be waning as a result of new lockdown measures, which is raising the prospect of another drop in economic growth during the first quarter of 2021. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Higher valuations driving investors into hedge funds: Hedge fund inflows surge amid equity valuation concerns, JPMorgan says

2020 was a record-breaking year for VC: Venture capital’s best year ever

Understanding 2020 ETF launches: 2020 ETF launches looked very different

Fidelity reduces minimum investment on their Freedom Index Funds: Fidelity takes on Vanguard in TDF space, matching its lower minimums

News and notes (Canada)

Canadians recognize the benefits of working with advisors: Poll finds growing satisfaction with financial advice

The income gap has widened further as a result of COVID-19: Income gap widening dramatically: report

Ed Devlin launches investment firm: PIMCO’s Devlin launches his own fund, with eye on private debt

iA Securities and HollisWealth are merging into a new brand: iA Financial launches iA Private Wealth brand