Monday morning briefing: U.S. real estate demand building

Canada’s parliament returned last week as the Liberal government gave its Throne Speech on September 23. The message was clear: do “whatever it takes” to help Canadians and the economy get through the COVID-19 pandemic.

The ambitious plan will likely cost billions, but it will provide much needed support to Canadians and businesses. More support will also be provided to provinces for better testing. The government plans to bolster employment by making a significant investment in infrastructure and other areas of the economy. While the government revamps employment insurance (“EI”) and ends CERB, it will look to provide the Canada Recovery Benefit for those who don’t qualify for EI but are still struggling.

Economic/industry news

U.S. manufacturing activity expanded at a faster pace in September: US manufacturing sector activity hits 5-month high in September, IHS Markit says

The Fed will help the U.S. economy: Powell pledges the Fed’s economic aid ‘for as long as it takes’

Will higher inflation occur?: Economists ‘push back’ on arguments for higher inflation

The potential economic impact of a pullback in further fiscal stimulus: What happens if there is no second stimulus package?

Don’t forget about the importance of asset location: Asset location is as important as asset allocation

Reasons for hope

Canadian government strikes another deal for a potential vaccine: Public health officials urge limited contact as Canada signs vaccine deal

How Google is helping small businesses: Exclusive: Ruth Porat on leading through crisis and Google’s latest moonshot to rebuild the U.S. economy – One small business at a time

Developing a vaccine for the flu: Moderna says it will begin developing a vaccine for seasonal flu

Adapting your business

Working from home will result in new work habits: Apple CEO impressed by remote work, sees permanent changes

Marketing tips to keep your brand strong: Marketing during COVID-19: How to communicate your brand in a crisis

Growing your business: Barbara Corcoran’s 5 tips for surviving and thriving in the pandemic

How to handle your personal finances during the pandemic: How to cope if the COVID-19 pandemic has stretched your finances to the limit

What advisors are looking for from asset managers: Advisors need asset managers to adapt in pandemic times

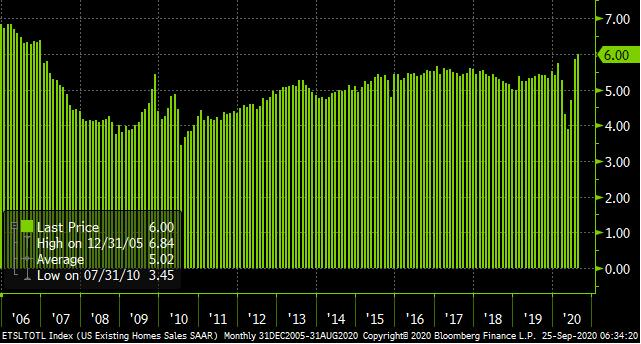

Chart of the week: U.S. real estate demand building

U.S. real estate activity came to a near halt in response to COVID-19 lockdowns. Pent-up demand, low mortgage rates and a shift in living arrangements, however, are contributing to a swift recovery in the U.S. real estate market.

As more people shift to work-from-home arrangements, they are moving into houses outside of big cities, which has increased demand for housing, including previously owned and newly built homes. Existing home sales rose to 6.0 million units in August, the highest level since 2006.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Secretive family offices are difficult to reach: Elusive family offices want upstart asset managers…but won’t take their calls

Hedge funds attracted positive flows in July: Hedge funds post a second straight month of inflows adding USD10.5bn in July, says Backstop BarclayHedge

A look at what is contributing to the surge in SPACs: Private equity plays a starring role in 2020’s SPAC boom

Using AI to align portfolios with values: How Merrill, Schwab, Fidelity are using tech to build values-based portfolios

News and notes (Canada)

CI purchases another RIA: CI Financial buys Bowling Portfolio Management

Contract with Ford extended: Canadian auto workers extend Ford contract, delay strike

Mutual funds posted strong net sales in August: Mutual fund sales solid, ETF sales slump in August

Fewer mutual fund investors are working with advisors: Fewer investors depend on advisors to purchase mutual funds: survey