Monday morning briefing: 30,000 reasons to love the Dow

Canada’s economy expanded 40.5%, annualized, over the third quarter of 2020. This was a record expansion that followed a record 38.1% drop in the second quarter. While gross domestic product is within about 5% of its pre-pandemic level, making up that 5% difference might be difficult and could take some time. With COVID-19 cases rising and new restrictions across the country, Canada’s economic growth slowed to 0.8% in September, down from 0.9% growth in the previous month. Statistics Canada projected an even weaker growth rate of 0.2% in October.

Economic/industry news

Canada’s GDP expanded 40.5%, annualized, in Q3: Canada’s record expansion meets reality of second COVID wave

The U.S. labour market could take years to recover: It could take 4 years to recover the 22 million jobs lost during COVID-19 pandemic, Moody’s warns

What the President-elect’s economic team may look like: Biden tapping Wall Streeters for economic team: reports

S&P Global purchases IHS Markit: S&P Global buys IHS Markit in $44B deal joining data companies

Reasons for hope

Pfizer and BioNTech hoping to get EU approval on potential vaccine: Pfizer, BioNTech apply for COVID vaccine approval in Europe

U.K. approves Pfizer vaccine: U.K. clears Pfizer COVID shot for first vaccinations next week

How to travel safely during the pandemic: 7 ways to reduce some COVID-19-related travel risk

Adapting your business

The workplace impact of Salesforce’s purchase of Slack: What Salesforce’s $27.7 billion acquisition of slack means for the workplace

Tony Hsieh’s secret to success: Zappos chief Tony Hsieh discovered the formula for attracting fiercely loyal customers

People are looking for advisors online: Advisors need to get personal in their digital efforts to compete

Financial advisors need to avoid these mistakes: Top 14 mistakes made by financial advisors

Financial firms are being cautious in returning to the office: Investment firms cautious on reopening plans, notification procedures

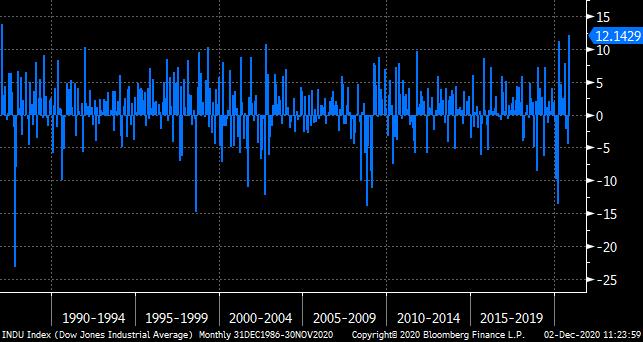

Chart of the week: 30,000 reasons to love the Dow

Not only did the Dow Jones Industrial Average close above 30,000 points for the first time ever in November, but it also posted its best month since 1987 – with a return of 12%. The Dow benefited from expectations that a COVID-19 vaccine will be deployed in the near future.

Leading the charge were companies expected to do well as the economy recovers. These companies included The Boeing Co., American Express Co. and Chevron Corp. While the S&P 500 Index and NASDAQ Composite Index reached record prices over the previous few months, it was finally the Dow’s time to shine. As we appear to be getting closer to a vaccine, the Dow may further demonstrate its strength in the months to come.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Blackstone has agreed to purchase DCI: Blackstone puts a quantitative spin on its credit business

Late-stage deals have attracted the bulk of U.S. deal value in 2020: Top valuation step-ups of 2020 dominated by fintech, lockdown-friendly names

Private equity becoming mindful of ESG: How ESG is sweeping private equity alongside hedge funds

Some tax tips you need to know for year-end: 10 tax tips to take advantage of by year-end

News and notes (Canada)

Mackenzie to purchase an environmental investment firm: Mackenzie Financial to acquire Greenchip

Things to consider when purchasing a property: How should your clients own real estate properties?

The number of women on Canadian boards is rising: Women on boards jump 30% in last six years

TD launches ESG ETFs: TD Asset Management launches three ESG Exchange-Traded Funds – helping clients align their investments with their values Tax rules for employee stock options are changing: Employee stock option changes to take effect July 1