Tuesday morning briefing: Germany continues to struggle

Private equity’s success in the NBA. Helping companies eliminate wasteful spending. Family offices favour PE and real estate. And much more in this week’s briefing.

Economic/industry news

The U.S. inflation rate was up in January: US underlying consumer prices rise in January

Thematic funds could be beneficial in portfolios: Where do thematic funds fit in a portfolio?

Will hedge funds see more outflows this year?: Hedge funds to lose $20 billion from investors this year

Advisors do a better job of constructing portfolios: Using advisors improves portfolio diversification for 90% of investors: Vanguard

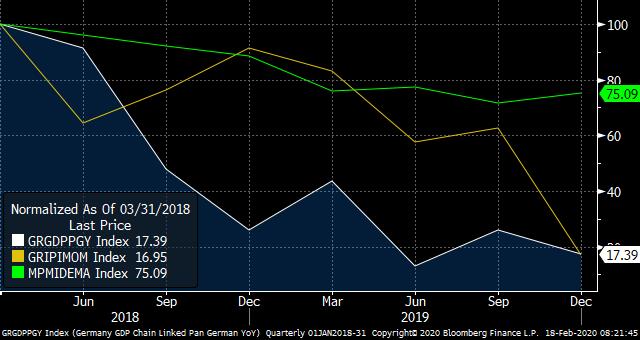

Chart of the week

Germany just announced that its economic growth slowed in the fourth quarter of 2019. Ongoing trade tensions and the slowdown in global economic growth have negatively impacted the German economy. Since the beginning of 2018, there has been a clear slowdown in economic growth in Germany. Manufacturing, one of the nation’s most important sectors, dropped markedly. Industrial production has also weighed on growth. Please tell us where you think the German economy is headed.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds fell 0.18% in January: Hedge funds down 0.18 per cent in January

Private equity’s success in the NBA: Private equity is dominating the NBA in 2020

The rise of direct lending: Following a decade-long uptick, direct lending continues to rise

Co-investment funds benefit from lower fees: Why co-investment funds outperform in private equity

BlackRock had US$298 billion in global flows in 2019: BlackRock steals top spot for 2019 global inflows from Vanguard

News and notes (Canada)

BMO introduces new ETFs: BMO launches 5 new ETFs

RBC iShares looking to launch three green ETFs: RBC iShares pushing further into ESG

Canadian DB plans returned 14% last year: Canadian DB funds generate second-highest returns in a decade: RBC

A look at who is driving the housing boom in Canada: Young, well-heeled immigrants drive Canadian housing boom

CFA Level 1 can be used in place of the CSC: CFA meets IIROC licensing standards

On the pulse – New frontiers in fintech

Banks are looking at partnerships with fintech firms: Fintech deals seen as innovation shortcut by financial institutions

A look at what may be next for fintech: Building the next stage of fintech

How to handle the expectations of the modern customer: Customer experience in the 2020s

Helping companies eliminate wasteful spending: Fintech startup Ramp aims to disrupt the corporate credit market

Could AI help boost retirement savings?: Tick, tick, tick…

Enhancing the popularity of Eno: Capital One doubles down on chatbot with new features and marketing

High-net-worth topics

Family offices are favouring private equity and real estate: Family offices disrupting traditional investment models

How advisors can attract the high-net-worth: 3 things the wealthy need from their advisors

Polls & surveys – What financials are saying

Debt can ruin relationships (Credit Canada): It’s not you, it’s your debt: couples call it quits over finances

Canadians are worried about a retirement savings shortfall (Scotiabank): More than half of Canadians fear not having enough for retirement, says poll

Canadians are delaying saving for retirement (Oaken Financial): Half of Canadians put off retirement saving, survey finds