Monday morning briefing: Services sector slipping

The COVID-19 pandemic has severely changed the way we live. And it will, no doubt, impact the scariest night of the year, Halloween, which will likely look a lot different this year as a result of social distancing and fears of the virus. Not only will it affect children, it will also impact adults, who often hold Halloween parties. It also means the usual pick-up in Halloween sales for retailers may not be as robust as in past years.

Sales of candy, along with costumes for Darth Vader, Princesses and Spiderman, will be down. Market researcher Numerator found that 48% fewer households will be handing out candy this year in the U.S. Lower sales will also impact the manufacturers of candy products, along with costume manufacturers. The expected drop in Halloween sales will negatively impact businesses, up and down the supply chain.

Economic/industry news

Canada’s inflation rate was 0.5% in September: Inflation ticks up but price pressures stay muted in Canada

Canadian retail sales increased 0.4% in August: Retail sales slow in Canada after strong run peters out

No decision by the Fed on issuing a digital currency: Powell says Fed has made no final call on digital currency

Strict redemption policies could be good for the entire market: When hedge funds lock up investor money, the whole market benefits

Pension plans feeling the pressure from the pandemic: Pandemic puts pressure on global pensions

Reasons for hope

Remdesivir gets approval as a COVID-19 treatment from the FDA: FDA approves Gilead’s remdesivir as coronavirus treatment

Onto the final stage of COVID-19 trials: Moderna gets 30,000 patients for final stage of vaccine trial

Improving the face mask: There’s finally a face mask that delivers equal parts protection and breathability

How to help lonely seniors: Help is here for lonely and isolated seniors

Adapting your business

The keys to the turnaround at Airbnb: 3 important lessons from Airbnb’s pandemic pivot

Combining banking, lending and investing: Financial services must be frictionless to truly serve future clients

Overcoming the challenges of business development amid the pandemic: Developing new clients remotely

Overcoming the fear of becoming an entrepreneur: 7 obstacles that prevent people from starting businesses (and how to overcome them)

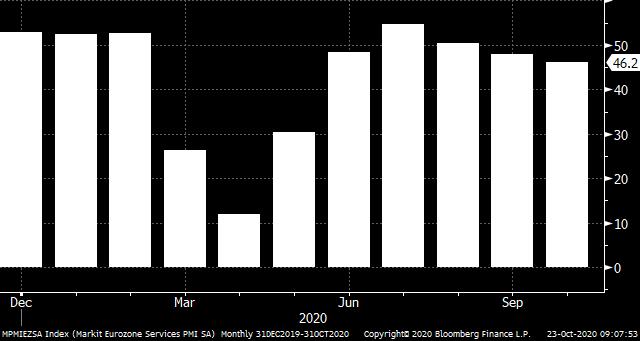

Chart of the week: Services sector slipping

The European services sector weakened in October, according to a preliminary estimate from IHS Markit. This marked the second straight month the sector contracted. Coming out of the lockdowns, the services sector had surged higher, but a second wave of COVID-19 cases, and more restrictions in response, has put pressure on the sector.

Of notable concern was a significant drop in expectations for business conditions over the next 12 months. While the manufacturing sector continues to expand at a robust pace, the services sector could dampen the recovery in Europe. Let us know what you think.

Used with permission of Bloomberg Finance L.P.

News and notes (U.S.)

Hedge funds posted positive inflows in August: Hedge funds add USD5.6bn in August

Hedge funds’ top go-to research firms: The world shut down. This is who hedge funds called.

A look at the richest self-made women in the U.S.: America’s richest self-made women

Those participating in their companies’ stock plan also save more in 401(k) plans: Fidelity: Participants in both 401(k)s, stock plans save more for retirement

News and notes (Canada)

Fidelity enters liquid alt market: Fidelity Investments releases four new funds

Brookfield invests in U.S. annuities firm: Brookfield Asset Management to buy stake in U.S. annuity firm

Sun Life purchases 51% of U.S. alternative credit firm: Sun Life buys majority stake in Attanasio’s Crescent Capital

Cyber attacks are on the rise in 2020: Cyber attacks becoming a fact of life