Monday morning briefing: What’s the no-deal?

The world received some excellent news last week about a potential vaccine for COVID-19. Pfizer Inc. said its vaccine, developed alongside BioNTech SE, showed positive results from a large trial. The vaccine appeared to be more than 90% effective at preventing COVID-19. Importantly, no serious safety issues were found. Global equity markets surged higher on the news. The question now becomes how close this vaccine is to being distributed and used globally. Cases are rising and new restrictions are being implemented, and investors are hoping a successful vaccine could reduce continued uncertainty in the global economy.

Economic/industry news

The U.S. inflation rate slowed in October: U.S. consumer prices unchanged in October

Joe Biden is the new President-elect: Biden called U.S. election winner after bitter contest with Trump

Are we using the sharpe ratio correctly?: The sharpe ratio broke investors’ brains

A new era for financial advice: The ‘Netflix’ era of financial advice

Time to keep costs in check: Cost control is paramount during uncertain markets, say advisors

Reasons for hope

Excellent trial results from Pfizer: How close are we to a COVID-19 vaccine? What Pfizer’s early results mean for Canadians

Canada is buying more rapid tests: Canada to buy 7.6 million Becton Dickinson rapid COVID tests

Important considerations for making a family charitable donation: 15 questions to guide family charitable discussions

Adapting your business

Setting up for success while working remotely: Smart steps to setting your team up for success when working from home

Don’t expect work-from-home to go away: Remote work is ‘here to stay’ – even with a vaccine, says former IBM CEO

Adding real value to your customers’ lives: Why banks need to be an integral part of customer lifestyles

Helping yourself to help others: What advisors need to grow amid COVID-19

Successfully transitioning from doctor to financial advisor: Doctor-turned-advisor finds new ways to help clients

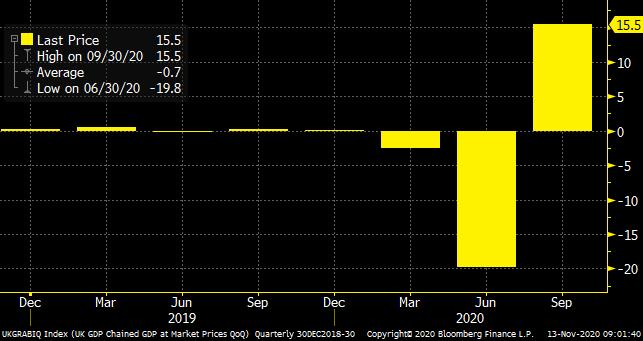

Chart of the week: What’s the no-deal?

The U.K. recently reported a preliminary estimate for its third-quarter gross domestic product (“GDP”), which expanded at a record pace (up 15.5%), after plummeting 19.8% in the previous quarter. This is similar to other major economies, like the U.S. and Europe, which recently announced record-setting expansions in the third quarter. Much uncertainty remains, however, regarding the U.K.’s economic recovery. Cases of COVID-19 have risen at a sharp pace, prompting additional restrictions, while a trade deal with the European Union remains elusive. With year-end fast approaching, the ultimate impact a potential no-deal Brexit could have on the U.K. economy remains largely unknown.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Changing landscape for hedge fund operations: How the MiFID II review and COVID-19 are reshaping the hedge fund operational landscape

Keys for PE to attract capital, deals and talent: Where private equity firms need to step it up to win capital

The race for robo-advisor dominance: Schwab vs. Fidelity: Who’s winning the robo race?

Mutual fund sales and performance over the past two weeks: Mutual funds scorecard: November 11 edition

News and notes (Canada)

Another RIA acquisition for CI: CI to acquire Roosevelt Investment Group

The pandemic could have a lasting impact on Canada’s economy: Canada will exit pandemic with lower potential, Wilkins says

Ontario defined benefit pension plans’ solvency up in Q3: Ontario DB pension solvency up again in third quarter: FSRA

High household debt could weigh on economic recovery: Indebted households put recovery at risk, says report