Monday morning briefing: Coinbase arrives … to mixed reviews

Walmart Inc. has taken a major step in its plan to create a more efficient delivery network to challenge Amazon.com, Inc. Walmart now has a position in Cruise LLC, an autonomous-vehicle company. Cruise’s majority shareholder is General Motors Co. Walmart will be begin testing grocery deliveries in Scottsdale, Arizona, this year.

Large e-commerce companies are looking to control the entire sales ecosystem, meaning from warehouse to customers’ doorsteps. Walmart expects fewer customers will visit its physical locations in the future.

Economic/industry news

U.S. inflation rate rises to 2.6% in March: Consumer prices rise more than expected, pushed by 9.1% jump in gasoline

U.S. retail sales jump 9.8% in March: Rebound in U.S. economy gathers steam with surge in retail sales

China posts strong year-over-year growth: China’s economy grows by a record 18.3% in the first quarter

ESG investing requires the human touch: Goldman Sachs says humans beat algorithms when it comes to ESG

Has the earnings boom arrived?: The earnings boom is here

Reasons for hope

Pfizer increases vaccine shipments to the European Union in Q2: Pfizer boosts second-quarter EU vaccine supply by 50 million

J&J vaccine pause not slowing down the U.S. vaccine rollout program: U.S. vaccination pace picks up as officials say Johnson & Johnson pause won’t slow rollout

People preparing for a better post-pandemic future: People are optimistic the end of the pandemic is near – and they’ve laid the groundwork for a better future

Adapting your business

Get your business ready for the coming rush of customers: How to scale your team for the impending customer surge

How to be “politely persistent”: 10 ways to be politely persistent

Crafting a great client e-newsletter (featuring Richard Heft): You’ve got mail

It may be time for a recharge: Pattie Lovett-Reid: WFH fatigue grows as pandemic enters year two

Protecting retirees’ portfolios from inflation: How financial advisors are protecting retirees from inflation

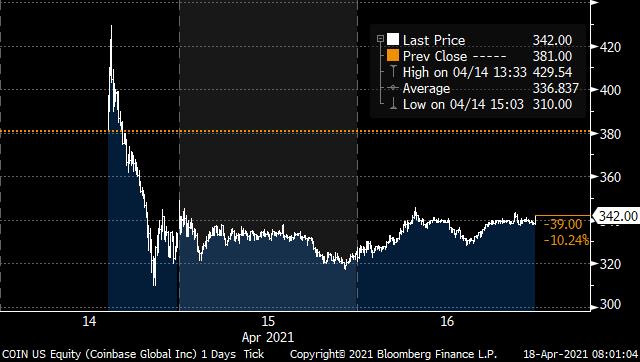

Chart of the week: Coinbase arrives … to mixed reviews

Coinbase Global Inc. went public on April 14, and it didn’t take long for the company’s market capitalization reach US$100 billion as investors rushed into the stock … before quickly pulling back. It was reported ARK Investment Management purchased almost US$250 million worth of the company’s stock on the first day for some of its funds.

Coinbase provides a platform for investors to buy, sell and store digital assets, and is an extremely popular cryptocurrency exchange in the U.S. Coinbase earned a revenue of US$1.3 billion in 2020, with Bloomberg estimating that its revenue will grow to US$4.7 billion in 2021. Could this listing give cryptocurrencies even more legitimacy in the investing universe? Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Putting the SRI into macro hedge funds: How macro hedge funds can do more to embrace SRI

Ellie Rubenstein building her own PE firm focused on responsible food companies: Carlyle family dealmakers stake out new ground with food portfolio

The SEC is paying close attention to SPACs: Regulators ramp up scrutiny of SPACs

New applications for Bitcoin ETFs keep getting filed with SEC: Bitcoin ETF drumbeat gets louder as eight issuers file with SEC

News and notes (Canada)

Capitalizing on the clean energy investing trend: Canadian ETF providers look to capitalize on clean energy theme

Offsetting large companies’ carbon footprints: Proposed ETFs from Evolve will offset carbon footprints of large companies

Fundata Canada introduced its new Fundata ESG Ratings: New Fundata ESG Ratings can help build RI portfolios

The Canadian federal government provides a loan and an investment in Air Canada: ‘Holy cow’: Feds take stake in Air Canada as airline lands $5.9B in aid